Summary:

- AT&T’s dividend yield has approached the 7% mark again after the stock plummeted on risks of FCF deterioration.

- But robust subscription net adds in the first quarter continues to defy a weakening economy, suggesting a relatively recession-resistant fundamental backdrop.

- Paired with capital spend that has peaked in the first quarter, management’s reaffirmed guidance for $16 billion in 2023 FCF remains largely intact to safeguard AT&T’s competitive dividend yield.

- Looking ahead, potential monetary policy is likely to reduce long-end Treasury yield and, inadvertently, benefit market-wide valuations, allowing AT&T to also unlock pent-up value accrued from its consistent delivery of profitable growth.

Justin Sullivan

Despite the consistent delivery of profitable growth, sustained by its utility-like core connectivity business, and a strong capital returns program, AT&T’s stock (NYSE:T) has largely underperformed key market benchmarks, as well as its rivals Verizon (VZ) and T-Mobile (TMUS) this year, with year-to-date declines pushing the 15% mark. Much of the pressure came after AT&T reported weak quarterly free cash flows in early April, implying a back-end loaded year for cash generation after reaffirming the metric’s full-year guidance of $16 billion. This has inadvertently increased investor concerns over elevated execution risks ahead, as the combination of continued deterioration of financial conditions and looming recessionary fears could threaten to further lengthen AT&T’s customer payment cycles – the culprit behind management’s decision on slashing the FCF guidance in 2022 from $16 billion to $14 billion – and put dividends at risk. Speculation that Amazon (AMZN) might be contemplating a roll-out of competitive low-cost wireless mobility products for its Prime members earlier this month had only exacerbated the stock’s declines before paring some losses after AT&T and its telco peers denied rumours they were in talks with the e-commerce giant.

The slew of negative developments has returned AT&T’s dividend yield back to the 7% range (NYSE:T.PC yield 5.75%; NYSE:T.PA yield 5.65%), after it fell below 6% earlier this year on a stock rally backed by robust underlying business fundamentals. However, the bullish thesis propping the stock then – namely, attractive dividends with durably profitable growth – has remained largely intact and unchanged, despite a setback in investor confidence from the weaker-than-expected first quarter FCF delivery, which management had attributed to working capital requirements and seasonality that is in line with historical trends. Business has also stayed resilient in the face of a worsening cyclical downturn, with demand trends normalizing back to pre-pandemic levels alongside expectations for continued profitable growth.

Although the stock may remain pressured in the near term due to investor skepticism on AT&T’s ability to deliver sufficient evidence in supporting what looks like a back-end loaded FCF generation roadmap to sustain its dividends – a key focus for its income-driven investor base – the underlying business fundamentals remain robust. The anticipated durability to AT&T’s fundamental prospects amid the challenging market backdrop is further corroborated by its mission-critical role in the provision of connectivity services, and prudent management of pricing to stay competitive without compromising margins, as evidenced by the first quarter earnings beat, which taken together remain value accretive factors for the stock. Considering the current 7% dividend yield, and resilient business fundamentals against looming recessionary headwinds to support the capital returns program, AT&T’s stock has resurfaced as a viable income pick at current levels.

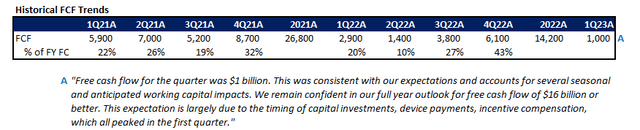

AT&T’s Historical FCF Trends

Despite the first quarter earnings beat, AT&T’s weaker-than-expected quarterly FCF of $1 billion for the period “missed where it matters most”, dialing up investors’ angst on the durability of its dividends. Admittedly, the concerns are not at all unreasonable given AT&T’s reaffirmed full-year FCF guidance of $16 billion was already a discount from earlier projections of $20 billion due to the spillover impact of delayed customer payments experienced earlier in 2022, which had reduced FCF expectations then from $16 billion to $14 billion. And the looming recession risks, given signs of persistent deterioration in economic conditions, are also stoking fears that customer payment cycles might lengthen again, and dent the company’s FCF aspirations needed to fund dividends and its ongoing deleveraging efforts for the year.

However, management had clarified that the weak FCF generated during the first quarter was a reflection of “anticipated working capital impacts”, alongside seasonal trends in line with historical observations due to non-recurring payments typically made earlier on in the year, spanning “capital investments, device payments, (and) incentive compensation”. Management has also reaffirmed the full-year FCF guidance of $16 billion, with spending largely having already “peaked in the first quarter”. This would imply a back-end loaded FCF generation roadmap, which is in line with observations in prior years:

Author, with data from historical AT&T SEC filings

The expectation for improved FCF generation through the remainder of the year is also consistent with capex spend pertaining to “historically high levels of investments in 5G and fiber” that are expected to moderate over time with scale, as well as the restructuring of related costs to further the durability of AT&T’s planned annualized cost-savings of $6 billion by the end of 2023:

As previously said, we expect stand-alone AT&T capital investments of $24 billion in 2022 and 2023. Starting in 2024, we expect our capital investment to begin tapering to around the $20 billion range as we surpass peak levels of investments in 5G and transformation.

