Summary:

- Affirm’s user base includes middle-income consumers with manageable debt, debunking misconceptions that it primarily serves financially insecure individuals.

- Affirm’s partnerships with major players like Shopify and Amazon have driven growth, attracting prime customers and increasing spending.

- Affirm demonstrates superior credit risk management and capital efficiency compared to large banks, with lower delinquency rates and higher return ratios.

- Affirm’s strong operating leverage, reduced expenses, and strategic partnerships position it for continued growth and potential GAAP profitability by FY 2025.

Rawpixel/iStock via Getty Images

Introduction

Affirm (NYSE:NASDAQ:AFRM) reported a stellar earning today and its stock went up by 30%. We first discussed Affirm in November of 2023. We demonstrated the distinctiveness of its business model, and we’ll do it once more this time, but with a clearer justification with a focus on Affirm’s user profile.

Debunking Misconceptions about Affirm’s Users

The most common misperception among investors. Who uses Affirm as a consumer? Many people think that Affirm is only utilized by those who are financially insecure. Customers with lesser incomes are the ones most likely to use Affirm to make payments.

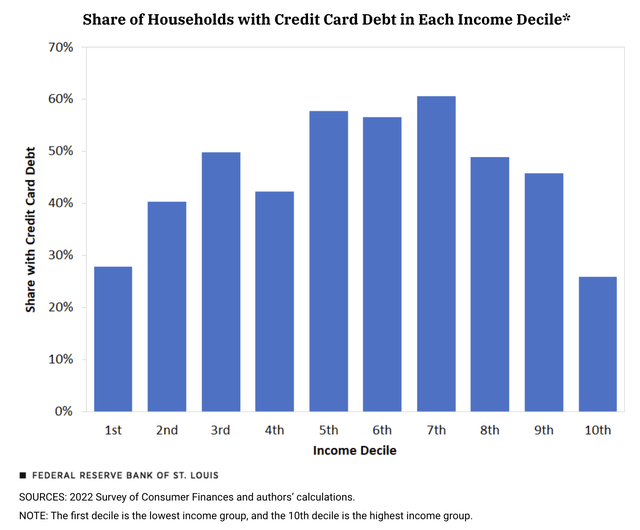

Credit Card Debt Analysis

Let’s start by examining the US credit card user profile.According to the Fed, credit card liabilities represent 6% of all household debt as of Q1 2024, with $1.14 trillion in outstanding balances. It’s a rather big figure. When examining credit card debt by income level, it’s evident that those carrying debt are primarily middle-income consumers rather than low-income ones. 40-60% (see below chart) of middle-income consumers have credit card debt. This can be easily explained, as lower-income consumers are less likely to be approved for credit.

Share of Household with credit card debt by income (Fed)

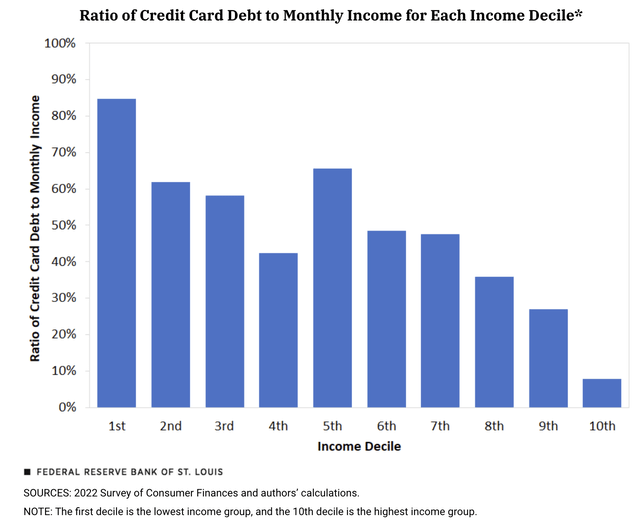

The second misconception is that those with credit card debt are unable to repay it, which makes this model unsustainable. According to the Federal Reserve’s data, the debt burden isn’t that high, with debt balances accounting for 40%-60% of income. (see below chart) Given that consumers may not carry this debt every month, it’s likely they feel comfortable holding debt temporarily for large purchases, such as planning an annual family trip or upgrading home appliances. Alternatively, they may use credit cards for general merchandise, like food or home goods, shortly after making a large purchase.

