Summary:

- Altria’s transition to smoke-free products is crucial for sustaining its high dividend yield and long-term shareholder returns amid declining smokeable tobacco sales.

- Despite recent stock price gains and dividend increases, the success of Altria’s SFP transition remains uncertain and requires close monitoring by investors.

- Altria’s SFP revenue needs to grow significantly to offset the decline in smokeable products, with a target of $5 billion in SFP revenue by 2028.

- Investors should watch for signs of a faltering transition, such as payout ratios exceeding 80%, delayed dividend increases, halted share buybacks, and declining stock prices.

Yuri_Arcurs/E+ via Getty Images

Introduction

The vast majority of Altria Group (NYSE:MO) investors are motivated by one objective: High and growing income supported by sustainable cash flows and profits. With an almost 8% yield, 55 years of dividend increases and predictable quarterly results, Altria is ideal. Further, most Altria shareholders are long-term investors – they want this income to continue growing for years to come. But there is one problem. The product that has generated most of the profits distributed to shareholders for most of Altria’s 100+ year history, smokeable tobacco, is a dying business. In response, Altria is in the midst of a transition, or even a transformation, to become a provider of what’s called smoke-free products (SFPs), like vapes, tobacco pouches, and heated tobacco systems. No less than the future of the company as we know it is at stake, as is the continued high and growing income that shareholders have enjoyed for so long.

A personal story

My family has owned Altria (and predecessor Philip Morris) for over 100 years. As Investopedia reports, Altria is the number one wealth creating company for the 98 years between 1925 and 2023. One dollar invested in 1925 would have turned into $2.66 million by last year. I would like to say I am incredibly rich, hanging out with the Hiltons, Waltons, and Buschs, comparing yachts, Hamptons estates, and tax attorneys. Right? Wrong! For good or ill, our Philip Morris stock was not hidden away unseen for 98 years. Instead, it was used to buy houses, fund university educations, and even lifestyles. Furthermore, the shares that remained were distributed to many descendants over four generations. I do own some shares, not enough to move me out of the middle class, but it’s a nice way to continue a family tradition, so to speak.

I have actively followed Altria for over 60 years, which I believe gives me a deep, if unusual, understanding of the company. I was with them through the many challenges to their business, including the 1964 Surgeon General’s Report and the 1998 Master Settlement Agreement. At the time, some of those situations seemed to put the company’s future in question, but I believe the transformation they are now attempting may be the greatest challenge they have ever faced.

Altria’s declaration

To comprehend the totality of the new strategy, Slide #1 of their Q2 slide deck says the company’s goal is to:

Responsibly lead the transition of adult smokers to a smoke-free future.

The goal is not less smoking, but no smoking. Goodbye, Marlboro.

The importance of the Altria transition

This issue should be on the mind of every Altria investor because nothing less than the continuation of the company’s envious record of shareholder returns is at stake. Not only must the company have an SFP business, but the new business must be as successful as the old one. Altria’s tobacco business has enjoyed a dominant market share, high barriers to entry, high margins, low capital requirements, price elasticity, and other benefits that have enabled its success. It’s very much an open question as to whether the new SFP company can be as big and profitable as the old one. If not, the high-yield and 55-year dividend growth streak that investors’ bread and butter cannot continue.

One would think that this critically important topic would be prominent in analyses on Seeking Alpha, but such is not the case. It’s always mentioned, but most analyses focus more on the performance of Altria from quarter to quarter and do not emphasize the SFP transition. Perhaps it’s part of the human tendency to think the way things are now is the way things will continue to be. However, long-term investors – most Altria shareholders, must look beyond the present. The investment thesis is not just that it has a high yield, but that the yield will continue to be grown into the indefinite future. SFPs are where future dividends will come from.

