Summary:

- Thermo Fisher excels in diversified life sciences sectors, bolstered by innovative R&D, efficient PPI systems, and economies of scale.

- Thermo Fisher aims for 7%-9% organic growth, outpacing its 4%-6% growing end markets, through strategic acquisitions, innovation, and diversified revenue streams.

- Thermo Fisher balances capital between high-ROI reinvestment and shareholder returns, excelling in strategic acquisitions that drive synergistic growth and value.

- I believe TMO to have a five-year price target of $864.72, offering a 10% CAGR.

JHVEPhoto

Investment Thesis

I believe Thermo Fisher Scientific Inc. (NYSE:TMO) stock is a buy for investors looking for a high-quality business with the potential for robust returns. The company has a strong presence across diversified life sciences sectors and is backed by innovative R&D, efficient PPI systems, and significant economies of scale. With an aggressive growth strategy targeting 7%-9% organic growth, Thermo Fisher is well-positioned to outpace its already expanding end markets. Its balanced capital allocation strategy focuses on high-ROI reinvestment opportunities and shareholder value, further solidifying its investment appeal. Most compellingly, a conservative estimate projects a 13% annual growth in TTM Cash flow per Share, which I think points to a promising five-year price target of $864.72 and a potential CAGR of 10%. Given these factors, I see Thermo Fisher as a compelling investment opportunity.

Company Overview

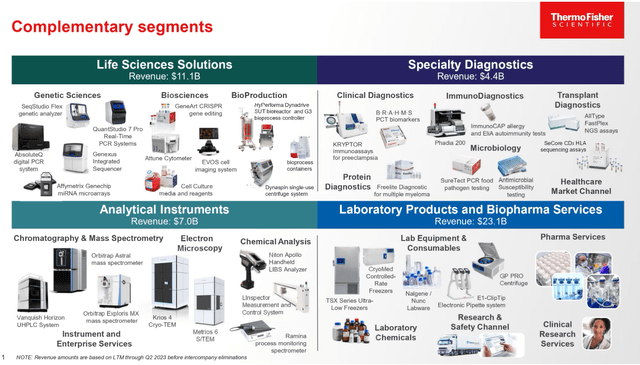

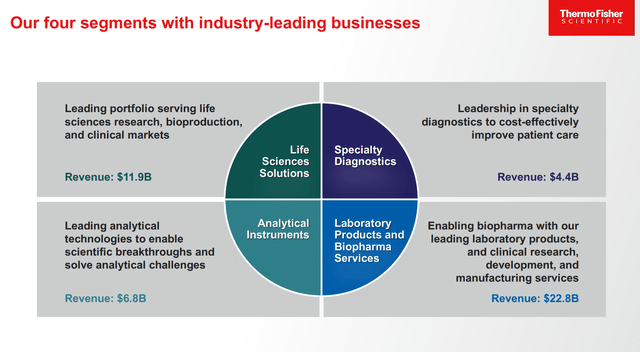

Thermo Fisher Scientific operates in four key segments that form the backbone of its business model. The Life Sciences Solutions segment is crucial for medical and biological research, offering a range of reagents and instruments. I believe this segment is likely to continue supporting advancements in drug discovery and diagnostics.

2023 Thermo Fisher Investor Day

The Analytical Instruments segment caters to both research and industrial needs, providing essential lab equipment and software. In my opinion, this segment is well-positioned to meet the growing demands of scientific research and industrial quality control. Specialty Diagnostics focuses on diagnostic kits, particularly in immunodiagnostics. I think this segment has the potential to grow, especially with the increasing need for precise clinical diagnosis and monitoring of various health conditions. Lastly, the Laboratory Products and Biopharma Services segment offers essential lab products and services. In my view, this segment is fundamental in supporting research institutions, likely contributing to the company’s long-term stability.

Overall, these segments collectively contribute to Thermo Fisher’s diversified revenue streams and growth prospects. In my assessment, the company’s broad portfolio positions it well for sustainable growth in the life sciences sector.

