Summary:

- The Walt Disney Company shares have experienced a significant decline, down 28% in the past year and 6% in the past month.

- The company’s poor fundamental results and uncertainty in the media/entertainment industry have contributed to the selloff.

- Negative sentiment surrounding Disney, including political backlash and controversial content decisions, has also impacted the stock.

Joe Raedle

This article was coproduced with Nicholas Ward.

Since the start of the COVID-19 pandemic, The Walt Disney Company (NYSE:DIS) has turned from the king of content into an absolute battleground stock.

Disney shares are down by roughly 28% during the past 12 months.

They’ve underperformed the market terribly during 2023, down nearly 9% while the broader market is up by approximately 16.5%.

Disney shares are down by more than 6% during the past month alone.

DIS shares currently sit near 52-week lows…and today’s ~$80/share levels represent the lowest price that investors have been able to pay for this stock in nearly a decade.

This selloff has sparked conversation amongst our members about whether or not this is a buying opportunity?

After all, Disney is an iconic American brand within the media/entertainment space and it’s very rare to see companies like this experience such negative sentiment.

Part of the reason why Disney has sold off are its poor fundamental results as of late.

Part of its selloff is due to ongoing uncertainty regarding the future direction of the media/entertainment industry (will streaming ever match the profitability of the legacy linear television model?).

And lastly, we’d be remiss not to mention that some of the negative sentiment surrounding these shares is politically driven, with negative headlines about the company and its management popping up left and right.

All of this makes Disney a complicated stock to analyze.

But today we’re going to do our best to ignore much of the noise surrounding these shares and focus on the company’s underlying results to see whether or not this is a dip worth buying.

Ignoring Sentiment and Focusing on the Fundamentals

Disney has been in the headlines a lot over the past year or so…and usually not for good seasons.

This company has been in the crosshairs of Florida’s Governor Ron DeSantis’ war on wokeness, and this negativity extends outside of the boundaries of the Sunshine State.

Disney had an ugly leadership chance with its lauded CEO Bob Iger stepping down and naming his replacement, only to have to come back a couple of years later to replace him and attempt to right this ship.

What’s more, when it became clear that Disney was leaning towards replacing Iger with Bob Chapek, there was a major talent drain at the top of this company.

Kevin Meyer and Tom Staggs both left Disney and have since gone on to have extremely successful careers in the children’s entertainment industry (Meyer and Staggs co-founded Candle Media, which is essentially a Blackstone-backed VC firm for the industry, which now owns popular children’s IP brands like Cocomelon).

Now, there are questions about who will lead Disney after Iger’s second stint. This is just one of the major question marks that this company faces moving forward.

For readers who’ve missed Disney’s recent political/legal battles and some of the other unique headwinds that this stock faces right now, here’s a quick list:

-

Disney’s response to Florida’s Don’t Say Gay Bill has created unprecedented operational headwinds and uncertainty for Disney while the company is locked in legal battles over the future with The Central Florida Tourism Oversight District (formerly known as Reedy Creek Improvement District) which not only impacts the company’s current operations in Florida, but also its future expansion plans.

-

The negative impact of political rhetoric on its theme park operations (I’ve spoken to right-leaning individuals who no longer want to support this company monetarily; I’ve also spoken with left-leaning individuals who don’t feel safe/comfortable traveling to Florida because of some of Ron DeSantis’ recent rhetoric) is an ongoing threat.

-

The negative impact of climate change on theme park operations add uncertainty to Disney’s Parks/Resorts segment, which has been its strongest unit over the last couple of years (rising temperatures can make park visits unpleasant – lowering summer demand – and the increasing frequency of major hurricanes creates a potential headwind for Disney in terms of park maintenance/construction costs).

-

Numerous “politically-correct” stances that the company has taken with its intellectual property (such as same-sex romance, gender identity issues, overzealous virtue signaling, and other inclusivity related decisions that have sparked backlash from some of its customers) are ostracizing certain consumers and damaging this once pristine brand.

