Summary:

- Thermo Fisher Scientific is a top dividend growth stock with a complex post-pandemic situation.

- Recent earnings show promising growth in key segments, despite a high valuation.

- Strategic investments in R&D and acquisitions position TMO for continued long-term success.

isak55/iStock via Getty Images

Introduction

Thermo Fisher Scientific (NYSE:TMO) is one of my favorite dividend growth stocks and one of the trickiest stocks due to the complicated post-pandemic situation.

As some readers may know, I own Danaher Corp. (DHR), the company’s largest peer, which has an extremely high stock price correlation. Thermo Fisher is held in several family accounts that I manage/advise.

My most recent article on this stock was written on June 7, when I went with the title “Low Yield, High Growth: Unveiling The Power Of Thermo Fisher’s Dividends.”

Since then, shares have risen by roughly 5%, beating the S&P 500 by three points. This was fueled by its just-released earnings, which showed a very promising picture of the return of post-pandemic growth and confirmed its many secular tailwinds.

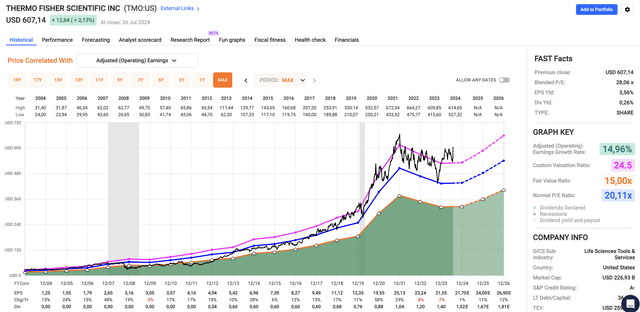

Furthermore, we’ll discuss its valuation. Thermo Fisher is the only stock where we broke the rule of not buying a stock that is “obviously” undervalued. As we will find out in this article, TMO is not cheap. Especially after the pandemic, a lot of COVID-related tailwinds started to unwind, leaving the company with a “high” valuation and contracting growth.

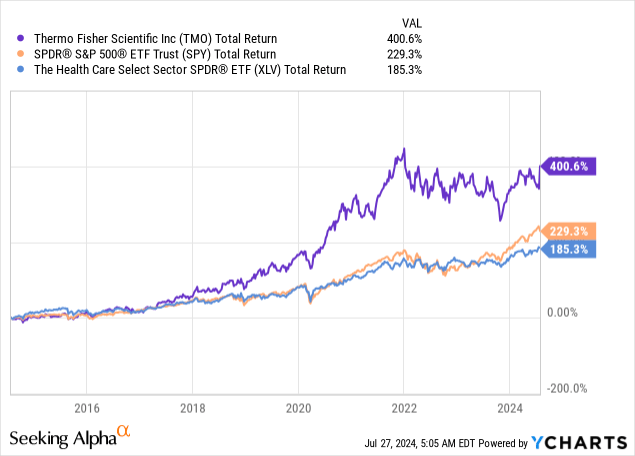

Nonetheless, over the past ten years, the TMO stock price has still returned more than 400%, beating the S&P 500 and the Health Care Select Sector ETF (XLV) by a huge margin.

In this article, I’ll explain why we continue to buy TMO, believing it will allow us to beat the market with a fantastic anti-cyclical business model.

So, let’s get to it!

A Future-Proof Business Model

I’m fascinated by healthcare. By now, I doubt that’s a surprise.

Not only does the healthcare sector come with anti-cyclical demand and secular growth, but it also helps to improve the lives of countless people.