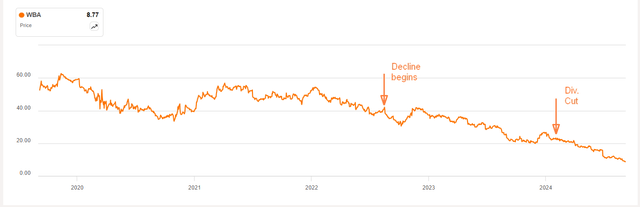

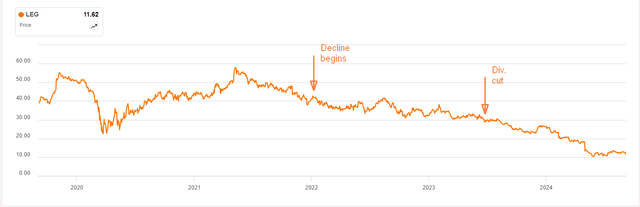

Broken dividend streaks

Investors can’t look solely at continued dividend growth to assess the success of the transition. Companies with very long dividend growth records typically go to great lengths to maintain them, even if the business itself falters. A big dividend is not a win if it’s negated by a fall in the stock price. Too much attention to the dividend can divert attention from share price changes until too late. The damage is done long before the actual dividend cut – stock prices often start declining years before then. The charts below show recent examples of this phenomenon, where many years of dividends are cancelled out by share price drops that began long before the cut. Walgreens Boots Alliance (WBA), V.F. Corp. (VFC), and Leggett & Platt (LEG) had dividend growth streaks of between 47, 49, and 51 years before cutting. By the date of the cuts, their stock had declined year earlier prices by 26%, 63%, and 15%, respectively.

Walgreen Boots Alliance 5-year chart (Seeking Alpha) VF Corporation 5-year chart (Seeking Alpha) Leggett & Platt 5-year chart (Seeking Alpha)

Presentation of these charts should not be construed as a prediction for Altria. The examples show a common pattern that could apply if Altria fails to produce earnings to support the dividend.

This report discusses the progress of Altria’s transition, what will define its success or failure, and how a focus on the transition affects the investment. The objective is to continue reaping the benefits of the high and growing income, while assuring that our income is not negated by a possible decline in the business that reduces the total return to an unacceptable level.

Altria snapshot today

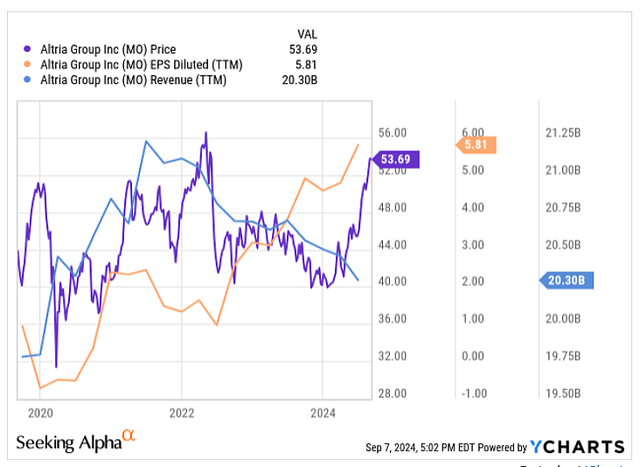

Altria has an interesting five-year chart, with decreasing revenue, increasing earnings per share, and a stock price enjoying an overdue rise.

Altria 5-year chart (Seeking Alpha)

The company is enjoying several tailwinds that have contributed to a long-awaited rise in the stock price.

-

First, the anticipated decline in interest rates benefits all companies where high income is an important part of the investment equation.

-

Second, the announced use of funds from the partial sale of Altria’s stake in Anheuser-Busch (BUD) for stock repurchases will bolster shareholder returns.

-

Third, increasing chatter about a recession drives more attention to recession resistant sectors like tobacco.

-

Fourth, the successful launch of the NJOY product line, which is a pillar of the company’s transition, has injected some confidence into investors.

These tailwinds have contributed to a price breakout from $40.75 in April to a recent $53.69, up 32%. The stock hasn’t been at this level since June 2022.

The annual dividend was recently increased 4% from $3.92 to $4.08. Based off a projected EPS of $5.10, the increase is in line with MO’s old dividend policy of distributing 80% of earnings and the new policy of mid-single digit increases. Investors are reassured by analyst projections of a 2025 EPS of $5.30, which will allow for another similar increase.

Smokeable segment performance: The number of Americans who smoke continues to decline, and the rate of decline has been accelerating. Presently, just under 12% of Americans smoke, compared to 43% in 1964 before the Surgeon General’s Report. Consequently, shipment volumes in the first half were down 10.5% (imagine the reaction to that in any other industry!), more than the decline of 9.5% for the industry. Thanks to price hikes, H1 revenue was only down 4.7% and income down 1.9%. Trends for the first half of the last 3 years are as follows:

|

H1 2022 |

H1 2023 |

H1 2024 |

|

|

Volume (millions) |

43993 |

39740 |

35227 |

|

Revenue (million $) |

11138 |

10910 |

10401 |

|

Operating inc. (million $) |

5311 |

5401 |

5278 |

|

Adjusted margin |

59.3% |

60.4% |

61.0% |

Smoke-free segment performance: This segment consists mainly of moist smokeless tobacco (chewing tobacco) and Tobacco pouches. NJOY vapes, which completed rollout in June 2024, had a small impact, but will be a significant SFP contributor in the future.

