Summary:

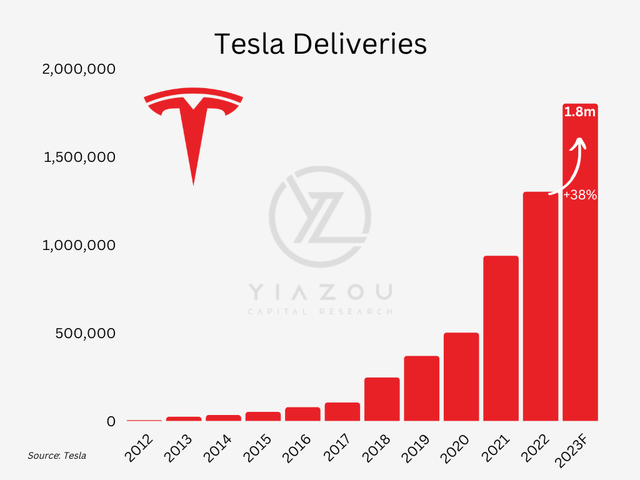

- Tesla’s Investor Day may have disappointed some fans and analysts, but the 2023 outlook remains positive, with 1.8 million estimated deliveries.

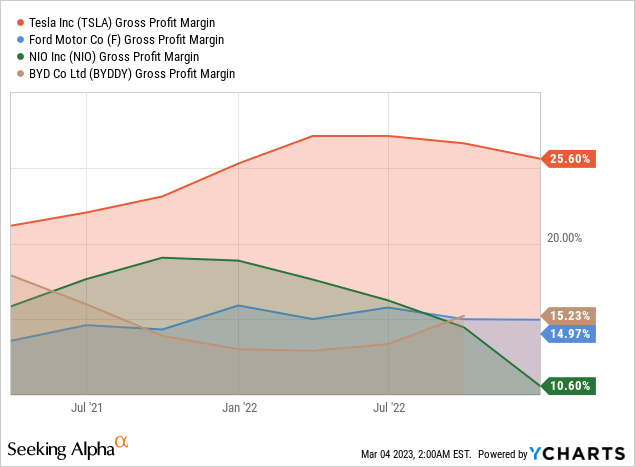

- Tesla enjoys market-leading gross margins, and its highly efficient cost structure, backed by its manufacturing efficiency, can easily support price cuts.

- The company faces its toughest growth challenges since entering the global automotive market.

- My short-term target price for TSLA stock remains at $230; however, any positive surprise with vehicle delivery volume will significantly boost shares above that target.

Jag_cz

Investment Thesis

On the recent investor day, Tesla, Inc. (NASDAQ:TSLA) reaffirmed its long-term goal to sell 20 million vehicles annually, which justifiably many analysts still question. Moreover, the ability of Tesla to scale should result in stronger long-term free cash flow generation, which was my key lesson learned from the event. Therefore, with a stronger FCF and less debt, we might see the initiation of a share repurchase program.

Close to the 2022 year-end, we opened a long position for TSLA in the model portfolio, handsomely returning nearly 64% in two months. Even though it might be a good trimming point, TSLA has more upside. I maintain the long position for the short term, as several catalysts, such as a repurchase program announcement, a margin expansion, or a delivery volume surprise, can significantly boost shares.

