Summary:

- Procter & Gamble boasts a robust brand portfolio and consistent dividends but is currently overvalued, making it a hold rather than a buy.

- Despite strong fundamentals and a wide economic moat, the stock’s high valuation limits its potential for market-beating returns.

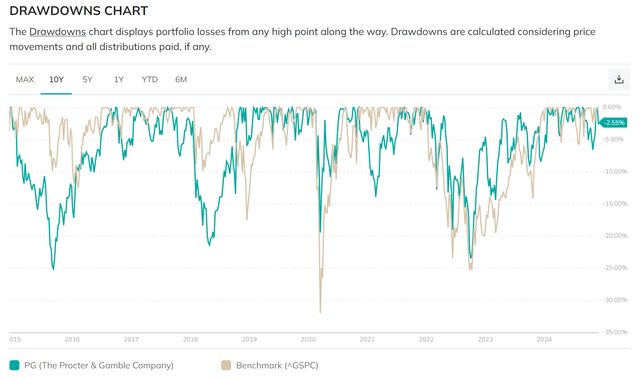

- The company has underperformed the S&P 500 for years and not provided much shelter in bear markets, limiting its appeal for risk-averse investors.

- Technical analysis suggests limited short-term upside, recommending new investors wait for a pullback or seek better opportunities.

RobsonPL

Procter & Gamble (NYSE:PG) is one of the most recognized consumer staples companies in the world. With a market cap exceeding $400 billion, a robust portfolio of household brands, and a dividend track record spanning more than a century, it’s easy to see why many investors view it as a core holding. However, despite many objectively strong qualities, Procter & Gamble’s current valuation presents a significant obstacle for investors seeking value and market-beating returns. In this article, I will explore the company’s fundamentals, the key aspects of its investment thesis, and why I believe this is a hold—not a buy—at current levels.

Company Overview

Founded in 1837, Procter & Gamble is a mature and well-established multinational corporation. Its portfolio of brands includes household names across multiple categories that you might recognize:

Baby Care: Pampers, Luvs

Fabric Care: Tide, Gain, Downy

Paper Products: Bounty, Charmin, Puffs

Personal Care: Gillette, Pantene, Head & Shoulders

Household Products: Mr. Clean, Swiffer, Febreze

Health Care: Metamucil, Pepto-Bismol, Vicks

Procter & Gamble’s competitive advantages, like any investible consumer staples company, lie in its intangible brand equity.It wouldn’t be surprising to hear that the majority of American households have at least one of the company’s products currently in their household, given their impressive portfolio of products.Their broad market share across many household staples makes the stability and pricing power of their portfolio appealing to investors who seek a modest dividend yield that is growing in excess of inflation.

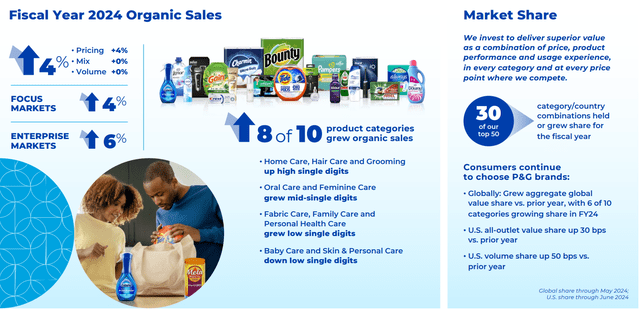

With a strong presence in many product segments, the company reported growing market share in several categories (2024 PG Fact Sheet)

Thesis: Risk is Minimal, But so is Upside

At first glance, Procter & Gamble appears to bean ideal investment for those seeking stability and income. The company derives a wide economic moat from significant brand equity intangibles, enabling pricing power from high consumer loyalty. It holds leading market shares in many of its categories. As such, the company has increased its dividend for 68 consecutive years which is the 3rd longest streak of any US company. The current dividend yield of 2.26% is supported by a payout ratio of 66%, and its five-year compound annual growth rate (OTC:CAGR) of 6% has outpaced inflation.

