Summary:

- Tesla, Inc. CEO Elon Musk’s commentary on Tesla’s third-quarter 2023 earnings call disappointed some analysts and investors.

- The company is amassing significant computing resources to tackle its quest to achieve full self-driving capabilities in its EVs.

- Tesla is working on developing Artificial Intelligence and robotics capabilities, potentially leading to a significant upside.

Xiaolu Chu

Tesla, Inc. (NASDAQ:TSLA) reported third-quarter earnings on October 18, 2023, that missed analyst’s top and bottom line estimates. Even worse for investors, Chief Executive Officer Elon Musk’s commentary on the earnings call didn’t go over well with some analysts and investors. If you are an investor in this stock strictly for near-term performance, you might be disappointed with what Musk had to say, as the prospects for revenue growth and margins look bleak for the car company over the next year. Disappointed investors dropped the stock by 9% the next day.

However, suppose you believe Tesla’s long-term future is as a tech company, monetizing Artificial Intelligence (“AI”), robotics, software, battery storage, self-driving cars, electrical vehicle (“EV”) charging services, and more. In that case, the reason to continue investing in the company remains intact.

For instance, amidst all the doom and gloom on the company’s third-quarter earnings call, some may have missed Elon Musk’s comment that AI could “make Tesla the most valuable company in the world by far.” Today, Tesla has a market cap of $672.86 billion, and the most valuable company in the world is Apple (AAPL), valued at around four times more than Tesla at $2.70 trillion. Elon must believe the company has a lot of stock appreciation ahead in the long term to make that statement. If you believe in Musk’s vision for this company, consider buying Tesla’s stock.

Tesla is a technology company

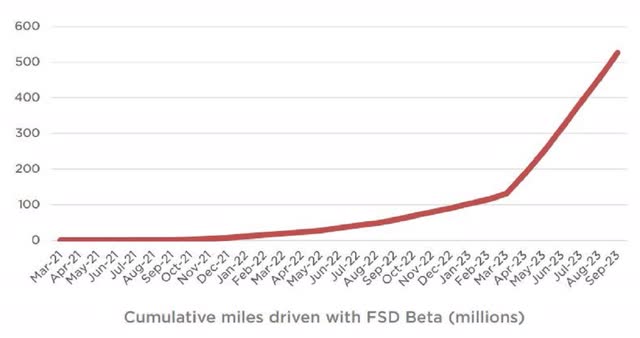

One of the first things that Elon Musk discussed on Tesla’s third-quarter 2023 earnings call was the company’s full self-driving (“FSD”) program, and he did so with good reason. On the earnings call, he said, “Training is the fundamental limiting factor on progress with full self-driving and vehicle autonomy.” Musk made that statement because for FSD cars to become a reality, the self-driving models need to become more complex, requiring the raw amount of data and computer resources needed to train these models to increase drastically. The chart below shows the cumulative miles driven by FSD beta, which generates massive datasets, driving Tesla’s need to increase computing power.

Tesla Third Quarter Update Deck

Despite unveiling a massive supercomputer based on NVIDIA A100 chips in 2021 that, at the time, the senior director of AI at Tesla, Andrej Karpathy, believed was “roughly the number five supercomputer in the world,” Tesla has aimed for even more computing power. Tesla unveiled its plans to build its own chips and supercomputer named Dojo, a superfast training computer, at Tesla AI Day in 2021.

While it built Dojo explicitly to train FSD, according to reports, Morgan Stanley (MS) analysts are already wondering what other markets Dojo and Tesla’s other data-crunching assets can open up that “extend well beyond selling vehicles at a fixed price.” When Reuters published that article, those same analysts estimated the Dojo supercomputer could add “$600 billion” to Tesla’s market value. Morgan Stanley analyst Adam Jonas thinks the company’s advanced supercomputing capabilities will power what he calls the “Muskonomy,” the other companies like SpaceX (SPACE) and X (formerly Twitter) in Elon Musk’s empire. So, while Tesla’s primary source of revenue comes from EVs today, and some think of it as “just a car company,” there is a possibility that a decade or two from now, more people might think of it as primarily an AI company.