Outlook Remains Positive

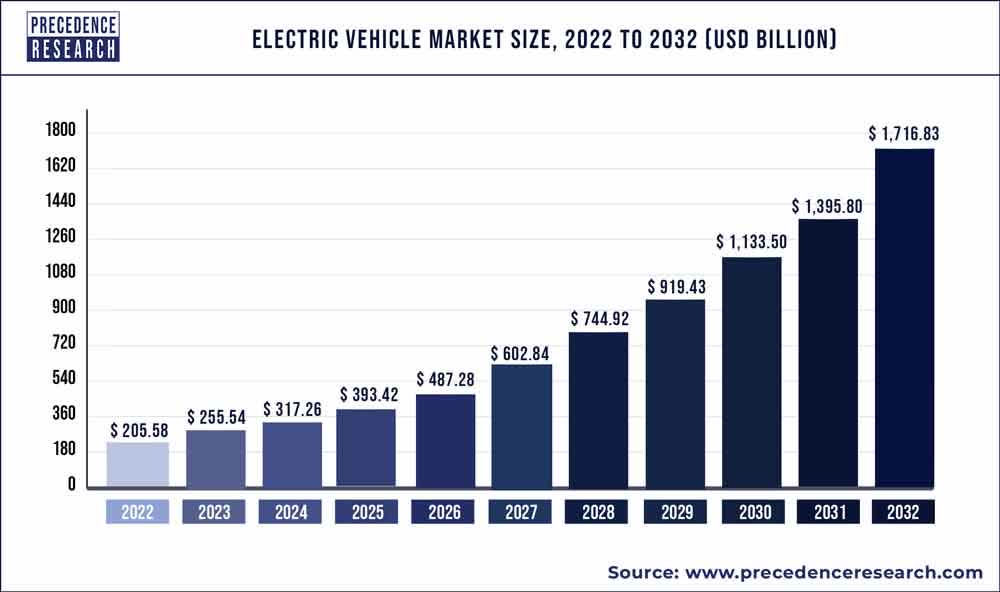

Although Tesla continued to expand its electric car business in the past year, the pace of progress could have been faster compared to 2021. However, the demand for electric cars is anticipated to remain high for many years due to government policies and growing interest in this category, which bodes well for Tesla’s future growth prospects.

Furthermore, Tesla is well-positioned to benefit from other lucrative opportunities, including energy storage systems. However, despite a strong track record, concerns have been raised about the management quality following the recent wavering commitment of Elon Musk, especially as competition in the electric car industry is set to intensify.

www.precedenceresearch.com

Similar Delivery Growth In 2023

Government initiatives to speed up the energy transition will help to accelerate a structural transition from combustion engines to electric vehicles. This represents a vast growth opportunity, as just a minor share of today’s car fleet, especially in the US, is made up of electrified cars. Traditional car makers have, in recent years, stepped up efforts to adjust, and the vast growth opportunity has also attracted new entrants, of which many are located in China.

Although competition is intensifying, including from plug-in hybrid vehicles, Tesla still enjoys key competitive advantages, including a highly efficient cost structure that it achieved by setting up highly automated factories and by lowering the costs of its battery packs, which account for a large part of the total costs of an electric car.

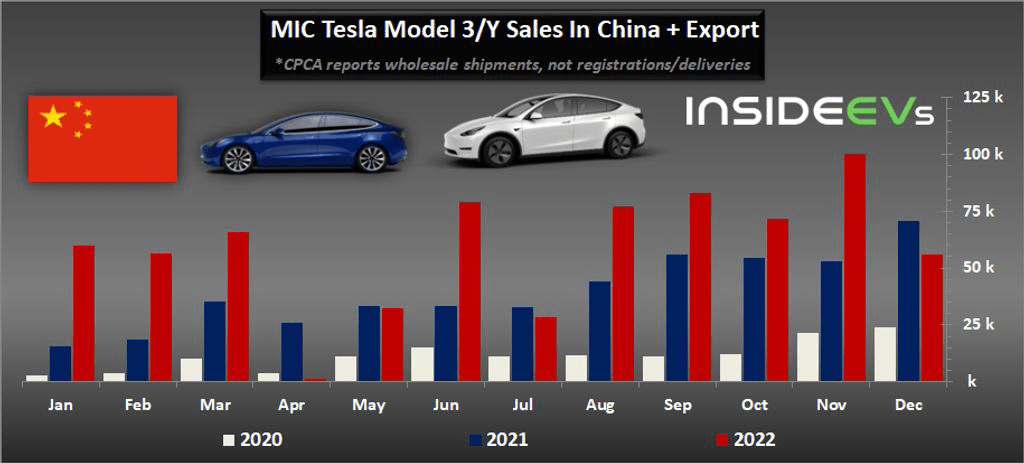

To boost its growth in China, the largest market for electric cars and Tesla’s largest market after the US, Tesla recently lowered prices sharply. These appear to have been effective in boosting orders. The firm also cut prices elsewhere, likely in response to competition, but lower prices for some models were also needed to qualify for purchase credits in the US, available since this month under the Inflation Reduction Act.