Diversified World Leader in Serving Science

I believe TMO stands as a global leader in the life sciences industry, where its diversified portfolio is a strong point for the company.

The revenue figures, based on the latest twelve months (LTM) through Q1 2023 before intercompany eliminations, indicate significant contributions from each segment. Specifically, Life Sciences Solutions generated $11.9 billion in revenue, Specialty Diagnostics accounted for $4.4 billion, Analytical Instruments brought in $6.8 billion, and Laboratory Products and Biopharma Services amassed a staggering $22.8 billion.

In my view, Thermo Fisher Scientific’s diversified portfolio is a strong asset, allowing the company to serve various sectors like pharmaceuticals, biotechnology, and healthcare. The company’s R&D efforts have resulted in notable innovations, such as an FDA-approved blood test for Preeclampsia, which I believe positions it well in healthcare technology. Thermo Fisher’s global presence is another advantage. In my opinion, this enables the company to meet diverse customer needs across different markets, likely strengthening its leadership in the life sciences sector. This combination of a broad product range, innovation, and global reach, supported by diversified revenue streams, forms the core of my thesis that Thermo Fisher is well-positioned for long-term growth.

2023 Thermo Fisher Investor Day

Thermo Fisher’s PPI Business System, which is based on Lean Six Sigma principles, is a strategic asset for the company. I believe it likely contributes to operational efficiency by focusing on data-driven decision-making and continuous improvement. This, in turn, could result in faster lead times and cost savings, making Thermo Fisher potentially more agile and responsive compared to competitors. This operational efficiency forms a part of my underlying thesis that Thermo Fisher has built-in advantages that position it well for long-term growth and competitiveness.

In my view, Thermo Fisher’s large scale is likely a key factor in its economic advantages. I believe this scale enables the company to achieve economies of scale in both production and R&D. Additionally, the company’s global reach could potentially allow for more cost-effective sourcing of materials and efficient distribution, which in my opinion, would lead to lower per-unit costs.

Strong and Durable End Market Growth

In my assessment, Thermo Fisher’s capital management strategy appears to be well-designed to enhance shareholder returns. The company seems to prioritize strategic acquisitions and shareholder payouts, which I believe is a sound approach for long-term growth and value creation.

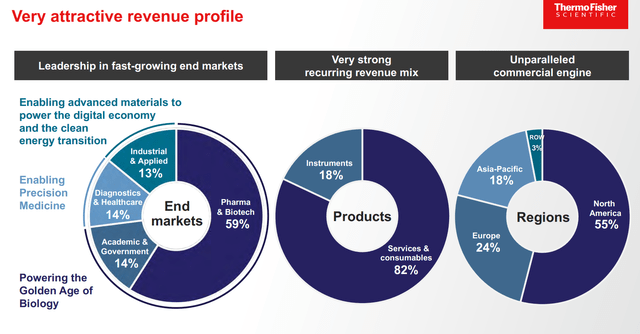

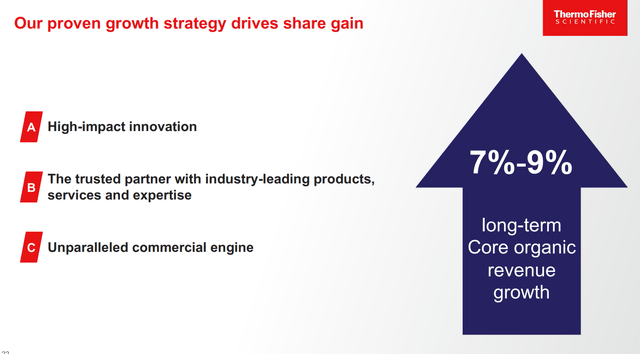

The markets Thermo Fisher operates in are likely to experience long-term growth due to factors like increasing healthcare needs and advancements in scientific research. In my view, this makes the company potentially resilient to economic downturns. Thermo Fisher’s growth strategy, in my opinion, is anchored in innovation, customer trust, and market reach. These elements likely contribute to its strong position in various sectors, reinforcing my thesis that the company is well-positioned for long-term success.