Ratios of credit card debt to monthly income by income (Fed)

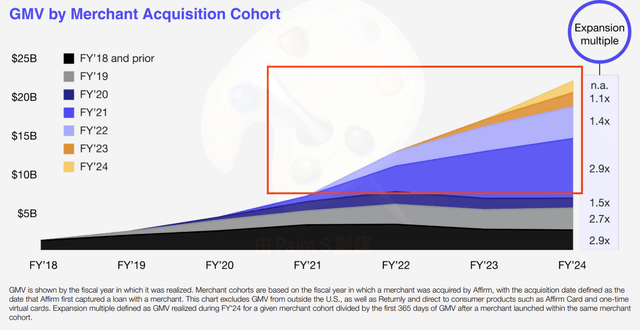

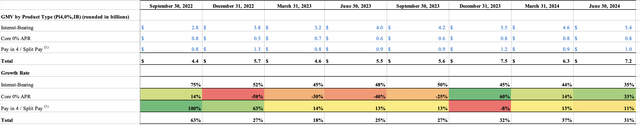

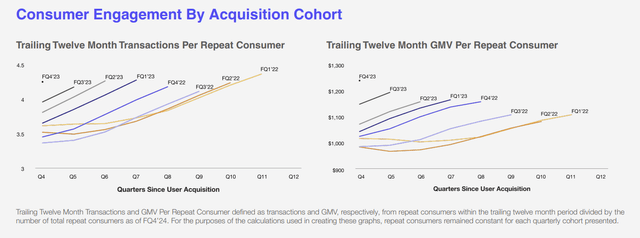

Affirm’s GMV Growth by Cohort

The charts below illustrate the transformation of Affirm’s user base after FY 2021. Users who joined before 2020 show stagnant spending. This could be due to two reasons: either these early users decided not to use the service or they are unable to spend more. If it’s the latter, it suggests that Affirm’s older cohort of customers may be those who cannot afford to spend more.

GMV by cohort (Affirm)

However, the new cohorts after FY2020 show increasing spending each year, which coincides with Affirm’s partnerships with Shopify. Low-income consumers were most affected by high inflation after FY2022, while high-income consumers were less impacted. The chart above also shows that the older cohort performed relatively poorly after FY2022. This suggests that Affirm’s partnerships with major players may have helped the company attract prime customers. Consequently, it appears that Affirm tapped into the mainstream of credit card users who carry debt after FY2020.

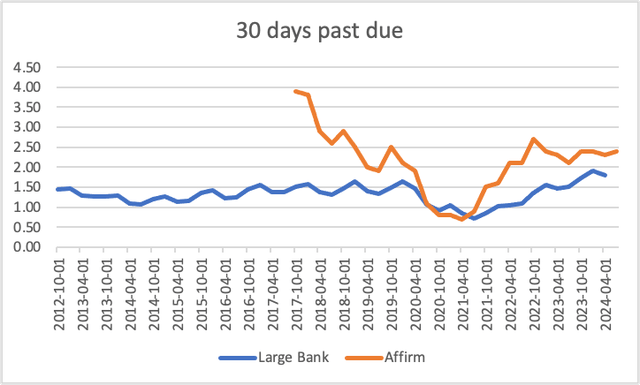

Affirm’s Performance in Credit Risk Management

As long as Affirm grants them credit, customers who assume the function of capital receiver ought to come to Affirm automatically. As a result, Affirm must address the requirement for capital suppliers, or ABS purchasers, to balance supply and demand. Thus, for Affirm to succeed in credit card loan underwriting, it must select the greatest assets for these purchasers.