Another business that Musk highlighted during the earnings call was the company’s energy storage business, which is growing like gangbusters. Tesla’s energy storage deployments in the third quarter increased 90% over the previous year’s comparable period to 4.0 gigawatt-hours. Musk said the following about the company’s energy business:

And as this business grows, the energy division is becoming our highest margin business. Energy and service now contribute over $0.5 billion to quarterly profit.

Source: Tesla third-quarter 2023 earnings call.

Lastly is the Tesla Supercharging network. The company claims it “owns and operates the largest global, fast charging network in the world,” with over 50,000 Superchargers. Tesla’s third-quarter 2023 update deck states, “Pay-per-use Supercharging remains a profitable business for the company.” Since multiple automakers, including Ford (F), General Motors (GM), and Toyota (TM), plan to use certain Tesla Superchargers by 2024, you can expect this business to become an additional solid source of profits. Suppose you take the long-term view on Tesla as a technology company; Elon Musk said nothing on the latest earnings call that busts your thesis for investing in the stock.

The terrible third quarter 2023 earnings call

Finding any investor with good things to say about the company’s third-quarter earnings call takes a lot of work. Even some staunch Tesla investors had criticisms of Musk’s performance. For instance, prominent YouTuber, investment advisor, and Tesla investor Kevin Paffrath said the company’s earnings call was “terrible” and that “Tesla is a leadership-less company right now,” according to Yahoo! Finance report. Although the company is having a challenging time, Musk’s overall pessimism took some people aback. Investors waiting to hear at least one piece of good news walked away empty-handed.

If you were waiting to hear about the terrific opportunity the Cybertruck launch could represent, Musk quickly poured icy water on those dreams. He said during the earnings call:

The Cybertruck, I know a lot of people are excited about the Cybertruck. I am too. I’ve driven the car. It’s an amazing product. I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive.

Source: Tesla third-quarter earnings call transcript.

So, you shouldn’t expect Cybertruck to come riding to the rescue to save the company from its ills any time soon. Additionally, Musk gave no firm timelines on plans for FSD to reach full autonomy or to introduce a non-human driven robotaxi, differentiating Tesla’s EVs from competitors. The company has promised for many years that full autonomy was near and has consistently disappointed. In contrast to Musk, S&P Global Mobility has forecast the car industry to reach full autonomy in 2035. So, investors should not rely on the company suddenly introducing autonomy and changing the conversation around Tesla any time soon.

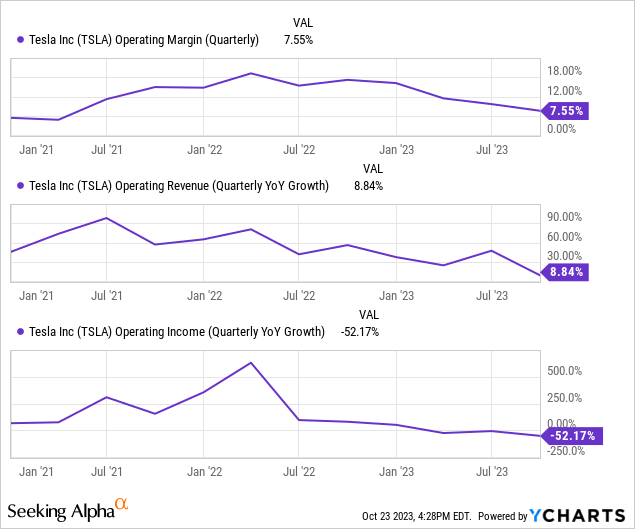

Tesla’s operating margin shrank 960 basis points from 17.2% in the third quarter of 2022 to 7.6% in the third quarter of 2023. Operating income dropped 50% from the previous year’s comparable quarter despite growing revenue growing 9% year-over-year, as seen in the chart below.