Source: AT&T 1Q22 Earnings Call Transcript

As we reposition to 5G and fiber, that cost structure we still carry. And I’m really pleased we made some changes about a year ago in how we organize within the business and how we focus on our operating cost structure that is putting the right kind of exposure on how we execute around that cost migration…And I would say just generally speaking, it was not a friendly quarter to operating costs just to deal with the things that we need to deal with to make sure the network keeps running. And I think we came through it in pretty good shape relative to our commitments. And I think that’s one of the things that we believe will be in good shape from a cash production perspective as we move through the year.

Meanwhile, management also has not identified any material changes to the customer payment cycle during the first quarter that would imply a deterioration in customer quality and cause an uptick in collection risks within the foreseeable future. This largely removes a significant overhang on its FCF prospects, as collection risks were cited as a key hold-back on cash generation efforts in the prior year:

Moving to free cash flow. Given the combination of elevated success-based investment, the potential for further extension of payments by our customers, inflation and the more challenging environment facing our Business Wireline unit, we consider it prudent to take a more conservative outlook to free cash flow for the year. Given these factors, we anticipate pressure of about $2 billion to our free cash flow guidance from our prior $16 billion range for the year.

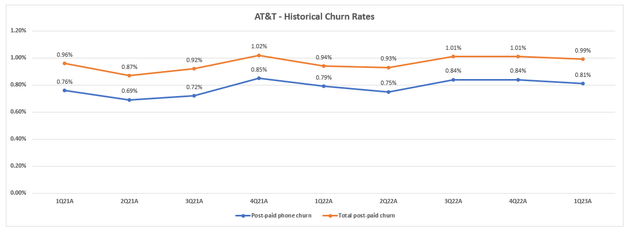

Resilience in AT&T’s underlying business growth is further corroborated by management’s observations of robust “industry demand trends (in mobility) that would continue to normalize to pre-pandemic levels”, as well as churn that remains consistently at historically low levels of below 1%.

Author, with data from historical AT&T SEC filings

This essentially suggests resilient take-rates on AT&T’s “high-value 5G and fiber plans”, despite lingering macroeconomic uncertainties, which would help preserve profitable growth and improve durability to its FCF prospects. The strength of its underlying business is further corroborated by absolute growth in subscription adds across both the wireless mobility and fiber businesses, despite rising competition for increasingly price-sensitive customers.

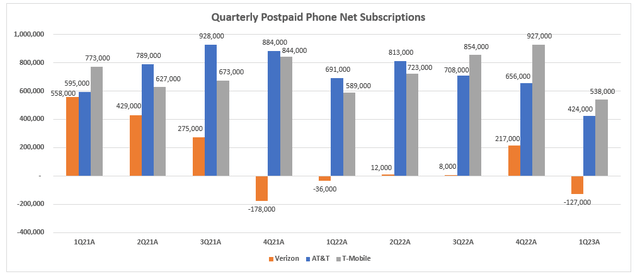

Author, with data from historical AT&T SEC filings

Durable Underlying Business Fundamentals

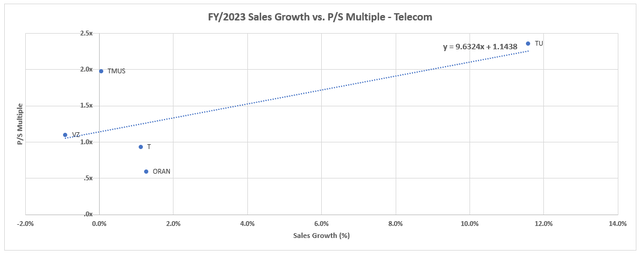

Despite deteriorating macroeconomic conditions, AT&T’s earnings beat during the first quarter, and management’s reiterated guidance for $16 billion in full-year FCF, alongside robust subscription growth relative to rivals to imply resilience in its underlying business fundamentals remain key value accretive factors to the stock. Trading at about 6x estimated earnings and under 1x forward sales, the market currently values AT&T at a discount to peers like Verizon and T-Mobile despite comparable – if not better – growth and profitability prospects within the foreseeable future.