|

H1 2022 |

H1 2023 |

H1 2024 |

|

|

Volume (millions) |

402 |

395 |

385 |

|

Revenue (million $) |

1278 |

1308 |

1362 |

|

Operating inc. (million $) |

837 |

859 |

886 |

|

Adjusted margin |

68.8% |

68.7% |

67.5% |

The state of the Altria transition

For now, Altria in holding up well. But the volume of smokeable products, which contribute 88% of revenue and 86% of operating income, is declining at a precipitous rate. Moreover, as smokeable volumes decline, the price hikes Altria has relied on to boost revenue and income will be less and less effective. It is by no means clear that SFPs will grow fast enough to counteract the decline. SFP revenue only rose 6.5% over the last two years, so the coming boost from NJOY looks very important.

The future of the transition

The key issue for the company and its long-term oriented investors is whether Altria can increase its smoke-free business enough, and fast enough, to cover the inexorable reduction in smokeable volumes. If it cannot, simple arithmetic demands that earnings will suffer and the dividend will be at risk. Investors need to take a close, honest look at the transition so far.

SFPs are at an annual run rate of $2.72 billion, 11.6%, of total revenues, based on H1 2024. Altria’s goal is to have $5 billion in SFP revenue by 2028, which would be a 184% increase in 4 years. Can it be done? Altria projects the vape market alone will be $8.8 billion in 2028. We can assume consolidation among four major players (three companies and the illegal market, which is currently 60% of all vapes). If Altria gets 25% that would be $2.2 billion. Add that to current SFP revenue of $1.36 billion brings sales to $3.56 billion. Adding non-vape SFPs and growing international sales makes $5 billion by 2030 a stretch, but theoretically in reach.

On the other side of the business, the $17 billion in smokeable revenues that generate 86% of profits will be constantly shrinking. In H1 24 a 11% decline in volumes led to only a 2.3% decline in income, but as volumes continue to decline the price hikes that minimized the income loss will become less effective. Prices are not completely elastic (MO estimates 2% of the volume decline was due to elasticity), and as volumes decline price increases are applied to a smaller number of units.

Altria’s future is also challenged by the increasing competition in the US market, which is the second largest in the world. Japan Tobacco (OTCPK:JAPAY) just announced the acquisition of Vector Group (VGR), a small US tobacco company. In addition, Philip Morris International (PM) paid $2.7 billion to reclaim the rights to sell IQOS in the US. Obviously, they believe they can make that much back and more in the US. PM already sells the very popular Zyn pouches, which competes with MO’s new !ON line.

In summary, we know what numbers to look at, but where those numbers go and whether they will be enough to maintain Altria’s shareholder returns is very much unknown.

The Altria transition and its influence on investment strategy

Altria has one very powerful thing going for it: They are in the nicotine business, and it’s doubtful in the history of the world humanity has ever lost its taste for an addictive substance. In fact, as Prohibition showed, they will do almost anything to keep consuming it. In a sense, then, Altria is not changing their product, just changing the delivery method.

The question remains, however, as to whether they can transition quickly enough to support the dividend level and share repurchases that investors rely on. They are a marketing behemoth, but so are the other domestic and international tobacco companies, so determined to grab a big share of the US SFP market.

I give Altria a rating of Watchful HOLD. I am not proposing that Altria’s transition will fail, just that there are important issues that long-term investors must be mindful of. Company earnings estimates have usually been very accurate, and those estimates say that the record of dividend growth will continue in the near future. Investors owe it to themselves to watch financial results, however, to assure that the SFP transition is progressing enough to continue supporting earnings and dividend increases. Some possible signs of a faltering transition are:

-

Payouts greater than 80% of EPS, which was MO’s long-term guideline.

-

The common technique of delaying dividend increases by a quarter or two, which delays the payout while keeping the streak intact.

-

A freeze on share buybacks, which has long been part of MO’s shareholder return equation

-

A decline in the stock price that puts MO in the “sucker yield” category.

We all hope that the transition is successful, but if it falters, we want to know to take action while the total return on our Altria investment is not irretrievably damaged.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.