Summary:

- Football season is back, fueling excitement for sports betting. But while gambling is fun, it often leads to financial issues for bettors.

- States legalize betting for tax revenue, despite the financial harm to consumers. DraftKings is positioned to profit from this trend.

- DraftKings boasts diversified revenue streams, rising market share, and strong growth potential in the sports betting and iGaming markets.

- Though not yet profitable, DraftKings’ expansion, customer growth, and future earnings make it a strong contender for growth-focused investors.

spxChrome

Introduction

Football season is back!

As much as I love summer, I always look forward to early September, when college football and the NFL return – my two favorite sports leagues.

According to Cornell University, there are ten good reasons why people love the NFL:

- The NFL is a piece of popular culture.

- NFL is part of American tradition.

- NFL fosters relationships.

- Tailgating is fun (this goes without saying).

- People love watching talented athletes (this applies to other leagues too).

- League parity keeps things interesting (technically, everyone has a shot at winning).

- The NFL hits hard (unlike soccer, football players usually do not pull punches).

- The NFL has the best sporting final (even people who don’t like the NFL usually end up watching).

- There is a chance to win big (gambling!)

- Fantasy football has real stakes (football has become a huge industry).

The last two points explain why the gaming industry is booming.

As reported by NBC News on August 24, sports betting is having a major impact on America’s checkbooks, sportsbooks, and public finances.

The article mentioned a number of academic research papers that reported some interesting developments. One could say these developments are somewhat worrying. I added emphasis to the quote below:

In separate papers released this month, academics have found that households in states where gambling was legalized saw significantly reduced savings, as well as lower investments in assets like stocks that are generally considered more financially sound.

Meanwhile, states that legalized sports betting saw their residents’ aggregate credit scores decrease, while bankruptcies increased. – NBC News

In other words, the more people start gambling, the more their financials suffer. This makes sense, as “the house” always has better odds. After all, bookies and casinos would go out of business if the odds were against them.

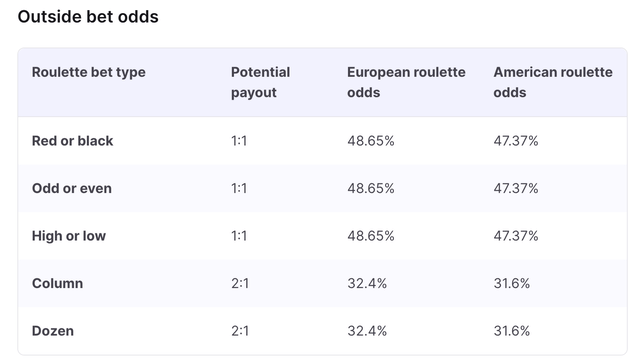

To give you an example, according to Casino.org, the biggest chance of winning at roulette is betting on a color or an even/uneven number. These chances are 47.4%. This means that bettors can go home with a profit if they play just a few games.

However, once volume increases, there’s no way someone goes home profitable. That explains the negative consequences of sports gambling.

So, why would any state legalize sports betting if it’s bad for consumer finances?

That’s because of taxes.

This is what NBC News wrote:

The “lunch” has nevertheless been substantial for state coffers: New York, which has a 51% tax rate on mobile sports wagering, raked in $862 million last year in tax revenues from the activity and more than $2 billion over the past three years, according to Legal Sports Report — with most of it going toward education. New Jersey, the first state to allow online sports betting, has a much lower tax rate — though it is contemplating an increase — but has still seen $549 million in tax receipts from sports betting since 2018. – NBC News (emphasis added)

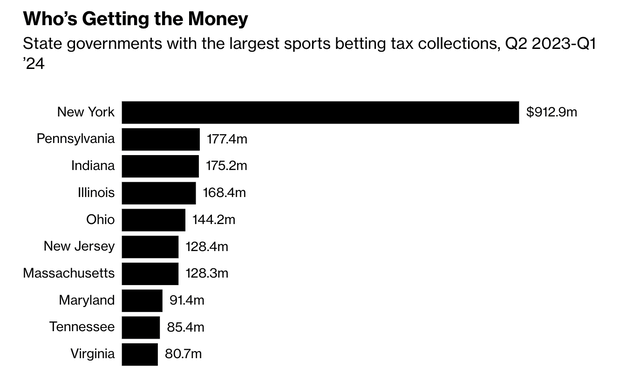

Here’s a Bloomberg chart I found, which shows tax collections from sports betting between 2Q23 and 1Q24:

As we are in an environment of elevated pressure on government finances, I believe this will be a tailwind for sports betting legalization.

Although my opinion doesn’t matter, I am not against legalization. Many things that are “sins” and/or unhealthy are legal, including cigarettes, alcohol, and online adult “entertainment.”

However, I highly discourage people from betting on sports. Buying stocks is much more fun, and the odds are in your favor!