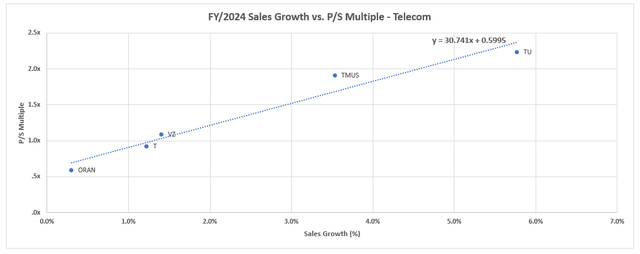

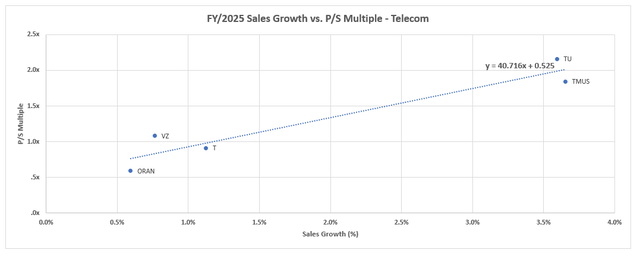

i. Sales growth vs. P/S multiple – Telecom

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

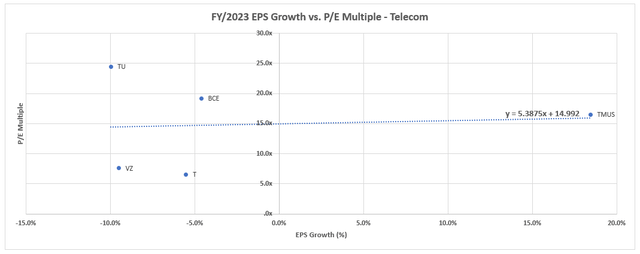

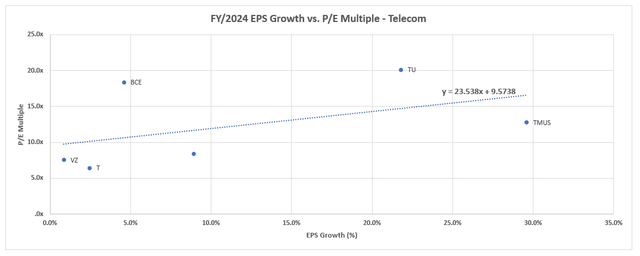

ii. EPS growth vs. P/E multiple – Telecom

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

This suggests much of the pressure over the AT&T stock remains sentiment driven as investors mull on the company’s FCF prospects as an indicator of durability to its dividends. The pent-up value stemming from ongoing efforts to sustain profitable growth as discussed in the foregoing analysis will likely unlock incremental upsides to the stock later in the year, especially as AT&T is expected to deliver consistent evidence supportive of a back-end loaded FCF generation roadmap needed to sustain its $8 billion annual dividend payment alongside other working capital requirements.

At current levels, the stock is providing yet another opportunity for income investors to lock-in a competitive 7% dividend yield, with prospects for incremental upside potential in the stock when market sentiment improves. Specifically, expectations for an upcoming pause in the Fed’s monetary policy tightening campaign, and potential easing later this year is likely to reduce long-end Treasury yield and, inadvertently, the risk-free rate typically used in discounting the value of a company’s future cash flows, buoying investor optimism on longer-term market valuation prospects. This would likely drive AT&T stock higher from current levels to reflect the shift within the foreseeable future, thus reducing its dividend yield to match lower rate prospects.

The Bottom Line

While AT&T’s weaker-than-expected first quarter FCF amid deteriorating macroeconomic conditions has caused its income-focused investor base to retreat to the sidelines, the underlying business performance continues to demonstrate resilience against looming recession risks. Expectations that capital investments for the year have “peaked in the first quarter” and will revert to normalized levels through the remainder of the year also reinforces AT&T’s prospects of achieving its full-year FCF target of $16 billion, which would be more than sufficient to sustain its annualized dividend payment, ongoing deleveraging efforts, as well as other working capital requirements. This makes the stock’s current discount to peers representative of an opportune risk-reward set-up, given a 7% dividend yield that remains largely intact, alongside incremental upside potential when cyclical tailwinds return. Taken together, AT&T’s durable revenues from its core wireless connectivity business, profitable growth prospects, and attractive capital return program fit the bill for investors seeking a haven amid the uncertain market climate.

Admittedly, AT&T’s elevated debt load remains a downside risk to consider, given rising borrowing costs implemented by the Fed to stem persistent inflationary pressures in the economy. Although the company has locked in low fixed rates (weighted average interest rate 4.1%) on its existing debt profile, it remains on a pressed schedule to deleverage its balance sheet to prevent the risk of expensive refinancing.

We expected to transition back to more historical cost of debt. That is certainly underway, with the added dose of tighter credit availability to some segments of the economy. I’m clearly not breaking any ground with these observations, but this is why we have been focused on reducing our leverage and optimizing our use of capital over the last few years…We’ve reduced our debt, taking advantage of the prior low interest rate environment on our remaining debt and managed our debt towers for the next several years. As a result, more than 95% of our debt is now fixed at an average rate of 4.1%.

Source: AT&T 1Q23 Earnings Call Transcript

And with its sights fixed on a full-year FCF of $16 billion, the company leaves a comfortable margin for addressing both its annualized dividend payment requirement of $8 billion and deleveraging needs totalling at least $7 billion, inclusive of interest payments, for the year.

AT&T 2022 10-K Filing AT&T 2022 10-K Filing

The underlying business’ ability in funding its ongoing deleveraging goals, alongside the competitive dividend program, is further reinforced by observations of strength in the prior year. Despite a lower FCF of $14 billion in 2022 compared against the improved $16 billion guided for the current year, AT&T was able to reduce its debt portfolio by $24 billion, while also sustaining the full-year dividend payment totalling almost $10 billion at the time. Taken together with continued fundamental resilience demonstrated by the company, which reinforces its FCF prospects and, inadvertently, its competitive dividend yield, the stock exhibits an attractive income and value set-up at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!