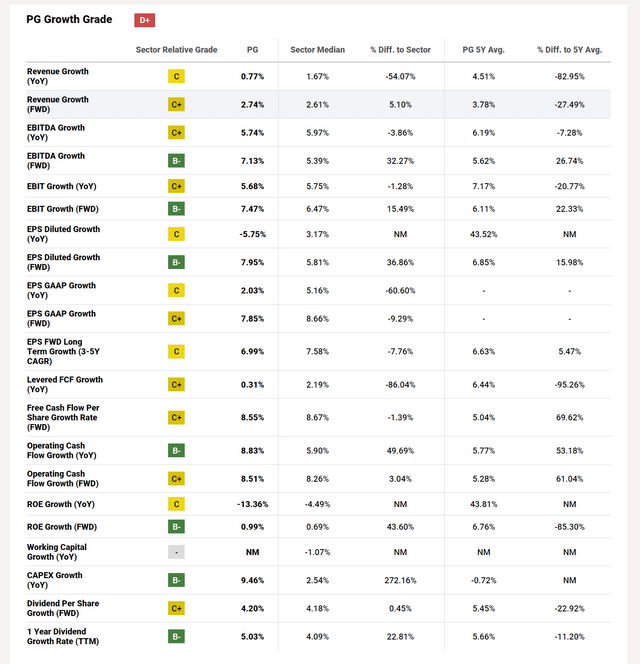

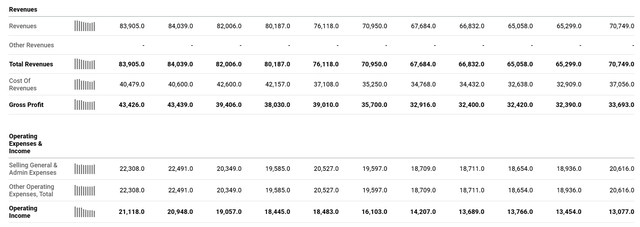

The financial performance also checks the boxes I like to see when looking at a company of this profile. Between fiscal year 2015 and the trailing twelve months (TTM), Procter & Gamble’s revenue grew from $71 billion to $84 billion—a modest 20% increase over nearly a decade. However, gross profit and operating income grew at faster rates (28% and 62%, respectively), indicating pricing power and cost efficiency. So, the wide moat from brand intangibles is verified by the numbers, as I would expect a weak moat company to have inconsistent gross margins over time.

Earnings and cash flow have grown at high single digit rates vs low single digit revenue growth, indicative of string operational efficiency (Seeking Alpha)

While revenues have grown roughly 20% over 10 years to $84 Billion, Operating Income has grown significantly from $13 to $21 Billion (Seeking Alpha)

The company uses its substantial cash flow to buy back shares and return capital to shareholders. Over the last decade, shares outstanding have been reduced by ~20%, accelerating dividend growth and share price appreciation.

Roughly 20% of the shares outstanding have been retired in the last 10 years, helping the company accelerate dividend growth (Seeking Alpha)

As a consumer staples giant, Procter & Gamble in theory should outperform during bear markets, providing a safe haven for investors during economic downturns. However, the company does not perform as well here as I would prefer, which is admittedly a big dampener of enthusiasm for me. For me to get excited about a slow grower with recession-resistant properties, I would hope for massive outperformance in bear markets, which just hasn’t been the case. Nonetheless, the company has performed modestly well when investors were bearish recently. There is no noticeable demonstration of bear market strength here, implying that the beta of this stock is lower due to slow growth more so than inverse correlation at times.

The company has slightly outperformed in drawdowns, but the outperformance is not significant and it has also drawn down worse than the S&P 500 in the last 10 years (Portfolioslab.com)

Ultimately, the company has a lot of compelling qualities but is priced in a way that reflects this. Combine that with the fact that there really hasn’t been any negative sentiment around the stock that might create a better value price, and it’s hard for me to see much value here.

The Valuation Leaves Little to be Excited About

While Procter & Gamble’s fundamentals are modestly strong, its valuation leaves a lot to be desired. I don’t have heartburn with buying great companies at fair prices, but when I estimate a company will grow slower than the market, I only feel comfortable snagging it at a deep value price. Currently, its free cash flow yield is just under 4%, which seems pretty expensive to me especially since the 10 year treasury is 4.18% at the time of this writing.

Right now, the dividend yield has is hovering at the lower end of the spectrum seen in recent years. Arguably, this is not great because the dividend is one of the most appealing things about an investment in P&G. The price-to-earnings growth (PEG) ratio of 3.6 and price-to-sales ratio of ~5 highlight its elevated valuation. The valuation of PG is even high in comparison to peers Colgate-Palmolive (CL) and Kimberly-Clark (KMB), who recently have seen multiple contraction. Again, I can get on board with buying a company at high valuations, even with strong conviction, but there is nothing about this company at the current price that excites me especially because it appears that other companies in its peer group might be more attractive.

PG’s valuation is elevated compared to consumer products peers, and has not seem the same multiple contraction as of late. (Seeking Alpha)

The dividend yield is near the low end seen in the last 10 years (Seeking Alpha)

The stock grades poorly in valuation metrics, which would be fine if it was growing quickly (Seeking Alpha)

To be fair, stocks like Procter & Gamble often trade at a premium due to their stability and strong dividend history. However, such premiums are typically more palatable when accompanied by negative sentiment or temporary challenges that create an opportunity for value investors. Unlike Hershey (HSY), which I recently analyzed in another article and granted a Buy rating, Procter & Gamble has no obvious weaknesses or controversies dragging down its stock price. In fact, it’s near all-time highs. Strong momentum is not a turn off for me for a GARP style investment but this company does not fit this profile for me.

