Summary:

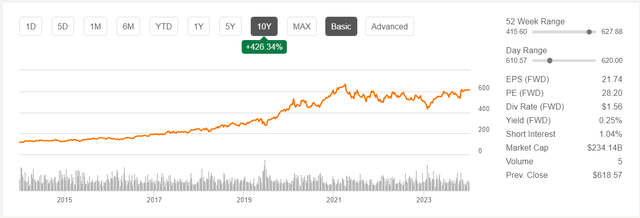

- Thermo Fisher has outperformed the market with a 420%+ return over the past decade, but its current valuation is high.

- The company’s recent results show mixed performance, with a slight revenue decline, but improved earnings per share and raised 2024 guidance.

- Despite strong growth prospects and market tailwinds, the stock’s high valuation and low dividend yield make it a hold for now.

- I recommend waiting for a better entry point, specifically a share price range of $544 to $565, before considering an investment.

MoMo Productions/DigitalVision via Getty Images

Thermo Fisher Scientific Inc. (NYSE:TMO) has been one of the best-performing stocks over the last decade, with shares returning more than 420% over this period.

Over that same period, the S&P 500 Index has returned ~230%, as Thermo Fisher has easily outpaced the market index.

A return like this is reserved for only the highest of quality companies, but the valuation is very rich. Let’s look at why I am waiting for a better entry point into this great company.

Company Background and Recent Results

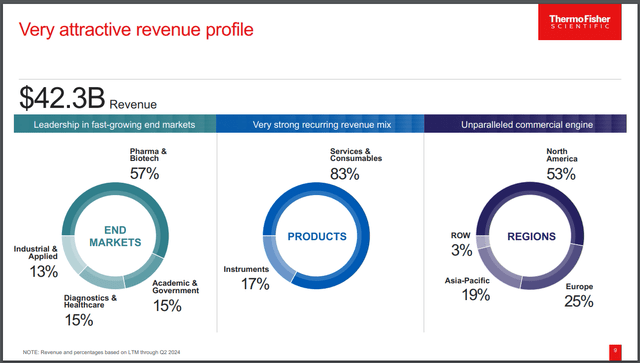

Thermo Fisher provides products that help its customers to accelerate advancements in life science research, improve patient diagnoses, and help increase the effectiveness of both domestic and international laboratories.

The company has four reportable segments, including, Laboratory Products and Biopharma Services, which provides products used in laboratories and clinical research, Life Sciences Solutions, which offers reagents, instruments, and consumables for biological and medical research, Analytical Instruments, which provides instruments and other products for research and clinical laboratories, and Specialty Diagnostics, which offers specialized equipment for various needs.

Thermo Fisher generates annual revenue of more than $42 billion and is valued at $231 billion, making the company one of the largest in its industry. Slightly more than 80% of the company’s revenue comes from services and consumables, with instruments making up the remainder.

Thermo Fisher’s second quarter, which was announced at the end of July, was mixed. Revenue fell 1.4% to $10.5 billion while adjusted earnings-per-share of $5.37 improved from $5.15 in the same period of 2023. Both results did top estimates.

By individual segments, Laboratory Products and Biopharma Services declined 1.3% to $5.76 billion while Life Sciences Solutions was down 4.4% to $2.36 billion. Analytical Instruments grew 1.9% to $1.78 billion and Specialty Diagnostics improved 0.7%.

Management did raise its guidance for 2024. Revenue is now projected to be in the range of $42.4 billion to $43.3 billion, which would represent growth of just 0.1% at the midpoint.

Earnings-per-share are expected to be in the range of $21.29 to $22.07, up from $21.14 to $22.02 previously.

The analyst community is slightly more bullish for the year.

While this year is expected to see relatively stable earnings results, those covering Thermo Fisher expect near double-digit earnings growth in both 2025 and 2026. This would mark a return to much better results than the company experienced before and directly after the pandemic.

Long-Term Trend of Outperformance

Some of the stock’s returns over the last decade can be attributed to the company’s performance during and immediately after the Covid-19 pandemic. Thermo Fisher was the first company to bring an accurate Covid-19 test to market during the pandemic, which greatly aided the business. Earnings-per-share surged 74% in 2020 and the company followed that up with a nearly 22% improvement the very next year.

As the pandemic eased and the demand for testing decreased, earnings-per-share did retreat, but they remain above pre-Covid-19 levels.

This is because Thermo Fisher is more than just a Covid-19 story. Yes, the company did benefit from the unprecedented demand for Covid-19 testing, but Thermo Fisher is a leading life science and research company.

