Summary:

- Back in 1997, Jeff Bezos told the world AMZN wouldn’t sacrifice its long-term strategy to meet short-term targets.

- But many who bought AMZN stock ignore that and jump ship whenever AMZN doesn’t meet Wall Street targets.

- Yet all the while, the company has been and still is sticking to the Bezos vision and delivering handsomely to shareholders who take it seriously..

- Contrary to what many believe, AMZN is not simply an oddball combination of retail and cloud services.

Cindy Shebley

“When someone shows you who they are, believe them the first time,” said poet, memoirist and activist Maya Angelou.

It’s just as well Ms. Angelou isn’t an e-commerce/cloud investment analyst.

When it comes to Amazon.com, Inc. (Nasdaq: AMZN), her words often fall on deaf ears.

After AMZN went public in 1997, founder/ first C.E.O. Jeff Bezos’ laid it all out in his first Shareholders’ Letter.

In the first sub-heading, Bezos asserted “It’s All About the Long Term.”

Many companies also say that. But several Bezos bullet points really drove it home:

We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions….

When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows….

We will balance our focus on growth with emphasis on long-term profitability and capital management. At this stage, we choose to prioritize growth because we believe that scale is central to achieving the potential of our business model.

(Emphasis supplied by me.)

But the Street, it seems, has often refused to believe it. For years many complained when AMZN about failure to satisfy short-term investment community priorities.

In my prior AMZN articles, I did believe what AMZN was showing the world.

Between November 28, 2006 and December 1, 2017, I published eight Seeking Alpha articles on AMZN.

The first and second didn’t have Seeking Alpha recommendation tags. But they were positive in tone. The third, fourth, fifth and sixth articles were all tagged “Buy.”

Then, on October 31, 2016, I said “Sell.

That, in and of itself is no sin. Being wrong is part of investing life. It happens to all of us.

But my process was regrettable.

My last paragraph led with “I love AMZN, the company.” Valuation was high. But whether the stock deserved its high ratios was at least debatable.

Ultimately, I used a quant model that suggested shares with exceptionally high growth and sentiment scores faltered in the future. You could call it reversion to the mean.

The model back-tested very well. So, I used it to say “Sell.”

Check the bio in my current Seeking Alpha Profile.

You’ll see that now I’m retired from the corporate world. I’m no longer bound by employers’ rules, policies, etc. And now, I don’t serve the numbers. The numbers serve me.

So, you can be darn sure I won’t do something like that ever again.

In this Seeking Alpha incarnation, I’m back to my earliest roots. It’s about HI (Human Intelligence); supported, but not dominated by numbers.

I tried to correct my late-2016 blunder with last last December 1, 2017 writeup.

I said Buy. Since then, AMZN rose 234.65% (through 7/12/24). That beat the S&P 500’s 112.52% gain.

But I also floated the idea of pairing AMZN with an investment in the Pro Shares Decline of the Retail Store ETF (EMTY). That fund took short exposure to brick-and-mortar stores.

From December 1, 2017 through its April 3, 2020 peak, EMTY rose 56%. But from the peak until now, it fell 74%. So, from the 2017 writeup till now, EMTY clocks in with a 57% loss.

I never specified how big the EMTY stake should be relative to AMZN.

If I now assume the stakes to have been equal, the combined position would have gained 88.83%. That would have trailed the S&P 500’s 112.52% gain.

So much for trying to outthink the room.

Going forward, I’ll keep it simple. As Ms. Angelou counsels, I’ll believe what AMZN is showing me and the world. I’ll explain below and recommend accordingly.

But first, I want to address an issue that often troubles the bears…

The Stock’s Valuation

There’s more to valuation than just ratios.

You can’t get a Mercedes for the price of a Chevy. And you can’t buy shares of a super company for the price of a dud.

(I explain further in my May 28, 2024 Nvidia article. I even discussed it in 2016, but wasn’t firm enough in my convictions.)

Ever since it came public in 1997, AMZN has been a live case study showing how it’s OK to accept high valuations for shares of great companies.

