Summary:

- Today, we take a more in-depth look at drug giant Pfizer Inc., which has experienced falling revenues as Covid-19 has become endemic.

- The acquisition of Seagen did add blockbuster oncology therapies to Pfizer’s portfolio, boosting sagging oncology sales.

- Pfizer plans to launch new therapies and expand its oncology pipeline, aiming to generate $45 billion in revenue by 2030.

- With a low P/E compared to the overall market and a near six percent dividend yield, Pfizer merited a deeper dive.

- An analysis of the drug behemoth follows in the paragraphs below.

JHVEPhoto

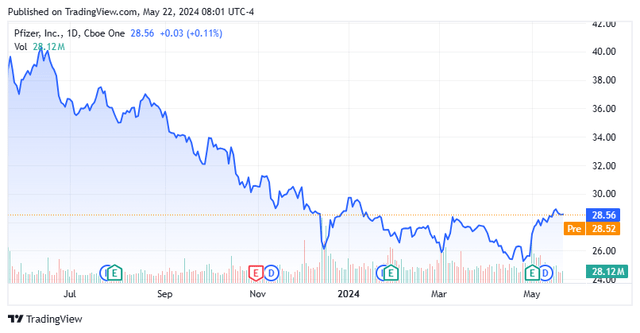

Not really needing any introduction, Pfizer Inc. (NYSE:PFE) is a New York City-based biopharmaceutical behemoth that generated revenues of more than $240 billion in 2021-2023, primarily from vaccines and cancer medicines, which are sold in more than 200 countries across the planet. The December 2023 $43 billion acquisition of Seagen added at least two soon-to-be blockbuster products to the nine it marketed in 2023. That acquisition brought the company’s clinical program total (as of January 30, 2024) to 112. Pfizer was established 175 years ago in 1849 and went public in 1942. Shares of PFE trade just over $28.50 a share, after putting in an 11-year low in April. The stock has just over a $160 billion market cap, and the options against the equity are extremely liquid.

Top-Selling Products

Since registering an all-time intraday high of $61.71 per share in December 2021, the company’s stock has fallen by more than half, due in large measure to the cratering demand for its Covid-19 products, as well as patent expiration concerns for many of its best-selling therapies over the coming years.

Comirnaty. Somewhat surprisingly, Pfizer’s top-selling product is still its Covid-19 vaccine, Comirnaty, which generated FY23 revenue of $11.2 billion, accounting for 19% of its total. Furthermore, it contributed 4Q23 revenue of $5.4 billion, or 38% of the company’s total. That said, the FY23 figure was down 70% from FY22, when it was responsible for revenue of $37.8 billion, up 3% from FY21. Even though the FDA continues to amend its emergency use authorization to include the latest version of the exceedingly questionable booster shots, FY23 U.S. sales were only $2.4 billion.

Paxlovid. In the same boat is oral Covid-19 treatment Paxlovid (nirmatrelvir-ritonavir), which after generating FY22 revenue of $18.9 billion, fell 92% to $1.3 billion in FY23. Sold primarily to government agencies, the 2023 figure includes a non-cash revenue reversal of $3.5 billion, reflecting the return of ~6.5 million treatment courses of U.S. government inventory that were recorded as sales in FY22. Either way, demand for this pandemic therapy is now nearly nonexistent.

Eliquis. Pfizer’s number two revenue generator in FY23 was Eliquis (apixaban), an oral blood thinner approved for nonvalvular atrial fibrillation, deep vein thrombosis, and pulmonary embolism that accounted for sales of $6.7 billion, up 5% from FY22. Marketed in partnership with Bristol-Myers Squibb Company (BMY), it is scheduled to face generic competition starting April 2028.

Prevnar. The company’s next best revenue generator is the pneumonia vaccine Prevnar, which includes Prevnar 13 and Prevnar 20. It contributed FY23 revenue of $6.4 billion, up 3% over FY22. Unlike many of its other top-selling products, Prevnar 20 is not due to come off patent protection until 2033.

Ibrance. Pfizer’s number four seller in FY23 was Ibrance (palbociclib), a CDK4/6 inhibitor approved for HR-positive/HER2-negative metastatic breast cancer. It was responsible for sales of $4.8 billion, down 6% from FY22. Already facing pricing pressure internationally, it loses patent protection in 2027.

Vyndaqel. The other asset family in the company’s portfolio that generated FY23 revenue over $3 billion was heart muscle and polyneuropathy med Vyndaqel (tafamidis meglumine), which along with Vyndamax/Vynmac (tafamidis) accounted for sales of $3.3 billion, up 36% from FY22, due in large measure to significant uptake from transthyretin amyloid cardiomyopathy prescribers. However, Vyndaqel is expected to come off patent protection in December 2024, although Pfizer has filed a patent term extension into 2028.

Other blockbuster meds facing impending generic competition include Inlyta (2025), Xeljanz (2025), and Xtandi (2027).

