Summary:

- Salesforce is a leader in the customer relationship management software industry, with significant revenue growth and a strong market position.

- The company is focused on profitability and has implemented a transformation plan to improve its financial metrics.

- Investors have different views on Salesforce’s valuation, leading to volatility in the stock price.

- The upcoming earnings report may swing the needle on the side of investors betting on Salesforce’s ability to become a true cash cow.

Stephen Lam

Introduction

As stocks go up, investors actually seem to consider stocks cheaper and tend to be greedy. Warren Buffett has often spoken about this issue. Salesforce (NYSE:CRM) is one of the stocks that has caught many investors’ attention in the past few years, with huge runs up and then steep drops.

Among many macroeconomic uncertainties, one thing we know for sure: demand for IT products and services won’t go away and will actually increase, particularly now that AI is set to become a big part of our lives. Among this huge industry, one of the fastest growing ones in recent years has been customer relationship management software, with another 14% YoY growth in 2022, reaching $96.3 billion worldwide. The company that has made it to the top of the industry is by now known: Salesforce has been in fact able to triple its revenue from $10.5 billion in FY18 to $31.4 billion in FY23. At the end of the month, Salesforce will be releasing its Q3 FY24 earnings. What should we expect?

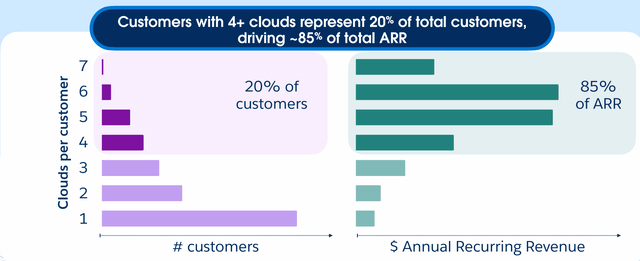

The company: A pioneer then and now

Salesforce was one of the first cloud companies in the world and is now the global leader in cloud-based CRM software thanks to its Customer 360 suite of products. It was also among the first ones to introduce the software-as-a-service (SaaS) business model, shifting the overall revenue structure from being linked to the direct purchase of a software product by the customer to being subscription-based. The advantage is by now well-known: revenues become recurring. With cloud this becomes incredibly important. As the company shows, 20% of customers – the ones with four or more clouds – generate 85% of annual recurring revenue. This gives the company a great visibility and its future growth because it knows these companies are more engaged and locked into the ecosystem. Therefore, the company can easily predict how much revenue it will generate in the future. This can be seen every time Salesforce releases its guidance: usually its forecasts stay within a very tight range, unlike many other companies with a different sales structure.

CRM 2023 Investor Presentation

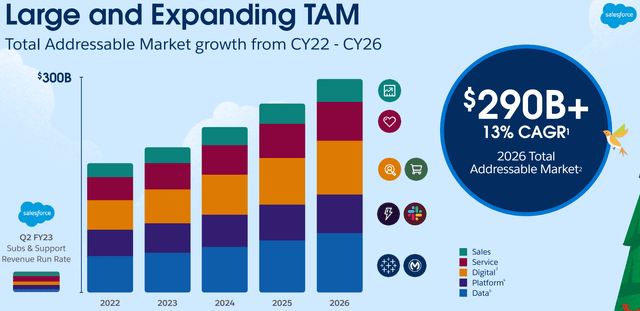

Now, Salesforce offers a platform uniting sales, service, marketing, commerce and IT teams by connecting all the available data about a company’s customers. Any business using the platform may choose just a single app from Customer 360 or combine two or more of them. A CRM system provides a company with a clear way to manage interactions with acquired and to-be-acquired customers. In this way it helps a business have a clear overview of its customers. Not only, but a CRM that works can make a business save a lot of money. In fact, it prevents data from being lost and organizes them to help a business build a complete record of every customer relationship over time. But a CRM software is also used to manage daily customer activities and interactions. Therefore it is also a marketing tool which enables a company’s salesmen to engage the company’s prospects with the right message, at an appropriate time and through targeted campaigns. Clearly, this helps reps have a better overview of their sales funnel. Even smaller businesses can quickly launch and scale ecommerce and customers feel more engaged. The advantages of this software are before everyone’s eyes and this explains the success and the growth we talked about at the beginning of the article. In addition, according to Salesforce, this growth is just in its early stages because the total addressable market is expected to grow at a 13% CAGR until 2026.