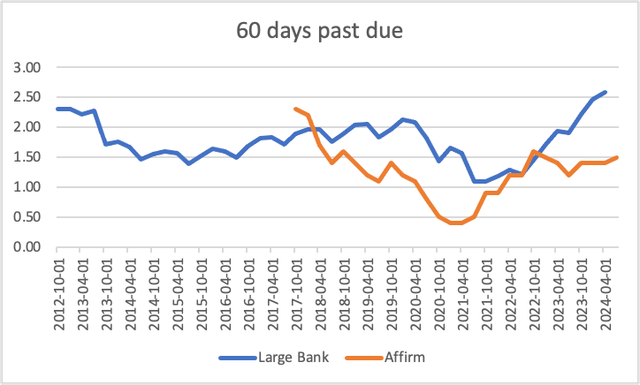

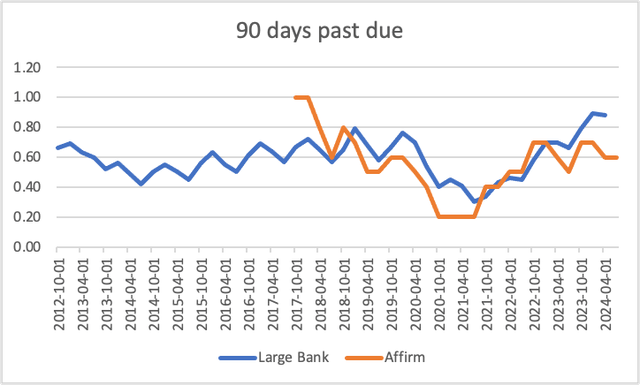

Affirm has actually exceeded expectations, and perhaps even more than anticipated. The comparison below shows Affirm’s performance relative to large U.S. banks (source: Fed) in terms of credit card delinquency rates for 30, 60, and 90 days past due. Affirm outperforms big banks in the 60- and 90-day delinquency rates, with the gap widening after 2022. This indicates that Affirm’s risk management is superior to that of large banks. Banks have better performance in the 30-day past due delinquency rate, likely because Affirm does not charge late fees. As a result, Affirm users may tend to pay after the 30-day deadline. However, this does not imply they are less disciplined or unable to pay, as the lower 60- and 90-day delinquency rates suggest they are willing and able to pay later.

30-days past due rate (From Fed and Affirm and edited by LEL)

60-days past due rate (From Fed and Affirm and edited by LEL)

90-days past due rate (From Fed and Affirm and edited by LEL)

Capital Efficiency Comparison

One commonly used indicator for evaluating capital efficiency is Return on Equity (“ROE”). To compare Affirm with banks, we will use transaction margin to allocate capital rather than non-interest expenses, making it a comparable metric to ROE. The rationale is simple. If an organization scales its capital use effectively, non-interest expenses should become less significant. For instance, a loan officer can process a $1 million or $100 million loan at minimal additional cost. Since Affirm is still in its growth phase, we will compare the efficiency of its transaction margin relative to its capital. As of Q2 2024, Affirm has an average equity capital requirement of $601 million (see definition below) and a $309 million transaction margin, resulting in a return ratio of 51%.

The Company defines equity capital required as the sum of the balance of loans held for investment and loans held for sale, less the balance of funding debt and notes issued by securitization trusts as of the balance sheet date. The Company believes that equity capital required is a useful financial measure to both the Company and investors in assessing the amount of the Company’s total platform portfolio that the Company funds with its own equity capital

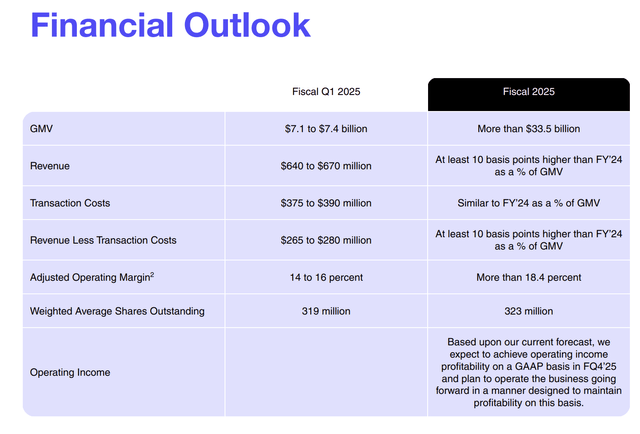

For comparison, we used Bank of America as an example and calculated a similar metric by subtracting credit provisions from revenue and dividing by average tangible common equity, which yields a 12% return. This suggests that Affirm’s model is likely more profitable than banks, provided it continues to leverage its operating efficiency. Affirm is demonstrating its operating leverage, and based on its guidance, it seems poised to continue gaining operating leverage into FY 2025. (see below chart) Consequently, we expect the market to recognize this momentum and respond positively, as seen today. Only if Affirm fails to maintain operating leverage and its margin expansion stagnates would we consider it has reached a plateau.

