Summary:

- Thermo Fisher Scientific is finally starting to show signs of growth after getting through the headwind of declining covid-related business.

- Growth sources include increased business in China, completion of the Olink deal, and an increase in the number of clinical trials.

- Financial model updates and valuation analysis suggest the stock is currently priced at fair value, making it a Hold for now.

Monty Rakusen/DigitalVision via Getty Images

Slow Progress Justifies Hold Rating

Thermo Fisher Scientific (NYSE:TMO) stock has done little since my last quarterly review, down about 2% including the bounce it got after reporting 2Q 2024 earnings. The downgrade to Hold in my last article has been a good call so far.

The thesis at that time was that Thermo’s long-term growth plans still looked feasible, despite headwinds from the declining covid-related business that supercharged the company in 2021 and 2022. This new growth had yet to emerge, but the valuation of the stock already priced it in.

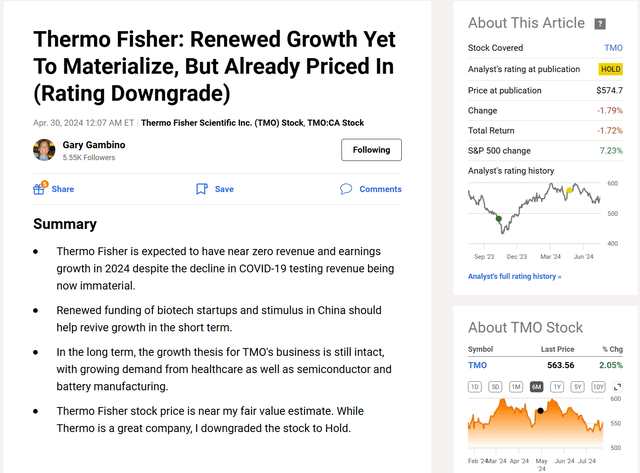

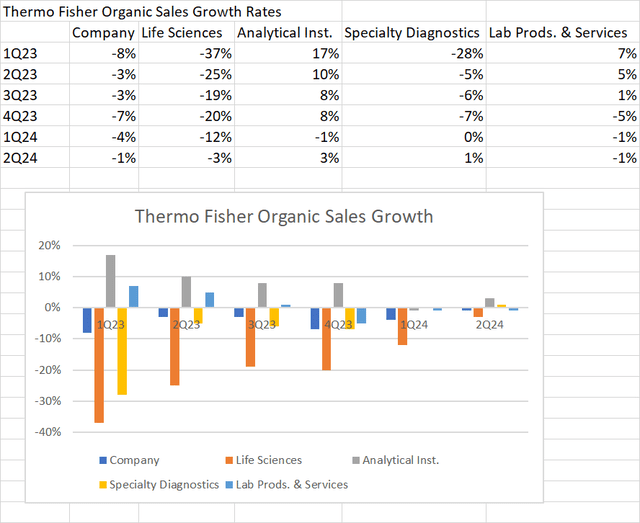

Since then, Thermo Fisher has shown continued signs of gradual improvement. After a year and a half of declining sales, 2Q results showed only a 1% year-on-year organic decline and would have been flat excluding the decline in covid-related revenue. The rate of improvement has varied across Thermo’s different segments. Life Sciences Solutions and Specialty Diagnostics have been improving since early 2023, while Analytical Instruments and Lab Products and Services appear to have bottomed in the last quarter or two. Lab Products and Services is the last segment to have significant pandemic-related sales, with its bioproduction facilities used in vaccine and treatment production. The other segments, more focused on viral research and testing, saw their covid-related revenue tail off earlier.

Author Spreadsheet (Data Source: Thermo Fisher 2Q 2024 earnings supplement)

This slow improvement is reflected in Thermo Fisher’s guidance update for the full year 2024. The company raised its sales outlook to $43.4-$44.3 billion, up only 0.1% at the midpoint. EPS guidance increased to $21.29-$22.07, up just 0.5%.

The 2024 guidance is less optimistic than Thermo’s long-term targets, which has the company growing sales at 7%-9% per year. This is 3 percentage points better than their 4%-6% expectation for overall market growth. EPS growth would then be in the low double-digit range, considering margin improvements and share buybacks. While this is a big reach from the microscopic growth in 2024, some growth drivers are now coming into better view. Nevertheless, the stock valuation still suggests this growth is already priced in.