The reductions in selling prices may translate into lower operating margins in the near term, but significant pressure is unlikely. Whereas the price of lithium, a key battery material, is expected to remain high, prices for many other materials used in its cars may go down again. In addition, cost efficiency is set to improve in its newer plants and battery production. Finally, an expected rise in the adoption of Tesla’s self-driving software, currently used by 400,000 customers in North America, is expected to help offset pressure on margins from price cuts. As a result, Tesla remains confident that it will maintain the most efficient cost structure in the car sector over time and the highest margin, supported by its manufacturing efficiency.

Tesla’s fourth-quarter results show a relatively slow revenue gain and notable pressure on the gross margin of its electric car business. In the entire year, Tesla’s operating margin improved notably to a level well ahead of the rest of the automotive industry. The company’s net income more than doubled, and the free cash flow rose substantially. In the conference call, the management downplayed concerns over demand weakness for its cars, pointing to recent strong orders after price cuts. Tesla expects to deliver 1.8 million cars in 2023, roughly similar to growth in 2022. Lastly, the firm suggests the production of Cybertruck is on track to start later this year, although mass production of the new design is expected to start next year only.

Tesla Faces Tougher EV Competition In China

In January, sales of new energy vehicles (NEVs) in China dropped by 6% compared to last year, but this decline was less severe than the overall market’s 35% slump. Despite discontinuing subsidies, NEVs maintained a 22% share of total car sales due to the continuation of zero purchase taxes. BYD Company Limited (OTCPK:BYDDF) was the leading industry player, accounting for approximately 27% of new car sales in 2022.

However, Tesla’s market share is at risk as domestic EV rivals offer competitively priced and updated designs to attract consumers. In addition, the company is facing its toughest growth challenges since entering the global automotive market and can no longer attribute lower-than-expected delivery figures to production constraints in key regions. Instead, decreased consumer demand results from worsening economic conditions, increased competition in the EV market, a lack of new product offerings, and self-inflicted reputational damage.

insideevs.com

VW, Audi, & Porsche Acceleration In Europe

Volkswagen AG (OTCPK:VWAGY) will likely maintain its leading BEV market share in Europe with ten new pure-electric models introduced in 2023-24. This is despite Tesla’s Model Y and Model 3 taking the top two spots for best-selling European BEV in 2022, with a new Berlin factory ramping up production of the Model Y. As a result, the combined registrations for VW, Audi, Porsche, Cupra, and Skoda surpassed Tesla in 2022.

Given increased competition, Tesla is unlikely to regain the lead for BEV sales in Europe from VW, as BEV sales for the region are forecasted to approach 3 million units a year by 2025, for a 20% market share. However, government subsidies replacing automaker incentives have eased margin pressure during the transition.

Competition for Tesla’s market-leading Model Y in Europe will come from premium brands as wealthier consumers can afford the current higher BEV price point and will often have the flexibility of another combustion-powered vehicle in their household. In addition, a wave of new models from BMW, Mercedes, and Audi provide a wider choice for consumers who favor SUVs and will benefit from extended ranges and greater connectivity.

These new BEVs will erode what’s effectively been a premium-segment monopoly for Tesla, giving consumers a much wider choice via comparable ranges. Volkswagen’s ID range will likely be an essential volume driver in 2023 with the ID.3 and 4’s increased availability and the additions of ID. 5, 6, and Buzz. An updated Q8 e-tron joins Audi’s Q4.