Additionally, Thermo Fisher’s diversified revenue across different markets and its focus on services and consumables could potentially result in recurring revenue.

2023 Thermo Fisher Investor Day

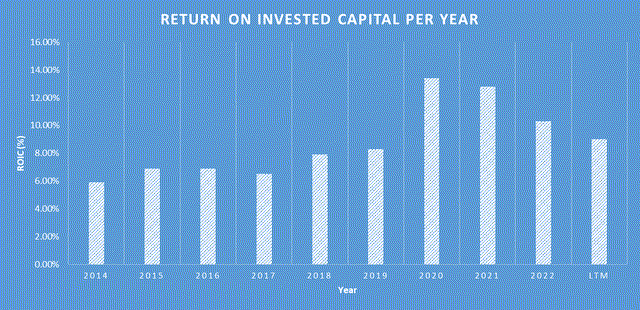

In my opinion, Thermo Fisher’s projected 4%-6% long-term growth rate in its end markets seems plausible, given its strategic investments in innovation. I believe these investments are likely to be amplified by the company’s capability and capacity expansions, often facilitated by what appear to be well-thought-out mergers and acquisitions. This is supported by the business’s strong historical return on invested capital which in recent years has been close to double digits as seen in the graph below.

Externally, I believe the market conditions seem favorable for growth, driven by demographics like an aging population that will likely require more healthcare services. Advances in life sciences and material science are also creating new opportunities. In my view, Thermo Fisher is well-positioned to capitalize on these trends, particularly in sectors like semiconductors and clean energy, which are seeing rapid growth and often benefit from government investments.

2023 Thermo Fisher Investor Day

While the end markets are expected to grow at 4%-6%, Thermo Fisher Scientific aims to outperform this with a 7%-9% long-term organic revenue growth. I think this is achievable given the structural tailwinds in healthcare such as an aging population, increased healthcare spending and a rise in chronic diseases.

2023 Thermo Fisher Investor Day

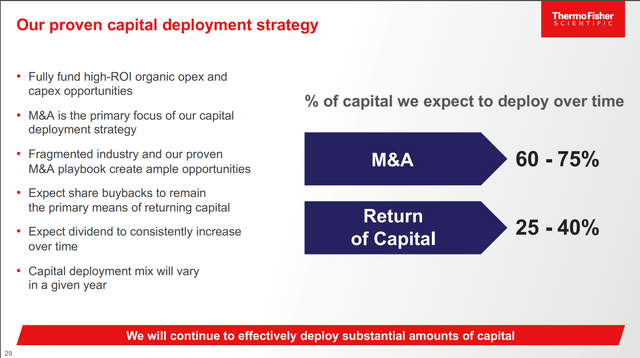

Proven Capital Allocation Strategy

Thermo Fisher Scientific adopts a balanced approach to capital allocation, aiming to reinvest 60%-75% of its capital back into the business while returning 25%-40% directly to shareholders.

2023 Thermo Fisher Investor Day

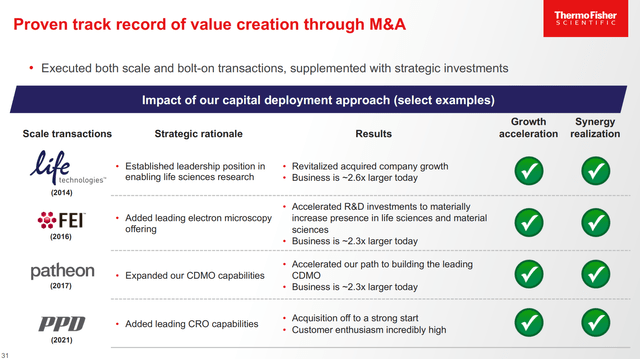

I believe Thermo Fisher has an impressive track record of successful acquisitions that strategically broaden its capabilities and market presence. For example, the acquisition of Life Technologies helped grow TMO’s market share in the life sciences sector, to where is now 2.6x larger today. Similarly, the purchase of Patheon significantly expanded its pharmaceutical manufacturing and development services, making Patheon 2.3x larger today and offering an end-to-end solution for drug development. The acquisition of FEI Company also paid off, FEI is now 2.3x larger today.

