Summary:

- I maintain a “Buy” rating on Microsoft stock, despite its stock lagging the broader market.

- Microsoft’s Q4 FY2024 results showed robust growth in cloud and AI, with Azure and AI services driving significant revenue increases.

- Near-term challenges like Azure’s capacity issues and OpenAI losses are temporary; I expect growth to reaccelerate in 2H FY2025 with new data centers.

- Microsoft’s unmatched competitive advantages and strong execution across cloud and productivity segments position it to outperform Wall Street’s conservative growth expectations.

- If Microsoft delivers better than forecast growth (as I believe they will), then today’s valuation could be a compelling buy for long-term investors.

tupungato

My Thesis Update

I initiated coverage of Microsoft Corporation (NASDAQ:MSFT) in late July 2024 with a “Buy” rating ahead of its Q4 FY2024 print, expecting a strong performance from the company’s OS and cloud businesses, as well as some strength in the search segment even though it was still far behind the Google (GOOG) search. Despite my concerns about how negatively the market might perceive management’s comments regarding large investments in AI, I issued a bullish rating. Since then, the stock has grown by only ~6.5%, which is half the performance of the broader market.

Seeking Alpha, Oakoff’s coverage of MSFT

Despite lagging the broader market, I believe Microsoft stock still deserves a positive rating in the medium term.

While the stock’s valuation may seem high at first glance, the strength and moat of Microsoft’s business are incredibly difficult to match – this competitive advantage is likely to sustain the company’s current growth rates for the foreseeable future, which is why I believe MSFT could grow out of its high valuation multiples faster than what the consensus currently anticipates.

My Reasoning

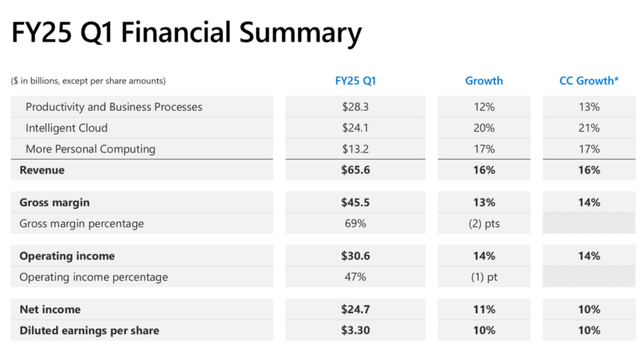

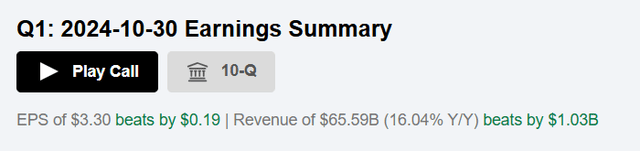

I think Microsoft’s Q2 FY2025 earnings clearly showed that the company remains the tech industry’s leading player with its booming cloud, AI business, and strategic investments. MSFT’s revenues were $65.6 billion (up 16% from a year earlier) and earnings per share were $3.30 (up 10%), so the Q1 results exceeded the consensus expectations quite meaningfully:

MSFT’s IR materials Seeking Alpha, MSFT

We could see great execution across Microsoft’s main lines of business, particularly cloud computing and AI – let me quickly summarize the company’s financials and operational performance segment by segment.

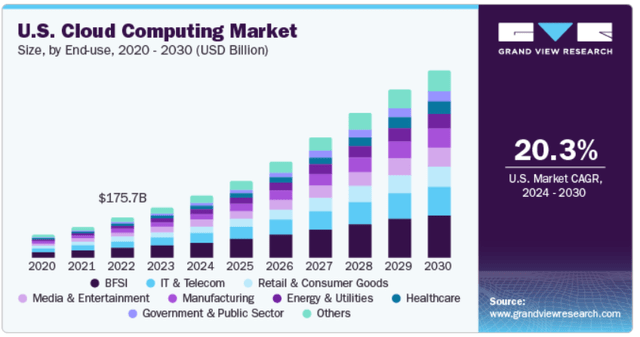

Microsoft Cloud remains the company’s growth engine with $38.9 billion in sales, up 22% from the previous year. Azure expanded 33% YoY in constant currency, and AI services were responsible for 12% of the growth. On the other hand, Azure’s growth slowed down a little bit over the last quarter due to “limited capacity and delayed third-party data center leases.” Though Azure growth slowed to 31-32% in Q2 guidance made analysts worried, the consumption dynamics are still the same. Also, the management said during the earnings call that it expects a reacceleration in the second half of FY2025 as new first-party data centers open. Also, MSFT’s AI programs -such as its OpenAI collaboration – are set to overtake ~$10 billion run rate next quarter, the fastest-growing business in Microsoft’s history. Given that the company can scale the monetization of AI using its infrastructure and product ecosystem, I believe the profitable growth from this segment is still in its early innings as the U.S. cloud computing market size is projected to grow at a CAGR of 20.3% from 2024 to 2030, according to Grand View Research.