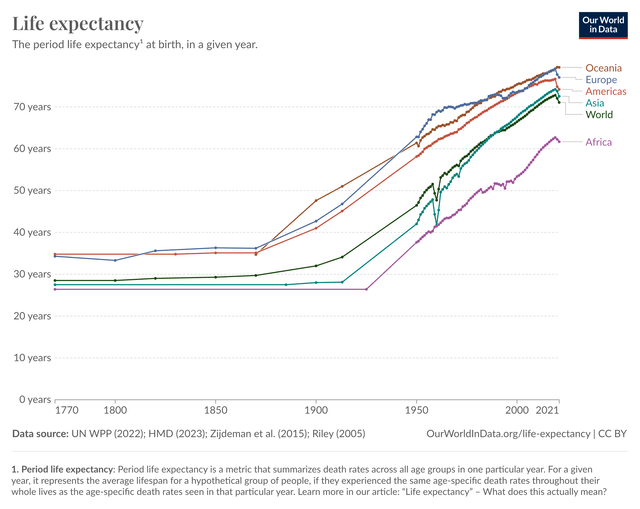

Before the Industrial Revolution, the median life expectancy in the world was roughly 30 years. Honestly, I did not expect it to be that low when I looked it up online. In more advanced nations, the life expectancy was roughly 35 years back then.

Now, the average life expectancy in advanced nations is in the high 70 range.

Needless to say, there are many factors at play here. Since the early 1900s, affordable energy has gone mainstream, our nations have become industrialized, agriculture has become efficient, and we now have cures for things that would have killed us a hundred years ago. This includes much lower infant mortality rates.

However, when it comes to investing in healthcare, there are many opportunities and many pitfalls.

Biotechnology companies come with patent loss and innovation risks, healthcare real estate comes with occupation risks, hospitals have razor-thin margins, and producers of medical supplies have high competition.

While I have found value in all of the sectors mentioned above, I’m very keen on one specific area: healthcare diagnostics and research.

That’s where Thermo Fisher comes in.

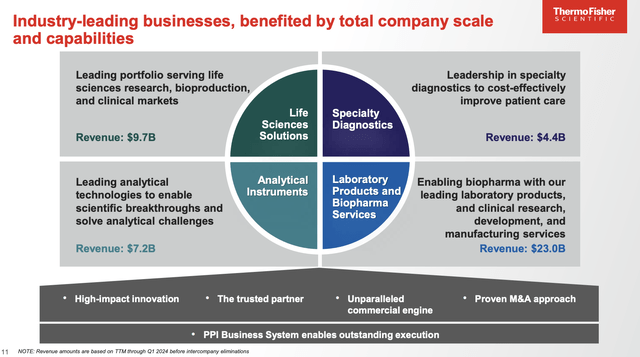

The giant, with more than $40 billion in revenue and 120 thousand employees, is one of the world’s largest life science and clinical research companies that sells laboratory equipment and supplies needed for biotech/pharma research.

In other words, the Waltham, Massachusetts-based corporation sells the equipment and supplies needed for biotech and related companies to do research, making it a critical player in global healthcare.

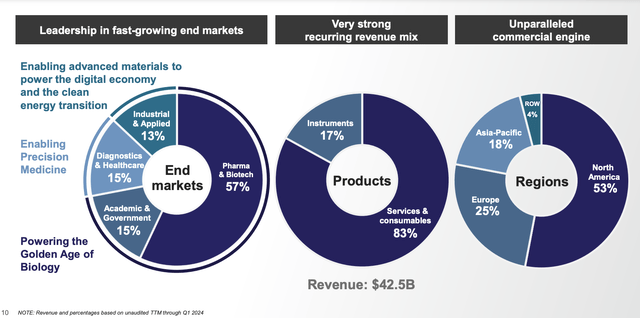

More than 80% of its sales are consumables, with more than 75% of its sales coming from developed markets in North America and Europe.

The company’s products allow it to “power the golden age of biotechnology,” support advanced precision medicine, and supply the necessary tools for research in advanced materials for the energy transition and digital economy (13% of its sales).

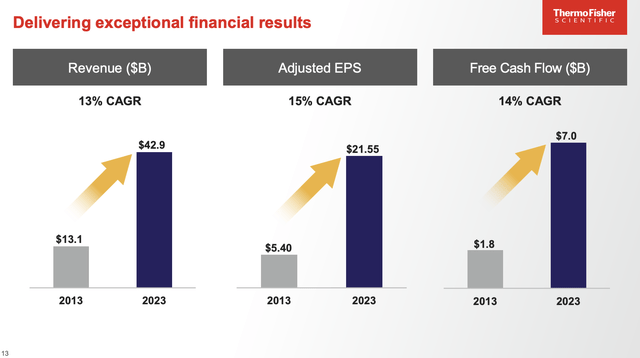

Fueled by its Practical Process Improvement (“PPI”) Business System to streamline operations and support the integration of acquired companies, Thermo Fisher has reported mindblowing growth, growing its revenues by 13% per year over the past ten years. Higher margins have turned this into 15% annual compounding earnings per share growth and 14% annual compounding free cash flow growth.