This brings me to DraftKings (NASDAQ:DKNG), a stock I have never discussed before. However, readers kept bringing it up, and I have often promised I would take a closer look.

Hence, in the second part of this article, I’ll explain why DraftKings is in a fantastic position to benefit from sports gambling legalization and trading far below its fair value.

So, let’s get to it!

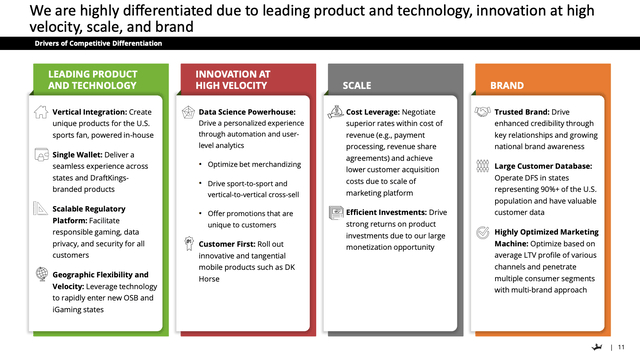

DraftKings Has What It Takes To Gain Ground

I own CME Group (CME), which is the world’s largest futures exchange operator. It’s the first investment of mine where I started betting on “the house.”

Instead of betting on sports, investing in DraftKings may be a much smarter move, as I am truly impressed by the qualities this company brings to the table.

With that said, as this is my first article on the stock, let’s take a step back and look at its business model. Essentially, DraftKings is a digital sports entertainment company that has three major revenue streams:

- Sportsbook: Users place bets on sports events at fixed odds. The company sets these odds to provide a built-in margin (the house always wins).

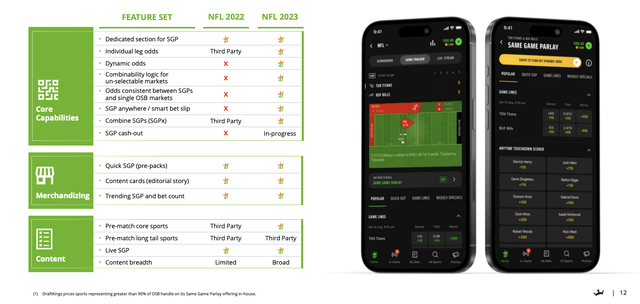

- iGaming: This includes online casino games like blackjack, roulette, and slot machines. DraftKings also offers proprietary games and third-party content, where it shares a percentage of the revenue with content suppliers. In this case, I need to add that DraftKings has become much more independent of third-party suppliers, as it has built its own capabilities. This is great for margins and revenue diversification opportunities down the road.

- Daily Fantasy Sports: This involves peer-to-peer play, where people can win prizes. DraftKings makes money from the difference between collected entry fees and prize payouts.

On top of that, other revenue streams include its retail sportsbook locations, advertising, and gaming software services, among others.

In other words, the business model is rather straightforward: the company is an online casino with a focus on sports-related events. The key to becoming successful is offering superior customer service in a highly competitive industry and attracting as many people as possible without sacrificing margins.

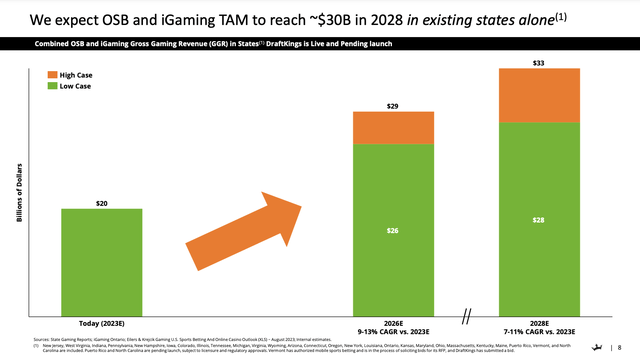

The fact that its total addressable market (“TAM”) is rising helps tremendously.

As we can see below, thanks to legalization, the company believes the TAM of online sports betting and iGaming could reach $33 billion in 2028. This would imply 7-11% annual growth compared to 2023.

This is not the only good news.

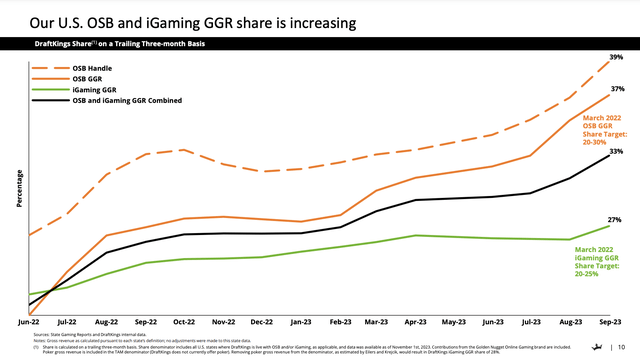

It also helps that DraftKings’ market share has been rising steadily, reaching almost 40% in the online sports betting industry, where it battles giants like FanDuel and BetMGM.

