Summary:

- Over the last twelve months, the average loss in share price for FAANMG stocks is approximately 40%.

- I make the case for Alphabet as the best buy out of the bunch.

- I explain why Netflix is the manifest worst investment of the six stocks.

MagioreStock

Back when Meta Platforms (META) was known as Facebook, the FAANMG stocks were the path to market outperformance. Over the last decade, the sextuplets are up an average of 469% versus a 164% increase by the S&P 500.

However, the FAANG gang, combined with Microsoft (MSFT), averaged a 41% loss over the last 12 months, well over twice the downtrend in the S&P. And despite these losses, a reasonable argument can be made that several of these tickers are overvalued.

From my perspective, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is the clear winner in terms of current valuation. Furthermore, I view the headwinds facing Alphabet as transitory in nature, and at the same time, I see prospects for growth on the horizon.

Why Did GOOGL Shares Fall So Far?

The obvious answer is that we are in a bear market. Even so, shares of Alphabet are down more than twice that of the S&P 500, so that cannot be the sole factor affecting the stock.

It is also reasonable to claim the downtrend in the NASDAQ and the FAANGs is working against GOOG. Add to that disappointing Q3 results and the threat of a recession, and you have summed up the impetuses for the shares’ downfall.

In the week and a half following Q3 results, shares of Alphabet dropped double digits to a new 52 week low. This marked the GOOG stock’s worst decline in the past decade.

The earnings call revealed that EPS of $1.06 was well below the consensus of $1.25, and revenue of $7.07 billion also fell short of analysts’ $7.42 billion forecast.

YouTube revenue of $7.07 billion was 2% below the $7.21 billion in the comparable quarter.

The Google Services segment recorded an anemic 2% increase in revenue, and Google Search and other advertising revenues were up a mere 4% in Q3.

Consolidated revenue of $69.1 billion increased 6%.

Alphabet’s operating profit margins were 25%, a 3% decline from the prior quarter.

Management noted advertising revenues were impacted by “the challenging macro environment.” However, aside from a brief period during the pandemic, Alphabet recorded the slowest growth since 2013 in Q3.

So the question to be answered is whether the quarter is a one-off event, or is Alphabet devolving into a low growth company?

Alphabet: How do I love thee? Let me count the ways

I contend that Alphabet has many strengths, and those attributes translate into a desirable investment.

Alphabet Is A Legal, Enduring Monopoly

Google controls over 90% of the global search engine market, and Chrome holds a 65% market share among web browsers. The network effect created by Search, Android, Maps, Gmail, YouTube, and other assets provides the firm with an unrivaled collection of consumer data. This enhances both the user experience and the return for advertisers, creating a virtuous cycle that reinforces Alphabet’s moat.

The Drop In Advertising Spend Is Transitory

Management attributed lackluster Q3 results to a pullback in advertising revenue.

It is common during periods of economic malaise for companies to proactively lower advertising spend. During the 2008-2009 downturn, Alphabet’s revenue growth dropped to low-single digits before rebounding to a 25% growth rate. When COVID shook the markets, Alphabet had one quarter of declining revenue, but demand surged when the economy returned to a normal state.

Yes, macroeconomic trends will slow Alphabet’s revenue growth, but this, too, shall pass.

The Digital Advertising Market Forecast Is Promising

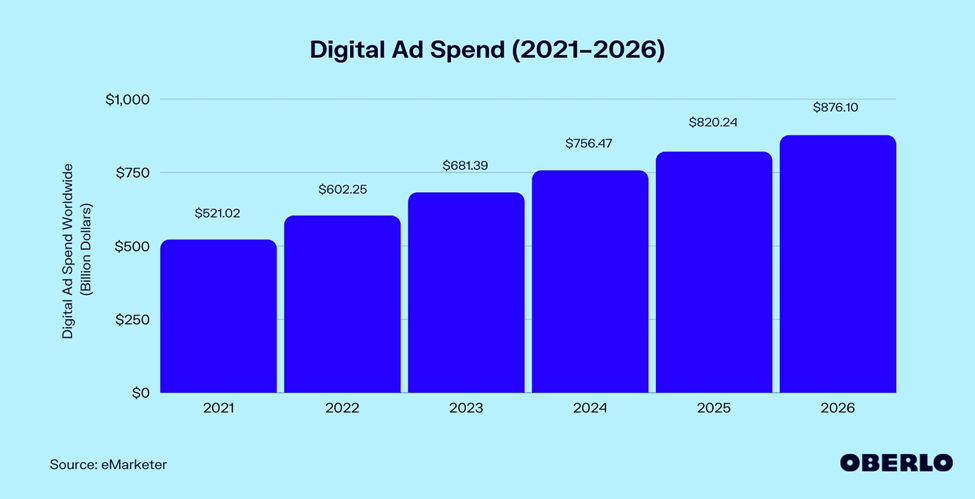

The following chart provides Oberlo’s forecast for the digital advertising market.