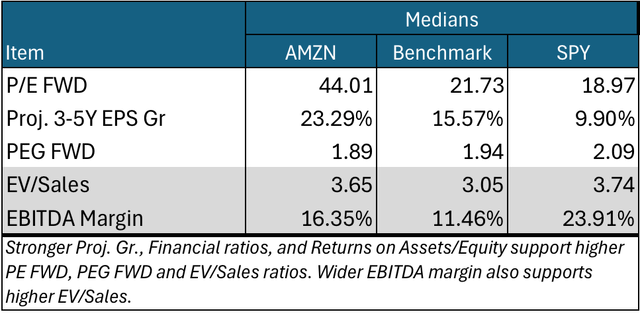

Let’s see where valuation now stands.

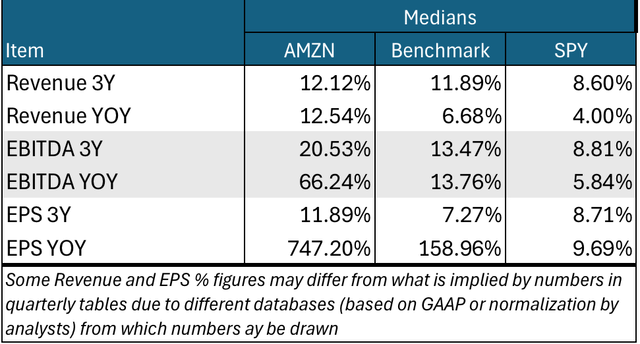

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

(Note: The Benchmark I show in the Table is something I created specifically for AMZN. I’ll explain it below when I present the rest of AMZN’s numbers.)

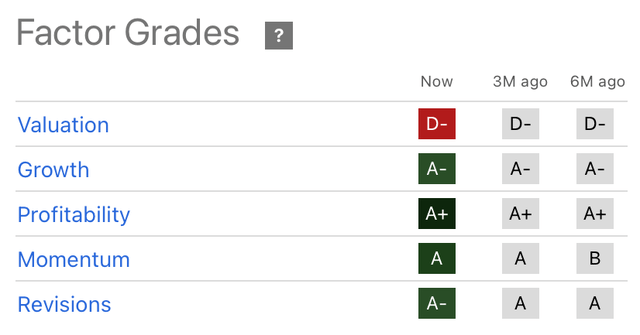

The ratios remain high. And Seeking Alpha gives AMZN a “D-“ for Valuation.

But look at the other Seeking Alpha factor grades, especially Growth and Quality. (Don’t ignore these. Seeking Alpha is spot on to consider five sets of factors, rather than just one.)

Notice, too, the relatively strong “Proj. 3-5Y EPS Gr” in my Valuation table.

Based on my assessment of the company (see below), I find the 23.29% projection credible. That’s enough to bring the “PEG FWD” down to earth.

Meanwhile, AMZN’s margins were low at times in the past. But they’re pretty good now. That makes AMZN’s sales-based valuation more acceptable than those of the Benchmark and SPY.

So let’s now get to the meat of this situation, whether AMZN as a company is really good enough to merit the stock’s high price tag.

The Vision

Although it was founded in 1994 and has been public since 1997, AMZN still isn’t mature. It’s still investing to build its long-term future.

C.F.O. Brian Olsavsky made that clear on the April 30, 2024 analyst earnings call:

Right now, in Q1, we had $14 billion of CapEx. We expect that to be the low quarter for the year. As Andy said earlier, we are seeing strong demand signals from our customers and longer deals and larger commitments, many with generative AI components. So those signals are giving us confidence in our expansion of capital in this area. And as he also mentioned, we’ve done this for 18 years. We invest capital and resources upfront. We create capacity very carefully for our customers. And then we see the revenue, operating income and free cash flow benefit for years to come after that, with strong returns on invested capital. So a little bit of a long-winded answer to your question.

But yes, we have — the main issue that we’ll see in the near term is additional CapEx and we’ve talked about that. And we continue to see strong CapEx performance in our stores business. Most of that will be related to modest capital or capacity increases in addition to our sameday fulfillment network and some Amazon Logistics upgrades to the fleet. But for the most part, what you’ll see is really going to be on the AWS side.

(Emphasis supplied by me.j

Increased depreciation is likely to cut into reported EPS. And increased capital spending will cut into free cash flow.

Investors should not find anything troubling about this. As Olsavsky said, AMAZ has been doing this successfully for a long time.

So are all these periods of heavy capex really as worthwhile as AMZN hopes?

To address this, we need perspective…

Not every year will be equally great. 2022, for example, was a bad year.

