Summary:

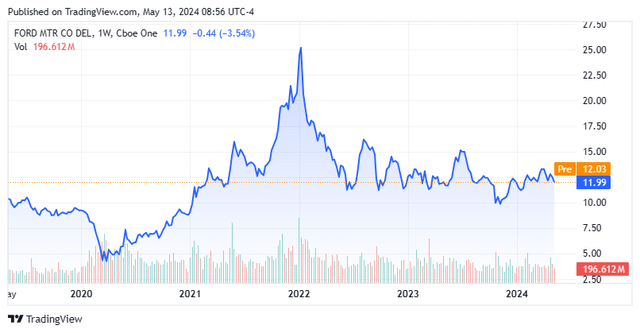

- The stock of Ford Motor Company is one of the cheapest large cap equities in the market, trading at under six times trailing earnings with a five percent dividend yield.

- One of the main reasons for investor pessimism around the company is that Ford’s EV operations are hemorrhaging money.

- We take a look at Ford’s EV losses and why this part of the company is likely to be an albatross around the company’s neck for the foreseeable future below.

DNY59

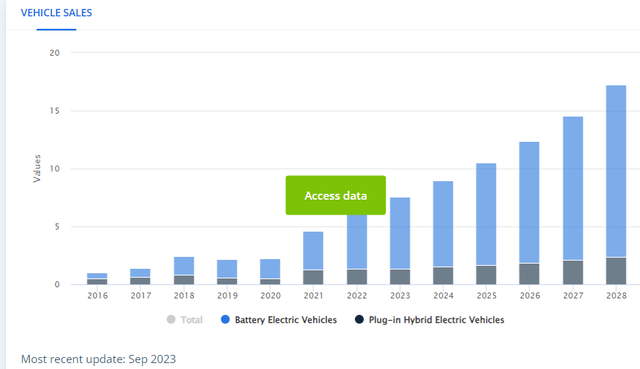

The rollout and adoption of electric vehicles, or EVs, have ebbed noticeably of late. This has resulted in a noticeable increase in inventories in recent quarters and a series of price cuts on many EV models.

Despite hundreds of billions of dollars in taxpayer largesse, not to mention major investments from the private sector, adoption lags many optimistic projections. Part of this reason is government’s spending on this sector has been deployed in an ineffective manner. To cite but one example, the $7.5 billion allocated by the federal government through an infrastructure bill in late 2021 to build out charging stations nationally via the National Electric Vehicle Infrastructure, or NEVI, program to establish a network of fast chargers along major highways has resulted in seven chargers with a total of just 38 parking spots to date.

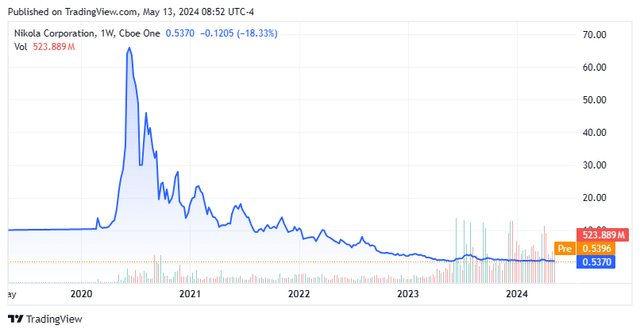

On the private sector side, billions and billions of dollars were poured into EV related startups during the IPO/SPAC boom of 2020/2021 that was powered primarily by near zero percent interest rates courtesy of the Federal Reserve. Names like Lordstown Motors and Electric Last Mile Solutions have gone bankrupt and Fisker Inc. (OTC:FSRN). Those concerns that have survived to this point, like Nikola Corporation (NKLA), Lucid Group, Inc. (LCID) and Rivian Automotive, Inc. (RIVN), have laid off staff and instituted almost drastic measures to conserve cash. All of these stocks sell for pennies on the dollar to their peak trading levels a few years ago.

Even mighty Tesla, Inc. (TSLA), which enjoys first mover advantage, large economies of scale and has its own substantial charging station network, has been forced to implement large layoffs recently. TSLA stock is far below its peak as well.

Toyota Motor Corporation (TM) has been among the smarter of the major carmakers as it has adopted an approach of building hybrid cars. This lowered capital investment needs and address consumers’ “range anxiety” around EVs given sparse charging network accessibility in many parts of the country. This strategy also played in well with the company’s long-term focus on reliability and focus on gas mileage. This decision has paid off financially to this point.

However, the problems in the EV space hang like an albatross around Ford Motor Company (NYSE:F). It is a key reason the stock trades for less than six times trailing earnings despite a five percent annual dividend. This makes Ford one of the cheapest large-cap stocks in the market based on valuation. Unfortunately, this EV anchor is unlikely to be removed from the company’s neck in the foreseeable future, which could continue to make F a “value trap.” Let’s take a look at Ford’s EV challenges in a bit more detail.

Hemorrhaging money is probably the best way to describe the electrical vehicle business at Ford, which is mostly done via its “Model e” business unit. This division sold some 10,000 EVs in the first quarter and managed to lose $132,000 on each vehicle for a total loss of $1.3 billion. The losses are so massive I cannot even humorously quip “the company loses money on every sale but makes it up on volume.” Revenues plunged over 80% on a year-over-year to $100 million. Ford also sells EVs via its Ford Pro unit, which handles fleet sales to businesses and government buyers.

April 2024 Company Presentation

Management projects this part of the company will post a $5 billion EBIT loss in FY2024. In FY2023, this division had a $4.7 billion EBIT loss while selling 116,000 EVs. These losses are hampering Ford’s overall profitability. While the rest of the company produced flat profits to the same period a year ago, the bleeding at Model e pushed overall earnings down 20% in the first quarter to $1.3 billion.

Ford is hardly alone dealing with the current challenges around EV profitability right now. Profits at mighty Tesla slipped nearly by half in the first quarter compared with 1Q2024. However, Tesla remained profitable as revenues fell by nearly 9% on a year-over-year basis. Ford is taking steps to reduce the bleed from the EV side of the business. Late last year, the company disclosed it was “delaying” $12 billion of planned investment on the EV side of the business. In February of this year, management announced it reassessing its EV battery strategy. Ford also said it would delay the rollout of its second generation of EVs until it can make its current first-generation EV production breakeven. Even with the cutbacks, the Model e division will eat up some 40% of Ford’s planned capital expenditure budget in FY2024.

Ford finds itself between a rock and a hard place. Given the size of the market and the federal government’s massive EV push, it can’t abandon the market. However, it is difficult to see how the company profitability competes in the space against pure play EV concerns like Tesla which continues to invest in developing the next generation of EVs, is profitable and owns its own charging network. In addition, I think the company has a longer-term marketing challenge. How do you market EVs to long-time customers that have grown up on “Built Ford Tough” and associate the company with F-150 trucks, SUVs, and muscle cars like the Mustang?

Ford’s challenges in the EV space reminds me of LBJ’s quote on the quagmire in Vietnam being like being caught alone outside in a Texas rainstorm, “Nowhere to run, nowhere to hide, and you just can’t make it stop.” One thing seems for certain, the massive losses Ford Motor Company is seeing from its EV operations are likely to remain a huge albatross around Ford Motors’ neck for the foreseeable future. It is also why the stock is likely to continue to trade range bound despite its cheap valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: This is your chance to try us out – without any strings attached. Activate your two-week free trial period now and see if The Insiders Forum is right for you.