This included the pandemic, which was extremely bullish for TMO and its peers, as accelerated investments in research and high demand for testing caused revenues to fly.

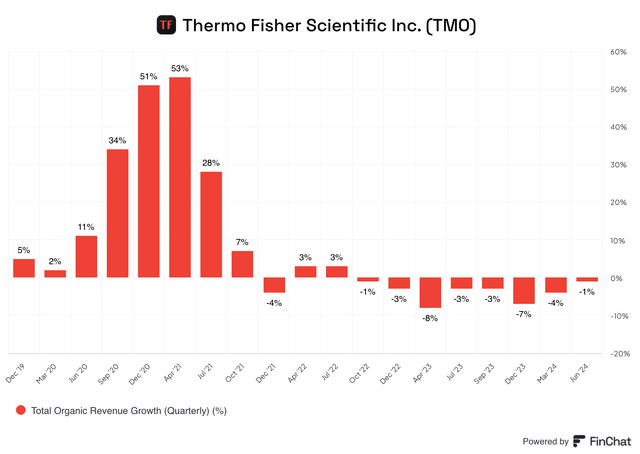

Then, the pandemic faded. So did growth.

This caused the stock price to go sideways for more than two years and made putting a valuation on the stock very tricky.

However, before we dive into the valuation, let’s take a closer look at its just-released earnings, which showed very promising developments.

Thermo Fisher Is Back

In the second quarter of 2024, the company reported an adjusted EPS growth rate of 4% to $5.37.

Despite a slight decline in reported revenue of 1%, the company managed to outperform expectations, with core organic revenue growth slightly ahead by 0.5 percentage points, which translates to roughly $60 million in additional revenue.

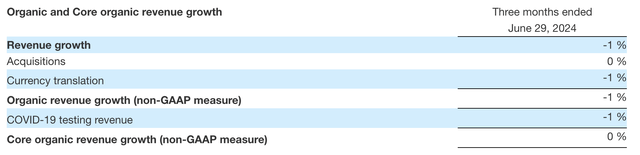

As we can see below, total revenue growth was -1%, the number I just mentioned. There was no change from acquisitions. Currency translations were a 1% headwind. The same goes for COVID-19 testing revenues.

When adjusting for non-organic factors and COVID-19, core organic revenue was flat.

Obviously, erasing negative factors does not make the company look better.

We’re excluding COVID-19 headwinds because we knew these would be an issue after the pandemic. What matters is the strength of Thermo Fisher’s core business.

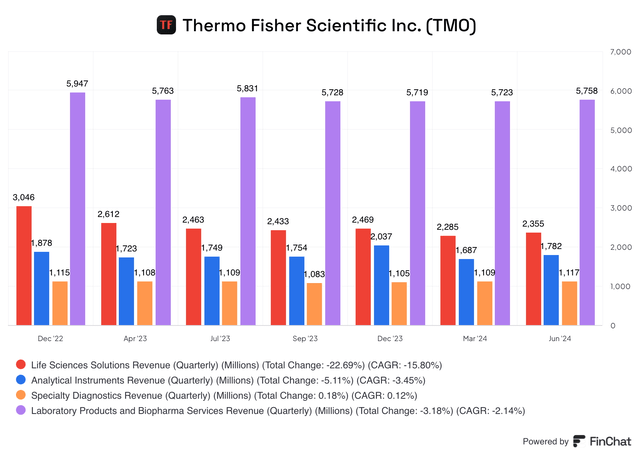

In the second quarter, it saw strong core growth, as the Analytical Instruments segment reported a 3% organic growth, driven by strong performance in the electron microscopy business. The Specialty Diagnostics segment saw a 1% increase in both reported and organic revenue, which was fueled by growth in transplant diagnostics and immunodiagnostics.