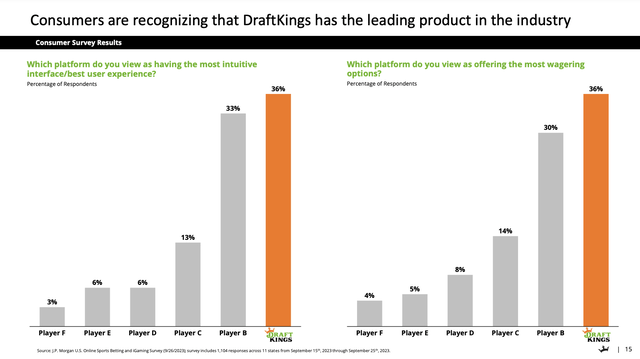

This is supported by a JPMorgan survey, which asked 1,104 respondents in 11 states to rank sports betting platforms.

Although Player B (we can guess which one that is) isn’t far behind, DraftKings is leading in the most intuitive interface/user experience and the best wagering options.

So, what does all of this mean for shareholders?

No Dividend, No Problem

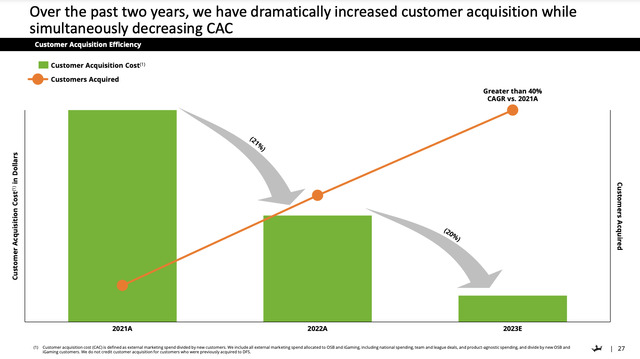

Last month, the company reported its 2Q24 earnings, which were great, as new Online Sports Betting and iGaming customers increased by almost 80% year-over-year. Even better, the costs to acquire these customers (customer acquisition costs – CAC) declined by more than 40%!

According to the company, this was supported by new state launches that made its marketing and customer engagement strategies much more effective. DraftKings expects this to continue, which bodes well for future growth.

As we can see below, the decline in CAC has been consistent, as it has declined by 21% between 2021 and 2022 and 20% between 2023 and 2022.

Meanwhile, the number of acquired customers has improved.

Moreover, in light of tax risks, the company noted that it is using strategic tax surcharges to deal with challenges coming from the aforementioned high-tax states.

DraftKings expects this to contribute to higher adjusted EBITDA in 2025 and beyond.

In 2025, the company also expects to reap the benefits from the integration of the Jackpocket app, which is a lottery app with a lot of expansion potential.

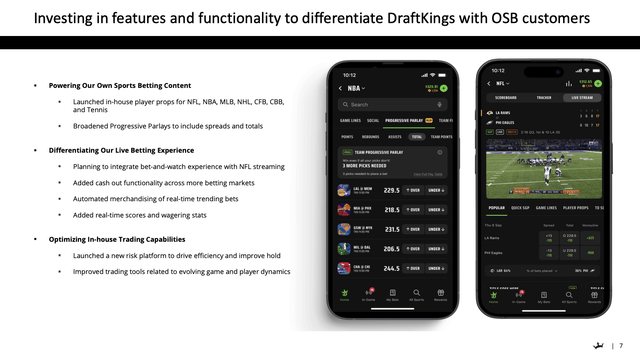

Furthermore, DraftKings continues to innovate within its core products, especially in Sportsbook and iGaming. The company recently launched in-house player prop wagers across major sports, increased progressive parlays, and plans to integrate a “bet-and-watch” experience with NFL streaming.

According to the company, in iGaming, the DraftKings and Golden Nugget Online apps were ranked number 1 and number 2 in a third-party survey.

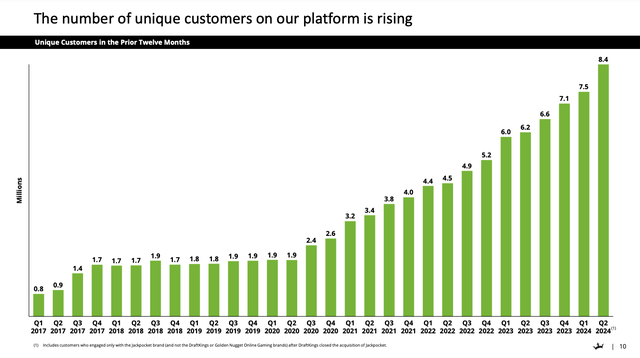

In general, the platforms are a huge success, as the number of unique customer visitors on the company’s platform has risen to 8.4 million in the twelve months ending 2Q24. In 2Q20, that number was less than 2.0 million.