Rising interest rates did not actually trigger what many said would be a full-fledged recession. But they did cause consumers to tighten spending. Businesses, likewise, were less aggressive about spending for cloud upgrades on AWS. At the same time, labor and logistics costs rise. And AMZN had to readjust staffing and logistics as the world exited pandemic era lockdowns, which proved especially lucrative for e-commerce platforms like AMZN.

Bad years happen. They always did. And they always will.

Ultimately, though, investors should judge companies by overall results.

This isn’t just bullish hype.

Chapter 37 of the Sixth Edition of the Graham and Dodd classic Security Analysis is all over this. Page 626, for example, says…

The concept of earning power has a definite and important place in investment theory. It combines a statement of actual earnings, shown over a period of years, with a reasonable expectation that these will be approximated in the future, unless extraordinary conditions supervene. The record must cover a number of years, first because a continued or repeated performance is always more impressive than a single occurrence and secondly because the average of a fairly long period will tend to absorb and equalize the distorting influences of the business cycle.

(Emphasis supplied by me.)

I’s like to think the Street will see things this way and look beyond any near-term weakness in AMZN’s results.

But I’ve been analyzing stocks since late 1979. And as described above, I’ve been watching AMZN for many years. So I recognize the risk the Street won’t do that.

But for those who can look beyond near-term potholes…

AMZN’s Vision Has Been Delivering Great Results

Looking back from today, 2022 investors who obsessed over the near term and ignored the big picture got burned.

The stock plummeted 56% from its 7/8/21 peak through its 12/28/22 trough.

Now you probably know what they say about huge 50%-or-so drawdowns… The stock has to about double to regain that loss.

Well, recoveries like that happens often in real life.

That happened to AMZN. From 12/2822 through 7/9/24, the stock rose 144%. So, it regained lost ground, and then some.

And it wasn’t irrational exuberance. It was genuine company fundamentals.

The GuruFocus.com 30-year AMZN data presentation shows that AMZN’s Returns on Equity (ROE) were all over the place in its early years.

ROE turned positive in the early 2000s. But it plummeted into the red due to heavy spending in the early 2010s.

But soon thereafter, from 2016 through 2023, annual ROE averaged 18.69%. (And that includes a -1.91% tally for the bad year in 2022).

Looking at “a number of years” and a “fairly long period,” as Graham and Dodd suggest, paints AMZN in a very positive light.

Neither I, nor any serious Graham and Dodd follower, would alter that view even if AMZN spends its way into another 2012-14-type rough patch. (During a bad 2012-14 interval, ROE averaged 0.07%.)

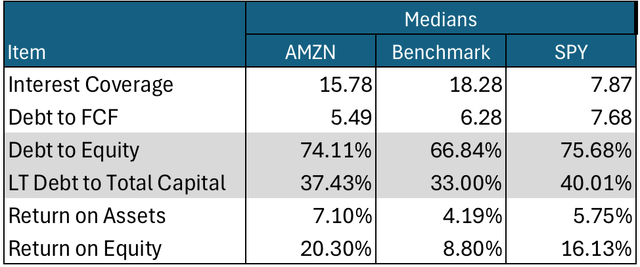

The following tables provides a closeup on AMZN’s current fundamental situation. They give us a sense of why Seeking Alpha’s non-valuation Factor Grades are as high as they are.

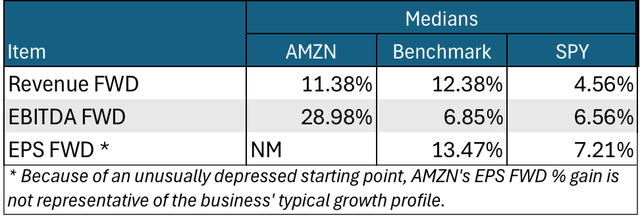

Comparing AMZN to companies in the SPDR S&P 500 ETF (SPY) is standard. But getting a peer benchmark has been challenging.

Databases classify AMZN as Broadlines Retailing. That’s not wrong per se. We all know AMZN does retailing. But its AWS (Amazon Web Services) cloud business is huge (see below).

So, I created my own benchmark.

I used median figures for companies in the Broadline Retail Industry, as defined in the Seeking Alpha Stock Screener. I also used the constituents of the Global X Cloud Computing ETF (CLOUD).

The Benchmark figures I show are averages of the two groups, weighted by their relative contributions to 2023 operating profits.