Outlook (Affirm)

Stock Performance Analysis

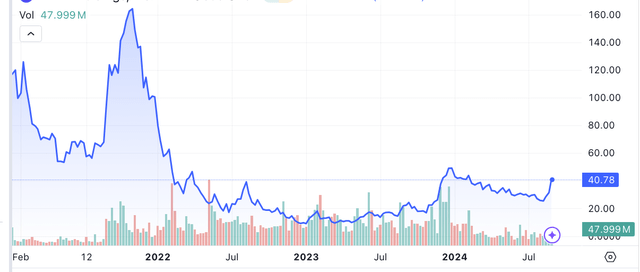

The last several months have seen tremendous volatility in Affirm’s stock. It peaks in January 2024 and then declines until the current quarter.

Stock chart (Seeking Alpha)

In our opinion, this trend coincides with the market’s focus on evaluating Affirm’s model primarily through the momentum of its merchant network revenues, as this revenue stream indicates its potential to outperform banks. Therefore, investors should closely monitor the growth of core 0% loans, as this product line reflects the health of Affirm’s merchant network revenues. Affirm’s core 0% loan growth declined during 2022, regained momentum in the December quarter of 2023, and then slowed again in the March quarter of 2024. (see below chart)

Loan growth by category (From Affirm and edited by LEL)

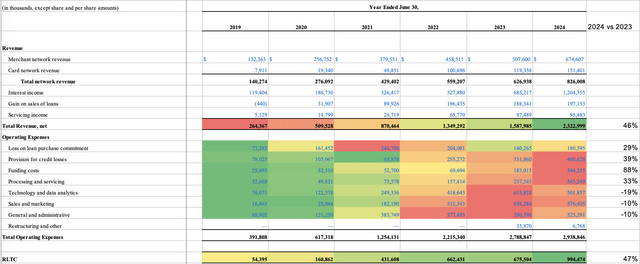

Operational Expenses and Efficiency

Operating expenses are a critical component to consider while considering the Affirms business. Currently, Affirm operates at a loss, leading investors to view its model as inefficient. However, a breakdown of Affirm’s expenses reveals a different story. After years of aggressive spending, Affirm is beginning to demonstrate strong operating leverage. In 2024, its technology, sales and marketing, and general administrative expenses were 19%, 10%, and 10% lower, (see below chart ) respectively, compared to 2023, while its revenues and RLTC (revenues minus variable expenses) grew by 46% and 47%.

Expense breakdown (From Affirm and edited by LEL)

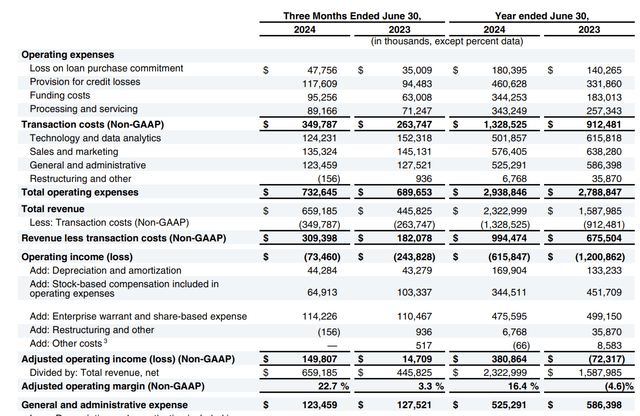

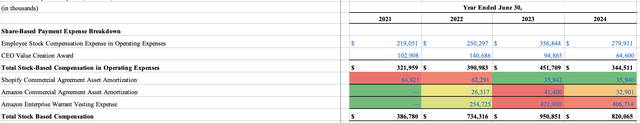

Next, let’s discuss Affirm’s operating loss. In FY 2024, the company adjusted for a $475 million expense related to enterprise warrant given to partners like Shopify and Amazon to show positive adjusted operating income. Essentially, these stakes are a marketing expense.