Emerging Growth Sources

Last quarter, I touched briefly on China as a re-emerging growth driver for Thermo. Since then, the country has released a 5-year plan that focuses on “High-Quality Growth“, as opposed to debt-driven, environmentally unsustainable development pursued in the past. China’s government media outlet described the stimulus program to achieve high-quality growth in this way:

During this year’s “two sessions,” Chinese Premier Li Qiang announced a projection of around 5 percent growth for China’s economy for 2024, highlighting the government’s focus on moderate yet high-quality growth.

To achieve it, China will launch a year-long program to stimulate consumption; launch policies to promote digital, environmentally friendly and health-related consumption; increase effective investment; modernize the industrial system; and develop new quality productive forces faster.

Thermo’s core market of healthcare research is clearly stated as a stimulus target. Other markets, such as sample analysis for environmental quality monitoring and electron microscopy to support chip manufacturing are also supported by Thermo’s products, mainly within the Analytical Instruments segment.

Both the national and provincial governments have been documenting their high-quality growth targets, and Chinese companies and institutions are beginning the process of applying for subsidies under these programs, according to Thermo management on the earnings call. While this is expected to impact Thermo sales in 2025, it is encouraging that China is already leading the world in terms of reported sales growth for Thermo in 2Q 2024. Growth was “mid-single digits” in China, as opposed to up low single digits in Europe and down slightly in North America.

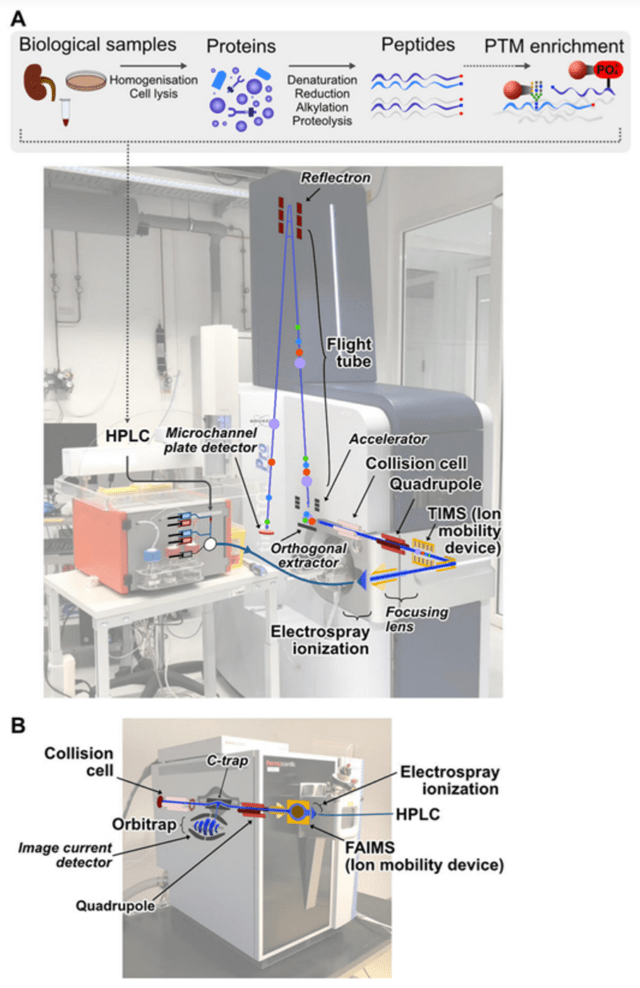

Thermo will also see inorganic growth in the second half as the $3.1 billion acquisition of Olink has now closed. As I noted in a previous article, this deal does not impact short-term results significantly, with just $200 million of sales on a standalone basis in 2024. Olink will be part of Thermo’s Life Sciences segment with its focus on proteomics, or the qualitative and quantitative analysis of proteins. Longer-term, there are clear synergies across different parts of Thermo Fisher. Olink makes assays and software for analyzing proteins. These are run on Orbitrap mass spectrometers, which are a key product in Thermo’s Analytical Instruments segment. Olink also offers analysis services to customers who don’t own the equipment themselves, a complement to Thermo’s Lab Products and Services segment.

The pace of new clinical trial authorizations has picked up, according to Thermo Fisher management on the earnings call. This is confirmed by data from the National Institutes of Health on clinicaltrials.gov. In the immediate post-pandemic environment, new clinical trial registrations increased slowly, from 36,722 in 2020 to 39,721 in 2023. So far, in 2024, however, there have been 25,572 new clinical trials registered through 7/24. This works out to a full-year pace of 45,500 new trials.

