Summary:

- Apple’s iPhone continues to dominate the smartphone market, with superior quality and functionality compared to competitors.

- Apple’s other segments, such as services, Mac, and wearables, are expected to drive higher-than-anticipated sales growth.

- Despite recent concerns about competition from Huawei and the Chinese market, Apple’s iPhone sales are likely to remain strong.

Wirestock

Since introducing the original iPhone in 2007, Apple (NASDAQ:AAPL) has pioneered the smartphone market beyond my wildest expectations. I recall that suddenly (after the initial iPhone launch), copycats started popping up everywhere with their versions of a buttonless touchscreen phone similar to the iPhone. Nevertheless, as I looked through the competing phones, I noticed some were flimsy, had functionality issues, plastic screens, and other cheap and low-quality characteristics. There was only one iPhone, and it was much better quality and functionality than anything else available at the time.

Fast forward sixteen years and Apple’s iPhone is still head and shoulders above the competition. The iPhone has faced competition concerns from Samsung and many other smartphone players. China’s Huawei is the latest “threat” in the news today. However, Huawei is not Apple, and no phone they bring to market will ever be an iPhone. Therefore, despite the transitory concerns, Apple’s iPhone sales should continue expanding globally.

Moreover, Apple is much more than just an iPhone maker. Its services, Mac, wearables, accessories, and other segments should perform well and provide higher than anticipated sales growth in future years and the coming quarters. Also, Apple’s costly Vision Pro headset could become more accessible, and a cheaper VR headset could arrive on the market in 2025. Therefore, Apple has an excellent growth opportunity in the Metaverse segment as the company advances. While Apple’s 27 forward P/E ratio remains expansive, the stock becomes much more attractive around a 20-22 P/E ratio, suggesting Apple’s stock is a solid long-term buy around the $140-$150 range.

My History With Apple – A Brief Overview

I got on the iPhone bandwagon when the iPhone 3G came out in 2008. However, I recognized early on that “everyone and their mother” would want an iPhone someday. Therefore, I went long Apple’s stock in late 2006 at about a split-adjusted $3 a share, exiting most of my Apple stake in 2020 after an approximate 2,200% return on my investment. Of course, I missed out on some gains since 2020, but the capital from my Apple investment was better utilized by investing in other companies during this time frame. My main issue with Apple was its elevated valuation and limited growth prospects, which is primarily why I’ve avoided owning the stock in recent years.

As far as Apple’s products go, I’ve never used anything better. Apple is at the pinnacle of consumer hardware technology, and despite the costly price tags, Apple’s products are worth every penny. Also, I’m not simply providing a baseless opinion because I’ve used numerous smartphones and laptops as secondary devices, and they have yet to come close to Apple. I did have an excellent Samsung laptop about fifteen years ago, but that’s all I recall being outstanding aside from Apple.

Some of the smartphones I’ve owned over the years have come from Samsung, HTC, Motorola, Huawei, Xiaomi, and others. While some devices have been decent, they must match up to the iPhone when considering the whole package. The list of laptops I’ve used over the years is extensive, but after switching to a MacBook Pro in 2016, I’m never returning to a PC. Apple’s brand is iconic, and its build quality is legendary, so Apple could experience better growth than is currently perceived.

Overreaction To The Chinese Situation

Apple’s stock cratered recently due to the news of a Chinese ban on using the iPhone in government agencies. While this may sound like terrible news for Apple, it’s not likely to have a significant impact on iPhone sales. China is a massive market for Apple, and even if some people don’t use their iPhones at work, they will use them elsewhere. The iPhone is intertwined with Apple’s ecosystem, making the iPhone a highly sticky gadget. It’s challenging to imagine that people will ditch their iPhones in favor of a Chinese Android device. It makes more sense that many Chinese consumers may buy a secondary, less costly Android device for work while maintaining the iPhones for personal use.

