Summary:

- Altria Group, Inc.’s shares have surged by 15.3% since April, outperforming the S&P 500.

- Second-quarter financial results showed a decline in revenue and adjusted earnings, with market share erosion continuing.

- Bright spots included growth in NJOY vaping technology and on! nicotine pouches, but overall weakness persists.

prchaec

Things have been going quite well for shareholders of tobacco giant Altria Group, Inc. (NYSE:MO). Since I last rated the company a “hold” back in late April of this year, shares have skyrocketed by 15.3%. That’s almost double the 8.6% increase seen by the S&P 500 (SP500) over the same window of time. This upside is also even though, on July 31st, shares declined by 3.1%. This was in response to management reporting financial results for the second quarter of the 2024 fiscal year. Revenue and adjusted earnings per share both came in lower than anticipated. This was disappointing, as was the fact that the firm continues to see an erosion of its market share.

This isn’t to imply that everything was bad. There were a couple of bright spots. And it was likely these that turned the firm’s after-hours decline on July 31st into a modest gain on August 1st. While it is true that shares are attractively priced, it’s difficult to imagine the stock warranting further market-beating upside from here.

A tough quarter

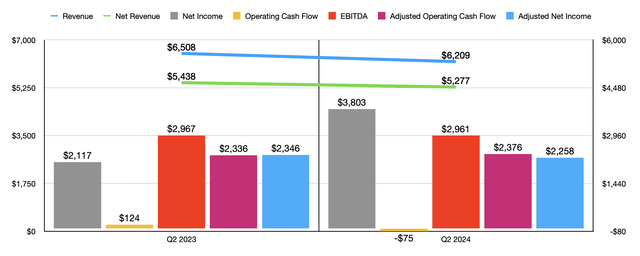

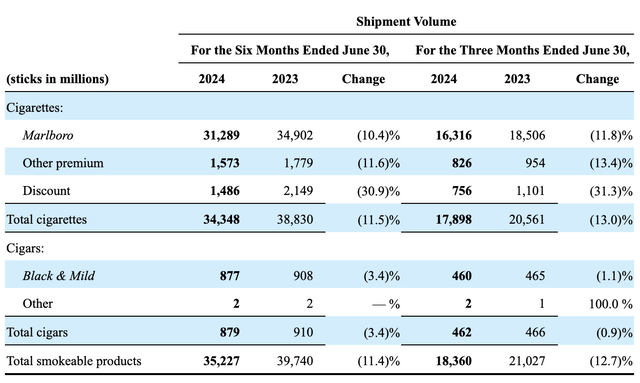

By almost every major measure, the second quarter of the 2024 fiscal year was not a great time for shareholders of Altria Group. Revenue, for starters, came in at $6.21 billion. That’s a decline of 4.6% compared to the $6.51 billion reported just one year earlier. Net of excise taxes, revenue dropped 3% from $5.44 billion to $5.28 billion. This happens to be $110 million lower than what analysts were anticipating. The biggest problem the company faces is a continued reduction in shipment volume. During the second quarter, the company shipped 17.90 billion sticks. That happens to be 13% lower than the 20.56 billion reported for the second quarter of 2023.

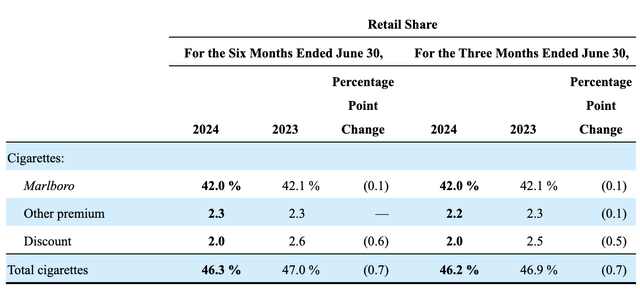

The biggest pain for the company came from its discount brands. Volumes here plummeted 31.3% from 1.10 billion sticks to 756 million. But even the company’s Marlboro brand, its crown jewel, reported an 11.8% drop in volume from 18.51 billion sticks to 16.32 billion. Fortunately, the Marlboro brand saw its retail market share of cigarettes drop only modestly from 42.1% to 42%. So this means that at least it is remaining competitive compared to other major brands.

However, total retail market share for cigarettes fell from 46.9% last year to 46.2% this year. Management claimed that this was mostly because of macroeconomic pressures. But the fact of the matter is that retail market share for the company has been declining for quite some time. In the second quarter of 2019, for instance, which was the final second quarter before the COVID-19 pandemic, the company’s retail market share was 49.9%. So it has been a gradual march down for quite a while.