2023 Thermo Fisher Investor Day

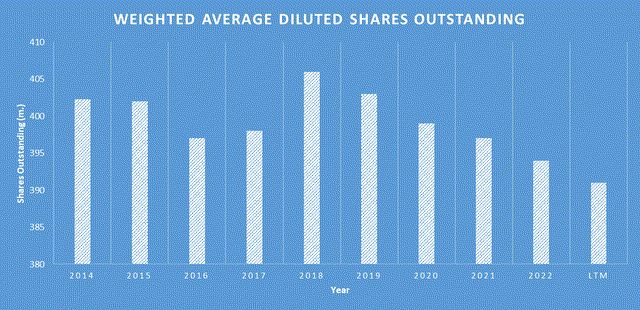

We can see that since 2018, TMO has been consistently reducing the shares outstanding to where the share count has dropped from 406 million shares outstanding to 391 million average shares outstanding in the last twelve months. I believe this shows that TMO is aligned with shareholders who wish to have capital returned to them.

Financial Analysis

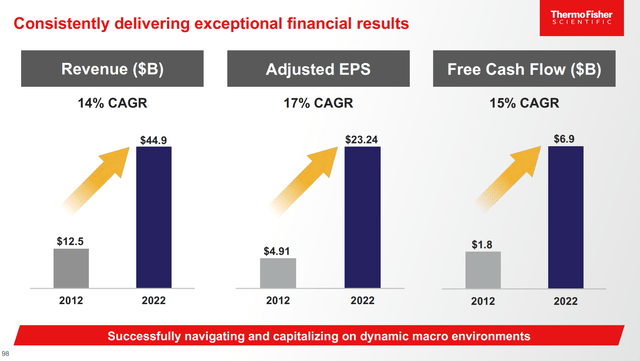

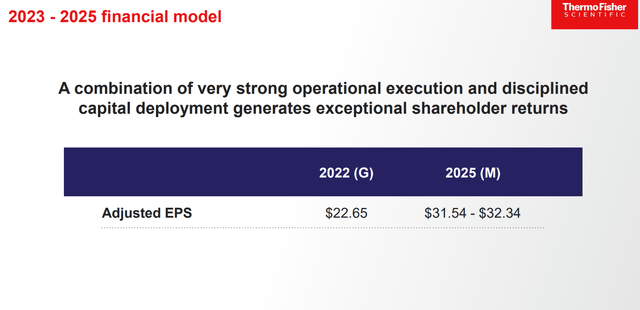

Over the past 5 years, the company has demonstrated remarkable financial performance. Its revenue has shown a consistent and strong growth, increasing from $24,358.00 in 2018 to $43,524.00 in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 12.3%. The earnings per share (EPS) has been equally impressive, growing steadily from $7.24 to $14.64, reflecting the company’s ability to translate revenue growth into bottom-line success. TMO’s management team projects that by Fiscal Year 2025, the company will reach adjusted EPS of between $31.54 – $32.34 per share. This projection, however, depends on the macro environment looking forward and the return on invested capital the management team on achieving through M&A activities.

2023 Thermo Fisher Investor Day

As of the most recent quarter, the company reported cash and cash equivalents of $3,133.00 million. The company’s total debt stands at $29,007.00 million, a hefty amount that reflects the company’s conservative approach to M&A. The net debt is approximately 4x times the last twelve months free cash flow which I consider to be high. It is unlikely TMO will find themselves in any major trouble considering the historic strength of the company though it is something to watch.