The Productivity and Business Processes (Microsoft 365, LinkedIn, Dynamics 365) revenue was $28.3 billion, up 12% over the prior year. Revenues of Microsoft 365 Commercial Cloud increased 16% in constant currency on strong seat growth and ARPU increases from E5 and Copilot subscriptions. Microsoft’s generative AI-powered personal assistant, Copilot, is still taking off: nearly 70% of Fortune 500 firms use it, according to the management. This broad adoption has also made Copilot the fastest-growing Microsoft 365 SKU in company history. LinkedIn was as strong as well with revenue growing 10% YoY thanks to “engagement record” and B2B advertising growth. MSFT’s business applications suite Dynamics 365 increased 18% in constant currency, with a high appetite for AI-centric business operations.

More Personal Computing (Windows, Surface, Gaming) had $13.2 billion in revenue, up 17% YoY, which is quite solid. Gaming was the top earner, and revenues were up 43% with the addition of Activision Blizzard and high performance in Xbox content and services. The new “Call of Duty: Black Ops 6” was released with new record-breaking day one and Game Pass subscribers, which was another evidence that Microsoft’s move to diversify gaming revenue streams worked. Windows OEM revenue rose 2% YoY based on “a mix shift to higher-margin markets” and devices revenue was down because of “execution problems in the commercial area.”

MSFT’s balance sheet has held up well as the company generated $34.2 billion in operating cash flow, up 12% from last year. But free cash flow slowed 7% to $19.3 billion as capital expenditures increased to fuel cloud and AI expansion. Capital spending (including finance leases) was $20 billion, half of it for long-term assets to be monetized in the next 15 years. I think this investment in AI and the cloud also positions Microsoft to unlock long-term growth opportunities with a prudent cost structure. Anyway, the firm returned ~$9 billion to shareholders in dividends and buybacks during the quarter, which is still a lot and helps support the stock’s price stability.

I believe Microsoft has one of the best tools to bring AI to its product portfolio in a symbiotic cycle of innovation and monetization. GitHub Copilot, for instance, an AI-based coding tool, has changed the way software is written, while Dynamics 365 Copilot is revolutionizing CRM and ERP processes, according to Morgan Stanley analysts (proprietary source, October 2024). AI technology from the company is helping security solutions as well, Security Copilot helping businesses solve their cybersecurity problems – such innovations don’t just separate Microsoft from its peers, but also engage customers and create a higher ARPU.

Looking ahead, Microsoft anticipates further growth in cloud and AI, with Azure growing more quickly during the second half of FY2025 as more capacity is opened up. Management forecast $66.1-66.9 billion in Q2 revenue and gross margins increasing sequentially; they’re also looking to scale AI and will be rolling out new Copilot features and self-assisted agents throughout its product line. Morgan Stanley analysts noted in their report that Microsoft’s generative AI revenue will exceed a $10 billion run rate in Q2 FY2025 and further bolster its AI leadership. Though there are immediate headwinds – Azure guidance dipping slightly for Q2 (33-32% growth) as capacity tightens – Morgan Stanley still believes Microsoft will be able to ramp up Azure growth in the second half of FY2025 as first-party data centers open.

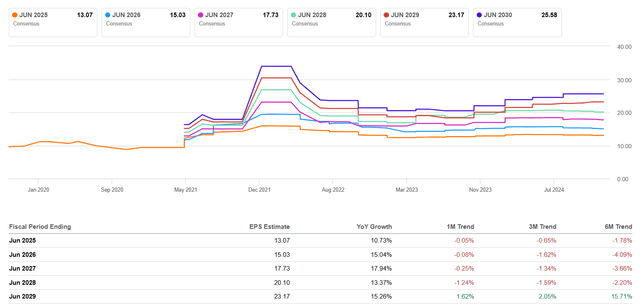

At the same time, a closer look at recent changes in analysts’ expectations reveals that the slowdown in Azure’s growth has prompted a notable reduction in Wall Street estimates over the past 6 months. For a company as large as Microsoft, these downward revisions are quite significant: In fact, EPS estimates have been lowered not just for the near term but for the next 4 years.

