Summary:

- Tesla stock continues to offer investors an exciting value proposition, anchored on advanced EV technology and strong brand.

- The new Model 3 launch focuses on product quality rather than price reductions.

- Tesla’s global market share has dipped, but the overall EV market is expanding rapidly.

- While I see a few potential challenges in the short term, particularly in Q3, I advise investors to maintain a long-term perspective on Tesla.

Justin Sullivan

Tesla (NASDAQ:TSLA) stock still offers investors lots of upside potential; the carmaker continues to defend some of the best technology in electric vehicles, or EVs, on both production efficiency and product features; in addition, the Tesla brand remains the most valuable car brand, by far, which supports broad consumer adoption.

However, reflecting on the latest developments in the global EV market, it becomes also evident that the Austin-based automotive company faces multiple challenges in its road to “EV domination.” In this article, I will discuss my take on Tesla’s (i) latest Model 3 launch, (ii) the broader price cuts/ price war, and the (iii) changing market share.

Overall, while I continue to defend the position that Tesla remains one of the most exciting growth assets listed on the market, I also understand that the goldilocks days of easy growth, notably the two year period 2020-2022, may perhaps have come to an end. The next level for Tesla’s growth as a company, in my opinion, is firmly anchored on the company’s next-generation hardware project, as well as full self-driving (“FSD”) technology.

Betting Again On Product – New Model 3

In context of the Munich IAA mobility event, held from September 5th to 10th, Tesla unveiled a new generation of its best-selling Model 3 car. On the design angle, the new Model 3 sports updated bumpers and lighting, as well as a somewhat revised interior. With regard to performance specs: the rear-wheel drive Model 3 has a 0-62 mph (0-100 km/h) acceleration time of 6.1 seconds and a WLTP range of 319 miles (513 km). The Dual Motor Long Range variant is even more impressive with a 4.4-second 0-62 mph (100 km/h) time and a WLTP range of 391 miles (629 km). Both versions offer fast charging capabilities of 170 kW or 250 kW, providing up to 175 miles (282 km) of range in just 15 minutes when the battery is depleted.

In my opinion, the new Model 3 launch is notable, because it is a welcome alternation in the carmakers strategy to fuel demand by simply cutting prices. With the new Model 3, Tesla may once again point with car buyers on product excitement, vs. price excitement. By the way, somehow Tesla’s Model 3 update reminds me of Apple’s (AAPL) strategy with relaunching the iPhone over and over again, with minor tweaks. Tesla plans to sell the new Model 3 as early as 2024. And overall, early management commentary suggests that the new product my help to improve profitability by both lowering the cost of goods sold and increasing the selling price compared to the outgoing model.

Market Share Under Pressure

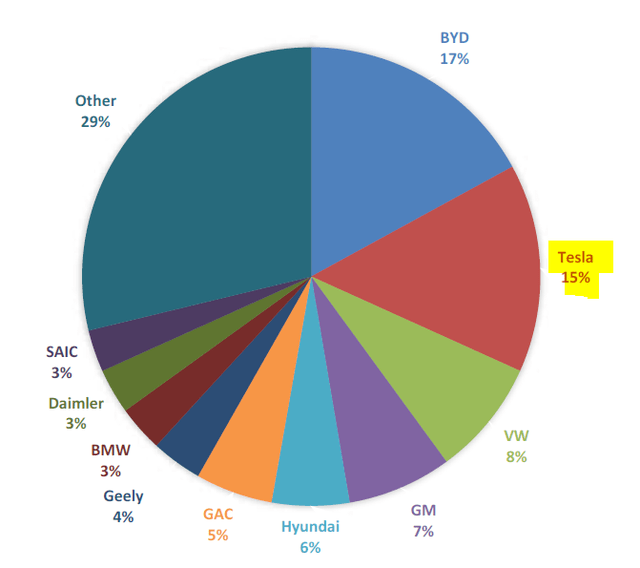

Tesla’s new Model 3 launch is also important, because Tesla needs to update its (somewhat) older product portfolio to remain competitive with European and Chinese carmakers, who bring new models to the market at record pace. In other words, the times where Tesla was the only game in battery EV, or BEV, are over. In fact, in terms of global BEV sales and market share, Tesla’s share now has dropped to only 15%, down from about 23% for the previous year.