CRM 2023 Investor Presentation

Now, AI marks another milestone which enables the development of a new generation of CRM. Last March, Salesforce announced its Einstein GPT, which is a generative AI for CRM. It integrates with Open AI and, along many interesting features, it will be able to generate content that continuously adapts to the information a company has about a customer. For example, the company showed during its Salesforce AI Day how Einstein GPT can generate personalized emails or specific responses for customer services professionals. It can also auto-generate code for developers. Of course, Einstein GPT was launched for each one of the main areas Salesforce focuses on: sales, service, marketing, Slack, apps for Customer 360, developers.

To me, the picture is clear enough to judge Salesforce at pace with the most recent innovations.

These are the financials to look at in the next report

As much as Salesforce has taken the lead in its industry, as much as its revenue growth has been impressive, the stock has been very volatile since the pandemic. At first it got crushed, falling from $200 to around $120. Then it raced all the way up to $310 and change. Last year it sold off until it bottomed around $125 and now it is going up once again to $225. This year alone, the stock is up 67%. So, what causes this volatility? The answer, to me, is quite clear: investors have very different views on Salesforce’s valuation.

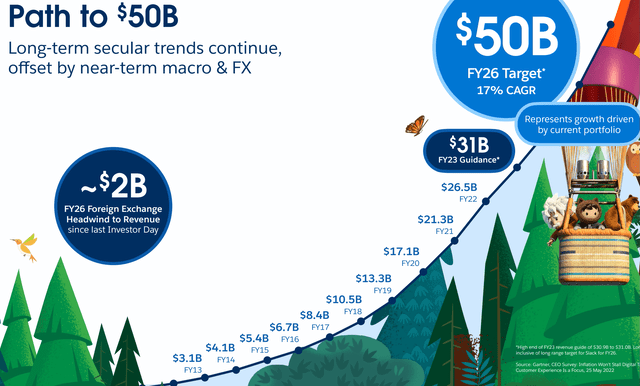

To get to this point, we need to look at its financials. In the past decade, the company has seen its revenues increase 10-fold: from $3.1 billion to $31 billion.

CRM 2023 Investor Presentation

However, as much as this growth was impressive, last year Salesforce found itself circled by activist investors, such as Elliott Management and Starboard Value, because its profitability was not following the same path. Seeking Alpha Quant Ratings show the same issue, with Salesforce achieving an EBIT margin of just 13%, a net income margin of 4.8% and a return on total capital of 3.7%. On top of this, net income per employee is just $19.88k. Just to get an idea, Microsoft (the second largest player in CRM) has a net income per employee of $348.85k – an abysmal difference. Thus, cost cuts were required as well as a shift towards real profits and cash flow.

No wonder, Salesforce’s co-founder and CEO Marc Benioff introduced the last annual report with a letter to the shareholders focused on one word: profitability. Here are his words:

We immediately put into place an accelerated transformation plan in four areas: short-term and long-term restructuring of the company, improving productivity and performance, prioritizing our core innovations, and forming a deeper and even stronger relationship with our shareholders.

We closed FY23 with operating cash flow reaching $7.1 billion, up 19% year over year, the highest cash flow in our company’s history.

We are deeply committed to profitable growth, and we believe the loyalty of our customers, as well as our unmatched portfolio of products and services, positions us well to increase customer engagement. We will continue to scrutinize every dollar of investment and resource to ensure we deliver the highest ROI while enabling us to accelerate into the future.