During the earnings call, the Chief Financial Officer (“CFO”) Vaibhav Taneja explained the company’s pricing strategy and why Tesla margins have declined the last several quarters:

I want to elaborate that most car buying happens with one or other form of financing, and hence we also view pricing in terms of monthly costs for the customer. And therefore, as interest costs in the U.S. have risen substantially, it has required us to adjust the price of our vehicles to keep the monthly cost in parity. We’ve tried to offset such adjustments via focus on reducing costs. However, there is an inherent lag in cost reductions, which in turn impacts margins.

Source: Tesla third-quarter earnings call transcript.

Paraphrasing the CFO’s above quote to make it more understandable, most consumers buy cars with some form of financing. When the Federal Reserve (“Fed”) raises interest rates to elevated levels, as the central bank did in 2022, the additional financing costs add to the overall price of buying a car, making the vehicle unaffordable for more people. So, Tesla has cut prices to make its EVs more economical for consumers and raise sales. The company has tried reducing costs to compensate for the reduced EV pricing. However, since it cannot reduce its costs as fast as it has slashed the pricing of its vehicles, its margins have been squeezed.

Don’t expect the situation to change much until the Fed reduces interest rates. Unfortunately, according to Bankrate, the Fed expects to raise rates one more time this year to a 22-year high of 5.5-5.75 percent. Economists think interest rate cuts will start sometime in 2024. So, conditions may not improve for Tesla over the next several quarters.

Valuation

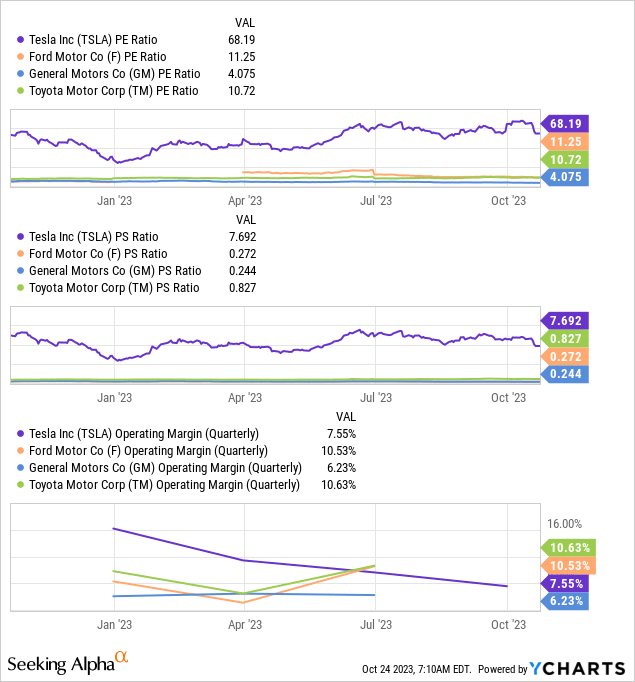

If you value Tesla like a car company, you might agree with Ashwath Damodaran’s valuation of $130 for the company this past January. As I write this article, that figure is 39% below the stock’s closing price on October 23, 2023, of $212.08. His perception of the company is one that has overachieved in the car industry and is now coming back down to earth. Damodaran stated:

Put simply, most businesses that want to grow faster have to accept that this higher growth will come with more risk (because it will require entering riskier geographies or market segments), will need more investment in capacity (to be able to deliver on that growth) and often require accepting lower operating margins (because you may have to cut prices to sell more). For most of the last decade, Tesla has seemed to be impervious to these rules, showing a capacity to deliver revenue growth with rapidly rising margins in a competitive electric car business, and doing so with far less reinvestment than other automobile companies.

Source: Ashwath Damodaran.

Damodaran went on to question whether the current price cuts are momentary or whether Tesla’s customers are now more willing to purchase competitors’ vehicles. Suppose it is true that Tesla is no longer the king of EVs; when the Fed eventually lowers interest rates, the company’s operating margins may not bounce back to lead the industry. Investors who value Tesla like a car company likely conclude the market overvalues the stock.

Wall Street analysts are more neutral and rate the stock as a hold with an average one-year price target of $237.71.

