Summary:

- Analysts have fairly rosy expectations for Netflix, both for revenue growth and earnings per share, despite a recent slump in growth.

- After adjusting for inflation, we see little evidence of Netflix’s ability to pass on costs to consumers or to expand margins, unless at the expense of growth.

- The industry is ripe for disruption, as several players have recently joined the sector and gained traction, potentially putting even more pressure on margins.

- Netflix could also be subject to disruption by Artificial Intelligence in the future, with Stable Diffusion’s ability to generate humanlike content.

- The company is trading at a high P/E and P/FCF ratio, despite being in a volatile sector with utmost difficulty to predict revenues and profits over the next 10 years.

Brandon Bell/Getty Images News

Investment Thesis

Netflix (NASDAQ:NFLX) recently announced its first quarter earnings results, which were mixed as revenue growth slowed to 3.7% and operating margins fell to 21.0% from 25.1% in Q1 2022, according to the latest report.

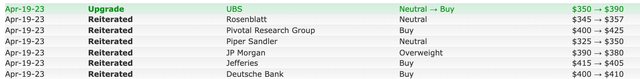

However, this earnings report was met with numerous upgrades from UBS JPMorgan, Deutsche Bank and others, who raised their price target for the company, reflecting significant upside potential. Almost all analysts on Seeking Alpha have assigned either a “hold” or “buy” rating following the earnings report, which leads us to our own contrarian view, in which we believe Netflix is trading well above intrinsic value.

We see several downside risks, including industry disruption, consumer recession, concerns about relative overvaluation, loss of pricing power in a competitive environment, among other things.

Finviz

A Growth Company?

Our bearish view on Netflix is largely due to the fact that the stock is trading at a very inflated multiple, e.g. 35x trailing 12 months earnings and 50x Price/ Free Cash Flow. However, this may be justified if investors believe Netflix is a high-growth company.

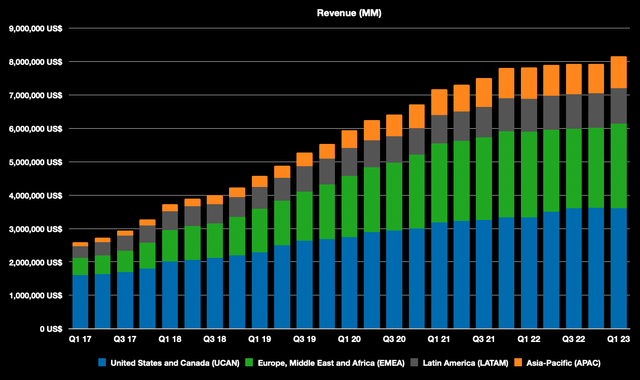

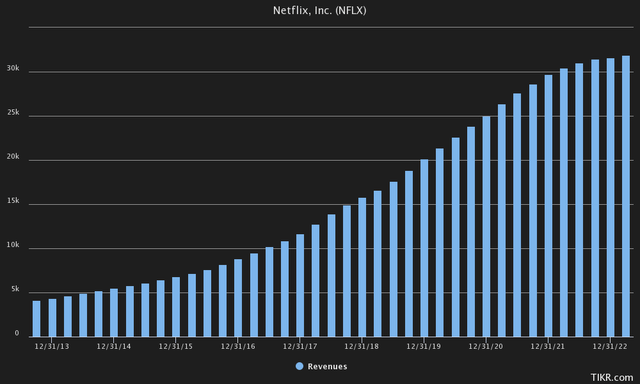

Which it certainly has been in recent years, through 2022. Between 2002 and 2021, the company’s revenue grew at a whopping 30.15% CAGR, from $152.81M in 2002 to $29.70BN in 2021. However, the biggest problem lies with the last few quarters, when revenue growth actually stagnated. Revenue growth fell from 20-30% year-on-year to just 5% in the last four quarters.

Looking at it from a geographic standpoint, most of the revenue growth came from overseas markets, such as EMEA and Asia Pacific. But even from the fourth quarter of 2021, revenues in these overseas regions appear to be leveling off.

