Summary:

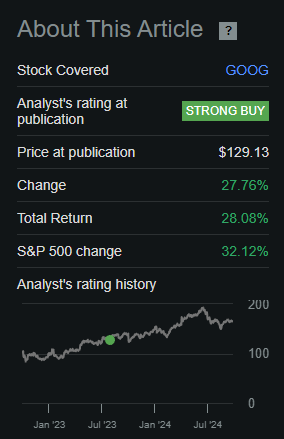

- Alphabet’s stock has risen by 28% since August 2023, underperforming the S&P 500’s 32% return.

- The company operates in the business segments Services (Advertisement), Cloud and Others.

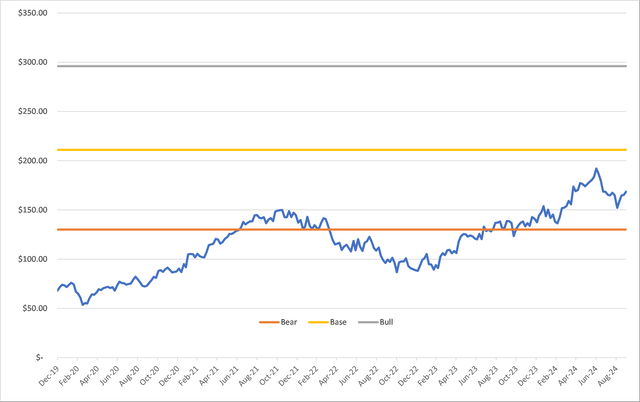

- We used a Bear-, Base- and Bull-Case scenario to evaluate the growth prospects and the profitability of each of Alphabet’s business segments.

- Given this valuation method, the company could currently be undervalued by up to 80%.

SEASTOCK/iStock Editorial via Getty Images

In this article we are revisiting my latest article on Alphabet (NASDAQ:GOOG; NASDAQ:GOOGL) from August 2023. Since the last article the stock performed with ~28%, while the S&P500 returned a slightly better 32%.

My Alphabet Coverage (seekingalpha.com)

To compare the current situation to the one ~1 year ago, we will use a similar path to evaluate the company. Last time we got the following fair price stock prices with our three scenarios and the resulting Discounted Cash Flow Analysis ($129 as the current stock price at publication).

Bear-Case: $114 – Overvalued by 11%

Base-Case: $177 – Undervalued by 38%

Bull-Case: $246 – Undervalued by 93%

Google Services, Google Cloud, and Other Bets are the three main business categories into which Alphabet, the parent company of Google, divides its activities. Here is a brief explanation of each:

1. Google Services:

With the most well-known Google goods and services included, this is Alphabet’s largest division.Google Maps, Chrome, Google Play, Gmail, YouTube, Android, Google Search, and Google Ads are all included.The main source of its income is advertising, which is produced by websites such as Google Search, YouTube, and Google’s network of third-party websites

2. Google Cloud:

Storage, productivity applications, and machine learning tools are among the cloud computing services offered by Google Cloud.It includes Google Cloud Platform (GCP), which provides hosting, infrastructure, AI tools, and data analytics.

3. Other Bets:

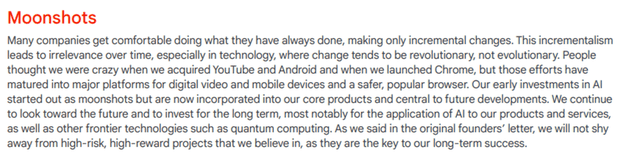

Alphabet’s longer-term and more experimental innovation initiatives, which seek to tap into new markets and technologies, are included in this section.Waymo (autonomous vehicles), Verily (biosciences), Calico (biotechnology), Wing (drone deliveries), and Loon (a balloon-powered internet that has since been shut down) are a few examples.These are often high-risk or early-stage businesses that might not be profitable right now but have the potential to develop significantly in the future. This is a very important segment for Google as they believe these high risk-high reward bets will materialize in the long run:

Alphabet’s Moonshots (Annual Report 2023)

Out of simplicity we will also include “Alphabet-level activities” into the Other business segments. This includes general administration costs, gains from hedging and as of 2nd Quarter, 2024 also AI development.