Heck, I’ve even taken some heat for my Disney-themed Florida license plate:

Now, when it comes to investments, we generally believe that it’s best to separate politics from portfolio management.

Sometimes this can be very difficult to do (especially if you’re someone who is passionate about politics). But, at the end of the day, investing is about making money.

The problem is, when it comes to consumer-driven businesses like Disney, politics play a part in its operational results.

For instance, Lightyear and Strong World lost hundreds of millions of dollars, largely due to political backlash.

Pixar’s most recent film, Elemental, was given poor reviews at launch (once again, related to unwanted virtue signaling) and failed to live up to the strong box office results that the company has come to expect from the studio that seemingly couldn’t miss for its first two decades of operation.

And, you don’t have to look hard to find a Star Wars fan, or a comic book connoisseur, who is unhappy about the direction that Disney has taken the characters and the plotlines from recently acquired IP.

But, it’s complicated.

You see, for everyone who agrees with Mark Hamill and hates what Disney has done with Luke Skywalker’s character, you’re going to find someone else who loves Daisy Ridley’s Rey story arc.

And for everyone who loves the classic animated Little Mermaid and wishes that the live-action remake would have more accurately reflected the original, you’re going to find someone who is fascinated with Halle Bailey’s portrayal of Ariel.

A list like this could go on and on.

It’s impossible to please everyone in today’s highly divisive world.

We certainly don’t envy Disney’s position as a worldwide leader in content production/distribution. But, as investment analysts, it’s not our job to make content related decisions for Disney, but instead, to inspect the company’s fundamentals and try to determine whether or not the stock is an attractive value.

Looking at the Numbers

The COVID-19 pandemic and the streaming wars have been a disaster for Disney, fundamentally speaking.

When the world basically shut down for a couple of quarters in 2020, Disney’s earnings-per-share fell by 65%.

The pandemic also changed the ways that people consume content.

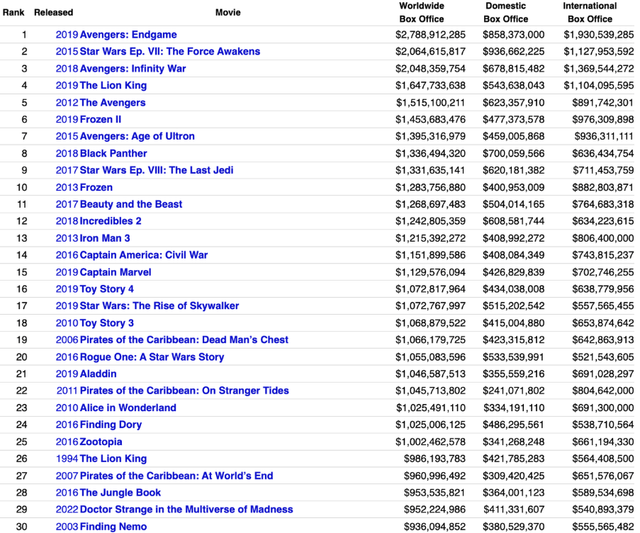

The global box office still hasn’t bounced back…as you can see below, only 1 out of Disney’s top 30 movies of all-time (#29, to be exact) came out after 2020.

Now, it’s worth mentioning that Disney now owns 20th Century Studios, which produced Avatar: The Way of Water in 2022…which is the 3rd highest grossing movie of all-time at the box office.

So that was a major success for the company; however, none of its recent films from its legacy studios have crossed up above that $1b threshold which was the pre-pandemic measuring stick of success for this company.

Two films have crossed that threshold in 2023…Barbie and The Super Mario Bros. Mother…both films are up above the $1.3 billion level and neither of them are Disney franchises.

So, there’s an argument to be made that the box office is alive and well again…and that Disney has been left behind.

Now, we don’t believe that’s totally correct.

For instance, Iger recently confirmed that Frozen 3 is in the works.

That’ll gross $1b globally without a doubt.

Few companies have 10-figure cards to pull out of their sleeves like this, but Disney still has franchises with untapped potential.

