Summary:

- Thermo-Fisher is among the top leaders in the life sciences segment with a demonstrated positive track record.

- The company combines internal development, acquisitions and opportunistic tactics to maintain its profile.

- I believe that shares are currently undervalued.

- Investors with medium and long-term horizons should consider TMO as a valuable addition to a portfolio.

gorodenkoff

Introduction

Thermo Fisher Scientific (NYSE:TMO) is a leader in its space. It operates in four distinct segments:

- Life Sciences Solutions

- Analytical Instruments

- Specialty Diagnostics

- Laboratory Products and Biopharma Services

Life Sciences Solutions provides a portfolio of reagents, instruments and consumables used in biological and medical research, discovery and production of new drugs and vaccines, and diagnosis of infection and disease.

Analytical Instruments offers a range of instruments and supporting consumables, software and services used in a variety of applications.

Specialty Diagnostics provides diagnostic test kits, reagents, culture media, instruments, etc., used to serve healthcare, clinical, pharmaceutical, industrial and food safety lab customers.

The Laboratory Products and Biopharma Services segment supplies the laboratory. It consists of multiple brands within the TMO umbrella – including Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon and PPD.

TMO resembles a Life Sciences conglomerate. It has grown organically and from consistent, strategic acquisitions. The company builds long-lasting relationships with customers, positioning itself as a functional one-stop shop in its sector.

There’s nothing flashy about TMO; it simply owns a proven track record, an expanding customer base, and a demonstrable opportunism. An example of the latter is the development of one of the first reliable COVID tests – PCR – for mass use. TMO quickly grasped both the necessity for useful testing and the aptitude to create a practical test for mass use. In the process, it helped to ameliorate a public health emergency that had spread devastating effects worldwide.

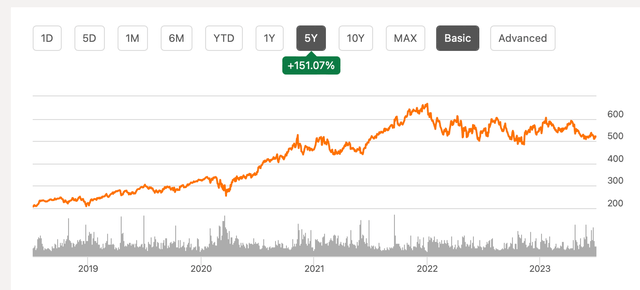

TMO also has been a very strong investment. Owning TMO shares has been rewarding – an outcome that I believe links directly to the company’s resources, strategies and tactics. Strategies such as ongoing acquisition toward expanding product lines and tactics such as opportunism (as with the COVID testing) create a very positive dynamic.

A mark of a truly successful company is the ability to set realistic goals and then consistently execute to achieve those aims. In my view, TMO fits a definition of such success.

Business Case

Life science toolmakers such as TMO are critical in enabling commercial drug production on a mass scale. TMO is a critical component of the pharmaceutical ecosystem. This is the case for at least two primary reasons:

- Government regulation of drug manufacturing builds in very strong switching costs for customers of the life science products essential in the manufacturing. Moving from a reliable, versatile supplier like TMO is an expensive proposition;

- Successful life sciences companies own the safest portion of the biopharmaceutical space and lack the significant pharma company risks found in the uncertain fates of individual drugs and families of drugs. Whether a specific customer’s particular drug line is a “hit” or not, TMO resources, products and services will remain in demand.

TMO supplies a range of critical services, has consistently demonstrated quality and reliability, and can plan for the future with faith in expanding revenue streams.

TMO Strategy

TMO delivered strong performance in 2022 despite two years of a tough global economy and limitations on customer spending budgets. Despite challenges around the economy – including shrinking customer budgets – the company moved ahead.

The most fundamental aspect of TMO’s strategy is the pursuit of a one-stop shop provider role for life science instruments and consumables. While internal RND is an element of this strategy, so are strategic acquisitions. TMO has spent over $50 billion since 2010 on this strategy (including the recent PPD acquisition).

