Summary:

- Amazon stock fell sharply following a mixed Q2 earnings report.

- Despite strong earnings momentum, weaker trends in the retail business highlight some concerns of slowing consumer demand.

- Amazon benefits from overall solid fundamentals, but that may not be enough to stem the headwind of macro volatility.

4kodiak/iStock Unreleased via Getty Images

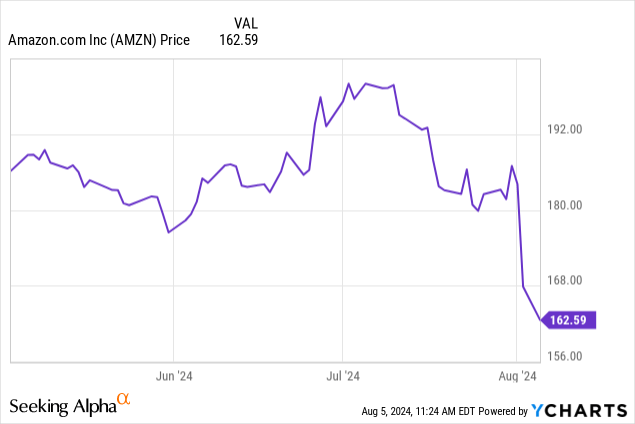

Shares of Amazon.com, Inc. (NASDAQ:AMZN) fell sharply following its latest quarterly update. While the cloud-computing and e-commerce giant beat the average of Wall Street EPS forecasts, sales growth disappointed.

The timing of the report couldn’t be worse as the market assesses a round of poor economic indicators. As the world’s largest retailer, Amazon now finds itself at ground zero for what could be the start of a broader economic slowdown. The stock is now down about 18% from its 52-week high.

This latest weakness hasn’t been a surprise to us as our last article on Amazon featured a sell rating and shares are down from that publication date. Here’s why we believe there is more downside ahead.

Amazon Q2 Earnings By The Numbers

Amazon reported Q2 EPS of $1.26, coming in $0.23 ahead of estimates, and nearly double the $0.65 result in the prior year quarter. Revenue of $148 billion was up 10.2% year-over-year, but modestly missed the consensus estimate by $760 million.

The context of the earnings momentum considers significant cost savings and efficiency efforts implemented in recent years. Amazon has benefited from easing supply chain disruptions and declining inflationary pressures.

The firm-wide operating margin of 9.9% this quarter is up from 5.7% in the period last year. The trend has also been favorable for free cash flow, reaching $53 billion over the trailing twelve months, compared to just $7.9 billion in Q2 2023.

The headline numbers here are solid, and beyond any stock market volatility, it’s fair to say Amazon fundamentals remain strong.

On the other hand, the concern here goes back to that top-line revenue miss with some indications that the business is slowing. The North America segment covering the core retail business along with services like Amazon Prime grew 9%, notably below the “double-digit” range.

Management noted customers have been generally more cautious toward large purchases, suggesting weaker consumer spending conditions. From the earnings conference call:

A few notes on our North America revenue growth rate. First, last quarter’s leap day added about 100 basis points of year-over-year growth. Second, we’re seeing lower average selling prices, or ASPs, right now because customers continue to trade down on price when they can.

The message is a poor sign against the challenging macro environment between still-high interest rates and a loosening labor market.

Trends have been strong in the AWS “Amazon Web Services” segment, capturing an ongoing cloud demand as companies continue to invest in new artificial intelligence opportunities. Q2 AWS revenue growth of 19% y/y was the strong point this quarter but also poses the question of whether that level will mark the peak for this cycle.