1. Google Services

Google declared a advertising revenue of $64,616 and $9,312 through subscriptions, platforms, and devices in their Q2 earnings this year. This in turn means, that currently ~87% of the revenue in this segment is generated through advertising. For our analysis I therefore think that it is safe to assume that the whole services segment behaves like advertising, especially when considering the also compelling business metrics of the included subscription segment.

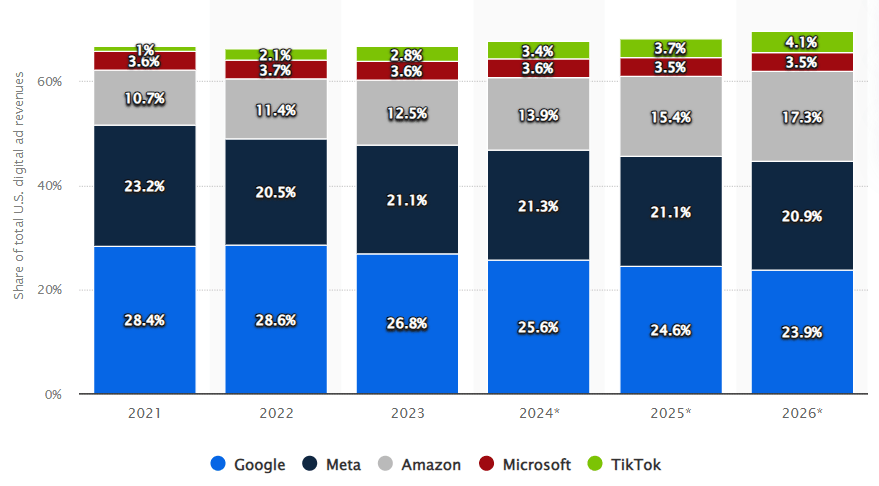

It is anticipated that global expenditure on digital advertising would increase at a 15.5% CAGR until 2030. We however have to also factor in that Google is increasingly battling with keeping market share in this very competitive market.

Market Share of Different Companies in Digital Advertising (statista.com)

With this in mind, we assume the following growth rates for our three scenarios:

Bear: 7.5% p.a.

Base: 12% p.a.

Bull: 15% p.a.

If we now take a look at the margins over the last five years

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| EBIT Margin | 33% | 32% | 39% | 33% | 35% |

The average of 35% seems like a good starting point for our analysis. To adjust for the different scenarios, I assumed the following EBIT margins.

| EBIT Margin | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Bear -0.5% p.a. | 34.5% | 34% | 33.5% | 33% | 32,5% | 32% | 31.5% | 31% |

| Base consistent | 35% | 35% | 35% | 35% | 35% | 35% | 35% | 35% |

| Bull +0.5% p.a. | 35.5% | 36% | 36.5% | 37% | 37.5% | 38% | 38.5% | 39% |

This includes that Alphabet, has to lower prices to fight off competition and hold market share in the Bear-Case, as well as the possibility to even expand their margins further in the Bull-Case due to increasingly scaling their business.