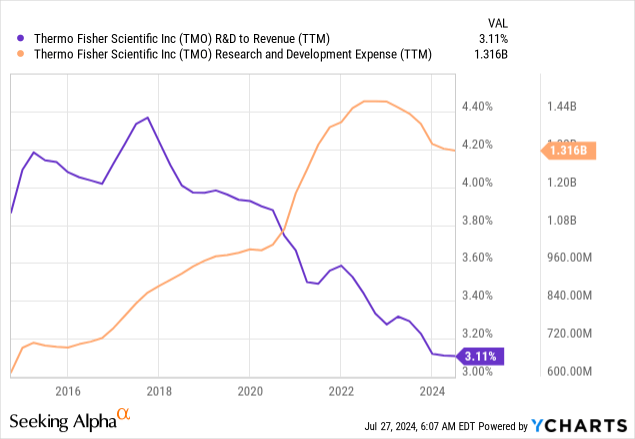

In order to remain competitive, the company is investing aggressively in R&D. Thermo Fisher spent roughly $340 million on R&D in 2Q24, 7.1% of its manufacturing revenue and 3.2% of its total revenue.

Over the past twelve months, R&D spending was 3.1% of total revenues, a new 10-year low. However, this does not make my other comments invalid, as aggressive revenue growth has more than offset spending growth in R&D, allowing the company to remain competitive with a relative (not outright) decline in R&D spending.

As a result, the company used the 2Q24 earnings call to explain that despite a decline in vaccine and therapy revenue, it managed to gain market share and deliver sequential growth across all four of its end markets.

According to the company, the biosciences and clinical research businesses led growth in the pharma and biotech sectors, while strong growth in electron microscopy boosted demand in the academic, government, industrial, and applied markets.

Meanwhile, in the diagnostics and healthcare sector, core revenue growth was driven by transplant diagnostics, immunodiagnostics, and the healthcare market channel.

With regard to R&D spending, the company launched new products, including the Thermo Scientific Stellar mass spectrometer and additions to the Thermo Scientific Orbitrap Ascend Tribrid mass spectrometer.

The company believes these advances not only support current demand but allow its tools to be used for future scientific breakthroughs as well, which is what this is all about.

Moreover, the company is expanding its footprint through new facilities in the Netherlands and Pennsylvania and partnerships in APAC nations, including with the National Battery Research Institute in Indonesia.

This also includes the acquisition of Olink, which was completed after the end of the second quarter in a $3.1 billion deal. Olink is a leader in proteomic solutions (the study of proteins). This is what TMO wrote when it announced the acquisition last year:

Olink offers leading solutions for advanced proteomics discovery and development, enabling biopharmaceutical companies and leading academic researchers to gain an understanding of disease at the protein level rapidly and efficiently. Olink’s proprietary technology, Proximity Extension Assay (PEA), provides high throughput protein analysis for the very large installed base of qPCR and next-generation sequencing readout systems in the market. With a library of more than 5,300 validated protein biomarker targets, adoption of the technology has been very strong, leading to over 1,400 scientific publications. Headquartered in Sweden, Olink has operations in the Americas, Europe and Asia Pacific. – Thermo Fisher Scientific

In general, the company is upbeat about its future, as it raised its full-year guidance, expecting revenue in the range of $42.4 billion to $43.3 billion and adjusted EPS between $21.29 and $22.07. The prior EPS guidance range was $21.29 to $22.07.

Shareholder Value

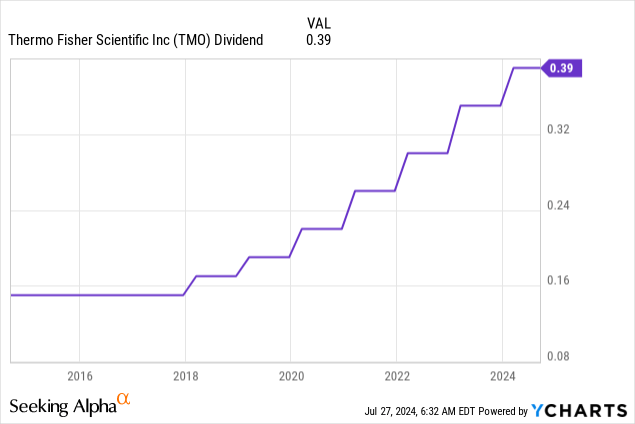

TMO is a dividend growth stock. It has a payout ratio of less than 7.0% and a five-year dividend CAGR of 15.5%.