Headwinds Facing Amazon

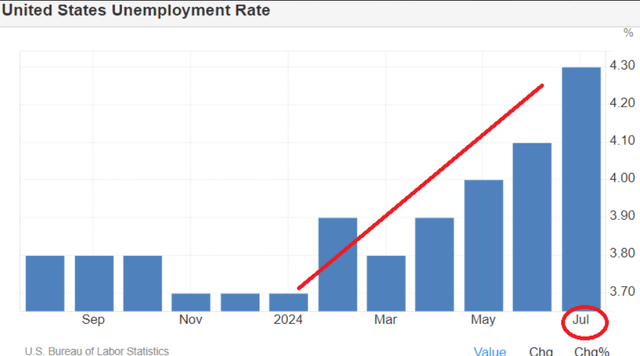

The white elephant in the room for Amazon is the explosive market volatility which coincided with a weaker-than-expected July U.S. payrolls report. The economy added 114k jobs last month, well below the 175k estimate. Prior months were also revised lower. The U.S. unemployment rate has now reached 4.3% compared to 3.7% at the start of the year.

The concern is that following more than two years of elevated inflation and decade-high interest rates, the economy is finally starting to get weighed down, marking the start of a broader slowdown. The Fed’s reluctance to cut rates at the last Fed meeting has added to uncertainties, raising the specter that monetary policy is now behind the curve.

Naturally, the setup here is a big problem for Amazon which is at the intersection of consumer spending and sentiment towards the technology sector. If the long-fabled recession materializes, Wall Street estimates for Amazon’s growth and earnings will need to be revised sharply lower.

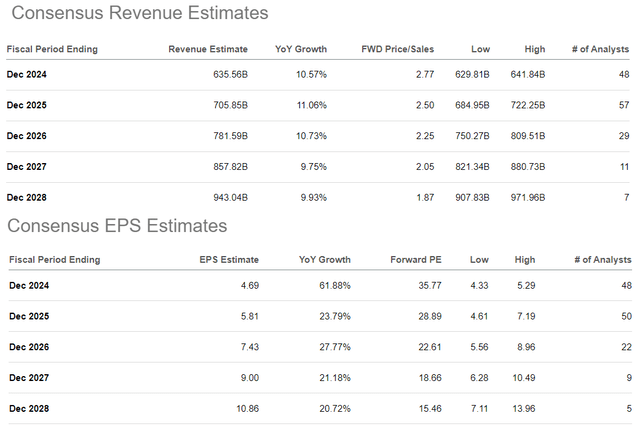

We sense that current forecasts for Amazon into 2025 and beyond are too optimistic. According to consensus, revenue growth is seen averaging 10% per year through 2028, balancing steady trends from the e-commerce side of the business with stronger AWS momentum. The market also sees EPS estimates maintaining the exceptional pace with a 62% increase this year to $4.69 to more than double toward $9.00 by 2027.

Valuation Could See a Haircut

In our view Amazon would be particularly hard hit as economic conditions slow, facing not only a drop in retail demand but also corporate customers pulling back on cloud investments.

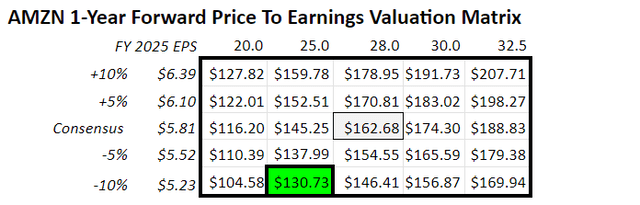

Compared to shares currently trading around $160 with a 1-year forward P/E of 28x, poor sentiment toward Amazon’s outlook would lead to a contraction in its earnings premium.

Looking out towards 2025, assuming the EPS estimate takes a modest 10% haircut from the current $5.81 forecast down to $5.23, applying a 25x multiple on shares of Amazon arrives at a $131 price target for the stock. If conditions get bad enough, a deeper discount could be warranted.

Our Bearish View on AMZN

We rate shares of AMZN as a sell, based on a belief that the current round of macro weakness is just getting started. The bull market has been very strong for nearly two years, which means long-term bulls will be stubborn to reset expectations. It won’t be a straight line, but we expect AMZN to be trading lower by this time next year. Patient investors interested in the stock may be able to pick up a position down the line at a more attractive entry point

Upside Risks

On the upside, the bulls should be rooting for economic conditions to quickly rebound. A scenario where Fed rate cuts over the next several months work to contain the labor market weakness and lead to a new round of credit growth and consumer spending strength should be positive for Amazon. If the company decisively beats top and -bottom line expectations over the next few quarters, we would be willing to return here and reassess our thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.