2. Google Cloud

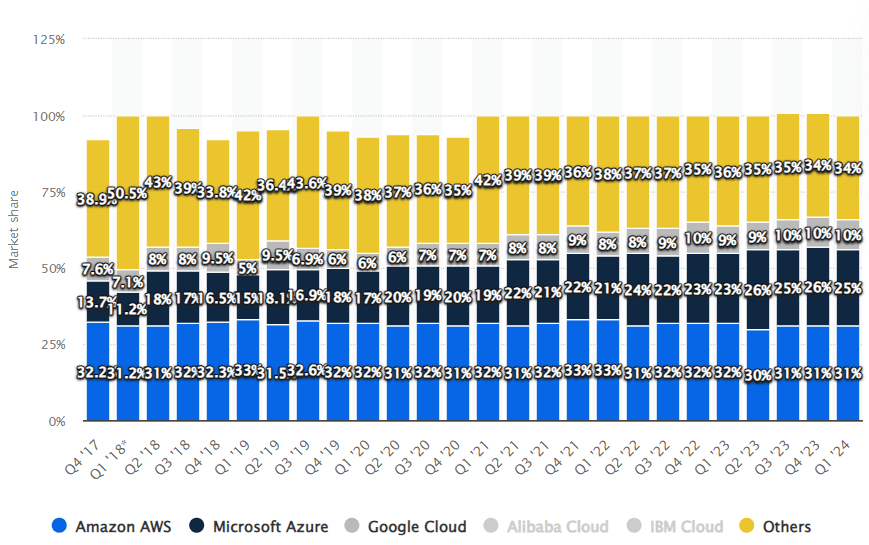

From 2024 to 2030, the worldwide cloud market is anticipated to expand at a CAGR of 21.2%. Google is also increasingly winning market share in the cloud space, going from 7.6% market share in 2017 to 10% in 2024.

Cloud Market Share (statista.com)

With the market growth rate and the possibility of increasing market share in the future, we can assume the following growth rates:

Bear: 10% p.a.

Base: 20% p.a.

Bull: 25% p.a.

The EBIT margins of Google’s cloud are improving rapidly:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| EBIT Margin | -52% | -43% | -16% | -11% | 5% |

In the latest quarterly earnings the margin was even at 11.3%. Given this astonishing development and the comparable margins of 35.5% at Amazon’s (AMZN) AWS and 45% at Microsoft’s (MSFT) Azure, we can assume the following margin development in this segment.

| EBIT Margin | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Bear 20% max. | 11% | 15% | 20% | 20% | 20% | 20% | 20% | 20% |

| Base 30% max. | 11% | 15% | 20% | 25% | 30% | 30% | 30% | 30% |

| Bull 35% max. | 11% | 23% | 20% | 25% | 30% |

35% |

40% | 40% |

3. Others

The fundamentals of the Others segment aren’t really going into any direction.

| Financial year | 2020 | 2021 | 2022 | 2023 |

| EBIT [million $] | -7,775 | -10,042 | -5,935 | -13,281 |

Especially now when the CAPEX intensive AI development and research costs will be reported in this segment and because of the high importance of this segment internally at Goggle, I don’t see any improvements in this matter soon. To asses for this issue, I used the following EBIT assumptions for this segment:

| EBIT Other [$ million] | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Bear-1,000 EBIT p.a. | -10,000 | -11,000 | -12,000 | -13,000 | -14,000 | -15,000 | -16,000 | -17,000 |

| Base consistent | -10,000 | -10,000 | -10,000 | -10,000 | -10,000 | -10,000 | -10,000 | -10,000 |

| Bull+1,000 EBIT p.a. | -10,000 | -9,000 | -8,000 | -7,000 | – 6,000 |

-5,000 |

-4,000 | -3,000 |

The Valuation – Discounted Cash Flow Analysis

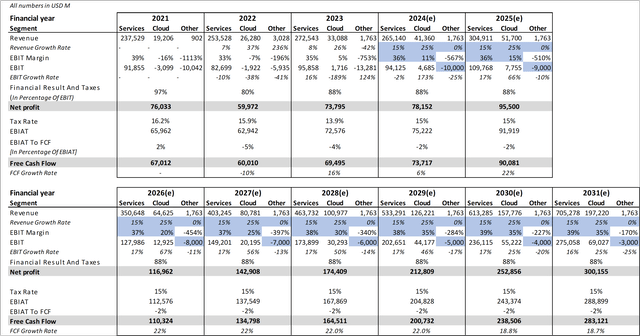

Now that the majority of the necessary indicators have been established, we can go on to the actual Discounted Cash Flow Analyses. However, in order to accurately determine GOOG’s fair value, we require a few additional assumptions.