The late 2021 acquisition of PPD added a leading global provider of clinical research services to for $17.4 billion. PPD’s clinical research services boosted TMO’s capacity for bringing advanced therapies to market. TMO expected to realize total synergies of approximately $125 million by year three following the deal’s close, consisting of approximately $75 million of cost synergies and approximately $50 million of adjusted operating income benefit from revenue-related synergies.

TMO added significantly to its debt in connection with the acquisition, assuming approximately $3.0 billion in net debt of PPD. I will address the debt issue later in the article.

A downside to heavy reliance on acquisitions has been limited returns on invested capital, or ROICs. TMO has now achieved enough scale and efficiency that I believe an increasing, accelerating ROIC is likely.

A more recent acquisition was announced just this past week:

“Thermo Fisher Scientific has agreed to buy data intelligence company CorEvitas from Audax Private Equity for approximately $913M in cash.”

“Thermo said the deal is expected to close by the end of the year and be immediately accretive to adjusted earnings per share by $0.03 in 2024. After the closing, CorEvitas will become part of Thermo’s Laboratory Products and Biopharma Services business. CorEvitas is expected to generate $110M in revenue for 2023, with topline growth in the low double digits.”

CorEvitas collects and organizes data from routine clinical care to help improve patient care and outcomes. The acquisition reinforces TMO strategy to grow internally and “externally” in the service of its one-stop shop goal. It adds one more point of product/solution diversity to an already broad story.

The COVID PCR Test

TMO leveraged its premier Life Science supplier role and superb portfolio of products and resources to be among the first to market a COVID test, and at capacity required to meet the huge demand.

The company displayed a most useful agility in responding to an international public health crisis. That TMO came up with a most practical answer to a profound need can only boost its profile and future growth possibilities.

Bull Case Highlights

The Bull case for TMO is strong. Some key Bull case drivers are:

- The TMO acquisition strategy continues. These acquisitions illustrate the strategy’s utility towards the one-stop shop goal.

- TMO has weathered the ‘silent’ recession in late 2022 and early 2023, despite some inevitable short-term hits to revenue and earnings.

- Thermo Fisher is able to successfully raise prices and offset inflation pressures thanks to its large footprint and customer relationships.

- The Coronavirus PCR test windfall was almost certainly not a one-time story. The PCR test also triggered market share gains within the instrumentation segment.

TMO Moat

The TMO moat is wide and further broadened by consistent acquisitions. The pace and timing of acquisitions has been opportunistic. TMP took advantage of the (late) low-interest rate environment to increase the pace. Since 2010, it has averaged $4.7 billion per year outlays to the program.

Each acquisition simply adds to mass and momentum and enhances ROIC potential beyond that of competitors. Only limited product gaps remain in TMO offerings to the life science research sector. And it boasts average organic growth of 4%-5% versus industry growth of approximately 3% over the past decade.

The one-stop shop approach results in strong customer relationships, especially with large clients that seek multiple services from single Life Sciences providers. The TMO moat is real and growing.

TMO Metrics

Thermo-Fisher demonstrates a strong financial profile, including solid share price performance. Most of the financial metrics are solid, and Wall Street analysts are quite positive on the company and the stock.

Our look at TMO metrics starts with share price performance (five years):

Seeking Alpha

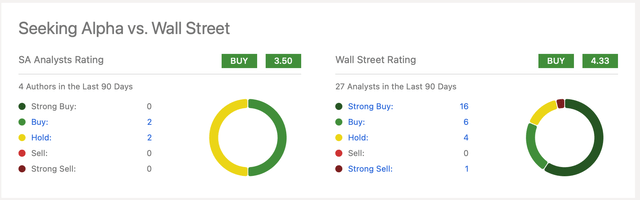

The next graphic shows a contrast between SA analyst views on TMO and those of Wall Street.

Seeking Alpha

I’m on the side of the WS analysts. My opinion is that TMO at current share price sits right on the border between Buy and Strong Buy.