I believe this is a solid foundation for Microsoft to continue to outperform these estimates. Investing in artificial intelligence is not just an option – it’s a necessity. Regardless of differing opinions, I think companies like Microsoft must consistently allocate a significant portion of their free cash flow to innovative projects to maintain their leadership position. In my opinion, management is making the right decisions, even if Wall Street’s focus today reflects a narrow, short-term perspective rather than an appreciation for the company’s long-term strategic initiatives.

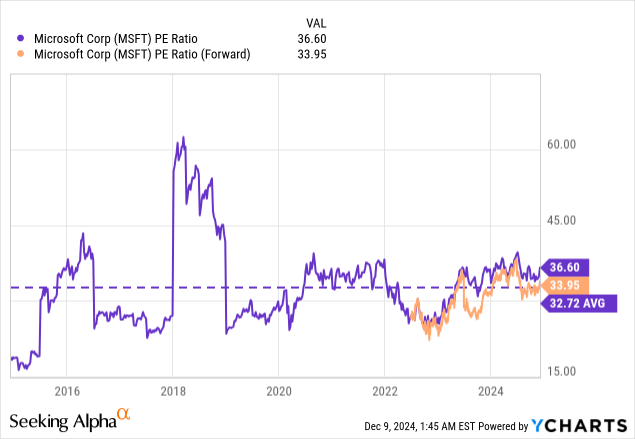

In other words, these reduced forecasts for the coming years could theoretically provide a solid foundation for Microsoft to continue to exceed expectations, as the company has consistently done in recent quarters. So if my reasoning is correct here, the current valuation of Microsoft, based on forecasted EPS for next year, doesn’t fully capture the real state of events. At present, the market expects Microsoft to trade at nearly 34x forward P/E for FY2025, with EPS projected to grow by only 10.7% YoY (for FY2025). However, I believe the company is likely to deliver stronger growth than consensus estimates suggest because during 2H FY2025 some of today’s headwinds are going to ease, which should lead to improved performance and, consequently, a lower multiple. So if the forward P/E multiple drops to around 27-28x, as I anticipate, Microsoft would effectively become cheaper than its historical average valuation over the past decade:

This would present a compelling opportunity for investors, as the market may be underestimating MSFT’s ability to outperform expectations, particularly given its strategic investments in AI and other high-growth areas.

Risks To My Thesis

I admit there are some issues Microsoft may have, like the ability to control the capacity and balance AI investment with monetization. The backlog on third-party data center leases affected Azure’s Q2 revenue, which underscores the importance of having better supply chain visibility. Also, Microsoft’s OpenAI investment – an equity stake that ended up losing $683 million in Q1 (and is expected to reach $1.5 billion in Q2) – is also a risk factor.

The capacity remains more challenging than many thought, so that may be the explanation for why the EPS estimates have decreased so sharply as of late. So Wall Street’s lower forecasts for the next 4 years could be a sign of more than short-term weakness: they might reflect broader worries about whether Microsoft can keep its current growth pace in an intensely competitive and expensive AI environment.

Any possible demand declines due to macro conditions may stall the overall business expansion, so the growth in Azure and AI revenues I predicted may not come as fast as I expected. That might leave the forward P/E multiple higher, making the stock look overvalued.

Your Takeaway

Microsoft’s latest results showed its cloud computing and AI leadership with aggressive execution and investments. Near-term challenges, including Azure’s capacity crunch and the cost of its OpenAI alliance, have dampened sentiment and led to lowered Wall Street estimates. But these hurdles are, I believe, only temporary and could accelerate again during the second half of FY2025 as more data centers open and the adoption of AI accelerates.

While the impact of the capacity constraints and OpenAI losses may impact performance in the short run, I think the longer-term growth prospects remain strong – with a wide array of AI products and services, Microsoft can make the most of the Gen AI revolution and keep bringing great value to shareholders. If Microsoft delivers better than forecast growth (as I believe they will), then today’s valuation could be a compelling buy for long-term investors.

Given all that, I reiterate my “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.