Going back to its financial performance, the company generated $1.1 billion in 2Q24 revenue. This is an increase of 26% compared to the prior-year quarter.

It led to $128 million in EBITDA, up from $73 million in 2Q23. Thanks to better-than-expected customer acquisition and effective promotions, the adjusted gross margin was 43% in 2Q24 and 1H24. In 1H23, that number was 43% as well.

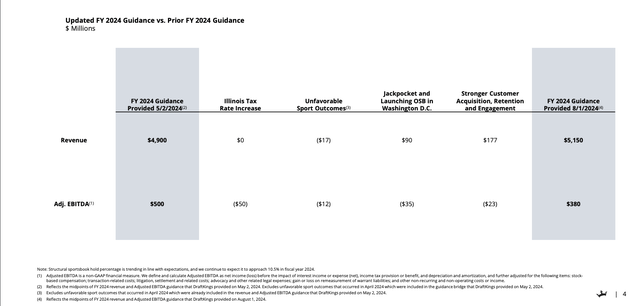

Thanks to these tailwinds, the company hiked its guidance. It now sees at least $5.2 billion in revenue this year, 5.1% more than initially expected.

However, DraftKings adjusted its 2024 adjusted EBITDA guidance to a range of $340 million to $420 million. This is down from the previous range of $460 million to $540 million.

According to the company, this revision is based on several factors, including the increased sportsbook tax rate in Illinois, the expected costs that come with higher new customer acquisition, and the inclusion of Jackpocket.

The good news is that the company expects 2025 adjusted EBITDA to be at least $900 million.

With all of this in mind, the company does not pay a dividend. It is not even profitable.

Not yet, anyway.

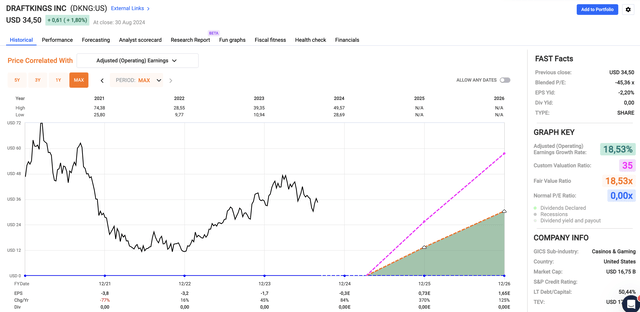

Using the FactSet data in the chart below, analysts expect EPS to be $0.73 next year, potentially followed by a surge to $1.65 in 2026. If we apply a 35x multiple, the stock has a fair price target of $58, 68% above the current price.

This is the same price target the company got from Oppenheimer on July 1.

Although a 35x multiple won’t be sustainable in the future, current growth rates justify an elevated multiple, especially because the company is growing rapidly in an environment of rather poor consumer sentiment(!).

I believe any improvements in middle-class finances will have a meaningful impact on its growth rates.

As a result, I apply a Strong Buy rating.

That said, I am not sure the stock is right for me. I am not saying that because I don’t trust my own research, but because I prefer wide-moat companies in other areas, including buying “the house” through stock exchange operators.

I’m also more focused on dividend-paying companies. However, if my portfolio were more geared toward growth stocks, I would be a buyer of DraftKings at current prices.

Takeaway

Football season is back, and with it comes the excitement of sports betting.

However, instead of placing risky bets, consider investing in companies like DraftKings, which are poised to benefit from the growing legalization of sports gambling.

DraftKings offers diversified revenue streams and a steadily increasing market share, putting it in a great spot for future growth.

Although it doesn’t pay a dividend and isn’t profitable yet, its growth potential is hard to ignore.

So, if you’re looking to invest in the future of sports entertainment, DraftKings might be a smart play.

Always bet on the house!

Pros & Cons

Pros:

- Growing Market Share: DraftKings is steadily increasing its footprint in the online sports betting industry, capturing almost 40% of the market.

- Rising TAM: The total addressable market for online sports betting and iGaming is expected to grow significantly, giving DraftKings an even bigger pond to fish in.

- Diversified Revenue Streams: From Sportsbook and iGaming to Daily Fantasy Sports, DraftKings has multiple revenue streams.

- Customer Growth: The company is adding new users at a rapid pace while reducing acquisition costs.

Cons:

- No Profitability Yet: The company isn’t profitable and doesn’t pay dividends.

- High Tax Exposure: Elevated tax rates in key states could pressure margins and impact future earnings.

- Volatility: High-growth stocks like DraftKings can be volatile, especially when market sentiment shifts.

- Competitive Landscape: DraftKings is in a fierce battle with heavyweights like FanDuel and BetMGM, which could limit profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.