(I compare companies to benchmark medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

Author’s computations and summary from data displayed in Seeking Alpha Portfolios Author’s computations and summary from data displayed in Seeking Alpha Portfolios Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Clearly, AMZN is pretty good compared to SPY companies and those in my custom cloud/retailing benchmark.

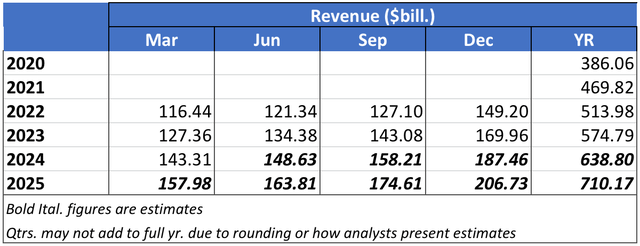

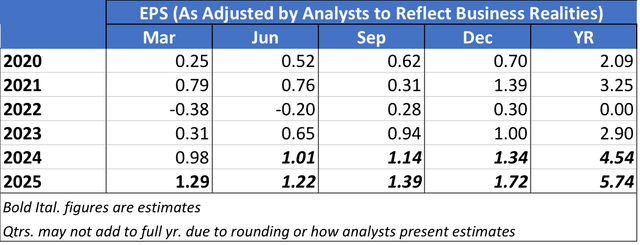

Here are AMZN’s quarterly Revenue and EPS trends and estimates.

Author compilation based on Seeking Alpha Estimates presentation Author compilation based on Seeking Alpha Estimates presentation

So it’s as clear as can be that ANZN has been executing its vision (spending for the long term rather than chasing short-term results). The company has been rewarded with powerful results.

And shareholders have been rewarded with spectacular returns, even though AMZN has yet to pay a penny in dividends.

Let’s note total return for AMZN from 3/10/99 through 7/9/24.

This starting date matches the debut of the iShares QQQ ETF Trust (QQQ). I’ll ignore AMZN’s rise from what, after several stock splits, now look like penny stock levels. And I’m including dividends from QQQ, and for SPY.

Over this very long period, AMZN returned 5,715%. SPY returned 578%. And QQQ returned 1,045%.

Clearly, the vision has been succeeding.

What AMZN Appears to Be

AMZN looks, to consumers, like an online retailer.

That’s not necessarily wrong. Many of us buy a lot of things from AMZN.

Also, most who pay attention to investing know Amazon Web Services (AWS) gives it a huge stake in the cloud business. This actually provides the lion’s share of operating profits. And it has lately been growing faster.

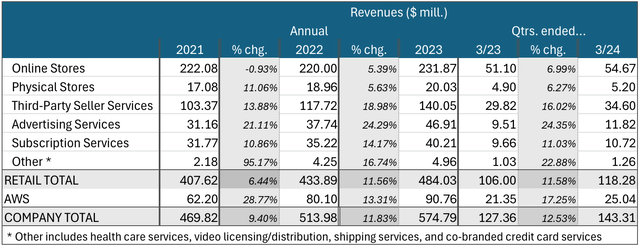

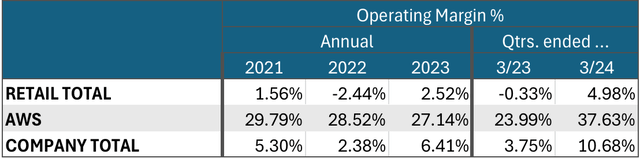

The following tables show how important AWS is.

Author compilation and calculations based on data from AMZN SEC latest 10-K and 10_Q documents Author compilation and calculations based on data from AMZN SEC latest 10-K and 10_Q documents

So, it looks like we have an oddball conglomerate-like company. It has one low margin cyclical consumer business. And there’s another that’s exploiting a hotter tech field.

But first impressions can mislead. Maybe we can blame Jeff Bezos for some of that. His annual Chairman’s letters presented impressive detail on “what” AMZN does.

But current CEO Andy Jassy’s 2023 letter took a bold leap in explaining “how” and “why.”

The latter paints a completely different different picture of AMZN. It’s one that shows that the company’s retailing and cloud operations are, to use a lawyers’ phrase, inextricably intertwined…

What AMZN Really Is — Beyond the Obvious

Think of the typical retailer. How does it grow?

