Summary:

- Artificial Intelligence (AI) is a disruptive and profound trend, with Microsoft leading in enthusiasm and technology, making it a top choice for gaining AI exposure.

- Many companies will likely not deploy AI investments in a way accretive to shareholders, so it’s crucial to evaluate AI for its effects on earnings.

- Microsoft is uniquely positioned with scale, expertise, and product ecosystem to use AI to boost earnings before new AI disruptors reach public markets.

Jean-Luc Ichard

“AI’s record of barefaced public deception is unparalleled in the annals of academic study.” -T. Rozak

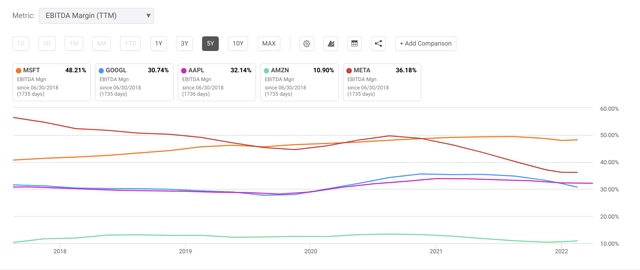

Artificial Intelligence has made a dramatic entrance on the commercial scene. The only question seems to be whether it will be more significant than fire or the Gutenberg Printing Press. Of course, the other principal question is whether it will destroy or save the human race. Whatever happens far in the future, it is safe to say that Microsoft (NASDAQ:MSFT) has the best near-term prospects of capitalizing on AI in a way that is accretive to shareholders. It also has more juice to squeeze than its mega-cap peers regarding potential efficiencies from AI.

The truth, as it is in so many cases, is devastatingly boring compared to sensationalized and bias-laden coverage of such profound technology. AI is going to unlock a lot of productivity and value in very boring areas of the economy: operational jobs, office jobs, data-intensive functions, and technical support functions.

The Microsoft Office Suite will likely be one of the first ways prodigious revenue will be gathered, likely in a year or less, not many years. How much is telling an AI assistant to build you a spreadsheet worth, rather than messing around with it yourself?

So, a commercial opportunity is arising here, or perhaps the end of all commercial opportunities. Because of this frantic discourse, you must be especially careful when investing in trends as profound and profoundly disruptive as AI. Dispassionate observation as a shareholder should be your objective if you want to make money on a trend. Hype is the enemy.

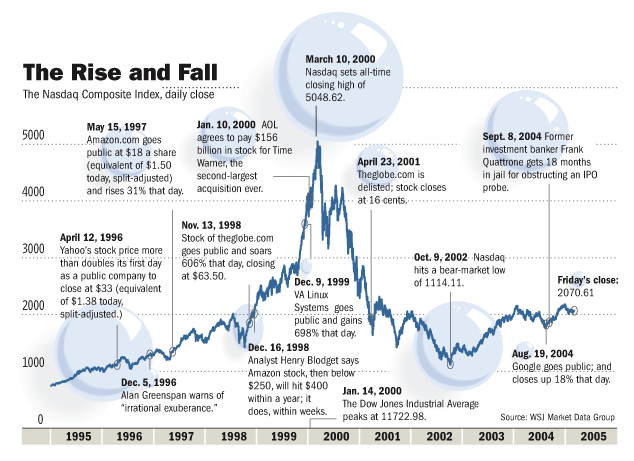

Of course, it always bears remembering that the natural undulations of excessive optimism and excessive pessimism that define markets can be even more pronounced when dealing with a fascinating technology with novel capabilities that seemed like magic only months ago. While some investors believe this is a 1999 “Tech Wreck” moment, I agree with Wedbush Analyst Dan Ives when he says it’s more like 1995.

Global Entrepreneurship Institute

In other words, there will undoubtedly be a reckoning for those who have overpromised AI in the future. Still, the fantastic results of ChatGPT and the lead in enthusiasm and technology that Microsoft has achieved will continue to set them apart from its peers, in my estimation.

There’s undoubtedly much fomenting of disinformation, both CEOs who want to ride the AI wave despite an inability to deliver and entrenched Tech firms that want AI slowed and regulated to mitigate its disruptive threat to their large moats. In contrast, they juice profits from current products and create new ones for their benefit, potentially at the expense of innovators.