The company maintains a very important position in healthcare as it provides the means for its customers in the sector to operate.

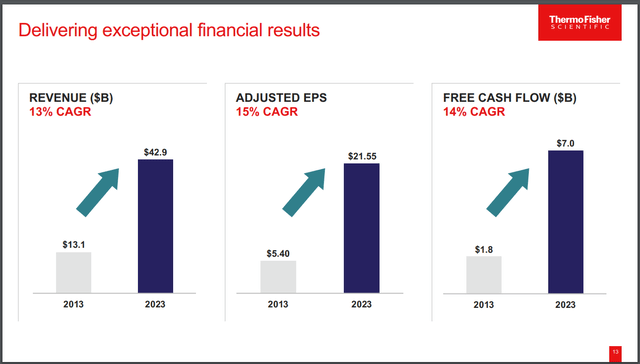

This leadership position has enabled Thermo Fisher to grow at a rapid pace. Even before the pandemic, the company was growing at a rapid pace. From 2014 to 2019, adjusted earnings-per-share almost doubled, which helped contribute to a compound annual growth rate of 15% for the last decade.

Revenue growth over this same period has generally been positive as the company’s only year of decline was last year.

Long term, the company believes that its market will see 4% to 6% revenue growth, but management has guided toward 7% to 9% organic revenue growth for Thermo Fisher. At the same time, margin improvements are also projected to aid results. In the most recent quarter, Thermo Fisher’s operating margin improved 10 basis points to 22.3% as expenses were down for the period. An improving margin should allow earnings growth to outpace revenue gains.

Margin expansion is something that the company has also proven successful at over the long term. From 2014 to 2023, the operating margin expanded 580 basis points to 17.1%. While that growth over the years is good, what is more impressive is that Thermo Fisher has projected an operating margin of 22.5% to 22.8% for 2024, which is markedly above what the company has historically produced.

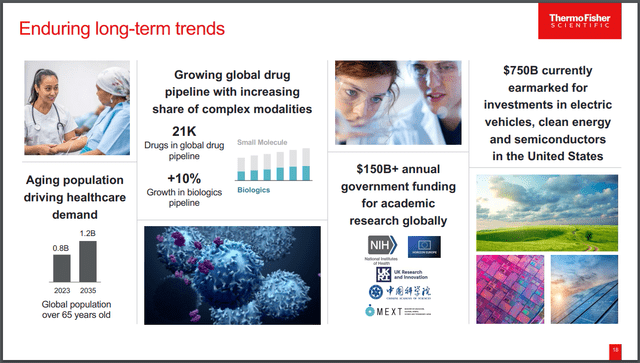

There are additional reasons to be optimistic about the company besides just its track record and margin expansion.

First, Thermo Fisher enjoys some strong tailwinds to its business.

The global population continues to age. The number of people 65 and older is expected to grow by 50% by the middle of the next decade. With old age comes the need for additional healthcare services. The need for products that can aid further scientific advancement will be necessary to meet this need, which is a major reason governments around the world are spending so much on medical research.

Thermo Fisher is already among the largest in its industry and is well-known and trusted by its customers. This places it in an enviable position when it comes to addressing the demand that will come with an aging population.

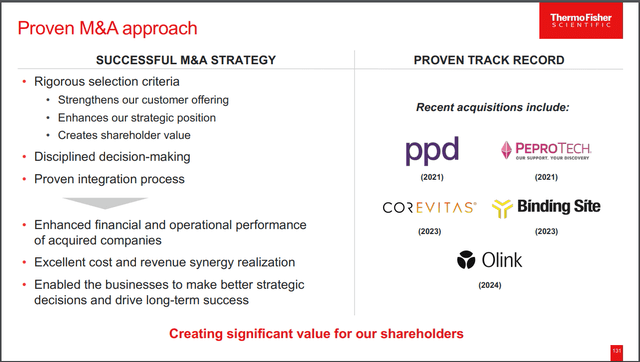

In addition, the company can augment its core business through the use of mergers and acquisitions.

Thermo Fisher has been extremely active on the acquisition front in recent years. Most recently, the company completed its more than $3 billion purchase of Olink in early July. Olink is a leading name in the proteomics market, which is the study of proteins, and should complement Thermo Fisher businesses in this area.

Finally, Thermo Fisher spends heavily on research and development to further optimize its portfolio. The company spends ~3% of annual sales on R&D.

