Summary:

- Due to rising interest rates, the housing market, HD’s primary consumer, has been struggling.

- Many analysts see these challenges, likely to endure through 2023, as the company’s biggest challenges.

- While I can see their point of view, I do not believe the magnitude of the challenges is as great as some analysts have suggested.

Justin Sullivan/Getty Images News

Investment Thesis

Harsh economic conditions, including high inflation and rising interest rates, have negatively affected the housing market. The Home Depot, Inc. (NYSE:HD) stock has decreased 22.28 percent in the past year due to the slump in housing.

Many analysts have pointed to these difficulties, expected to last through 2023, as the main obstacles to the company’s development in the years ahead. Even while I could agree with them, I think the scale of the problems isn’t as dire as some analysts have made it sound. To back up my claims, I’ll point to the company’s finances, which aren’t terrible, in my opinion.

Stock prices may be down, but the company is holding up rather well, considering the circumstances. In light of these potential setbacks, I am somewhat pessimistic about the company’s near-term expansion, but I am incredibly bullish on its long-term prospects. Since I don’t expect the current difficulties to hinder the firm’s dividend growth history, I think it’s worthwhile for dividend investors to invest in the company now so that they may profit from the long-run cumulative payout.

Company Overview

The Home Depot, Inc. was founded in 1978 and is premised in Atlanta, Georgia. It has stores known as The Home Depot, which sells a wide range of products for home remodeling, landscaping, decoration, and repair and maintenance of commercial and industrial buildings. The company also installs floors, cabinets, remodeled cabinets, countertops, furnaces, central air systems, windows, and central air systems.

Its primary clientele is individual homeowners, while it also works with general contractors, maintenance staff, handymen, property managers, BSCs, and specialists like painters, plumbers, and electricians. In addition to its physical stores, the company sells its wares online through sites like homedepot.com, blinds.com (a website specializing in custom window coverings), and thecompanystore.com (a website specializing in textiles and décor).

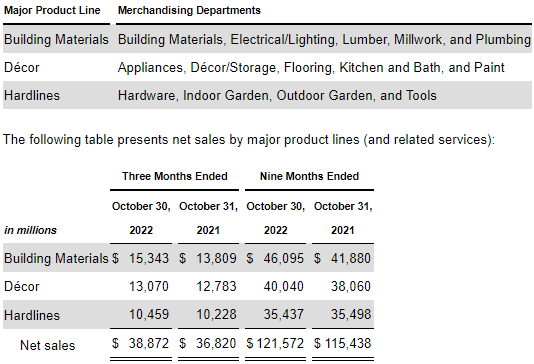

The company’s broad product offering has been organized into three key product lines, and their net sales are broken down below.

Form 10-Q

The Housing Industry: The Heat Is Cooling

October marked the ninth consecutive month of declining housing sales data. Sales were down 5.9% from the previous month, and annual results were down 28.4%. It’s becoming increasingly apparent that sellers are letting up on the property market. This follows a couple of years of exceptionally good growth, which occurred despite the disruption brought on by the COVID-19 pandemic.

In reality, rising interest rates are having a big effect on the housing market. Current Fed efforts to combat inflation have resulted in four consecutive rate hikes of 0.75 percentage points. The average rate on a 30-year fixed mortgage in the United States was 6.61% by mid-December. This is a significant increase compared to the average mortgage rate at the end of 2021, when it was around 3%.

Although these issues may affect buyers, homeowners also feel the effects. Existing homeowners also face this difficulty when selling their homes and relocating. Although it is feasible to “port” an existing mortgage to a new home, most buyers are looking to “upsize,” not “downsize,” when making a move. Many homeowners will need to add to their mortgage to move to a larger or more expensive home. Again, this is far harder for folks in that situation than six or twelve months ago. This slows the chain. Fewer house movers mean fewer listings and buyers. In this case, demand and supply are both declining.