Author’s Graphics, Netflix IR Data

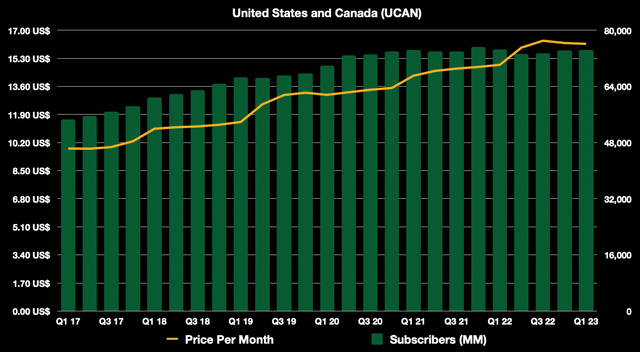

Zooming in on Netflix’s pricing structure, in its main market, North America, it becomes clearer to us that the company may have reached its maximum leverage in terms of pricing power relative to subscriber growth.

As we pointed out earlier, the U.S./Canada was a market that experienced relatively low growth in recent quarters. Perversely, revenues still increased despite the fact that the number of subscribers in the region actually declined. Until Q4 2021, Netflix could raise prices in this region while still gaining new subscribers. This display of leverage while showing growth is what we believe caused the optimism around the stock, reaching $700 in Q4 2021.

But as most know, this came to an end, with subscriber growth headed negative in recent history, meaning Netflix has arguably reached saturation in this region.

Author’s Graphics, Netflix IR Data

But in terms of pricing power, we think there are also quite a few details to consider. Between Q1 2021 and Q4 2022, Netflix was indeed able to raise prices in this region from $14.25 per month to $16.23, or a 13.89% increase over the past two years.

This may not seem like a bad trade-off, given that subscriber growth is flat, but still able to pass on nearly 14% to subscribers. A big caveat here is that this has not yet been adjusted for inflation, which has run high over the past two years. The CPI was 4.68% in 2021 and 7.99% in 2022, making a total of 12.67%. This means that if we want an accurate reading of Netflix’s pricing power, it was only able to push through 1.22% of its purchasing leverage in the 2-year time frame.

And that’s while subscriber growth has remained flat. And yet, it seems to us that Netflix is priced as a fast-growing company, with immense expectations for the future.

Immense Expectations

Let’s face it: Netflix is a company that has experienced tremendous growth, and analysts predict that Netflix will grow again relatively quickly. Revenue is estimated at $50.02BN in 2027, up from $31.62BN in 2022, or low double-digit growth.

But looking at growth over the past two years tells us something different. To smooth out revenue, we looked at Netflix’s quarterly revenue based on the last 12 months, to give an idea of what growth has been like recently.

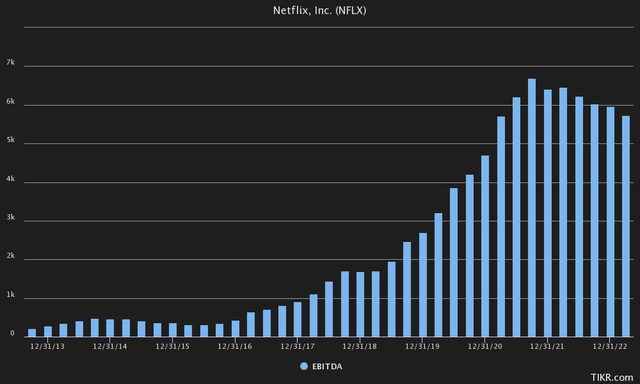

TIKR Terminal

Looking at this chart, growth appears to have peaked. Therefore, we believe the risk is strongly to the downside if Netflix cannot deliver on this future growth, which is currently expected and, in our opinion, may explain the high multiples at which the company is trading.