Morgan Stanley’s equity research

However, it is also important to note that the BEV market is still expanding rapidly, which renders the loss of market share less concerning. According to a research note by Morgan Stanley’s equity research team (Global EV Tracker: Tesla Cedes Share to Chinese, Others, dated 6th September), the global BEV sales in July 2023 YTD vs. the same period in 2022 are up a remarkable 36%, growing to 5,075,089 BEV units sold in 2023 so far. The growing market is supported by higher penetration levels in all regions: the U.S. at 8.0%, Europe at 15.9%, and China at 22.8%.

Finally, while BYD Company’s (OTCPK:BYDDF) 17% market share has overtaken Tesla’s, I would like to point out that Tesla is leading in the U.S. and Europe, while BYD is only leading in China, which is a more price sensitive market, although high volume.

The Next Growth Leg

Looking beyond the new Model 3 excitement, I see Tesla’s next growth leg supported by its next-gen vehicle platform, which could account for 4-7 million EVs produced by 2028/30, according to my estimates. For context, the next-gen platform is Tesla’s most important hardware project right now, aiming to reduce production cost and efficiency for more aggressive EV volume scale. According to management guidance, the next-gen platform will be leveraged at plants around the world, and not only in Mexico as I have initially assumed. The platform is expected to be used for the production of the Cybertruck, Semi, and Roadster, as well as other future vehicles.

Moreover, as the second major growth opportunity, Tesla continues to be working on FSD technology. In that context, Tesla’s ambitions are likely to accelerate over the next 12 to 24 months, as the company is investing in AI and its Dojo supercomputer project. As an additional consideration when discussing FSD, I would also like to point out that Tesla has recently reduced the price of its FSD package from $15 tsd to $12 tsd, which could likely push adoption up by anywhere between 10% to 20%, I believe. But more data points are needed to see how penetration and gross profit maximization is optimized by price adjustments in FSD. Like in its pricing strategy for vehicles, Tesla is lately experimenting a lot with pricing. Thus, pricing on FSD may continue to evolve over the next few months; and personally, I would not be surprised if the starter package drops below the five figure benchmark.

Outlook: What To Expect in 2023

I see a challenging Q3 for Tesla: In my opinion, there could be downside risk to investors’ expectations for volume and margin, reflecting planned summer production shutdowns which will push both production and deliveries down, while repeated, aggressive discounts on sales may limit profitability. Specifically, Tesla has recently estimated that both production and deliveries volume will likely be down in Q3 vs Q2, mostly driven by the discussed factory shutdowns around the globe. In that context, the company had about 16 days of sales in inventory in Q2, mostly in-transit vehicles, which may not be enough to offset the production impact from shutdowns happening in Q3.

Tesla has so far never voiced any doubts to hitting the 1.8 million in deliveries target. But the data still suggests downside risk to the flattish deliveries consensus at present. And if volume is met, it might come at a considerable cost, e.g., pressuring profitability on purchase-inducing price cuts. In that context, Tesla also intends to manage the delivery mix between the Model 3 and Model Y by adjusting the pricing gaps between the two models on a weekly basis for specific regions to tailor to market-specific nuances on supply and demand.

The manufacturing costs of Tesla’s Austin and Berlin factories are improving on volume ramp ups; but overall scale effects are still well below Fremont at present. However, once Austin and Berlin reach more stabilized production levels, they will be able to implement cost reduction efforts. In my opinion, however, meaningful operating leverage from the Berlin/Austin factory ramp will not materialize prior to 2024.

Regarding the Cybertruck, Tesla reiterated that the company is on track for start of production and deliveries in Q4, with 250k in target annual capacity. The vehicle is a product specific to the U.S. market, and management indicated that it is difficult to estimate how many Cybertrucks can be sold in 2023 and 2024, since it will also largely depend on the demand for its other vehicles.

Conclusion

Tesla continues to be an exciting investment opportunity. However, it is important to recognize the evolving landscape of the global EV market, which presents both opportunities and challenges. A few considerations stand out: First, the recent launch of an updated Model 3, focusing on product quality rather than price reductions, indicates Tesla’s commitment to sustainable growth; Second, While Tesla’s global market share has dipped, the overall EV market is expanding rapidly, with Tesla maintaining leadership positions in the US and Europe; Third, investors should keep a close eye on Tesla’s next-generation vehicle platform and Full Self-Driving technology, which hold the key to the company’s future growth.

While I see a few potential challenges in the short term, particularly in Q3, I advise investors to maintain a long-term perspective on Tesla; and, as long as the company maintains leadership in EV technology, as well as customer love, I recommend to remain invested.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.