Seagen Acquisition

With two of the company’s nine blockbusters experiencing substantial sales declines and another six subject to patent cliffs over the next few years, it’s not surprising to see shares of PFE trading at less than 2.7 times FY24E sales. In response, Pfizer opted to buy itself a new line of patent-protected blockbuster oncology therapies when it acquired Seagen. Specifically, the acquired company markets four products, three of which are antibody-drug conjugates (ADCs), two of which – frontline advanced Hodgkin lymphoma therapy Adcetris and urothelial cancer med Padcev – have multi-blockbuster potential. Although FY23 sales figures are a bit wonky due to the December 2023 acquisition, Adcetris accounted for sales of $751 million in the first nine months of 2023, while Padcev contributed $479 million, up 25% and 46% over the prior year period, respectively.

Near term, Pfizer anticipates launching five new therapies and six label expansions covering twelve indications (contingent on positive clinical data) by 2026 – just in oncology. Revenue from biologics (e.g., ADCs) in this area is expected to grow from 6% of cancer revenues to 60% by the end of the decade. In Pfizer’s vision, its oncology pipeline could produce eight blockbusters by 2030. For now, Seagen will bolster sagging oncology sales, which at $11.6 billion in FY23, represented a 4% decline from FY22 despite the late-December $120 million contribution from Seagen.

Overall, the company sees $45 billion in revenue generated from new molecular entities, new indications, and business development deals by 2030.

Strategic Priorities

The Seagen acquisition somewhat covered two of Pfizer’s five strategic priorities – becoming the industry leader in oncology and delivering the next wave of pipeline innovation. The other strategic priorities include maximizing the performance of its new products, expanding margins by realigning its cost base, and allocating capital efficiently to enhance shareholder value. As for the realignment of its cost base to reflect its even bigger push into oncology, Pfizer plans to spend ~$3 billion from 4Q23 through YE24 to drive ~$4 billion in annual cost savings.

4Q23 Results:

With that as the backdrop, the company reported its 4Q23 results on January 30, 2024, posting earnings of $0.10 a share (non-GAAP) on revenue of $14.2 billion versus $1.14 a share (non-GAAP) on revenue of $24.3 billion. Those results brought FY23 to $1.84 per share (non-GAAP) on revenue of $58.5 billion versus $6.58 per share (non-GAAP) on revenue of $100.3 billion, reflecting decreases of 72% and 42%, respectively. Removing Covid-19 products Comirnaty and Paxlovid, Pfizer’s top line improved by 8% in 4Q23 and 7% in FY23. Keep in mind that the Paxlovid reversal in 4Q23 impacted both GAAP and non-GAAP EPS by $0.54 a share.

1Q2024 Results:

Pfizer posted its Q1 numbers on May 1st, and it was a solid quarter for the drug giant, at least compared to expectations. Non-GAAP earnings per share of 82 cents a share, was some 30 cents a share above the consensus. Revenues fell 19.5% on a year-over-year basis to $14.9 billion, but that was $900 million over the median analyst firm estimate. Management reiterated its FY2024 guidance calling for revenue of between $58.5 billion to $61.5 billion and non-GAAP earnings per share in the range of $2.15 to $2.35 a share.

Balance Sheet & Analyst Commentary:

To acquire Seagen, Pfizer onboarded additional debt of $31 billion. According to the 10-Q filed for the first quarter, Pfizer had just under $12 billion in cash and marketable securities against long-term debt of just north of $61 billion at the end of March. Management remains committed to raising its quarterly dividend, increasing it from $0.01 a share to $0.42 in the first stanza of 2024, even though (annualized) it represented 91% of its non-GAAP earnings in FY23 and 78% of its non-GAAP FY24E EPS. With notable net leverage – its target is 3.25 – Pfizer does not anticipate buying back any stock in 2024, repeating its inaction of the prior year.

With the pandemic days rapidly moving into the rearview mirror, the Street is mostly unmoved by management’s attempts to negotiate upcoming patent cliffs for six of seven non-COVID-19 blockbuster therapies. Hold/Neutral ratings from analyst firms slightly outnumber Buy/Outperform ratings from the analyst community right now. On average, they expect Pfizer to earn $2.35 a share (non-GAAP) on revenue of $60.6 billion in FY24, followed by $2.74 a share (non-GAAP) on revenue of $62.9 billion in FY25.

Verdict:

Despite Pfizer Inc. experiencing a 42% decline in revenue in 2023 vs. 2022, it still had over 620 million people across the planet use its therapies, received nine FDA approvals, generated more sales from pharmaceuticals than any concern on the planet, and took significant action to address its current and impending decline in product sales. Pfizer’s stock is reasonably valued based on a P/E of 10.4 on FY25E EPS, especially considering the current yield of 5.9%. As such, having just put in an 11-year low in April, the stock seems a solid covered call candidate. This strategy provides a bit of downside protection and enhances yield via the acquisition of the option premium in addition to the quarterly dividend payouts.

Note: This research was originally published exclusively to our Investing Group members a week before Q1 results came out when the stock was trading at around $26.00 a share. It has been updated to include first quarter results and other data that has hit the wires since then.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.