Finally, the headwind from declining pandemic-related sales is nearing its end. The current pace of these sales is down to $400 million per year, $100 million for diagnostic testing and $300 million for vaccine and therapy contract manufacturing. This amounts to just 1% of Thermo’s annual revenue. As we saw in the table above, the Specialty Diagnostics segment has returned to growth, with good demand for transplant and immunological diagnostics. The Laboratory Products and Services segment is the last to see the unwinding of the pandemic business, but management noted on the call that there is demand in other areas for the capacity that was being used for vaccine fill and finish operations. Margin expansion is also possible from these new customers.

Financial Model Update

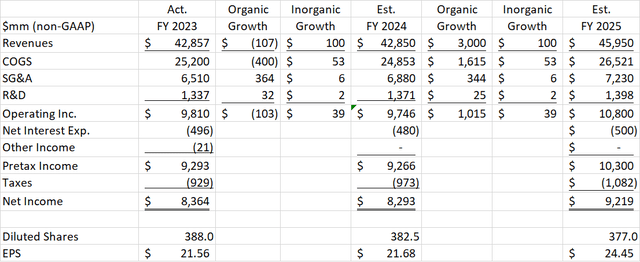

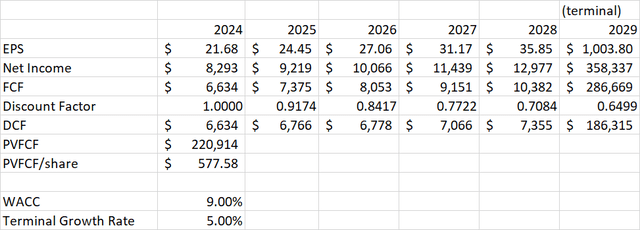

I made only minor changes to my model since last quarter. Sales are lower by about $100 million and SG&A higher by $150 million, but cost of goods is down $400 million as we have seen improved gross margins so far in 2024. This works out to an EPS estimate of $21.68 for 2024, in line with company guidance. For 2025, my EPS estimate is $24.45, down just $0.08 from last quarter’s model due to higher SG&A, extending the increase we have seen so far in 2024. The organic sales growth assumption for 2025 is 7%, the low end of Thermo’s long-term target. My 2025 estimate is about 1% above the analyst consensus at the time of writing.

Valuation

My DCF analysis has also changed only slightly. For 2026-2028, I am using analyst consensus estimates for earnings, which are down around 1% from last quarter. I am using the same assumptions of 5 million shares per year buyback and 80% free cash flow conversion to get my FCF estimates. Terminal growth rate and WACC are also unchanged.

The resulting DCF valuation is $577.58 per share, down from $582.68 last quarter. This is only 1-2% below where the stock was trading on the day of the earnings release, making it a Hold.

Capital Management

Thermo Fisher’s overall debt profile did not change in 2Q. $700 million of long-term debt rolled into short-term, as it is now within 1 year of maturity. Thermo ended the quarter with debt/EBITDA leverage of 3.3x gross, or 2.5x net. The company had a cash and investments balance of $8.8 billion at quarter-end, but $3.1 billion of that has since been spent on the Olink acquisition.

I do not consider this level of debt a problem at all. Interest coverage (operating income / net interest expense) has been 24x year-to-date. A lot of Thermo’s debt has been in the form of euro-denominated bonds at very low interest rates in the 0%-2% range. Still, Thermo’s interest coverage will decrease with lower interest income as the cash previously set aside for the Olink deal has been spent. Also, the $1.5 billion due in March and April 2025 was in the form of these low-interest euro bonds. The company would likely face higher interest rates if it tries to refinance this debt. I would like to see the company focus on paying this down in 2025 rather than expanding buybacks or dividends.

Starting from my FCF estimate of $6.6 billion for 2024, Thermo used $3.1 billion on the Olink deal, $3 billion on share buybacks, and will spend a total of $0.6 billion on dividends. That leaves nothing for debt reduction in 2024, but in the absence of a big acquisition next year, I expect Thermo to pay off the debt currently classified as short term, plus another $0.7 billion coming due in the second half of 2025.

Conclusion

Thermo Fisher is still on target for flat sales and earnings in 2024, but growth drivers are emerging with China, Olink, increasing clinical trials, and contract manufacturing demand to replace declining vaccine business. These will go a long way toward getting back on track to Thermo’s 7-9% long-term sales growth target. Nevertheless, at $570, the stock has a P/E of 26.3, which is at the high end of what I like to see for a stock with EPS growing around 13% per year. The DCF analysis update similarly suggests that the stock is currently only 1-2% below fair value. Thermo Fisher has been a successful and disciplined grower that can appreciate over the long term but for now the stock remains a Hold due to valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.