Traditional (brick-and-mortar) merchants grow by adding more stores. That obviously boosts sales. And hopefully, more scale and efficiencies can help profits outgrow the top line.

They also want to increase same store sales.

To do this, they need to market better. They keep trying to improve merchandise selection. They can gain share against rivals by cutting prices. And, perhaps, they could incentivize customer loyalty.

Online retailers, such as the e-bookstore AMZN introduced itself as being, did a lot of the same. It marketed itself. It competed on price. Sales-tax saving was a big deal early on. And it added new kinds of merchandise.

But right from day one, AMZN had a built-in advantage over brick-and-mortar. It immediately had a global presence. Barnes & Noble was all over too. But it had to keep building new stores. AMZN didn’t.

AMZN had an advantage in terms of inventory. It could centrally hold and manage inventories. So customers could buy anything immediately.

Sure customers had to wait for delivery.

But that was often better than driving to a local store, not finding the preferred book and being persuaded by a salesperson to let the store order it for the customer. And if the store wouldn’t arrange for direct delivery to the customer, the latter had to again drive back to the store.

Still, if that were all there was, AMZN critics and skeptics would be right. AMZN would just be another low-margin retailer, albeit one that could operate a bit more efficiently.

But that’s not all there is.

Jeff Bezos consistently wrote and spoke of fanatical commitment to pleasing customers. Another bullet point in his 1997 Shareholder Letter said:

We will continue to focus relentlessly on our customers.

Many likely brushed this off as corporate puffery.

But AMZN really put its money – lots and lots of it – behind its professed vision.

That means it had to be more than a web site with logistics people who knew how to ship from warehouses. It had to find ways to keep doing better.

That’s hard.

Every time you make customers happy, they decide they need more. And over the years, AMZN has often recognized customers will want more even before customers figured out they should ask for it.

So behind the scenes, AMZN developed a practice of working with what it calls “primitives.” Current CEO Jassy details these, and how AMZN uses them, in his 2023 letter.

AMNZ defines a primitives as…

the raw parts or the most foundational-level building blocks for software developers. They’re indivisible (if they can be functionally split into two they must) and they do one thing really well. They’re meant to be used together rather than as solutions in and of themselves. And, we’ll build them for maximum developer flexibility.

Initially, primitives were built to support the original business. They helped AMZN buy products, store them and then ship them to purchasers.

But each step of the way, AMZN wondered if it could add to what it was doing.

Eventually, according to Jassy “we realized we could add broader selection and lower prices by allowing third-party sellers to list their offerings next to our own on our highly trafficked search and product detail pages.”

The company tried using primitives relating to “payments, search, ordering, browse, item management (to let Target.com) use Amazon’s ecommerce components as the backbone of its website, and then customize however they wished.”

But it turned out to have been too clunky.

So AMZN backtracked and built “a new set of infrastructure technology services that would allow both Amazon to move more quickly and external developers to build anything they imagined.” (Emphasis supplied by me).

Hence the birth of AWS!

AMZN didn’t simply decide that the cloud was a hot area and that it would be good to get a piece of the action. AWS was born organically, as AMZN realized others would pay to use technology AMZN built for itself.

Those interested in more detail will find plenty in Jassy’s 2023 letter. For now, I’ll summarize using Jassy’s words:

As AWS unveiled these building blocks over time (we now have over 240 at builders’ disposal—meaningfully more than any other provider), whole companies sprang up quickly on top of AWS (e.g. Airbnb, Dropbox, Instagram, Pinterest, Stripe, etc.), industries reinvented themselves on AWS (e.g. streaming with Netflix, Disney+, Hulu, Max, Fox, Paramount), and even critical government agencies switched to AWS (e.g. CIA, along with several other U.S. Intelligence agencies). But, one of the lesser-recognized beneficiaries was Amazon’s own consumer businesses, which innovated at dramatic speed across retail, advertising, devices (e.g. Alexa and FireTV), Prime Video and Music, Amazon Go, Drones, and many other endeavors by leveraging the speed with which AWS let them build.

So for today’s investment case, we should recognize that this isn’t merely an on-line retailer and a cloud services outfit under the same corporate umbrella. AMZN today is a retail-distribution technology company.

And this retail-distribution tech company is benefitting from demand by outsiders to pay for the capabilities AMZN develops for itself.