But, in general, the superhero and Star Wars movies which were big money-makers for Disney during the last decade may have run out of stream and the creative side of the company hasn’t made it clear that they can consistently produce big winners for today’s consumer (largely due to the political/social stances they’re taking when making children’s movies).

Why does all of this matter?

Because IP is the fuel that trickles down and runs all of Disney’s diversified business segments.

Box office numbers are great, but IP also drives people to streaming, the parks, onto cruise ships, and into merchandise.

Disney is sitting atop a mountain of legacy IP and goodwill from consumers, but that can disappear if they don’t begin to execute in a more consistent fashion.

Thus far, we haven’t really seen a negative trickle-down effect impact earnings.

During Disney’s most recent quarter, its Theme Park segment posted 13% revenue growth (resulting in 17% year-to-date revenue growth).

Disney’s Parks saw their operating income rise by 11% last quarter and 20% throughout the first 9 months of the company’s fiscal year.

It’s the company’s media segments which have fallen apart post-COVID.

During Q3 of 2023 Disney’s Media and Entertainment Distribution segment posted sales of $14.004 billion and operating income of $1.134 billion.

Looking back to pre-pandemic times, we see much better results.

Disney has restructured how it reports earnings since the third quarter of 2019, but back then the combined revenues of its Media Networks, its Studio Entertainment, and its Direct-to-Consumer segments (which have since been combined into Disney’s Media and Entertainment Distribution segment) were $14.407b.

That’s just above current levels.

The problem lies with profitability.

In Q3 of 2019, the combined operating income of those 3 segments was $2.375 billion (more than double today’s profitability results).

Simply put, Disney hasn’t figured out how to make money with its IP in a streaming-driven world.

And that’s why Disney’s earnings-per-share has fallen down to levels last seen in 2010…even though the company’s total annual revenues have risen from $38.06b to $82.7b during the last 12 years.

Execution matters.

Margins matter.

And frankly, there’s no telling if/when this company will figure out how to profit from content in the streaming age in a meaningful way.

Truthfully, no one really has. Netflix (NFLX) has been the leader in the streaming space for over a decade now and last year their cash flows were only $1.6 billion (on ~$32b in sales).

Now, that isn’t to say that Disney can’t figure this out.

You don’t become an icon like The Walt Disney Company without an immense amount of talent and human capital capable of massive problem solving.

But, looking at consensus estimates right now, the Wall Street community doesn’t see Disney’s bottom-line returning to pre-pandemic levels for at least 2 more years.

That’s a long time to wait…especially since this company no longer pays a dividend (at least then, investors are being paid for their patience).

Valuation

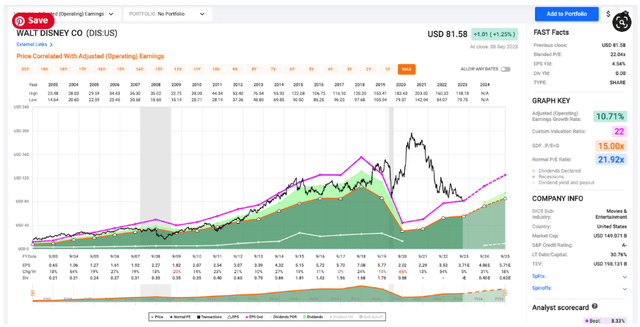

In 2019, Disney’s earnings-per-share came in at $5.77.

And, it’s worth noting that that annual result was down 19% from Disney’s all-time high adjusted annual EPS figure of $7.08 that it posted in 2018 before its massive Fox deal closed in March of 2019.

With the benefit of hindsight, that deal looks like a huge mistake now.

Sure, it gave Disney the ownership of 20th Century Studios which has since made a big-time Avatar film, but Disney has yet to do anything productive with the rights to the X-Men Universe that it bought with that deal and frankly, adding things like The Simpsons to Hulu and Disney+ likely isn’t driving subscribers to those platforms.