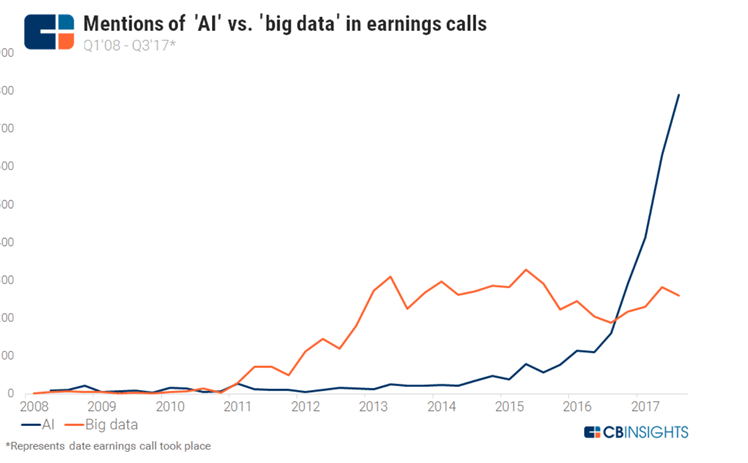

CB Insights

Of course, Microsoft’s unveiling of ChatGPT was the defining moment of the modern supercharged interest in AI, but let’s remember that far before we had this impressive unveiling, companies were trying to use AI to conduct a kind of “aggressive mimicry” not out of maliciousness or outside the bounds of the law, but out of a natural enthusiasm for a technology that is misunderstood and hard to monetize. You can see that mentions of AI in company earnings spiked long before Sam Altman and friends left the Turing Test in the dust forever.

Companies have the potential to distort and misrepresent their efforts on AI and can do so within legal reporting parameters, oftentimes by accident and much more rarely on purpose. Optimism is not a crime, and many managers might make overzealous statements in full honesty, not fully understanding the underlying technology themselves.

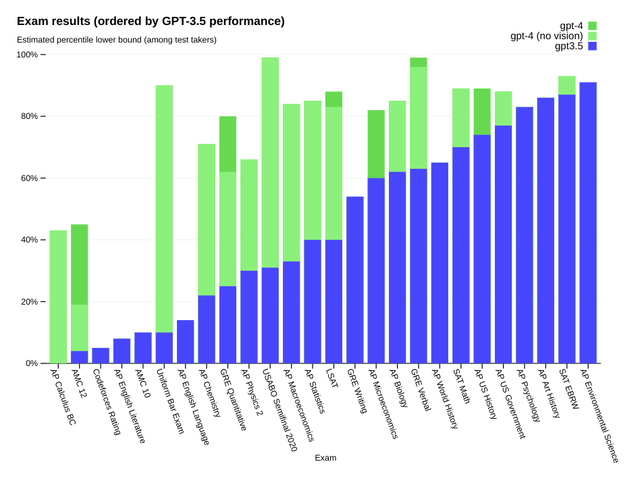

AI is a technology that changes much faster than the previous tech as well. Major improvement in only one upgrade cycle suggests that the ecosystem of AI developers and apps Microsoft is also hosting will lead to a virtuous cycle indeed.

The last thing you want to do is end up metaphorically in the mouth of the turtle. So, it’s essential to evaluate AI for its potential to benefit shareholders, and the sooner, the better. That’s why if you’re investing in AI, the easiest and juiciest worm to start with is Microsoft, as easy as it may seem. Consider this stock Occam’s AI pick.

The Sultan of Software Meets Artificial Intelligence

As exciting as the beginning of the AI revolution is from many perspectives, as shareholders, we still have to judge projects that management undertakes as either accretive or a waste of capital.

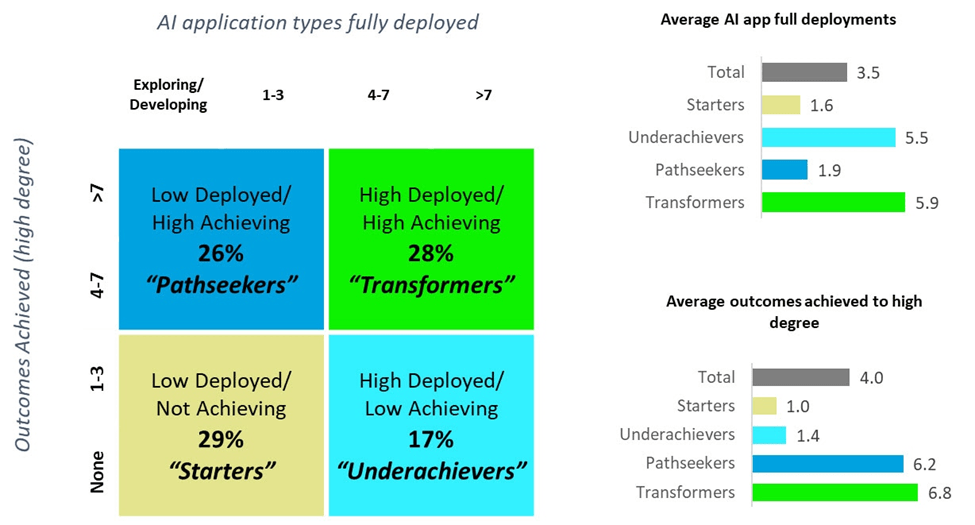

Deloitte Insights

Many such projects will waste capital, and most companies that use AI in their earnings report will not deliver to shareholders. Remember also that most AI investments have not yet reached public markets. For years, the future of AI, young and nonexistent companies, will be developing from the early and seed stage capital stage until they finally prove themselves to offer shares to the public through an IPO.