Also, telling people they can’t have or use something is essentially like telling them they can’t have the forbidden fruit. Human psychology dictates that many will crave the iPhone even more, potentially unleashing a backlash effect instead of leading to decreased iPhone sales in China. Apple’s China iPhone sales should not suffer in the greater scheme of things, and the recent selloff appears like a market overreaction to transitory events.

More Trouble From China – But Huawei is No Apple

It’s been several years since I’ve owned a Huawei device, but I can tell you it’s not Apple. First is the build quality issue; no one matches Apple, especially Huawei. One of my Huawei phones broke as it fell once. The perplexing thing was that the screen didn’t break or crack, and the phone had no visible damage marks. Nevertheless, the screen went black, never to be turned on again. This incident was years ago, and I have yet to use Huawei’s new flagship device. Still, to suggest that Huawei will take significant market share from Apple is a stretch.

Nonetheless, market participants are anxious about Huawei’s Mate 60 Pro smartphone launch. While the improved Huawei devices could help the company regain some market share, the gains could be temporary, and it’s improbable that Huawei will claw back all of its lost market share, never mind sustaining its market share gains. This story has too many ifs and buts, and it looks far-fetched that Apple’s earnings will feel a lasting effect.

Again, Apple’s products are sticky, especially the iPhone, making it a much higher probability that Huawei will steal market share from other Android devices rather than take back the market share it lost to Apple years ago. While the two devices’ specs are similar, Apple’s iPhone 15 uses Apple’s A17 Bionic chip, and Huawei’s flagship Mate 60 Pro uses a Chinese-made Kirin 9000s processor.

I am not an expert on processors, but I’d like my phone to have a time-tested, trusted processor rather than an unknown chip in my device. Moreover, I’ve searched the internet, and Huewei’s flagship phone starts at around $1,200. Therefore, it’s not cheaper (cost-wise) than the brand-new iPhone 15 Pro Max. How Huawei plans to capture significant market share from Apple in China remains a mystery, and the adverse reaction to Huawei’s new phones seems overdone.

Apple’s Extraordinary Metaverse Opportunity

Some people may view the Metaverse as a joke, but it’s no laughing matter when considering future profits for Apple and other major players in the industry. There is a reason why Meta Platforms (META), Apple, and others are investing billions into the future of the internet. The Apple Vision Pro headset is remarkable, as it immerses the user into an augmented/virtual reality world filled with 3D objects and can even transport you to new spaces.

Apple’s Vision Pro is new and expensive, and the mass market may still need more time to be ready for this product. However, Apple has done an excellent job by bringing a revolutionary product to market that should garner increasingly higher demand as we advance. Furthermore, the Vision Pro headset should become cheaper, as the current price tag of $3,500 appeals to only some consumers. Apple plans to introduce a more affordable variety of the VR/AR headset Apple Vision in 2025. Moreover, Apple could lower the cost of its current Apple Vision Pro headset, as its production materials cost $1,590, and its total production cost should be less than half its trial price.

If the average selling price for Apple’s Vision settles around $2,500, it would translate to approximately $25 billion in annual revenues for every ten million units sold. Who is going to want to walk around with a computer around their head all day? However, there are many consumers globally, and many love being immersed in a world that differs from their own. Therefore, we may be underestimating the market for the Vision Pro headset, and sales could come in much better than expected as we move on.

Earnings Remain Excellent

Last month, Apple announced Q3 (fiscal) earnings, providing $1.26 in GAAP EPS, beating the consensus estimate by seven cents.

- Revenue of $81.8B was in line with consensus estimates.

- Services revenue was $21.21B, an 8.2% YoY increase.

- Wearables, Home, and Accessories (“WHA”) revenues increased by 2.5% YoY to $8.28B. iPhone sales came in at $39.67B YoY, a 2.5% YoY decline.

- Mac sales were $6.84B, a drop of 7.3% YoY.

- And iPad sales cratered by 19.8% YoY to $5.79B.