2023 Thermo Fisher Investor Day

Valuation

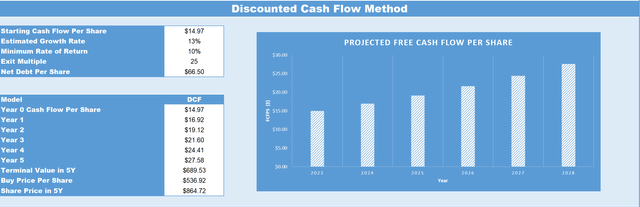

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cash flow analysis of the business as seen below.

TMO’s current TTM Cash flow per Share as of Q2, 2023 is $14.97. Based off 8% core organic growth and 5% from inorganic growth (which I consider as conservative), I believe that TMO’s TTM Cash flow per share should grow conservatively at 13% annually for the next five years. Therefore, once factoring in the growth rate by 2028 TMO’s Cash flow per Share is expected to be $27.58. If we then apply an exit multiple of 25, which is below TMO’s historical price to free cash flow ratio for the previous 10 years, this infers a price target in five years of $864.72. Therefore, based on these estimations, if you were to buy at today’s share price of $541.59, this would result in a CAGR of 10% over the next five years. Therefore, this stock is a buy if you are happy owning a high-quality business for a 10% annual return.

Risks

In my assessment, Thermo Fisher Scientific operates in a competitive landscape with key players like Danaher (DHR), Agilent Technologies (A), and PerkinElmer. These companies also offer a range of life sciences and diagnostic solutions, and any technological leap by them could potentially erode Thermo Fisher’s competitive advantage. However, in my view due to TMO’s PPI model as well as low per unit costs and aggressive R&D, I see the likelihood of TMO losing relevance in the market as low.

While Thermo Fisher has a strong track record of FDA approvals, the regulatory landscape remains a risk. As of writing this article, there were no high-profile regulatory challenges against the company, but the process of gaining FDA approvals for new products is always fraught with uncertainties.

Economic downturns could lead to reduced government and academic research funding, which are significant revenue streams for Thermo Fisher. In terms of currency risk, 45% of the company’s revenue are generated outside of North America, which can impact earnings when converted back to U.S. dollars. Currently, the company is facing FX headwinds due to the strong US dollar against other foreign currencies. Though, once the macro environment improves, I predict that foreign currencies will strengthen against the US dollar as many investors currently see the US dollar as a ‘safe haven’.

Regarding M&A risks, Thermo Fisher has been successful in integrating acquisitions like Life Technologies and Patheon, which have been accretive to earnings. However, the risk of overpaying for an acquisition always exists. For example, if the company were to make an acquisition at a high multiple and then fail to realize the expected synergies, it could result in financial strain and operational inefficiencies. It should be noted that TMO had a failed to acquire Qiagen for $12.5 billion, therefore not every deal is a guarantee of being closed.

Conclusion

I see Thermo Fisher Scientific as a compelling investment opportunity, excelling across diversified life sciences sectors. The company’s innovative research and development efforts, efficient Practical Process Improvement (PPI) systems, and economies of scale give it a competitive edge. With an ambitious aim for 7%-9% organic growth, Thermo Fisher is poised to outperform its already growing end markets, which I expect to expand at a rate of 4%-6%. This growth is fuelled by strategic acquisitions, ongoing innovation, and a diversified revenue model. The company also adopts a balanced approach to capital allocation, focusing on high-ROI opportunities for reinvestment while also returning value to shareholders through buybacks and dividends. Importantly, based on a conservative estimate of 13% annual growth in TTM Cash flow per Share, I believe Thermo Fisher has a promising five-year price target of $864.72. This translates to a potential compound annual growth rate (CAGR) of 10%, making it a strong buy for investors seeking a high-quality business with robust returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.