Summary:

- Debate on Airbnb’s valuation has filled the news since the 2020 IPO:

- Airbnb’s Q2 earnings approach and its shares are down 16% in past month amidst market correction and softer guidance from other peers.

- Investors are concerns by regulatory risks, travel trends, and geopolitical tensions.

- Yet, we should have in mind the overall picture and Airbnb’s business model to assess the stock and understand the opportunity.

Dreamer Company

Clouds looming on Airbnb’s Q2 earnings

Airbnb (NASDAQ:ABNB) will soon report its Q2 earnings and its shares are following a general sell-off, retracing over 16% in the past month.

With the market in for a likely correction, investors have turned from greedy to fearful amidst earnings season. Many companies reported earnings and often see softer guidance for the remainder of the year. It seems consumers are still spending but with a bit of exhaustion. Manufacturing activities still are below expansion territory. Interest rates are staying higher for longer. Geopolitical tensions contribute to the overall picture adding further reasons to be concerned.

Airbnb has then its risks. Some are regulatory, for example, with European cities that could follow the lead of Barcelona deciding not to renew tourist apartment licenses. Others are related to travel around the world. Currently, lower airline fares are actually a tailwind for the company, but things can reverse in a very short period.

In this article, we try to make an educated guess on what the earnings report may look like. Disclosure: I am long Airbnb and consider it one of my most promising long-term winners.

Summary of previous coverage

I have been long Airbnb for over two years and I haven’t sold a single share so far, while accumulating during steep downsides.

There are many things why I like Airbnb. For example, entrenched in its business models there are some similarities to Amazon and Costco which make it earn most of its money upfront and earns interest income on it while it holds on behalf of its customers. It is a capital-light business managing over 7 million homes with almost no cost of acquisition. It benefits from the network effect, as guests become hosts and increase both demand and supply.

Moreover, it has a growth potential both through organic growth of supply and by investing in expanding its platform beyond simple stays.

But I think the strongest argument in favor of Airbnb is simply the need people have to travel while finding more flexible accommodations than a hotel room. This is plain and simple and Airbnb has been able to make people aware of this need that was hardly explored before its invention.

Moreover, I think that a favorable tailwind for the company may come from lower airplane fares, which usually help with last-minute trips and bookings. Airbnb is a leader in capturing this kind of demand.

Airbnb: The macroeconomic context

Now, we have an advantage as we approach Airbnb’s Q2 earnings: one of its main competitors – Booking Holdings (BKNG) – has already reported earnings, giving us some valuable information we should take note of.

To tell the truth, Booking’s earnings were positive and topped estimates, with revenues up 9% YoY to $5.9 billion. Gross bookings (a core KPI for this industry) rose 6% YoY to $41.4 billion. And yet, the stock is down almost 10% since this report. Of course, in the past few days, we have witnessed a shaky market since the last monthly job report was weaker than expected and investors started fearing a hard landing scenario once again. The FED has not yet cut rates and we should finally see a cut in September, followed by at least another one by year-end if the environment deteriorates rapidly.

However, investors gathered some concerns over Booking’s earnings. In particular, the company warned it expects room night growth deceleration QoQ. Considering Q3 is usually a very strong quarter, this is no good news. However, we have to keep in mind that Booking is somewhat different from Airbnb as it is – so to speak – agnostic regarding the accommodation its customers want. Airbnb mainly focuses on apartments and homes and therefore it doesn’t perfectly overlap with Booking’s business areas. Now, during Booking’s Q2 earnings call, we heard that one business is growing faster than the others:

We continue to grow our alternative accommodations business faster than our overall business. For our alternative accommodations at Booking.com, our second quarter room night growth was 12% and the global mix of room nights was 36% which was up 2 percentage points from the second quarter of 2023.

So, this is positive for Airbnb as it means demand for accommodations different from hotels is increasing.

Another piece of news that matters to Airbnb’s investors comes from the economic environment in Europe. In particular, the forecast for Q3:

For the third quarter, we expect the booking window to be more similar to last year. Additionally, we have seen a mild moderation in the market growth in Europe over the last couple of months, though our growth in Europe has remained stable from May through July and we believe we continue to perform well relative to the market. […] We expect third-quarter gross bookings growth to be between 2% and 4%, slightly below room night growth due to about 1 percentage point of negative impact from changes in FX. We expect constant currency ADRs to be down slightly year-over-year and for this to be offset by a slight benefit on flight bookings growth.

Thanks to the Olympics in Paris, we know Airbnb’s bookings swelled by 400%.

Since France and Paris are a big market for the company, this growth will surely impact Airbnb’s Q3 results. So, the company might have a bit brighter outlook down the road. But Europe is any case weakening or – as many still want to say – normalizing.