Procter & Gamble’s growth is solid for its size but not extraordinary. Revenue has grown at a low single-digit CAGR over the last decade, and earnings growth is similarly modest. While its dividend is expected to grow at a 6% annual rate, the company’s total return prospects are limited by its valuation. In my taxable portfolio, I like to acquire companies that have a strong yield + dividend growth rate, otherwise known as the Chowder Number. Right now, the weighted average Chowder Number of my portfolio is 9.1%. Since PG’s Chowder Number is 8.2%, it does not look like an attractive investment. That being said, I would still purchase shares of a company that have a lower Chowder Number than my portfolio if I felt that the outlook of the company was shrouded in temporary headwinds. However, that is not the case here. Long story short, the biggest issue I have with PG is simply that nothing is wrong with it. While I don’t recommend bargain hunting as a primary investment strategy, I think it is required when buying value stocks.

Risks to Consider

The primary risk of investing in Procter & Gamble at current levels is the opportunity cost of allocating to a stock that is unlikely to outperform the market. With the S&P 500 realistically expected to show stronger forward total returns from heavy tech exposure, Procter & Gamble’s relative underperformance is a notable downside for investors seeking growth. I suppose it is reasonable to expect that growth oriented investors wouldn’t even consider investing in PG, so this “risk” is fairly benign. I could see why it would appeal to many investors, myself included, however I believe there are other stocks in the market similar to this trading at much more palatable valuations.

The stock has underperformed the S&P 500 over the last 10 years including dividends with llittle notable outperformance in bear markets. (Seeking Alpha)

Large multinational companies like this do carry some small currency risk. Approximately half of Procter & Gamble’s sales come from outside North America, exposing the company to currency fluctuations. I assign the materiality of currency risks to be fairly low given than 52% of sales are in North America, and if they were to impact earnings, I don’t anticipate that they would be of a large magnitude.

International presence is a demonstration and flex of brand power, but does introduce currency risk (PG 2024 Annual Report)

Litigation risks—such as product recalls—are also inherent in a business of this size and scope. These risks are very theoretical at this stage but what makes them so difficult to manage is that they are nearly impossible to anticipate. In theory, an investor can hedge currency risks, but lawsuits that arise because of faults consumer products are neither quantifiable nor predictable (unless you are an actuary, of course). Since they are hard to predict, they aren’t worth worrying about until they actually emerge. Usually, these events present possible buying opportunities.

Technical Analysis

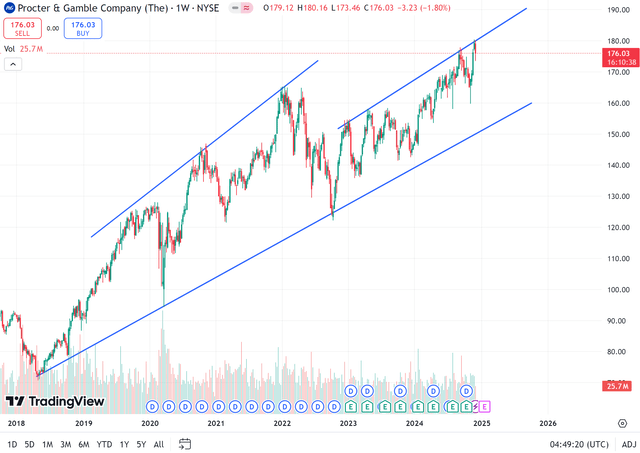

From a technical perspective, Procter & Gamble’s chart suggests limited upside in the very short term. The stock is trading in a wedge pattern near its all-time high, and the lack of significant volume or bullish momentum implies that a pullback is more likely than a breakout over the coming weeks. If I were looking to enter into a position on this, I would either wait for a high-volume breakout above the all time high, or a strong bounce off the lower trendline.

Since late 2022, the stock has been trading in an ascending wedge in a notably more gradual uptrend than prior. Given low volume and a recent failure to break out to further ATHs, the chart appears to indicate short-term downside (TradingView)

Conclusion: A Strong Company, But Not a Value. Initiating at Hold

For a long time, Procter & Gamble has shown stability, operational efficiency, and consistent shareholder returns. It’s a company that dividend-focused investors have been able to rely on for income growth and capital preservation, and frankly there is little reason to believe that this will change anytime soon. However, its current valuation makes it difficult to justify as a compelling buy vs other opportunities right now. While Procter & Gamble is an excellent long-term holding for existing shareholders, new investors may want to wait for a pullback or seek better opportunities elsewhere.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HSY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.