Affirm’s operating expense (Affirm)

For growth companies, the key is whether revenue growth exceeds marketing expenses and if those expenses stabilize. Affirm’s revenue has outpaced its marketing and warrant expenses, which have remained flat. This indicates strong organic growth. Notably, Affirm’s warrant expenses decreased in FY2024, and it reduced its selling and marketing expenses by 10% (see below chart), suggesting reduced reliance on these platforms for growth.

Affirm’s share base expense (From Affirm and edited by LEL)

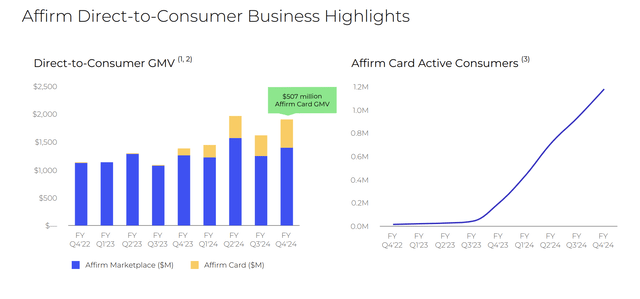

According to the CEO, Affirm is expected to achieve GAAP profitability by the end of FY2025. He noted that Affirm is pursuing partnerships with major payment players like Apple Pay and Google Pay. This strategy is likely to be effective, similar to its successful partnerships with Amazon and Shopify, as it eliminates the need for individual negotiations with merchants. Affirm was added to Apple Pay in June 2024, and we anticipate further growth in its user base as a result. With its own Affirm card, the company can retain users within its ecosystem after each partnership. We expect Affirm to capture a greater share of the credit card market, especially among those who carry credit card interest debt. Given the prevalence of credit card interest debt in the U.S. and the healthy growth of new cohorts, we anticipate that Affirm will move towards mainstream acceptance rather than remaining a niche player. Currently, with only 1.2 million active users, Affirm is expected to continue growing.

Affirm’s card operating metrics (Affirm)

BNPL Competition Risk Analysis

Major peers in the BNPL industry are PayPal (NYSE:PYPL), Block (NYSE:SQ), and Klarna.

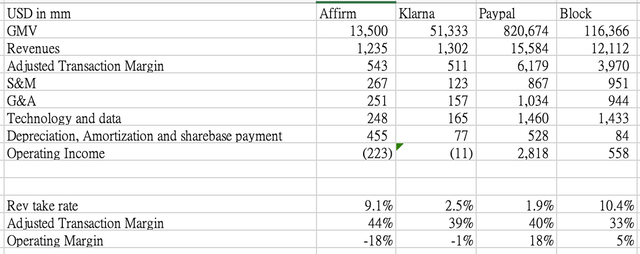

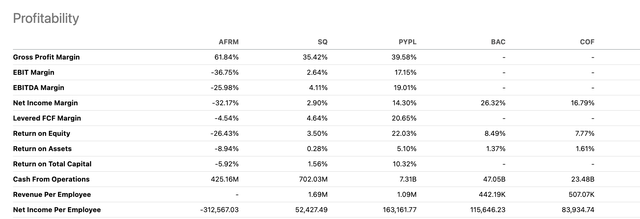

Because Block and PayPal do not reveal their BNPL transaction level margins, we will evaluate these businesses’ competitiveness on by their operating metrics at the company level. (For a comparative study, we gathered data from the previous two quarters. We made the transaction margin adjustments and made them comparable)

Comparable metrics (From companies’ filings and edited by LEL)

Take Rate: Because Block receives more revenue from Bitcoin, it has a higher take rate. It does, however, have the lowest adjusted transaction margin because of its extremely low bitcoin revenues margin. Affirm has the greatest take rate following Block, while Klarna and Paypal have extremely low take rates, which is indicative of their insignificant position in the food chain despite having BNPL companies. It so demonstrates that Affirm might add the greatest value to a purchasing decision.