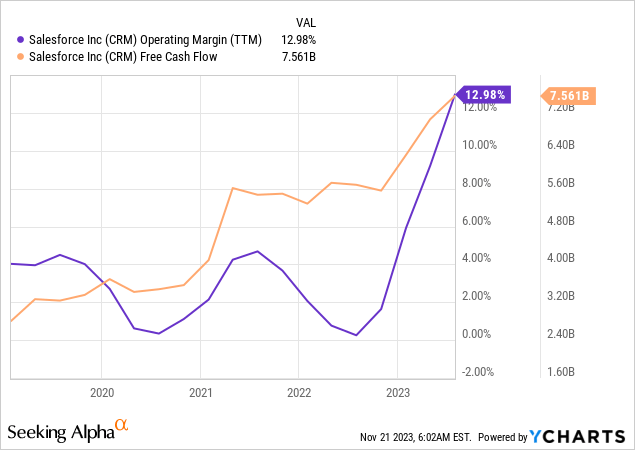

In the past quarterly reports, investors have seen the company’s turnaround with a massive spike in free cash flow and – most importantly, in its operating margin.

Of course, Salesforce can become even more profitable as its transformation plan is put into action. But important financial metrics are not hovering around a low range anymore, but are clearly pointing north.

In the last quarterly report, Salesforce reported total revenues of $8.6 billion for the quarter and $16.85 billion for the first half up from the $7.7b and $15.1b reported respectively in the prior fiscal year. Most importantly, the company has current remaining performance obligation (revenue in the pipeline) of $24.1 billion, up 12% YoY. The way to $50 billion in revenues is supported by this data.

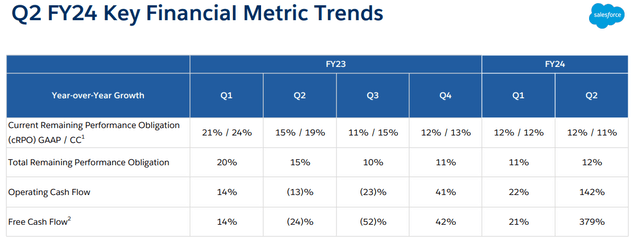

Its main financial metric trends also show a clear turnaround. While current remaining performance obligation is growing at a steady and healthy pace, it is staggering to see the swing in operating and free cash flow, up 142% and 379% respectively YoY.

CRM Q2 FY24 Results Presentation

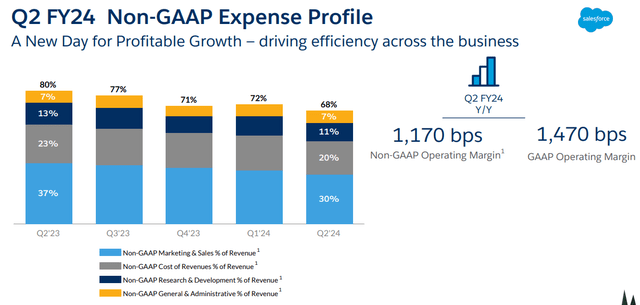

Salesforce did, in fact, talk about a new plan for profitable growth where efficiency is growing across the business: GAAP operating margin increased by 1,470 bps. Quite an achievement in just a year, but also quite a sign of how inefficient Salesforce was.

CRM Q2 FY24 Results Presentation

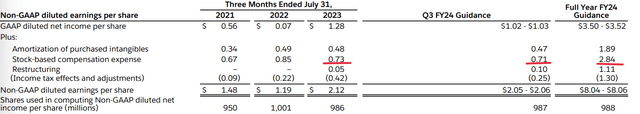

However, there is still a big issue between Salesforce and full operating efficiency. Let’s look at this screenshot taken from the last earnings report. We see what happens from GAAP EPS to non-GAAP EPS. And we also see the guidance the company is giving for Q3 and FY24.

CRM Q2 FY24 Form 10-Q

In red we can see the impact of stock-based compensation expense. In Q2 the company posted GAAP diluted EPS of $1.28. However, it adds another $0.73 for SBC. This is a massive impact. Accounting-wise it is accretive to non-GAAP EPS. But it actually is an expense which weighs on the shareholder and should be seen as a financing activity which reduces shareholders’ EPS.