The huge debt load included with the Fox deal combined with the massive cash flow shortfalls that occurred when the pandemic occurred have been the major one-two punch that has hurt Disney during the last 5 years or so.

Disney currently sits on ~$44.5 billion of long-term debt, down only slightly over the last year.

It wasn’t all that long ago that analysts were projecting that Disney would regain that $7.00/share bottom-line level in 2025, which factored into the stock’s big rally during 2021.

But now it seems like a stretch to believe that Disney will reach those bottom-line results until 2027 (at best) and honestly, this could be an end-of-the-decade type of story.

So, the question lies, what sort of premium should you be willing to pay for shares of this company which – due to a series of unfortunate events – has potentially set its bottom-line back by a decade?

Historically, Disney’s firm stance as the king of content allowed its shares to trade at a premium to its peers and the broader market as a whole.

Today that status is being called into question, though, which also means that the stock’s long-term average price-to-earnings ratio of ~22x may be too rich.

This is the billion-dollar question for investors because, as it stands, after Disney’s recent pullback, the stock is currently trading in-line with that 22x level.

If you’re someone who thinks this ~22x long-term average will hold…and that analysts are correct with their current earnings growth estimates of 31% next year and another 18% the year after that…well then, Disney looks like a wonderful investment here.

If those two assumptions prove to be correct, someone buying shares today in the $80 area would be looking at an annualized total return CAGR of ~23.8% over the next couple of years.

But, if that historical premium doesn’t hold and Disney shares trade in the 20x, 18x, 15x, or even the 12x area where its media rival Comcast (CMCSA) currently trades, then investors buying today could be looking at a lot of further downside ahead.

Assuming that analysts are correct and Disney earns $5.71/share in fiscal 2025 then…

-

A 20x multiple on shares equates to an 18.2% annualized total return CAGR between now and then.

-

An 18x multiple on shares equates to a 12.4% annualized total return CAGR between now and then.

-

A 15x multiple on shares equates to a 2.98% annualized total return CAGR between now and then.

-

A 12x multiple on shares equates to an -8.58% annualized total return CAGR between now and then.

It’s also possible that Disney doesn’t meet that long-term consensus of $5.71/share.

Obviously, if Disney falls short of that 2025 estimate then the potential total return CAGRs highlighted above will diminish as well.

During the last 3 months the consensus EPS estimate amongst Wall Street analysts for Disney has fallen by roughly 8% for fiscal 2024 and by roughly 10.4% for fiscal 2025.

During the last 6 months the consensus EPS estimate amongst Wall Street analysts for Disney has fallen by roughly 10.2% for fiscal 2024 and by roughly 13.6% for fiscal 2025.

We hate to see estimates trending in the wrong direction like this, but it points to the problem that we highlighted in the introduction here: there are a lot of major question marks overhanging this stock.

Conclusion

At this point in time an investment in Disney – more so than most of the mature, cash cow, established blue chip companies that we follow regularly – comes down to speculation.

If the stock’s EPS bounces back like analysts are currently expecting, then DIS shares will likely be much higher than this worst-in-a decade price point in 2-3 years.

If historical averages hold and Disney shares maintain their ~22x P/E levels moving forward, then they’re very likely to outperform the market.

But we could easily imagine a future where Disney is re-rated down to the 15-18x level, which would imply performance that is in-line, or even below, the broader market’s results.

With so many questions surrounding this stock, it’s impossible to provide a clear answer to readers here.

That’s why this remains a battleground stock.

We feel confident in saying that this company/brand isn’t going anywhere anytime soon.

But Disney no longer pays a dividend to support patient investors and while management has mentioned reestablishing one in the near-term, that’s not something that we’re going to bank on.

At the end of the day, there are better, more predictable, and more reliable opportunities across the dividend stock space right now, so while Disney at a 10-year low is intriguing, we’d much rather allocate cash towards investments that provide passive income and allow us to sleep well at night.

Our attention remains focused elsewhere.

We view Disney stock as a contrarian value bet at this point in time (which can be very profitable for investors who time them right), not a SWAN investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.