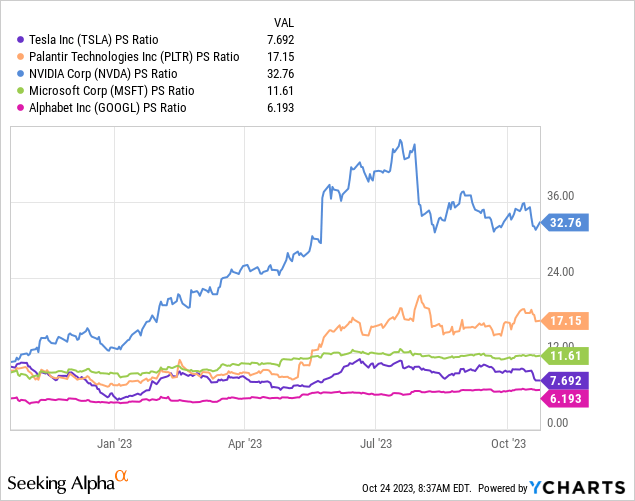

However, suppose people will recognize it more as an AI, software, hardware, and robotics company in the future. In that case, you might conclude the market is undervaluing the stock. Some analysts think it has significant growth potential in AI. It favorably compares if you measure its price-to-sales (P/S) to other companies that are counting on AI to produce future revenue growth.

Even if Tesla doesn’t reach full autonomy on the timelines of Elon Musk, it has amassed significant computing resources for advancing robotics, automating many vehicle functions, and many AI services. I have confidence that the company will find ways to monetize its computing resources over the next ten years that could potentially add significant value to the company that isn’t in estimates valuing it only as a car company. Additionally, if the economists are correct and the Fed lowers interest rates next year, the need for it to continue fighting price wars with competitors will eventually go away.

Also, remember Cybertruck. Although Musk said that Cybertruck could take “a year to 18 months before it is a significant positive cash flow contributor,” on the company’s third-quarter earnings call, if Cybertruck becomes a hit product over the next three years, the market may be undervaluing Tesla as a car company too. Cybertruck has massive potential. In his blog, Sam Korus at Ark Invest wrote,

“In addition to 1.5 million existing Cybertruck reservations, early Google Trends data suggest that the Cybertruck could be as mainstream as the Tesla Model Y.”

In addition, Korus believes that legacy auto companies use the profits from sales of gas-powered trucks to fund EV development and that if Cybertruck disrupts the truck market, companies like Ford and GM could be in peril.

Seeking Alpha author Christopher Robb did an interesting valuation exercise in August using a discounted cash flow (“DCF”) model. Using a growth exit of 10 years, he came up with a Fair Value price of $479.25, 121% above Tesla’s October 24 closing price of $216.52. Among the arguments he makes supporting his case that the market undervalues Tesla is that cash flow is a significant factor in a DCF valuation, and the company prioritizes cash flow. He also leans on the side that Tesla could have additional potential upside as a technology company.

Another interesting valuation metric I follow is the GF value, which estimates the Fair Value of a stock using a proprietary method. Today’s GF value is $449.14, or 107% above the October 24 closing price. This wide range of valuations on this stock should tell you there is a broad range of outcomes for the company. If its AI initiatives fail or it takes an exceptionally long time to monetize AI and self-driving cars, Tesla could look more like a car company, and the valuation could move in the direction of $130. If, however, Tesla can get self-driving vehicles and robotaxis on the road in the next several years while finding other ways to monetize AI, the stock price could move much higher than $400.

I am on the more optimistic side and lean more towards Christopher Robb’s valuation of Tesla rather than Ashwath Damodaran’s because Robb appears to factor in more of the potential upside of Tesla’s technology initiatives.

Should you buy the stock?

If you believe Tesla is primarily a car company that has overachieved in the last decade and now competitors are catching up to it in the EV market, you should avoid this stock. However, suppose you believe that Tesla will evolve into one of the premier tech companies over the next decade and challenge Apple for the highest market cap in the world; then now is a great time to start collecting Tesla’s stock on the dip. I recommend aggressive growth investors buy the stock today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.