- Financial Result And Taxes: I averaged out the last three years and used 88% to calculate the net profit for all three cases.

- Tax Rate: In order to forecast the tax rate, I also used the average of the previous three years and made the assumption that it would remain constant at 15.3% until 2031.

- Free Cash Flow: I tried to determine a suitable EBIAT to FCF ratio after calculating the EBIAT using the previously indicated tax rate. In order to determine Alphabet’s future cash flow, I once more averaged the previous three years and used -2% as the conversion rate.

- WACC: Here I used 9%, similar to Alphabet’s current WACC.

- Perpetuity Growth Rate: For the analysis, I considered a 3% Perpetuity Growth Rate. Given that Google’s Free Cash Flow CAGR in the Bear-Case is at 6% in 2031, this seems conservative.

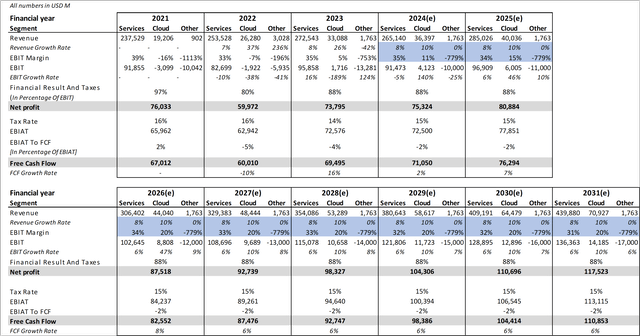

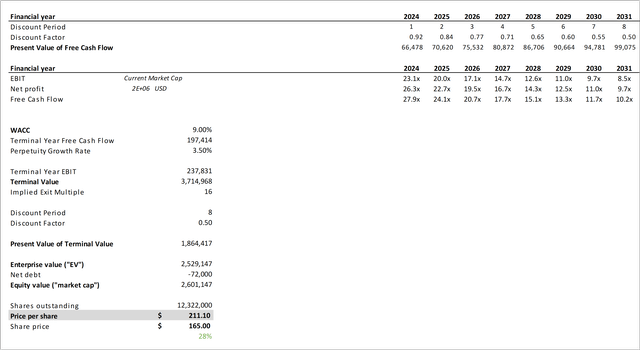

Bear-Case

Alphabet (Google) Discounted Cash Flow Analysis Bear Case I (seekingalpha.com; own assumptions, abc.xyz) Alphabet (Google) Discounted Cash Flow Analysis Bear Case II (seekingalpha.com; own assumptions, abc.xyz)

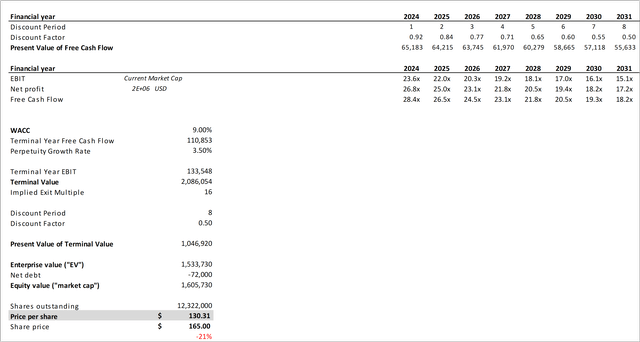

Base-Case

Alphabet (Google) Discounted Cash Flow Analysis Base Case I (seekingalpha.com; own assumptions, abc.xyz) Alphabet (Google) Discounted Cash Flow Analysis Base Case II (seekingalpha.com; own assumptions, abc.xyz)