The combination of improving margins, tailwinds, and historical performance likely means that Thermo Fisher will be able to continue to produce double-digit earnings growth.

Dividend Analysis

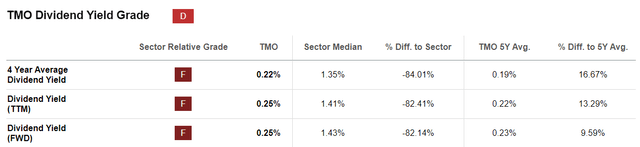

Shares of Thermo Fisher yield just 0.3%, which is well below that of the healthcare sector.

This could make the stock unappealing from an income perspective, but the low yield is not for a lack of trying on the company’s part. After holding its dividend steady from 2013 to 2017, Thermo Fisher began to aggressively raise its payments to shareholders. The dividend has a 10- and 5-year compound annual growth rates of 9.9% and 15.5%, respectively.

The company continues to aggressively increase its dividend, which included an 11.4% raise for the first payment of this year and a nearly 17% increase last year. In total, Thermo Fisher has a dividend growth streak of 7 years.

Historically, Thermo Fisher has rarely offered a compelling yield, with shares routinely averaging an annual average yield below 0.5%.

The reason that the stock’s yield remains so low is because the share price appreciation has been so immense over the last decade. Most investors would likely trade income for the nearly 430% gain in the stock price.

The good news is that the dividend is well protected, leaving room for additional increases going forward. Using current EPS estimates, Thermo Fisher’s projected payout ratio for 2024 is just 7.2%, lower than the 10-year average payout ratio of 9.1%.

Thermo Fisher generates tremendous free cash flow, including almost $8 billion over the last four quarters. The company has averaged nearly $7 billion of free cash flow going back to 2020. During this period, the dividend free cash flow payout ratio was just 6.2%.

The yield might be lacking, but Thermo Fisher’s dividend is likely one of the safest in the marketplace when you consider its payout ratios.

Valuation Analysis

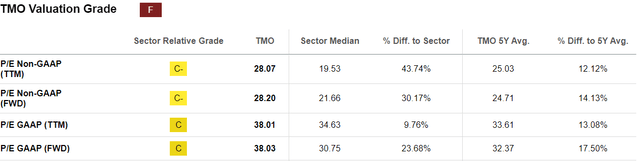

Given the change in share price over the long term, it is not surprising then that Thermo Fisher trades with an elevated valuation.

Currently, the stock trades at more than 28 times expected earnings-per-share. This is a premium to both the healthcare sector’s median figure and to the stock’s own historical average.

I would argue that Thermo Fisher does deserve to trade with a valuation that is higher relative to its peer group, given that the company has consistently demonstrated strong growth rates over a long period of time.

However, the current valuation does not leave much room for error in my estimate. A premium to the historical average, say 25 to 26 times earnings estimates, accounts for the quality of the company in my opinion, but at a more reasonable valuation. Therefore, I would look to add the stock in the $544 to $565 range, which is 6% to 11% below the current share price.

Risks to Investment Thesis

As much as I like the company, there are factors to consider that could lead to a price decline.

The healthcare sector is at risk for disruption. A misstep by Thermo Fisher or an ill-timed acquisition could cause the company to lose its leadership position.

The sector is full of companies that provide products and services that can be considered recession-proof, which has allowed for some names to have extensive dividend growth histories. While Thermo Fisher’s dividend growth has been impressive in the short term, the dividend has been paused for long periods of time before. This could happen again were the company to experience prolonged headwinds.

Importantly for income-seeking investors, the current yield is a fraction of the median yield for the sector. Those looking for higher levels of yield will likely be disappointed in what Thermo Fisher offers.

Lastly, while Thermo Fisher is expected to see a return to double-digit earnings growth as soon as next year, shares could see a valuation re-rating if the company fails to deliver on lofty targets, leaving investors holding a high multiple name that is struggling to grow at the expected rate. That could result in a steep drop in the share price.

Final Thoughts

There is a lot to like about Thermo Fisher, including its extensive growth track record, market tailwinds, and ability to outperform its peers.

That said, the valuation is higher than what the stock has traditionally traded with, and the dividend yield is extremely low. While I am not averse to owning lower-yielding stocks, I do prefer a higher margin of safety when adding names that trade with elevated multiples. At this point, Thermo Fisher trades above a valuation level I am comfortable with.

Therefore, Thermo Fisher is on my watch list, but I rate the stock as a hold until the valuation is closer to its historical average.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.