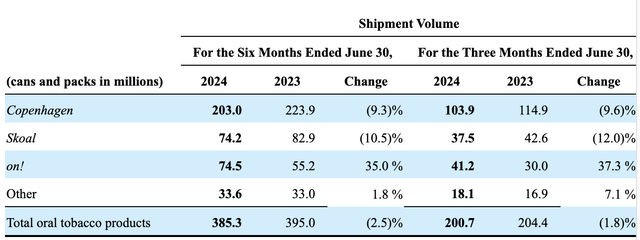

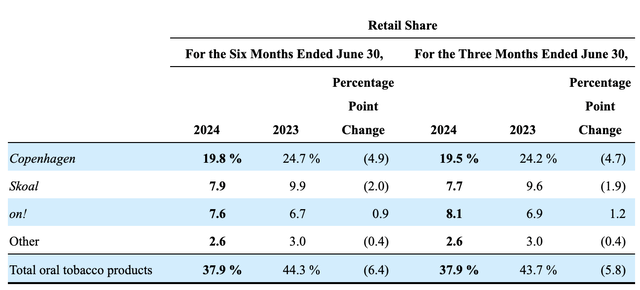

Another weak spot for the company involved its cigars. During the quarter, the company shipped 462 million sticks. That’s down slightly from the 466 million reported one year earlier. There’s also the oral tobacco products side of the business. Year over year, shipment volume, as measured by cans and packs, dropped from 204.4 million to 200.7 million. This brought the retail market share of these products down from 43.7% last year to 37.9% this year.

Surprisingly, the picture would have been worse had it not been for the company’s on! nicotine pouches. Volumes skyrocketed by 37.3% year over year, climbing from 30 million packs to 41.2 million packs. Had this not been part of the equation, the company’s retail market share would have fallen from 36.8% down to only 29.8%.

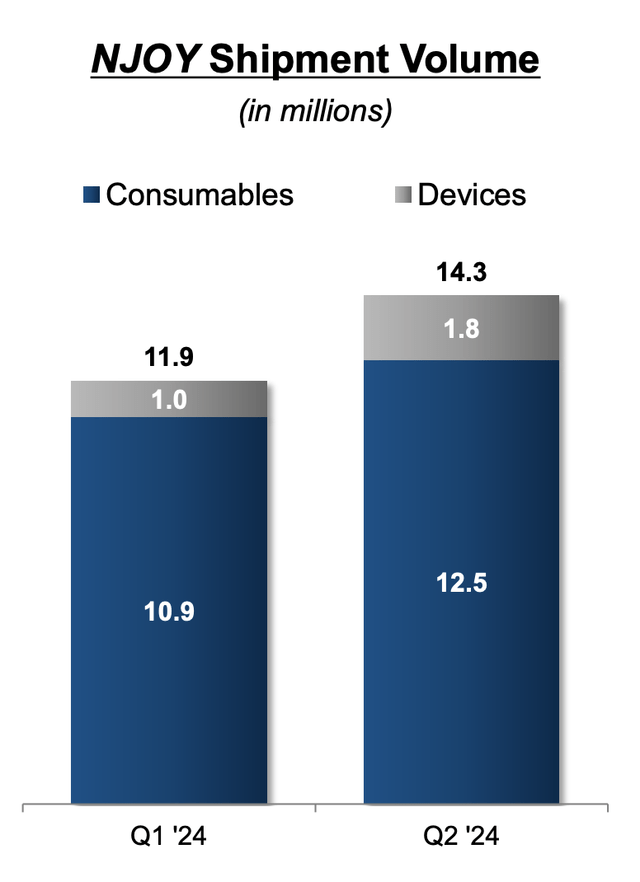

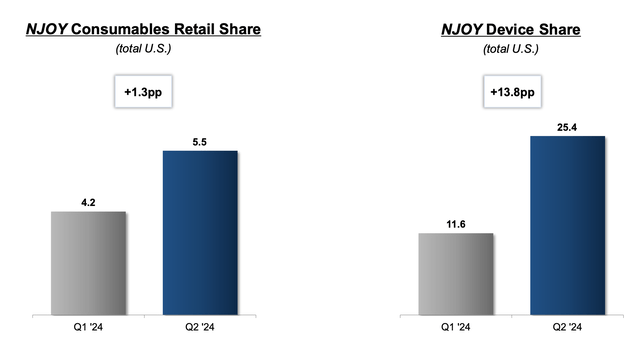

Another really bright spot for the company involved its NJOY vaping technology. During the quarter, the company shipped 1.8 million devices. That’s 80% higher than the 1 million reported in the first quarter of this year. And with that increase came growth in consumables, from 10.9 million units to 12.5 million. This astonishing growth caused the US device share for NJOY to jump from 11.6% in the first quarter of this year to 25.4% in the second quarter. And on the consumables side, its retail share grew from 4.2% to 5.5%. In fact, during the quarter, the company finally succeeded in tripling the NJOY’s presence to over 100,000 stores nationwide.