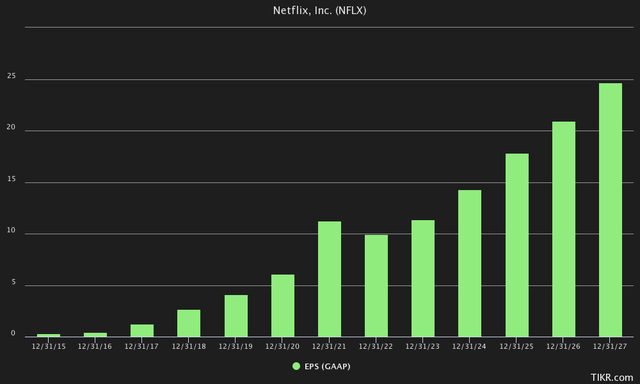

As for EPS, investors are counting on growth from $9.95 in 2022 to EPS worth $24.70 per share in 2027. In other words, analysts expect a nearly 2.5x increase in earnings per share over five years, even though a recession this year/early 2024 is a likely scenario.

TIKR Terminal

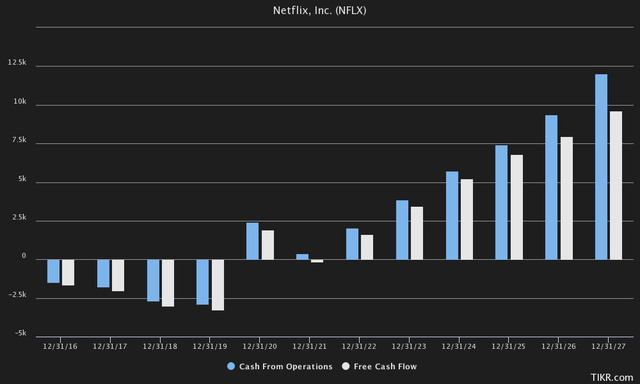

And even on a free cash flow basis, Netflix is expected to grow FCF from $1.62BN in 2022 to $9.67BN in 2027. Even if we take these expectations for granted, and $9.67BN of FCF is generated in 2027, Netflix would currently be trading at 15.10x 2027 Free Cash Flow.

TIKR Terminal

That also brings us back to the growth question, and whether Netflix will be able to leverage its existing subscriber base to increase margins. Even worse right now is the fact that Netflix no longer even gives quarterly figures on user numbers because it is diversifying into ads.

We think that both the increase in ads and the restriction on password sharing could lead to even more churn, as there are now many more other players in the streaming industry with prominent offerings. Recently, many prominent players have emerged, including HBO Max (WBD), Disney+ (DIS), Peacock, and industry giants such as YouTube TV (GOOG), Apple TV (AAPL), Amazon Prime Video (AMZN) and others.

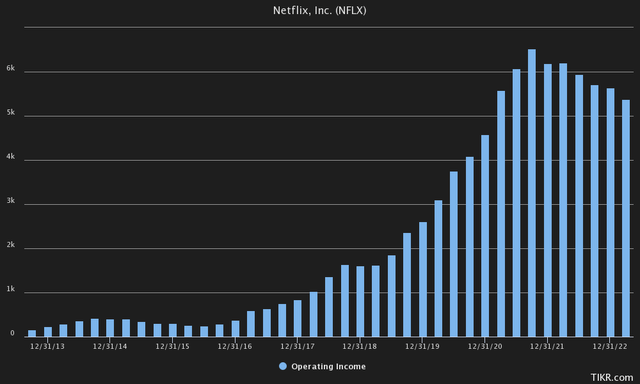

We believe that the current environment is immensely more competitive than before as in 2018, and there is a risk that the playing field will become even more competitive. Operating income on a 12-month basis also seems to reflect this.

TIKR Terminal

As for the idea of tackling password sharing and expanding advertising on the platform, it is also uncertain whether this will ultimately increase margin and profitability. There is also a risk scenario in which churn wipes out the additional revenue from both activities.