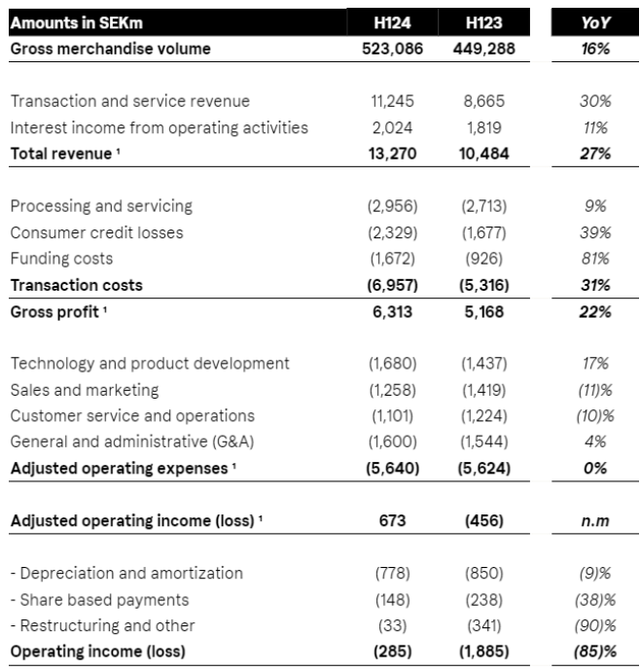

Adjusted transaction margin: This measure illustrates these fintech companies’ variable unit economics. If Block does not include its Bitcoin transaction, it can have the greatest transaction margin. Because Affirm generates more money from merchants than Paypal, it was placed second. Although Klarna’s merchant income is bigger than Affirm’s, the company lost a lot of money on its loan products. (see below chart) As a result, it indicates that Klarna has to accept more high-risk borrowers to increase its merchant network revenues because of its inadequate risk management mechanism.

Klarna’s fiancials (Klarna)

Affirm is likely to be among the top-tier over take rates and transaction margins compared to its peers. This advantage means Affirm may aggressively invest in operating expenses and operate at a loss compared to its peers. Therefore, for growth companies, demonstrating significant operating leverage and growth typically leads to a positive market response.

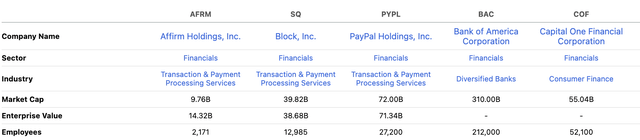

Valuation

Affirm’s business model differs significantly from both traditional banks and its peers in the non-performing loan market, making valuation challenging. Unlike its bank partners, Affirm excels in loan underwriting due to superior risk management. With a revenue per employee of $1.06 million, higher than its bank peers, and competitive advantages, Affirm’s market capitalization is under $10 billion. We anticipate that the market will assign a premium valuation multiple if Affirm continues to improve margins.

Peer profiles (Seeking Alpha)

Peer profitabilities (Seeking Alpha)

Affirm’s latest cohort shows greater purchasing power and increasing annual spending and shopping frequency, indicating growing consumer use. While the extent of Affirm’s market penetration potential remains uncertain, this trend suggests continued expansion. Therefore, we see substantial potential in Affirm’s valuation for FY 2025 based on these trends.

Customer engagement (Affirm)

Conclusion

We believe Affirm can pose a threat to established competitors because of its distinctive business strategy. Despite offering fewer lending products than its bank peers, it has a greater capital usage efficiency. Its financial production innovation endeavor to maximize the revenue stream produced this. Even though Affirm is smaller than its BNPL peers, its transaction margin profile is competitive. Consequently, we believe that Affirm’s stock should continue to rise since it is currently in the growth phase, has demonstrated significant operating leverage, and its management expects it to do so in FY 2025 and likely to achieve GAAP profitability. In the long run, Affirm’s stock potential should be substantial, especially if it can challenge its contemporaries in the banking industry. However, given we have a hard time quantifying the upside at the moment, we therefore just maintain our Buy rating as a result.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.