Mortgage rates may rise further. The Fed expects base rates to reach 5% by the cycle’s conclusion. That would raise mortgage rates to over 8% by 0.75 percentage points. This hurts the home market. In other words, the housing industry outlook is bleak.

A Resilient HD?

The housing industry is HD’s primary, if not exclusive, customer base. The preceding analysis of the industry shows that it has been performing poorly because of rising interest rates caused by the FED’s attempt to control inflation. Rate hikes are still expected, suggesting the market might expect prospects considerably worse than existing ones.

Many analysts have cited these rates as the major inhibitors to HD’s success; as much as I agree with them, I will disagree with them on the magnitude of these challenges affecting HD. To begin rebutting their claims, I will first state that these challenges have threatened HD, but it has not yet succumbed to them; indeed, I find the company very resilient. I don’t see the significant drop in its share price as a sign of giving in to these challenges because share prices are driven primarily by market forces. In light of this, I shall direct my attention to:

- Financials

- Dividends

Financials

Even though the housing market is cooling and revenues, demand, and supply are all going down, HD’s financials go against this trend, which shows how resilient the company is. To begin with, the company has a YoY revenue growth of 6.49%, which I believe is due to the strong demand for its products.

CEO Ted Decker stated,” Our results in the quarter reflect continued solid demand for home improvement projects. While we did see some deceleration in certain products and categories, as Jeff will detail, the project business remains strong across most of our departments. We also saw year-over-year growth with both, our Pro and DIY customers in the quarter.”

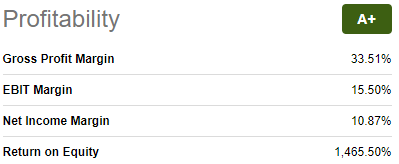

In addition to the growing topline, the company’s bottom line has also been attractive amidst the challenging macroeconomic climate. HD, on a TTM basis, has a gross profit margin of 33.51%, an EBIT margin of 15.50%, a net income of 10.87%, and above all, a return on equity of over 1000%.

Seeking Alpha

To add on profitability, HD’s liquidity is also worth noting; currently, the company has a cash balance of $2.46B; this is after paying approximately $1.9B to shareholders in the form of dividends, spending $1.2B in share repurchase program and reinvesting back $770M in the form of CAPEX during the Q3. To compliment the company’s liquidity is its ability to generate cashflows as exhibited by its positive cashflows from operations which stands at $12.21B. It’s also worth noting its levered FCF balance of $7.22B. These statistics speak volumes about the company’s good financial state despite the challenging macroeconomic climate.

Finally, I’d like to draw readers’ attention to the company’s share buyback, which, in my opinion, demonstrates that management has confidence in its stock and it believes that its shares are undervalued. This supports my earlier claim that the share price decline isn’t giving in to the existing challenges but is instead the result of market forces.

Dividend

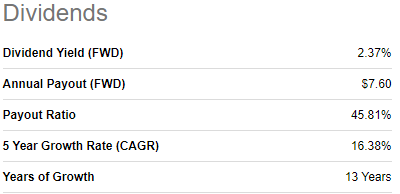

The company paid out dividends to its stockholders totaling approximately $1.9B in the third quarter. HD has maintained a dividend payment and growth streak of 13 years. Its dividend payment ratio of 45.81 percent is highly manageable and, in my opinion, perfect, as it allows for a sizeable percentage of earnings to be reinvested in the business to fuel future growth.

Seeking Alpha

Based on the firm’s financial status and dividend policy, I believe it will maintain its long-term dividend growth trajectory, as the current economic headwinds are unlikely to cause the company to change its dividend policy.

Conclusion

Increasing interest rates have already hurt the housing market, the primary consumer of HD products, and are anticipated to worsen matters. But the company has shown resilience, as evidenced by its solid financial performance, despite the terrible performance of its primary market. However, I still see the corporation as threatened but not rocked by the current challenges.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do not offer financial advice. This article should not be taken as financial advice and is provided for informative purposes only. Before making any financial commitments, readers are strongly urged and required to conduct their own research and reach their own conclusions.