Summary:

- Johnson & Johnson, America’s oldest and bluest chip corporation, is facing significant recurring litigation troubles.

- The company has been hit with diverse claims, including opioid-related lawsuits and a variety of product liability cases.

- These issues can result in periodic headline risk, but should not impact long-term results.

gyro/iStock via Getty Images

America’s oldest and bluest chip corporation has a pre-eminently American problem. Johnson & Johnson (NYSE:JNJ) formed in 1886 is one of two remaining corporations with triple A credit rating. The other Microsoft (MSFT) formed in 1975 is a rank newbie by comparison.

Microsoft had and shed its litigation albatross in the form of a year 2000 district court order that it break up into two companies. The order was subsequently reversed on appeal.

I have documented JNJ’s litigation travails in a series of four articles written in 2017-2019. As I will discuss here these troubles are proving sticky. These issues can result in periodic headline risk but should not impact long term results.

Litigants have tagged JNJ and its subsidiaries with a diverse group of claims.

General

Note 11, pps 29-41 to JNJ’s Q2, 2023 10-Q (the “10-Q”) covers a mind-bending review of JNJ’s endless stream of matters in litigation, Here I give a brief overview of just two, its opioid litigation and its product liability cases.

It has used its mammoth liquidity to substantially, but not entirely, defang opioid claims as discussed below. Its product liability claims are another matter entirely. They keep sprouting up in awesome numbers.

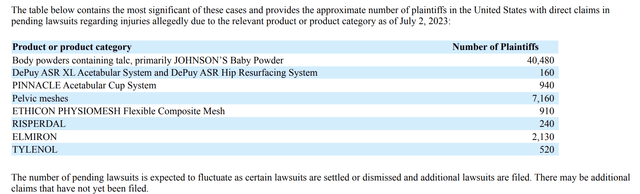

If anyone harbors any doubts as to the vexation that product liability claims in courts throughout the country currently pose to JNJ, just check out its 10-Q table below:

It goes on to note the fluidity of these numbers as cases are settled or dismissed and additional lawsuits are filed.

Opioid claims

It may be hard for those familiar with JNJ’s operations during recent years to wrap their heads around JNJ as an opioid malefactor. In “Johnson & Johnson’s Dead Serious Opioid Issues (“Serious“), I peel back the onion on how JNJ has moved steadily away from its troublesome opioid related businesses. Such businesses once included:

- medicinal poppy facilities in Tasmania initially acquired in 1982 which it grew into one of the world’s largest suppliers of API for various opioid based therapies including oxycodone; it exited the business in 2016;

- pain management therapies, “DURAGESIC ® , NUCYNTA ® and NUCYNTA ® ER”, divested in 2015.

Its forays into this field have generated a bumper crop of diverse tort claims by individuals, state attorneys general and sundry state and local government entities. References to such claims began popping up in JNJ’s 2014 10-K (p. 64).

The 10-Q provides a succinct update on its more current opioid exposures. They have significantly cooled compared to the situation as described in Serious. Most notably the Oklahoma district court judgment discussed in Serious was reversed outright on appeal to the Oklahoma Supreme Court.

Similarly, JNJ ultimately prevailed in the only other opioid case that has gone to trial. Additionally JNJ was able to participate in the blanket settlement of remaining government opioid litigation claims nationwide for an installment payout of up to $5 billion.

Approximately 40% of potential government plaintiffs elected not to participate in the deal. JNJ’s payment was reduced with credits back for entities that declined or were ineligible to participate.

Accordingly the bulk of the risk associated with opioid claims has been resolved. Remaining opioid claims as described in the 10-Q include:

- Approximately 35 remaining opioid cases in various state courts, 475 remaining cases in the Ohio MDL, and 2 additional cases in other federal courts.

- The Province of British Columbia filed suit against the Company and other industry members in Canada; it is seeking to have that action certified as an opt in class action on behalf of other provincial/territorial and the federal governments in Canada.

- Other proposed class actions have been filed in Canada against JNJ, and other industry members, asserting a variety of claims related to opioid marketing practices, seeking significant damages including punitive damages, and costs of abatement.

In addition to opioid claims directly against JNJ, its board of directors is dealing with claims alleging breaches of fiduciary duties related to the marketing of opioids. It retained independent counsel who opined that the board should reject the demands and seek to dismiss the derivative claims. the Board unanimously adopted the recommendations of its independent counsel’s report.

Beginning in 11/2019, a number of derivative complaints were filed against the Company as the nominal defendant and certain current and former directors and officers as defendants in the Superior Court of New Jersey. As of the 07/30/2022 date of the 10-Q, these cases had been substantially disposed of; the final one is on appeal by a shareholder from a dismissal following a JNJ motion to dismiss.

Product liability claims – talc

While JNJ’s opioid claims are in a waning phase, its talc product liability claims remain in abundance. Such claims are forever subject to a cautionary example of how bad things can get. Its 10-Q section (pps. 30-33) addressing matters relating to talc opens by addressing talc cases that have gone to trial.