Unfortunately, the weakness on the top line also translated to some pain on the bottom line. Earnings per share came in at $2.21. This was $0.87 per share greater than what analysts anticipated. But this was only because of a $2.70 billion gain associated with the sale of the company’s IQOS System commercialization rights. On an adjusted basis, earnings came in at $1.31 per share. That happened to be $0.03 below what analysts anticipated. So while net income jumped from $2.12 billion to $3.80 billion, adjusted profits actually declined from $2.35 billion to $2.26 billion.

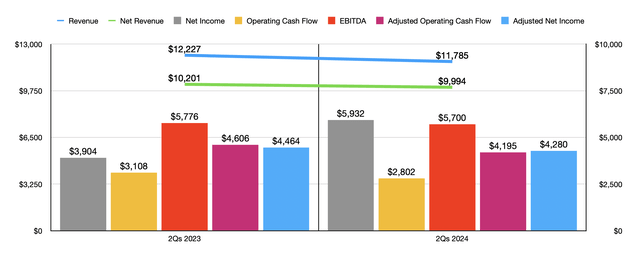

Unfortunately, most other profitability metrics saw weakness as well. Operating cash flow went from $124 million to negative $75 million. Though, if we adjust for changes in working capital, we would get a slight improvement from $2.34 billion to $2.38 billion. And finally, EBITDA for the company managed to fall from $2.97 billion to $2.96 billion.

In the chart above, you can see financial performance for the first half of 2024 compared to the first half of last year. Revenue, adjusted profits, and cash flows, all worsened on a year-over-year basis. For 2024 as a whole, management anticipates adjusted earnings per share of between $5.07 and $5.15. At the midpoint, this would translate to adjusted profits of $8.78 billion. Last year, this number was $8.82 billion. If we then annualized the results experienced for the first half of this year, we would get adjusted operating cash flow for 2024 of $8.50 billion, and EBITDA of $11.95 billion.

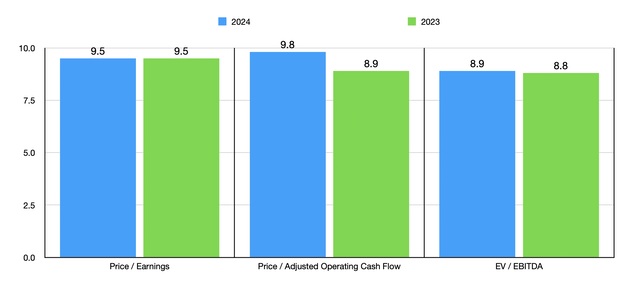

Using these estimates, as well as historical results for the 2023 fiscal year, I valued the company as shown in the chart above. I always love seeing a company trade in the single digit range, even if it is near the high end of that scale. And in the past, these kinds of multiples have gotten me to be bullish on the business. But seeing as how market share continues to deteriorate, I think the company requires lower trading multiples than this before it is attractive.

It’s also worth noting that shares are not exactly cheap compared to similar firms. In the table below, I compared it against five such businesses. On a price to earnings basis, only one of the five companies was cheaper than it, while another was tied with it. On a price to operating cash flow basis, two of the five companies were cheaper. But this number increases to three of the five when using the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Altria Group | 9.5 | 9.8 | 8.9 |

| British American Tobacco (BTI) | 6.3 | 5.2 | 10.1 |

| Japan Tobacco (OTCPK:JAPAY) | 15.1 | 12.8 | 8.3 |

| Imperial Brands (OTCQX:IMBBY) | 9.5 | 6.4 | 6.1 |

| Vector Group (VGR) | 11.1 | 9.9 | 8.1 |

| Philip Morris International (PM) | 20.5 | 15.5 | 14.9 |

Takeaway

Eventually, I suspect that there will be hope for Altria Group, Inc. in the form of products like NJOY and on!. But at this point, those are not stopping revenue and profits from taking a hit year after year. The company is attractively priced on an absolute basis. But when you have a firm that is in a state of decline like this, I think a larger discount is warranted. For these reasons, I’ve decided to keep the firm rated a “hold” for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!