There’s a lot of waiting and proving between now and then, but Microsoft is a unique name with the scale, expertise, and scaled product ecosystem to begin using AI to boost earnings long before the new wave of AI disruptors reaches public markets. This is why it is my first choice for gaining AI exposure.

Nvidia (NVDA) is undoubtedly a vital supplier of the chips needed for AI, and that is a great opportunity too. But in my mind, it is second to Microsoft, as it will be delivering value all over the economy using AI, and those it is delivering that value to will be willing to pay a lot for it. Chip demand is notoriously cyclical at a time when it’s hard to orient yourself cyclically. Also there’s increasing government intervention.

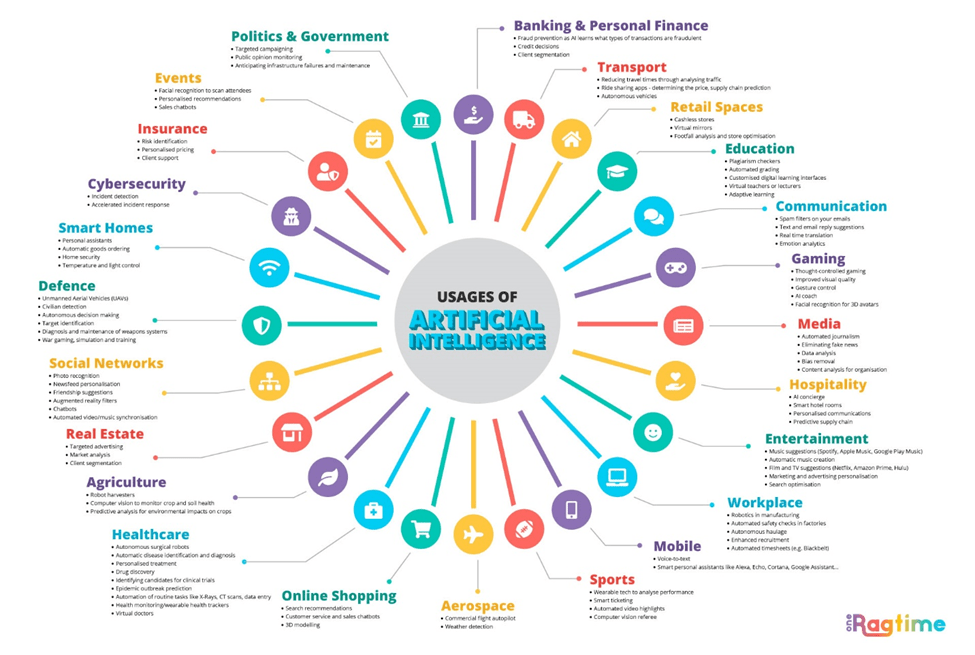

OneRagTime.com

However, Microsoft seems just on the edge of majorly augmenting profits and revenue in the immediate future by integrating AI into its incredibly sticky and ubiquitous Office Products and other Software Tools. For years, prophetic AI experts have said that the trend will affect nearly every industry, given its profound nature to augment human intelligence like never imagined.

And while this all has seemed very far into the future until recently, Microsoft is steadily unmasking a gameplan that makes a short path to significantly higher profits than even many optimistic analysts have forecast are a distinct and increasing possibility.

Risks and Where I Could Be Wrong

Microsoft is a seasoned company, and they have stumbled before when it appeared they were carrying the torch. I think this is not the case in the realm of AI. The attempted effort by Alphabet to counter Microsoft’s transformative announcement fell flat on its face, and a lot of R&D into AI may currently lack a viable commercial opportunity in terms of profitability, adoption, and scale.

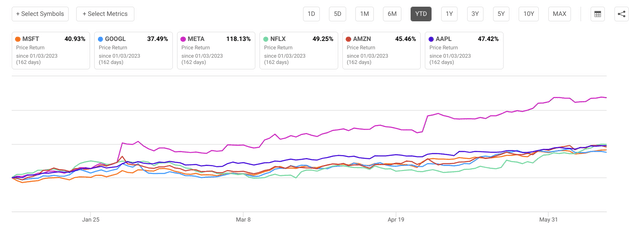

Of course, the biggest risk is the overperformance of Technology lately. Indeed, names like Meta (META) and other Tech names are up in a conspicuously precipitous fashion. But relative to others, Microsoft’s gains pale in comparison, and I also think they are more fundamentally oriented, given the AI opportunity discussed in this piece.

Microsoft is exposed to a recession, but perhaps less so than peers, given the essential nature of their product for so many business functions. That could diminish the upgrade to an AI-enabled Office product if it occurs at the wrong time.