That’s fantastic for dividend growth investors.

The bad news is that it yields just 0.3%.

In other words, a $10,000 investment in TMO gets you $30 in pre-tax dividends. That’s a single trip to a low-cost fast-food joint for 2-3 people – depending on where you live and how hungry you are.

The good news is that the yield is only low because capital gains in the past offset dividend growth. If you were to ask any long-term investors who are sitting on more than 400% in gains, I doubt they worry about the current dividend yield being low.

Moreover, the low payout ratio leaves a lot of room for aggressive M&A and R&D. Despite a number of big-ticket M&A deals, TMO has a balance sheet with a 2.3x 2024E leverage ratio and a credit rating of A-.

Needless to say, I understand it when investors dependent on income believe that TMO is wrong for them. While TMO is a dividend growth stock, the emphasis is on the “growth” part.

Regarding its valuation, we’re dealing with another issue.

- The pandemic caused both growth and the TMO stock price to explode.

- After the pandemic, growth declined.

- While the TMO stock price has gone sideways, it never became “cheap” because the market knew the decline in growth was temporary.

- Now, growth is accelerating again.

Using the FactSet data in the chart below, analysts expect EPS growth to accelerate from 1% in 2024 to 12% in 2026. Using its five-year normalized P/E ratio of 24.5x, we get a fair stock price of $660, 9% above the current price.

Although this suggests a subdued total return in the 2-3 years ahead, it’s important to acknowledge that TMO is likely about to return to pre-pandemic growth rates, where it consistently grew EPS in the low-to-mid double-digit range every year.

Since 2004, TMO has returned 16.7% per year!

Hence, I stick to what I wrote in my prior article:

Although I don’t expect to see these returns anytime soon, I have little doubt that this powerful business model is capable of elevated double-digit returns once we leave the slow post-pandemic years behind us.

That’s why my family keeps buying TMO.

This also means that TMO and DHR are the only stocks we’re buying that are not trading at clearly visible discounts. It’s a strategy that does not come without risks. However, given secular healthcare growth and the company’s fantastic business model, we believe TMO will be able to deliver elevated returns for many years to come.

Please note that I do not disclose a long position in TMO. As I briefly mentioned, I own DHR and do not benefit financially from the accounts that I indirectly manage. It’s all “pro bono.”

Takeaway

Thermo Fisher Scientific remains a top pick despite the tricky post-pandemic landscape. The company has a fantastic business model in healthcare diagnostics and research, with over 80% of its sales from consumables and strong growth driven by advanced precision medicine and biotechnology.

Meanwhile, recent earnings support the resilience of its core business, with promising developments in key segments. While TMO isn’t cheap, its consistent revenue growth, impressive historical returns, and strategic investments in R&D and acquisitions position it for continued success.

As a result, we continue to invest in TMO, confident in its ability to deliver long-term, elevated returns, even as it trades at a somewhat lofty valuation.

Pros & Cons

Pros:

- Solid Growth: TMO has shown impressive revenue growth of 13% annually over the past decade, with EPS and free cash flow compounding at 15% and 14% per year, respectively.

- Strong Business Model: With over 80% of sales from consumables and a significant presence in developed markets, TMO is a critical player in global healthcare, supporting biotech and pharma research.

- Future-Proof Investments: Aggressive R&D spending and strategic acquisitions, like the recent Olink takeover, provide TMO with innovation and growth opportunities.

Cons:

- High Valuation: Post-pandemic, TMO’s stock isn’t cheap, making it key that growth accelerates meaningfully in the years ahead.

- Low Dividend Yield: With a yield of just 0.3%, TMO isn’t ideal for income-focused investors despite its strong dividend growth rate.

- Competitive Risks: The healthcare sector is competitive and prone to disruptors – although I believe these risks are subdued for TMO.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.