OBERLO

PRECEDENCE RESEARCH forecasts a CAGR of 9.22% for the global digital ad spending market size from 2022 to 2030.

As the leader in digital advertising, Alphabet holds a global market share of roughly 30%. That leaves the firm with a long growth runway in my opinion.

YouTube Is Gaining Momentum

YouTube is now the second most-visited social site on the planet, with 2.52 billion monthly active users (MAU), only Facebook has more viewers, with 2.9 billion MAUs.

In September, YouTube became the streaming leader in the U.S. for the first time, surpassing Netflix (NFLX). And YouTube is buffing up its offerings with the recent purchase of the rights to the NFL’s Sunday Ticket games.

Starting in 2023, Sunday Ticket will be shown on YouTube TV and via the YouTube Primetime Channels services.

YouTube launched Shorts two years ago. That platform now boasts of 1.5 billion monthly users with 30 billion pieces of content being viewed on a daily basis.

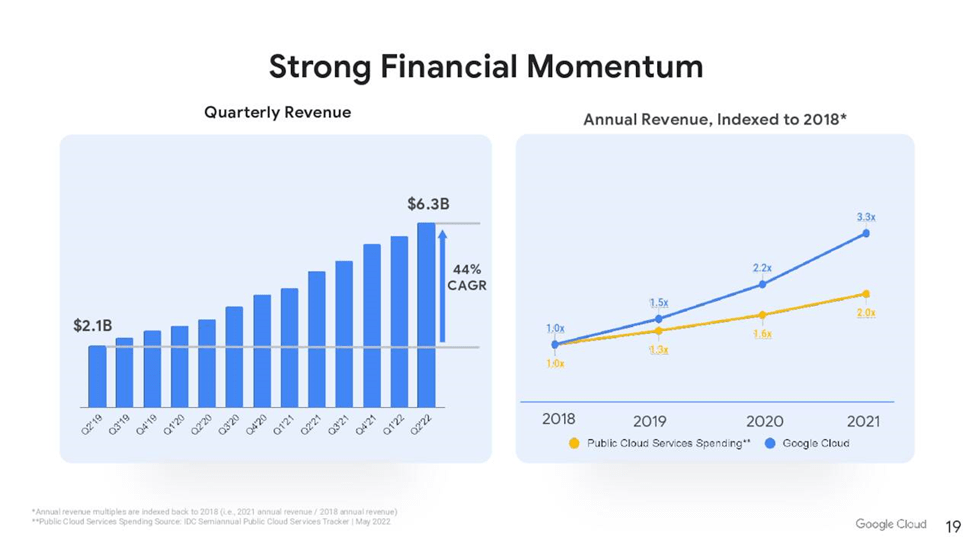

Google Cloud Is Also Gaining Steam

In Q3, Google’s cloud computing revenue surged 48% year-over-year. In contrast, revenues for Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS increased 35% and 27%, respectively.

Google Cloud Platform has an 11% market share in cloud infrastructure and platform services, an increase from 10% in 2021.

In 2021, Google Cloud recorded $19.2 billion in revenue, a 47% increase over 2020. In the first three quarters of FY2022, Google Cloud revenue hit $19 billion.

The growth of Google Cloud is outpacing the public cloud market by a wide margin.

Alphabet presentation

The Global Cloud Market Is Growing At A Double-Digit Pace

Grandview Research forecasts a CAGR for the global cloud computing market of 15.7% through 2030.

Fortune Business Insights has an even more sanguine outlook for the cloud computing market, projecting a CAGR of 19.9% through 2029.