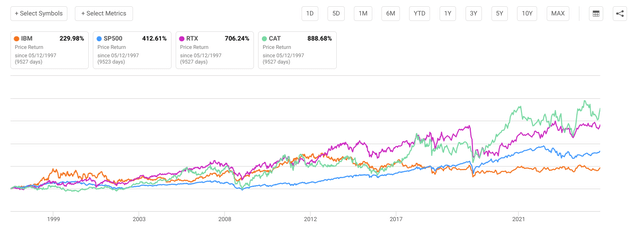

The biggest risk lies with the quote at the beginning of this article. AI is deceptive, and we can often misperceive how advanced it is because of a variety of factors, including The Clever Hans Effect. If you would have bought IBM on May 11th, 1997, because its AI beat Garry Kasparov in a chess match expecting outsized returns, you would have been sorely disappointed. Microsoft has many other drivers for returns outside of AI, including its burgeoning cloud segment that is increasingly successfully

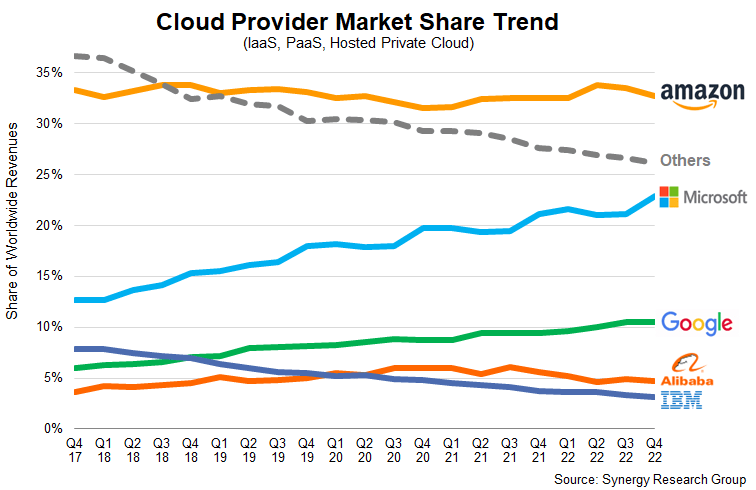

Synergy Research

There is a risk that despite the amazing functionality most of us have tested firsthand, humans could dramatically misunderstand the scope of the commercial opportunity, myself included. But even if AI is overhyped, Microsoft continues to gain market share in Cloud at the expense of Amazon and others.

Conclusion

Microsoft is a commercial behemoth. The firm’s reputation precedes it in many ways. Still, I think its prescient investments in artificial intelligence has created a commercial opening that is the envy of the rest of Big Tech. I know it has gone up a lot, but I think you should use price weakness to accumulate more of the stock. Microsoft, unlike many Tech firms, also allows you the opportunity to buy stock directly from the company using Computershares.com.

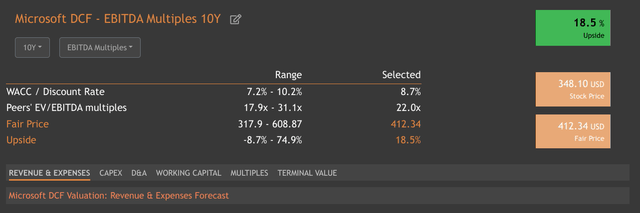

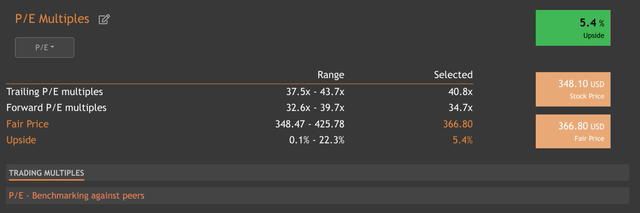

Microsoft is overvalued by some metrics, but you have to consider that the firm’s staying power, pristine balance sheet, and sticky product ecosystem are all warranting a premium valuation. Nonetheless, even though there has been some major appreciation in price and even some multiple expansion lately, I think there is also still some room to run, given the fundamental nature of the primary catalyst on earnings in the near future. The trading multiples aren’t in the danger zone quite yet.

Over a 3-5 year period, I feel comfortable buying Microsoft as long as it is below the high end of its trailing and forward P/E range. One of the features I like about buying directly from the company is that you can set up recurring purchases that help build a position over time and remove some of the psychological elements of buying and selling a lot in your brokerage account. The reason I’m comfortable buying all the way up until the high end of the range is that I am confident that AI will provide a basis for multiple expansions.

While the dividend won’t stick out on any screens, it is there, and it’s nice to have. You can still benefit from compounding, and I suggest that you must hold Microsoft for at least three years, and most preferably more than five, in order to realize the full benefit of investing thematically for the artificial intelligence revolution.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.