It notes that it has enjoyed a number of defense verdicts and many of those which it initially lost have been reversed on appeal. Many, but not all. A Missouri case, Ingham v. Johnson & Johnson, et al., went spectacularly wrong.

In Ingham a jury awarded each of various plaintiffs $25 million in actual damages (for a total of $550 million) plus $4.14 billion in punitive damages. It went thru various appeals reducing the award to an aggregate of ~$2.5 billion. It appealed all the way to the US Supreme Court, which denied its writ of certiorari in 06/2021. At which time JNJ paid the award plus interest — ~$2.5 billion.

The 10-Q notes in this regard:

,,, The facts and circumstances, including the terms of the award, were unique to the Ingham decision and not representative of other claims brought against the Company. The Company continues to believe that it has strong legal grounds to contest the other talc verdicts that it has appealed. Notwithstanding the Company’s confidence in the safety of its talc products, in certain circumstances the Company has settled cases.

Ouch, that $2.5 billion paid in Ingham is catnip for aggressive plaintiffs’ lawyers around the country. Those >40 thousand plaintiffs in the wings alleging damages arising out of body powders containing talc, primarily JOHNSON’S Baby Powder, are a damoclean sword hanging over JNJ.

Product liability claims – mesh

In 01/2017’s “Johnson & Johnson Lawsuits And Verdicts Multiply” (“Multiply”). I discuss JNJ terrible flood of ~50.000 lawsuits arising out of several of its pelvic mesh products. I reported:

…JNJ’s [01/2016]. settlement in the mesh arena … was a manageable $120 million to settle several thousand of the cases coming to ~$50,000 per case…

Bringing the situation more up to date, the table above showing an aggregate of ~8,000 remaining mesh cases seems relatively benign.

Product liability claims – other

In addition to its opioid, talc and mesh liabilities JNJ still has lingering medtech liabilities and pharmaceutical product liabilities. Its ~1,100 DePuy and PINNACLE hip med tech product liability claims started their long path through the courts in 06/2010. Their current numbers are well below the ~1.900 DePuy and the ~9,300 PINNACLE suits cited in Multiply.

The pharmaceutical product RISPERDAL is the only oldie among JNJ’s current pharmaceutical product liabilities lineup as shown on the table above. JNJ is doing a good job of addressing RISPERDAL; It was assaulted with >15,000 claims referenced in Multiply. Only 240 remain.

Of course the sheer number of claims is not the critical issue. The 10-Q advises that in 10/2019, JNJ knocked an $8 billion RISPERDAL punitive damage award down to $6.8 million. Just one case that goes askew can be a real problem. Usually on reconsideration outliers are modified. Not always as Ingham shows so distressingly.

Multiply does not discuss either ELMIRON or TYLENOL. ELMIRON cases have arisen recently in a variety of jurisdictions; they allege that ELMIRON, a bladder pain medicine can cause permanent retinal injury and vision loss. The 10-Q notes that JNJ has established accruals for defense and indemnity costs associated with ELMIRON related product liability litigation.

As for Tylenol exposures this is a developing situation. I expect recently divested JNJ subsidiary Kenvue Inc. (KVUE) should be the most involved (p, 27) in these liabilities.

JNJ’s burn from litigation over the years has been burdensome, but not existentially so.

In its annual 10-K’s, JNJ lists its litigation expenses as part of a grab bag of items under the heading “Other (Income) Expense, Net”. I have gone through its 10-K’s reporting its accruals related to litigation for:

- year 2022 — $0.9 billion primarily related to pelvic mesh;

- year 2021 — $2.3 billion primarily related to talc and Risperdal Gynecomastia;

- year 2020 — $5.1 billion primarily associated with Talc related reserves and certain settlements ($4.0 billion);

- year 2019 — $5.1 billion primarily related to the agreement in principle to settle opioid litigation ($4.0 billion);

JNJ’s 2019 10-K (p.24) reports in a different format. It advises of a litigation expense of $2.0 billion in 2018 as compared to $1.3 billion in 2017. Prior to year 2017 it gets harder to parse annual litigation charges.

There were significant variations from year to year. Fiscal year 2016 included higher litigation expense of $0.7 billion as compared to 2015. Fiscal year 2015 litigation expenses were $1.1 billion less than those for the prior year.

Conclusion

Note 11 to the 10-Q (p. 29) describes how accruals involve complex assessments of an ever changing kaleidoscope of facts and circumstances. The key takeaway for JNJ shareholders is to be aware:

…the ultimate outcome of legal proceedings, net of liabilities accrued in the Company’s balance sheet, is not expected to have a material adverse effect on the Company’s financial position. However, the resolution of, or increase in accruals for, one or more of these matters in any reporting period may have a material adverse effect on the Company’s results of operations and cash flows for that period.

So long as the underlying business remains solid, Investors who are in JNJ for the long term should look at periodic litigation developments as noise. Bad news on the liability front creates buying opportunities

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, MSFT, KVUE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may buy or sell interests in any company mentioned over the nest 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.