The Earnings Takeaway

Services continue powering Apple’s growth engine and will likely continue expanding, potentially improving to 10%+ annual growth as the economy improves. WHA growth has declined, but we should mention the obvious here. We are in a high-interest rate/low-growth environment. Therefore, it’s normal to see growth falling or moving negatively in some segments due to the current economic atmosphere. Apple produces high-end products that often cost more than those of its competitors. Therefore, seeing some growth and minimal growth declines in several segments is encouraging.

Considering the slow economy, a 2.5% YoY decline in iPhone sales is not alarming. Moreover, this dynamic implies that iPhone sales could increase considerably as rates move lower and economic growth improves in future years. We have a similar dynamic concerning Mac sales. Macs are expensive (worth every penny, in my view). Nevertheless, a drop in sales is expected as consumers pull back from purchasing costlier products. Nonetheless, we could see a boom in Mac sales as the economy returns to its growth path in the coming quarters.

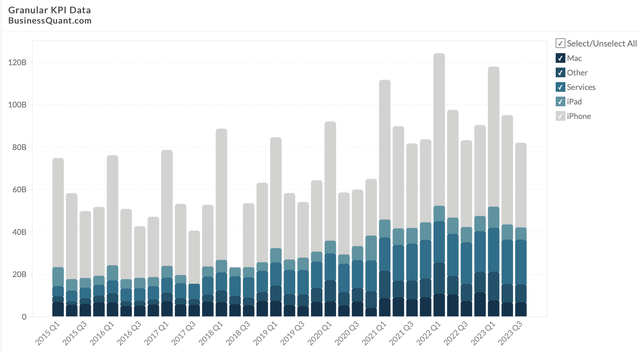

Sales by segment (BusinessQuant.com)

This year’s sales are slightly lower than in the previous fiscal year. However, due to the cyclical nature of its business, it’s impossible for Apple to continuously increase sales year after year, especially with the economy in a recession. Therefore, it’s normal to see a minor decline in sales from last year. Moreover, many consumers may be holding back on upgrading their Apple products. Still, when interest rates decrease, and growth improves, we should see a significant revenue jump as many consumers rush to upgrade their older iPhones, iPads, and Macs.

The Valuation Perspective

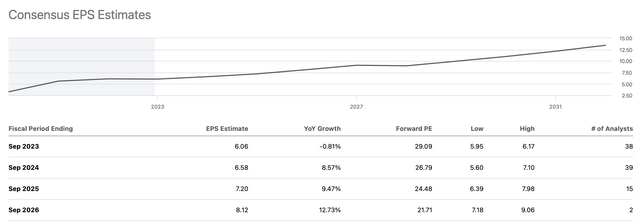

EPS estimates (SeekingAlpha.com )

Despite Apple’s growth issues, its stock is costly. Consensus estimates suggest we could see about a 1% EPS decline this year. Nonetheless, EPS growth should return to about 10% annually in 2024. Apple’s forward P/E (fiscal 2024) is about 27 now, and that’s more than I am willing to pay for Apple’s stock. Nevertheless, I’d feel more comfortable with a forward P/E around the 20-22 range. Apple could beat next year’s consensus EPS estimates, delivering about $7 a share instead of the proposed $6.58 figure. A 20-22 forward P/E multiple with EPS around $7 implies a buy-in range around the $140-$150 level in Apple’s stock, making this range a solid entry point for a long-term position in Apple.

Here’s Where Apple’s Stock Could Be In Future Years

| Year (fiscal) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $415 | 445 | 480 | $530 | $578 | $624 | $668 |

| Revenue growth | 8% | 7% | 8% | 10% | 9% | 8% | 7% |

| EPS | $7 | $7.8 | $8.7 | $9.9 | $11.2 | $12.5 | 14 |

| EPS growth | 15% | 11% | 12% | 14% | 13% | 12% | 11% |

| Forward P/E | 22 | 23 | 24 | 25 | 24 | 23 | 22 |

| Stock price | $172 | $200 | $238 | $280 | $300 | $322 | $350 |

Source: The Financial Prophet

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges and would buy Apple stock in the $140-150 range.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!