Financial Metrics: Drilling Down

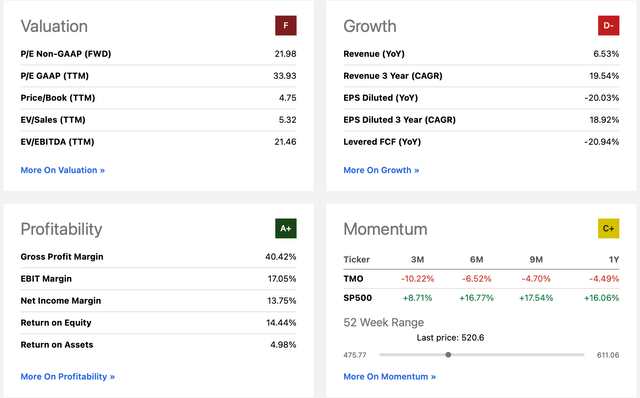

Let’s move on to a view of key TMO financial metrics, also from Seeking Alpha:

Seeking Alpha

The worst “grade” is for valuation. I think that the “F” is a bit harsh, though there is no denying that a PE ratio of nearly 34 for a “staid” company in a “boring” segment is higher than expected. The Growth score also is poor, a byproduct of customer belt tightening in large measure in the post-pandemic belt tightening period.

Profitability is outstanding. Reliable, repetitive profits are the bottom line when it comes to company performance and shareholder expectations. A gross profit margin of over 40% should sing to shareholders.

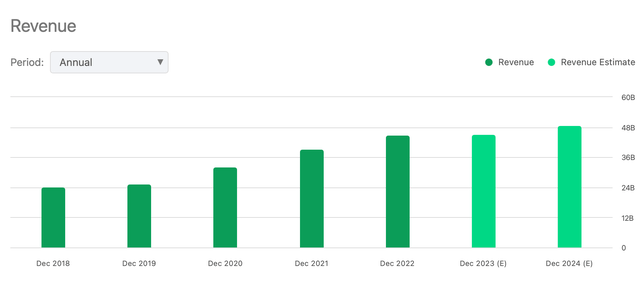

Revenues are shown here, both recorded and projected:

Seeking Alpha

The trend for most of the past five years is positive except for the projected dip for full year 2023. The 2024 projection implies a return to steady growth.

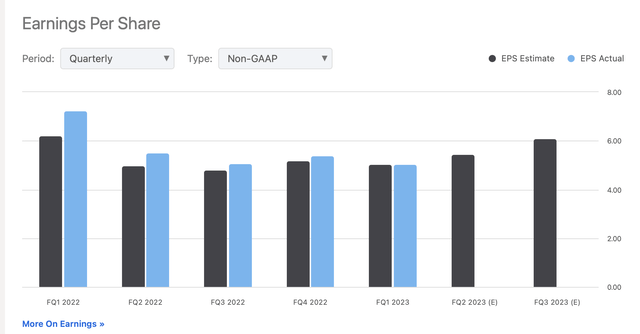

Earnings per share has been uneven viewed on a quarterly basis.

Seeking Alpha

Nonetheless, the anticipated EPS for the next two quarters is unabashedly positive.

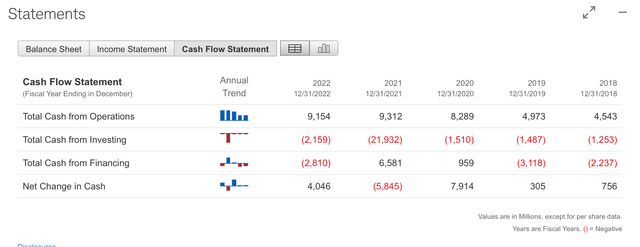

A quick look at income, specifically cash flow trends, also yields an optimistic view:

Seeking Alpha

Total cash from operations has doubled from 2018 to 2022.