Tesla Remains The Leader In the US

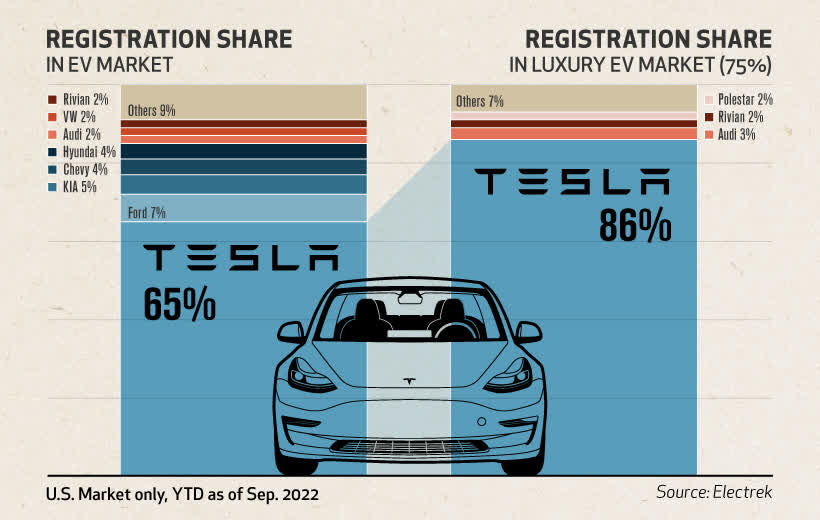

The number of EV registrations in the US in 2022 has increased significantly. Approximately 604,638 new BEVs were registered in the US during the first ten months of 2022, up roughly 60% from last year, according to the most recent registration statistics from Experian (via Automotive News).

With nearly 65% share of BEV registrations, Tesla continues to dominate the market and is also categorized as a premium/luxury brand. Tesla’s luxury EV market has grown substantially with the highest volume, reaching a staggering 85% registration share, signaling the premium and luxury perception of Tesla cars in consumer minds.

www.visualcapitalist.com

Models 3 & Y – Among The Most Reliable EVs

According to a study by Consumer Reports, Tesla’s Model 3 and Y are among the most reliable electric vehicles in the market, which may be one reason the company has leading brand loyalty. On the other hand, battery packs, charging, electric drive motors, and heating and cooling systems are among the most problematic areas consumers find with electric vehicles. Yet, Tesla’s decade-plus history of mass-producing EVs likely offers them both quality and scale advantages.

Sustainable Cost Advantage Over Its Peers

Elon Musk’s ambition for Tesla to be at the forefront of manufacturing technology and maintain strong profit margins could have significant implications for its competitors. Tesla’s advanced production and casting technologies could strengthen its position against Chinese automakers like BYD and create additional challenges for smaller companies like Lucid, Rivian, and Fisker, which need more scale and flexibility to compete in a market with deflationary pricing.

Tesla’s highly automated and non-unionized manufacturing process generates better profit margins than competitors such as Mercedes and BMW. This advantage could help the company outperform its rivals in the face of pricing pressures in the auto industry. Tesla’s high-teens operating margin is superior to its American peers, strengthening its free cash flow compared to its competitors. The company’s ownership of its Chinese manufacturing, limited range of vehicles, and vertical integration put it in a favorable position to achieve above-average profitability for the foreseeable future. Unlike competitors like Volkswagen, Mercedes, and Ford, Tesla’s sole focus on EVs means it can avoid redundancy costs.

Takeaway

Despite supply chain headwinds and other near-term issues that have impacted the TSLA’s stock price, I remain optimistic about Tesla’s future in the EV market as conditions are expected to normalize in the long term. Overall, the future of the EV market is bright, with sales volumes expected to double in the next 3-4 years. Finally, despite headwinds, the trend toward electrification of transportation is inevitable, and following the current stock’s pullback, TSLA offers another fair entry point.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.