In 2022, stock based compensation exploded to over $3 billion a year, reaching $3.58 billion at the end of FY23. Considering the company’s free cash flow is around $10.5 billion, SBC has a massive impact. In fact, the net free cash flow should actually be $3.3 billion (we need to subtract FCF twice because currently it is added to reach a company’s FCF). This year, the company is moderating this expense a bit, but without meaningful layoffs it is hard to reduce it because employees accustomed to being paid in shares will hardly give this privilege up. This is an issue similar to Google’s. If the company doesn’t address the issue, it could hurt the stock performance.

Salesforce did commit itself to offsetting dilution, repurchasing almost $2 billion of shares in Q2 and reducing the net share count by 1%. The company has also authorized a $20 billion buyback program. But unless SBC decreases, the company’s efforts are going to be costly for the shareholders.

So, as the next earnings report approaches, we have to be aware of the whole transformation plan to correctly assess the company’s performance.

In terms of revenues, we should expect a double-digit growth between 11% and 12%, which would lead to $8.7-$8.8 billion YoY growth 11%.

But we need to see if the operating income growth keeps on being as high as in the past two quarters. This means I expect an operating margin at least above 20%. A 25% margin would be even better, which would lead to around $2.19 billion in operating income. On a non-GAAP basis, the company is already above 30%. We need to see if this will translate into GAAP operating margin, too.

Let’s use the 17% threshold and assume an operating income of $1.49 billion. This would be a 223% growth YoY. With interest expense staying flat around $70 million and an income tax around 15%, we can expect net income of $1.2 billion. Divided by the 986 million shares outstanding we would have basic quarterly EPS of $1.22. Considering the buyback program is more than offsetting SBC, we could have a little reduction in the share count. But it won’t probably move the final EPS much. However, Salesforce is guiding for EPS of $1.02-$1.03 and current consensus is $1.04. Considering the large beat Salesforce delivered in Q2, I am inclined to think the company’s guidance has been quite low. In addition, if we add in the impact of D&A, SBC and restructuring costs, we could have non-GAAP EPS at $2.20-$2.30. In particular, I would not be surprised to see an operating margin above 17%, which would push EPS up as well. Therefore, assuming a Q4 with the same EPS as in Q3, we could be have FY EPS of $9.10 which translates into a FWD PE of 24.7. Not cheap, but not even that expensive for a company whose profitability is set to increase a lot over the next few years.

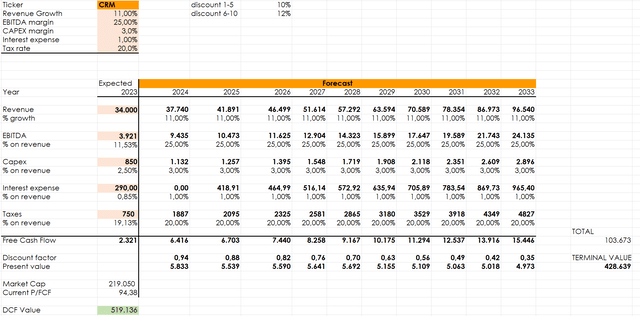

Running a simple discounted cash flow model where we project future cash flows ten years from now and then we discount it to see its present value, we can expect the company to generate around $100 billion in FCF, which is a little less than half of its current market cap. This comes from a forecast of 11% revenue growth, 25% EBITDA margin, capex at 3% of revenues, an interest expense around 1% of revenues and a tax rate around 20%. These are normal scenario assumptions, which I find more neutral than a bearish or a bullish one.

Author estimates

If we calculate the terminal value after ten years, we find out that the cash flow Salesforce can generate has a present value twice the current market cap. This would make me rate Salesforce as a strong buy. But we all know that the company has an issue with real free cash flow, which is being eaten up by SBC. Therefore, I have to moderate significantly my rating until I see a real shift with SBC. Currently I see Salesforce as a cautious buy. The company owns a very promising business and its endeavor to become more profitable seems to be at its early stages. Yet, I also need to see more convincing financial data about the transformation plan and the turnaround Marc Benioff has promised investors and this is what I will try to understand better after the report comes out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.