Not Just Tech, But Major League Tech

Tech is so important here, that AMZN’s relationship with Nvidia (NVDA) could get complicated.

Right now, AMZN needs NVDA products. And NVDA needs AMZN as a major customer.

At the same time, AMZN is developing its own chips to handle its own specific AI needs.

AMZN needs a lot of AI. It’ll join the race to supply generative AI tools to consumers. But it’s world won’t end if it doesn’t wind up leading here. AMZN really needs a ton of AI for itself.

It needs AI to support AWS’ cybersecurity. It needs AI to optimize its use of regional distribution centers. It needs AI to optimize shipping. It needs AI to get the right ads in front of the right customers. It needs AI to show the right products to the right customers.

Beyond AI grunt work, AMZN has been rolling out Rufus. According to the first-quarter earnings release, this is…

a new generative AI powered shopping assistant that can help customers save time and make more informed purchase decisions by answering a variety of shopping-related questions, providing product comparisons, making recommendations, and more. Amazon improved Rufus’ answer accuracy and response speed, and added new features, including “My Orders,” which answers questions such as “when did I last order coffee?” and “what dog treats did I last order?”

AMZN still has a very long runway for growth according to Jassy, because…

about 80% of the worldwide retail market segment still resides in physical stores. Similarly, with a cloud computing business at nearly a $100B revenue run rate, more than 85% of the global IT spend is still on-premises.

As happened with AWS, others could pay AMZN to use chips it develops for itself.

So it’s possible these AMZN and NVDA, close allies may eventually become competitors. This could turn into one heck of a show.

Get your popcorn ready

Risk

A big risk here is that investors will go ballistic and beat up the stock if the next or any upcoming quarterly earnings release – and/or guidance – isn’t all the Street wishes.

This is so for all stocks too.

But AMZN manages its business with a we-don’t-worry-about-that perspective. So don’t expect AMZN to manage earnings to please the Street.

Also, there are also many politicians and regulators who don’t realize or care how many of their constituents may be happy Amazon users, or even Prime subscribers. They often seek ways to cut the company down.

The Federal Trade Commission is even trying to reinvent monopoly theory to do this.

And as is so throughout the economy, many AMZN employees want more money and better terms of employment.

I think that’ll probably happen eventually – with or without unionization. That should cut a bit into margins and ROE… for AMZN and many other companies.

What to do About AMZN Stock

As discussed above, AMZN isn’t a traditional value play.

To own AMZN, one should assume this is, indeed, a growth company. And one should be willing to accept a growth-stock valuation.

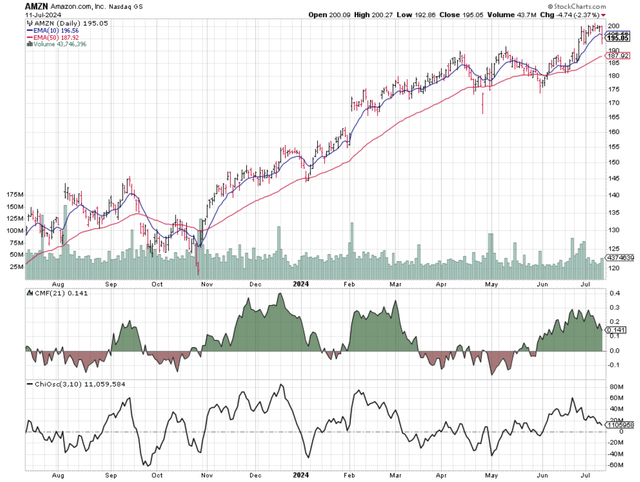

Here’s the price chart.

In technical-analysis lingo, the 50-day exponential moving average (EMA) has been a support level (floor) for the stock price. The strong 10-day EMA being above the 50 is a positive thing.

But the latest price bar crossed below the 10-Day EMA. That’s a modest red flag.

But for now, at least, Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO) both remain bullish.

These indicators measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general. Buyers being more motivated than sellers exerts upward pressure on stock prices.

The CO, however, is slipping toward neutrality.

AMZN has had a nice run since November 2023. So, it wouldn’t be outrageous to see the stock take a breather.

But on the whole, and from the perspective of a bona fide growth investor, I see nothing that scares me away from acting on the long-term investment case.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market and I’m bearish about the direction of the market.

Based on this scale, I’m rating AMZN as a “Buy” for those who can tolerate the above-discussed risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.