So, here are the takeaways from one of Airbnb’s closest peers: Q2 will probably be fine and Airbnb will report solid growth. The outlook on Q3 might be worse than investors thought. Airbnb has already been trading down due to the different concerns we have pointed out. However, a report suggesting slower growth down the road might cause a multiple compression of the stock.

Airbnb’s Q2 Earnings Estimates

Although Airbnb has been selling off for about a month, with an acceleration in the past week, analysts are not unanimous about the upcoming report. In the last 3 months, we have 13 revenue up revisions vs. 18 down; while EPS see 18 down revisions and only 6 up. So, it seems analysts think the company will likely report a margin contraction. This makes sense because the timing of Easter drove Q1 margin expansion but became a headwind to Q2 margins. Moreover, last year, Airbnb had some one-time credits in payment processing that will not recur this year. Finally, Airbnb informed us that it has shifted the timing of its marketing spend, making it a bit heavier in Q2 than in Q1. Seen in this context, a margin contraction should not be so scary if no other organic reason kicks in. So, current EPS estimates are around $0.91 (-7.42% YoY), with revenues expected to be $2.74 billion (+10% YoY).

Regarding Q3, Airbnb said during its Q1 earnings call that the backlog was strong and that Q3 revenues should accelerate. We will have to see if this is still true. But Airbnb has usually a nice visibility on its backlog and doesn’t present to investors inflated data that are then corrected and lowered.

All in all, I consider Airbnb’s current estimates reasonable. If the company doesn’t grow its top line by at least 10%, we will have a problem. An EPS contraction in the mid-to-high-single digits makes sense, as we have seen.

However, what matters the most for Airbnb is not its EPS. In fact, the company’s valuation hinges on two other drivers: growth rate and free cash flow.

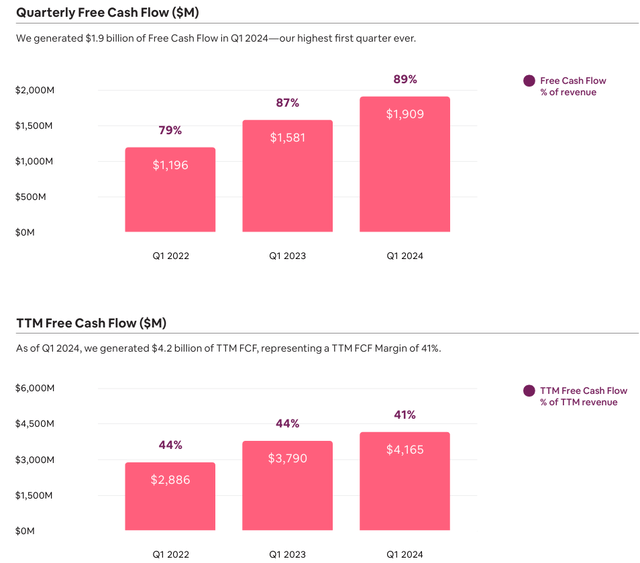

Airbnb is expected to grow its revenues by more than 14% going forward and its EBITDA by over 17%. Moreover, Airbnb is a capital-light business and is coming close to converting 90% of its Q1 revenues into FCF. For the TTM, the company converts over 40% of its revenue into FCF.

ABNB Q1 Shareholder Letter

This is why Airbnb trades at a fwd PE of 27. and a P/FCF of 21. Investors are expecting the company to compound quickly so that these multiples are actually lower. To understand what I mean, take a look at this table, where we see the expected revenue and FCF to then visualize the fwd P/FCF multiple that this implies. I use a 12% revenue growth rate and a 41% FCF/revenue conversion rate. The price/FCF is calculated based on the current market cap of $81.41 billion.

| 2024 | 2025 | 2026 | 2027 | 2028 | |

| revenue ( | 11.2B | 12.5B | 14.1B | 15.7B | 17.6B |

| FCF | 4.6B | 5.1B | 5.8B | 6.4B | 7.2B |

| fwd P/FCF | 17.7 | 16 | 14 | 12.7 | 11.3 |

The P/FCF quickly compresses if the company grows at 12% per year from 2024 to 2028. We might also assume that its FCF conversion rate improves, but by staying conservative we see in any case a strong FCF growth.

If the company suddenly decelerates, investors will immediately re-rate the stock and this is one of the biggest risks Airbnb faces.

Currently, its valuation is a bit steep, although not as high as it was some years ago, right after its IPO. So far, the company has been able to deliver consistently growing results, independently of its stock volatility. This has made investors debate Airbnb’s case. Some think it is one of the most disruptive businesses on the planet, some think it is simply overvalued.

If the stock sells off for ungrounded reasons or an overreaction to minor issues, I expect new influxes of money to be deployed soon because of the quality of Airbnb’s business model and financials.

So, although this earnings call comes with some uncertainties, my overall thesis on Airbnb remains the same and I keep rating the stock as one of my favorite buys.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.