The TMO Debt Question

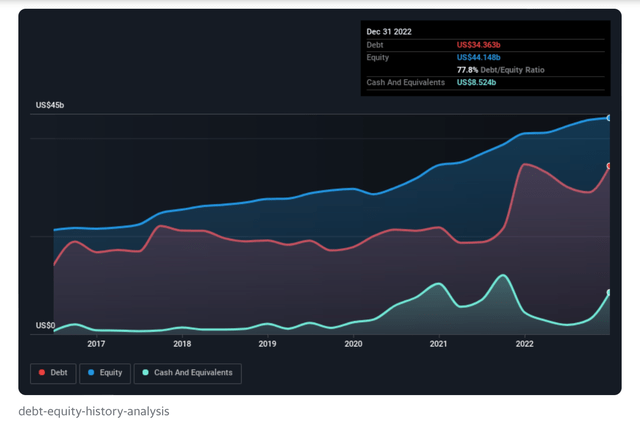

Debt is a concern, evidenced in this graphic from Simply Wall Street:

Simply Wall Street

A 78% debt to equity ratio at the close of 2022 is substantial. Still, this debt burden is mostly the result of systematic strategic acquisitions – a “policy” that has propelled TMO into the top spot in its sector. The related spend has damped down ROIC historically.

“According to the last reported balance sheet, Thermo Fisher Scientific had liabilities of US$17.0b due within 12 months, and liabilities of US$36.0b due beyond 12 months. On the other hand, it had cash of US$8.52b and US$9.43b worth of receivables due within a year. So its liabilities total US$35.1b more than the combination of its cash and short-term receivables.”

“Thermo Fisher Scientific’s net debt to EBITDA ratio of about 2.2 suggests only moderate use of debt. And its commanding EBIT of 18.9 times its interest expense, implies the debt load is as light as a peacock feather. Unfortunately, Thermo Fisher Scientific’s EBIT flopped 17% over the last four quarters.”

Financial Safety Scores

The three key scores that I include in this section come from GuruFocus. The two most relevant scores are the Altman Z-score and the Beneish M-score, reflecting financial health and potential manipulation. The Altman Z-score for TMO is “safe,” while the Beneish manipulation risk number is average.

TMO does not fall within the range of suspicion for financial manipulation.

TMO Risks

I believe that TMO is a strong component of a varied investment portfolio. Like any company that is publicly traded, however, investing in its shares poses risks.

- Debt is often raised by skeptics of a choice to invest in the company. This is a reasonable source of doubt. I believe that the risk is moderate given TMO’s track record and presence. The debt also is linked to a historic acquisition strategy that has made TMO a Life Sciences segment leader.

- Competition can be considered a form of risk that applies to any company except for true monopolies. Certainly, TMO has worthy competitors such as DHR, IQV, A (Agilent), ILMN and MTD. Yet, TMO remains a dominant player in its space. Some of the most successful investment strategies are associated with companies (MSFT, COST, MA/V, AMZN etc.) that enjoy almost unassailable positions within their segments. I consider competition a minor risk for TMO, which leads me to the next risk factor.

- Strategic Missteps can derail any company, including those with impressive size and moats such as TMO enjoys. I would rate this as an internal or autonomous risk factor. Yet, there’s little evidence that TMO is making any significant mistakes. As long as it continues building its profile as a one-stop Life Sciences tools and solutions company, I consider this risk minimal.

Additional risks such as leadership changes or regulation also may come into play. A summary view of TMO risk demonstrates a very competent and methodical approach to achieving strategic goals within a context of strong reputation and resources.

Summary

I believe that TMO is an excellent investment for people with different kinds of portfolios. I’m confident that it’s undervalued at current levels – just above $510 as of this writing. The company has provided excellent shareholder returns over time.

TMO owns a very strong position within its segment, follows a consistent growth strategy including consistent acquisitions, and also is quite opportunistic (as with the COVID PCR test). This step only raised awareness of Thermo-Fisher among its customer base, the public and government agencies that might buy its products in the future.

Common criticisms of TMO are first its debt load, and second its very lean dividend. I addressed the debt at length in this piece; it can also be seen as an essential element in the successful TMO acquisition strategy.

While the current dividend yield will disappoint classic dividend investors, other analysts have emphasized how companies with modest dividends often provide excellent returns to investors. MSFT and ROP are two examples. TMO, I believe, is another.

Given current share price levels, I believe that a 12-month call deserves a price of at least $575 per share. Barring macro shocks, I think TMO will continue to reward those with a medium or long-term horizon.

Good luck.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.