Google’s Cloud is not yet profitable, as the company has devoted a great deal of capex to building out its offerings. In Q3, Alphabet recorded a $699 million loss on cloud revenue of $6.9 billion. However, it is a virtual certainty that Google Cloud will turn a profit in the not too distant future. When that day comes, expect a significant boost in the company’s revenues.

Alphabet Is A Free Cash Flow Machine

The company reported $16.1 billion in FCF in Q3 and $63 billion in FCF over the trailing twelve months. This is in spite of significant currency exchange rate headwinds.

In Q3, the firm reported consolidated revenues were up 6% but that number would have stood at 11% in constant currency.

The strength in the U.S. dollar is largely attributed to the Fed adopting a hawkish monetary policy in response to skyrocketing inflation. Like the drop in advertising, this headwind is transitory, and it should subside when the Fed reverses course.

Alphabet Has a Solid Stock Repurchase Record

In the first three quarters of 2022, GOOGL repurchased $43.9 billion in stock. To place that in perspective, the company’s market cap is $1.14 trillion.

Alphabet bought back $18.4 billion, $31.1 billion, and $50.3 billion in stock in 2019, 2020, and 2021, respectively.

The share count dropped 3.2% in the last 12 months and nearly 7% since the end of 2019.

Alphabet Has A Fortress Balance Sheet

Alphabet’s credit ratings are in the high A’s.

In Q3, the company reported $116.3 billion in cash, cash equivalents, and marketable securities and $14.7 billion in long-term debt.

Other Bets Could Create Future Growth

Alphabet recently announced that Waymo is adding Los Angeles as its third ride-hailing city, and Wing has notched 300,000 commercial deliveries.

Waymo, Wing, artificial intelligence research company DeepMind, a line of smart home products in Google Nest, and Verily life sciences, are examples of some of the moonshot projects that could eventually pan out, and perhaps in a big way.

Why Do I Rate Alphabet As The Best FAANMG?

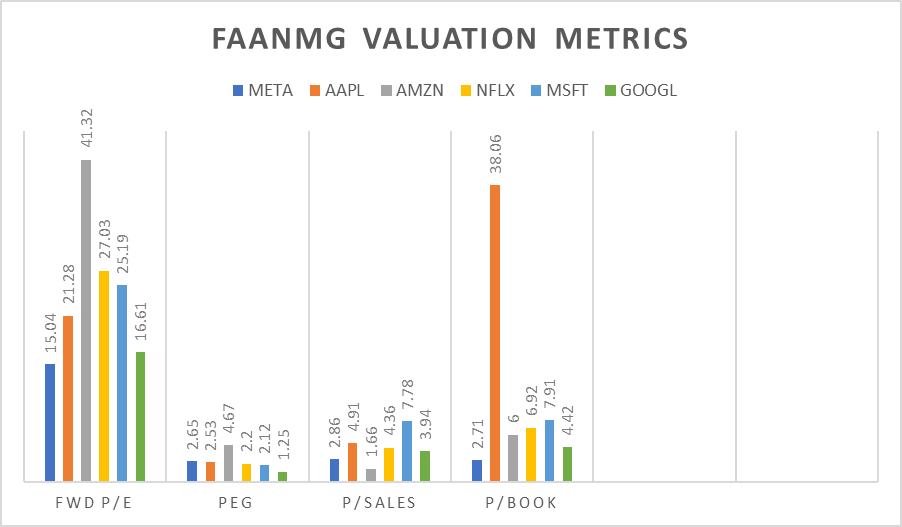

If a picture is worth a thousand words, then the following charts provide a degree of visual eloquence.

I’ve included several widely followed valuation metrics to compare the FAANMGs. The valuations include a forward P/E (the next fiscal year’s consensus GAAP EPS estimate), a five year PEG ratio, a forward price to sales (market cap divided by the company’s total sales or revenue per share estimate), and a forward price to book (the next fiscal year consensus book value per share estimate).

Author chart SA/Yahoo for data

Note Alphabet has the second best forward P/E, the best 5-year PEG ratio, the third best price/sales, and the second best price/book.

I’ll add that of the four valuation marks cited, I place the greatest weight on the PEG ratio. I rarely invest in a stock with a PEG above 2.00.

Using these metrics, the only company that competes in terms of valuation is Meta.

However, Alphabet generates well over twice the FCF of META, ($69.8 billion versus $25.7 billion), and Alphabet also has about three-and-a-half times more cash on the balance sheet than META ($140 billion versus $41.8 billion.)