In reading what is considered the holy grail of value investing, Benjamin Graham’s book “Security Analysis,” we came across a quote that we believe describes Netflix’s growth projections quite accurately:

The bigger they get, the slower they grow. A $1-billion company can double its sales fairly easily; but where can a $50-billion company turn to find another $50 billion in business? Growth stocks are worth buying when their prices are reasonable, but when their price/earnings ratios go much above 25 or 30 the odds get ugly. (Security Analysis, 1934)

One Bird In The Bush

So now, knowing that we must be extremely careful about pricing in future growth, we look at current earnings to estimate intrinsic value.

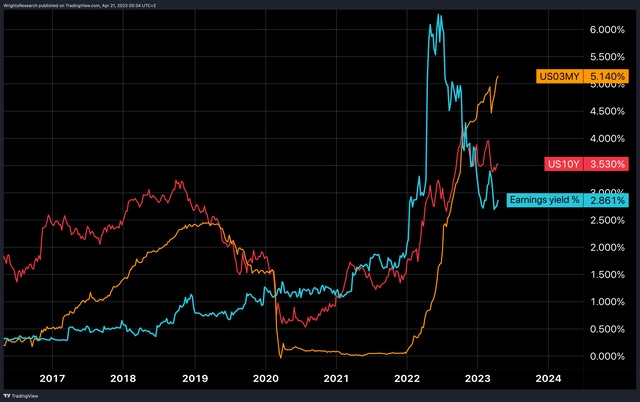

In the chart below, we have compared Netflix’s current earnings yield, which is 2.86%, to the yield investors are currently getting on both a 3-month and 10-year Treasury bill. In the short term, investors are currently willing to accept nearly 50% less yield by investing in Netflix.

Wright’s Research, Tradingview

Even over the next 10 years, investors could face an assumed risk-free rate of 3.53%, but they are willingly taking the risk to buy Netflix and seem to be betting on solid EPS growth going forward. This is despite stagnant revenues and Operating Income, which we discussed earlier.

At the low of $162, it could easily be justified that Netflix could be considered a screaming buy, as its earnings yield exceeded 6%. Even with little to no growth, we think that would be very easy to justify, since interest rates were only around 3% at the time. Which brings us to one of our favorite quotes from Warren Buffett, which goes like this:

The math of investing was set out by Aesop in 600 BC: a bird in the hand is worth two in the bush. We ask ourselves how certain we are about birds in the bush. Are there really two? Might there be more? We simply choose which bushes we want to buy from in the future. (Warren Buffett)

And in this case, looking at growth, Treasury yields and earnings, we would conclude that we only see one bird in the bush. To estimate fair value/intrinsic value, we can also look at relative valuation, and see what its sector peers are trading in EV/EBITDA multiples. The industry average for Entertainment is 17.46x EV/EBITDA. With Netflix’s EBITDA worth $5.73BN over the past 12 months, it would be defensible that Netflix should only trade at an enterprise value of $100.05BN.

Currently, Netflix is at an Enterprise Value of $156.91BN, which means we see it trading 56.83% above its peers. At an enterprise value of $100.05BN, Netflix shares should trade around $209.13, which we would consider a fair value.

TIKR Terminal

Questionable Risk/Reward Profile

As mentioned earlier, there is quite a bit of competition, recently introduced and currently competing with Netflix for viewers. In a previous article here on Seeking Alpha, we explained why the United States and U.S. stocks are likely facing tough times ahead.

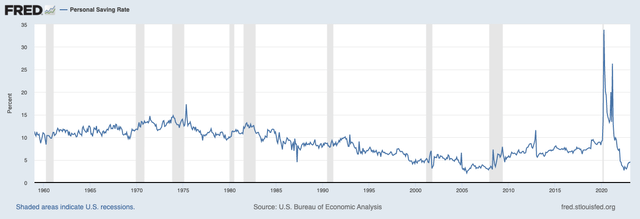

What particularly worries us when it comes to Netflix is the possibility that operating margins could be even more negatively impacted if macroeconomic headwinds persist. If inflation remains too high for too long, unemployment rises or the economy slows even more, it could cause an earnings recession in which some people may be forced to cut back on discretionary spending.