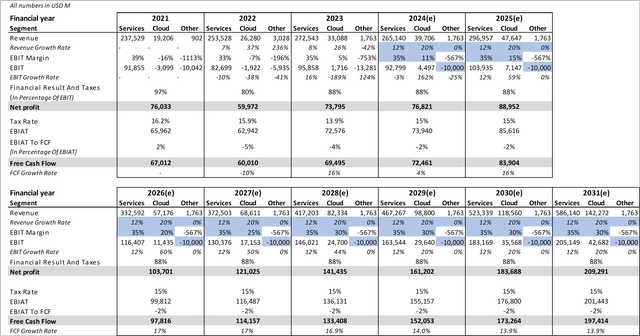

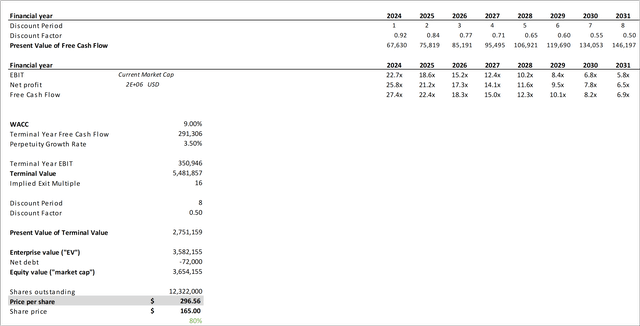

Bull-Case

Alphabet (Google) Discounted Cash Flow Analysis Bull Case I (seekingalpha.com; own assumptions, abc.xyz) Alphabet (Google) Discounted Cash Flow Analysis Bull Case II (seekingalpha.com; own assumptions, abc.xyz)

Conclusion

Within our three scenarios, we get the following fair price share prices:

Bear-Case: $130 – Overvalued by 21%

Base-Case: $211 – Undervalued by 28%

Bull-Case: $296 – Undervalued by 80%

Naturally, the truth will most likely fall somewhere in the middle of these three possibilities, or we may even obtain a result outside of the range that has been specified. Assume, for instance, that one of Google’s other investments is prepared for series production and begins to provide significant income and profits. Waymo for example, which is gaining traction. Executing this profitably however is still a challenge as I believe scaling Waymo can be very CAPEX extensive, but let’s discuss this in the comments below.

Risks to Consider

1. Regulatory and Antitrust Risks: The constant scrutiny Alphabet receives from regulatory agencies is one of the biggest threats. Alphabet’s operations, profits, or income may suffer if the Antitrust Commission brings a big case that results in limitations, fines, or even forced divestitures. Its core Google Services division, which mostly depends on its supremacy in search and online advertising, may be especially impacted by this.

2. Uncertainty in Long-Term Forecasting: It’s critical to acknowledge that long-term forecasts are by their very nature uncertain, especially because many assessments employ an eight-year time period. It is challenging to make accurate predictions about market circumstances, technical developments, competition, and economic considerations. The conclusions drawn from this research should be interpreted with caution because no one can predict a company’s future operations with any degree of accuracy.

3. Cloud, AI and Emerging Business Uncertainty: Although Alphabet’s creative initiatives are reflected in Other Bets and Google Cloud’s growth, these sectors are not assured to achieve the levels of success anticipated. Growth expectations may be hampered by heightened competition, changes in the uptake of business cloud computing, or the inability of some “Other Bets” to eventually turn a profit. Especially the current uncertainty in the AI market paired with no clear AI-monetization method for Google poses a big risk.

My Focus Points For The Earnings

In the earnings on the 29th, October I want to see the following points, to reassure my thesis and Alphabet’s growth catalysts:

- Solid Cloud and Advertising growth

- Increase in Cloud profitability

- Decrease in Other’s money burning

- (Declaration of AI development costs)

With all this in mind, I think that this analysis and the DCF provide a good insight of Alphabet’s growth trajectory and potential undervaluation. Considering the unique positioning and the potential, I currently rate the company as a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.