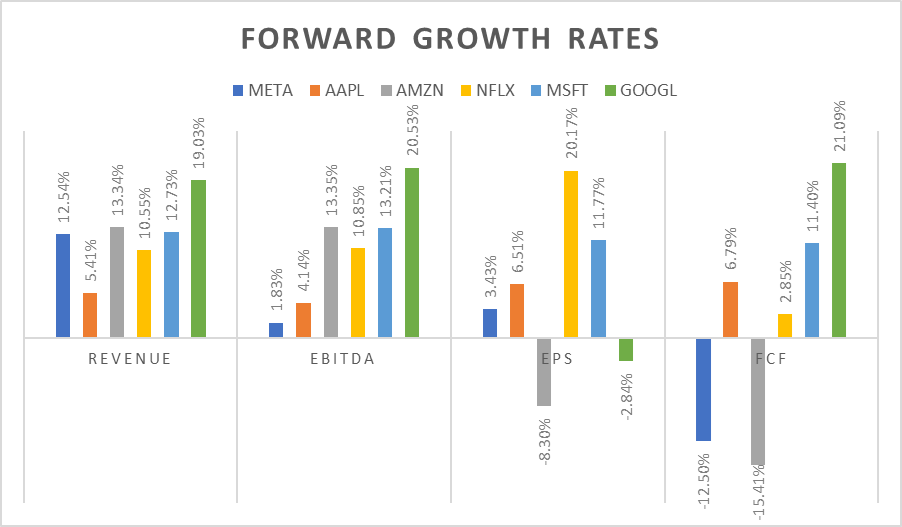

The next graph provides analysts’ consensus forward growth rates. With the exception of EPS, which is a 3 to 5 year estimate, all metrics are analysts’ 2 year projections.

Chart by author/ data form SA

Note that Alphabet is ranked first in three of the four measures.

Although META ranked second overall in terms of valuation, the stock ranks 4th, 5th and 6th in every growth category.

Microsoft ranks well in terms of growth, but that stock ranked 4th, 5th and 6th in three of the four valuation measures.

Why Netflix Ranks Dead Last

Reviewing the two charts I provided, NFLX ranks in the bottom half in six of the eight data sets.

NFLX holds $6.1 billion in cash equivalents and has $13.9b in long-term debt. Of the other five companies, with $41.8 billion at the end of last quarter, META has the lowest level of cash and equivalents.

NFLX had $21.57 billion in content obligations at the end of last quarter, and $4.3 billion of that will be spent within the next year. Herein lies a major stumbling block for me when I consider NFLX as an investment.

Competition within streaming companies results in enormous capex devoted to content creation. It appears to be a vicious circle for all content providers, and that includes the likes of Apple, Amazon and Alphabet, each of which is now in competition with NFLX.

However, Apple, Amazon, and Alphabet have a great deal of FCF to potentially devote to content efforts. For example, Alphabet generated $69.8 billion in trailing 12-month free cash flow. Trailing 12-month free cash flow for NFLX was a relatively paltry $717 million in 3Q22.

Furthermore, while the other five FAANMG’s have investment grade credit ratings, Moody’s still rates NFLX at Ba1/positive, a notch below investment grade.

Analysts’ price targets support my observations. The average 12-month price target for META, AAPL, and MSFT are each roughly 30% higher than the current share prices. AMZN and GOOGL have price targets that are 66% and 61.7% above the current share valuations, respectively.

NFLX? Analysts give that stock an upside of 1.3%.

Summation

GOOG is the sole member of the FAANMGs that I rate as a buy. As I previously stated, I seldom invest in companies with PEG ratios above 2.0, and I cannot in good conscience rate a stock as a buy unless it meets my own investing criteria.

GOOG took a hit last quarter, but I believe the lackluster results are due to transitory headwinds. A lagging economy has a strong negative effect on advertising, and advertisers tend to be proactive in reducing spend.

The current exchange rates, which nearly halved Alphabet’s revenues last quarter, should be less of a headwind once the Fed reverses course.

Meanwhile, I see great potential in Alphabet’s cloud business. There is a possibility that a big winner could someday emerge from the company’s Other Bets, and there is a long growth runway for the digital advertising business.

While conducting my investigation for this article, I initiated a small position in GOOG.

Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.