Personal savings rates are still at historic lows and total personal savings are at pre-2014 levels, despite record stimulus spending over the past two years.

Federal Reserve (FRED)

Political concerns may also arise, as previously around certain series, e.g. series cancelled after one season, or the content/entertainment culture itself labeled as skewed toward a certain political stance.

There are many inherent risks in the content/entertainment industry, which, when a series of missteps occur, can lead to unexpected losses or loss of audience, such as a lackluster offering of series/movies. The film industry is also characterized as an inherently risky industry, which is also why we think Netflix should receive a lower multiple than other companies in the S&P 500, as opposed to the high multiples it currently has. Netflix is also not immune to technological disruption, especially when it comes to AI.

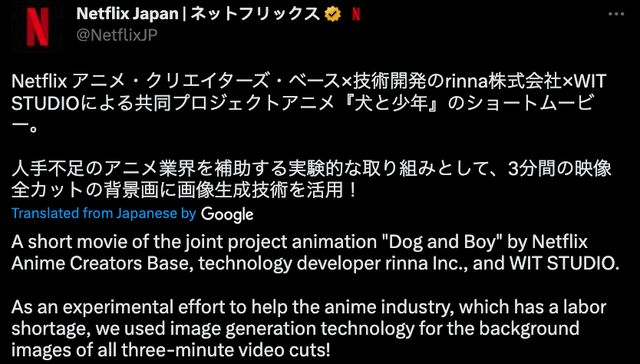

Recently, Netflix itself began introducing artificial intelligence-generated content as it faced labor shortages. Some AI models, such as Stable Diffusion, are already currently able to generate games that are almost indistinguishable from reality. The content of one of the games looked so realistic that the engine developer had to release images to prove that the game was not fake or a video.

Twitter, Netflix Japan

The impact of generating content through Stable Diffusion, at ultra-low cost, is hard to say how it will affect the industry as a whole, as large budgets may not be a requirement in the coming years. It is also difficult to quantify what impact it will have on the legacy IP that Netflix currently owns.

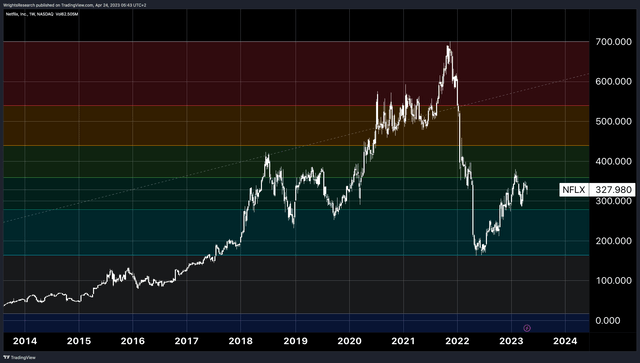

From a technical perspective, we also see a lot of resistance at the $400 level, and believe the stock could fall back below the $300 level if future earnings or guidance disappoints, or falls short of optimistic expectations.

Wright’s Research, Tradingview

The Bottom Line

We believe that numerous factors such as increased multiples, recent struggling growth and a difficult-to-predict sector with competitive threats, lead us to conclude that Netflix does not currently offer an attractive risk-reward ratio, especially with yields on risk-free Treasuries exceeding 5%.

Currently, Netflix still seems to have an edge when it comes to their library of iconic IP, although it would be too much of a guesstimate for us to predict where exactly Netflix will be headed in the next 10 years in the current environment. We estimate fair value for Netflix at $209, and would be happy to adjust our price target if Netflix moves closer to this price. We believe the multiples currently assigned to Netflix, at 35x TTM earnings, are hard to justify when compared to the most rigid companies like Apple, whose products are arguably indispensable to individuals.

We do not believe this is necessarily the case with Netflix, and it reinforces the risk that consumers could cut back on discretionary spending like their Netflix subscription in the face of macroeconomic turmoil. We are apparently “the last Netflix bear in the room.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.