Summary:

- Thermo Fisher Scientific has strong growth prospects due to easing COVID-19 headwinds, improving Chinese and biotech markets, and favorable funding environments.

- The company’s margins should benefit from volume leverage, cost-saving initiatives, M&A synergies, and favorable price/mix as organic growth improves.

- TMO’s valuation is attractive, trading at a discount to historical averages and peers like Danaher, suggesting potential for P/E multiple re-rating.

- Given the positive growth outlook and attractive valuation, I have a buy rating on Thermo Fisher Scientific.

JHVEPhoto

Investment Thesis

Thermo Fisher Scientific Inc. (NYSE:TMO) has good growth prospects ahead. The company’s revenue growth should benefit from easing year-over-year comparisons and dissipating COVID-19 Vaccines and Therapies-related headwinds. In addition, improving Chinese end markets thanks to increasing clarity for government stimulus packages, and recovering the biotech end market due to improving funding environment should also help the company in delivering positive growth moving forward. In addition to good organic growth, I am also expecting good inorganic contributions from acquisitions given a reasonable leverage and reversal in the interest rate cycle.

On the margin front, the company should benefit from volume leverage as sales improve, cost-saving initiatives, M&A cost synergies, and favorable price/mix. The company’s valuation also looks attractive as it is trading at a discount to its historical averages as well as at a discount compared to high-quality peers like Danaher (DHR). Hence, given the good growth prospects ahead and an attractive valuation, I have a buy rating on the stock.

Thermo Fisher Scientific’s Revenue Analysis And Outlook

After seeing a solid demand during the COVID-19 period, the company sales have declined in the recent year due to headwinds from reduced COVID-19-related sales and cautious customer spending. However, the sales seem to be bottoming at the current levels.

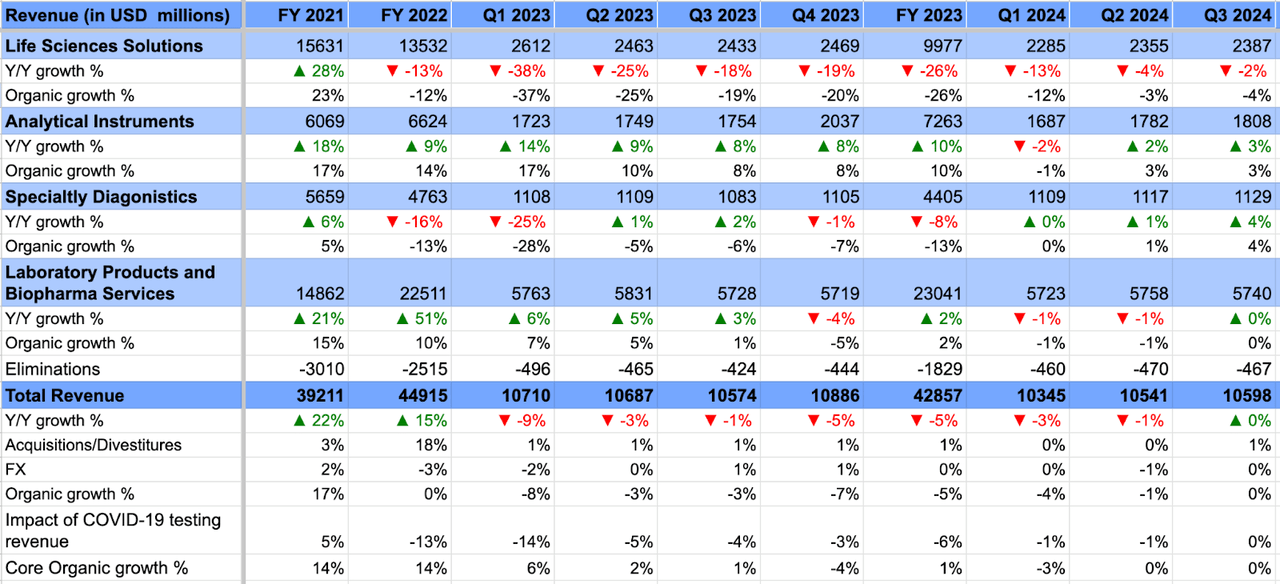

In the third quarter of 2024, the company’s revenue of $10.598 billion was flat Y/Y and grew by 0.5% sequentially from Q2 2024. Core organic revenues, which exclude the impacts of COVID-19 testing revenue, acquisitions, and currency translation, were also flat Y/Y.

Segment-wise, in the Life Sciences Solutions segment, revenues declined by 2% Y/Y on a reported basis and 4% Y/Y organically, mainly due to moderation in COVID-19-related revenue. The Analytical Instruments segment’s revenue increased by 3% Y/Y organically, driven by strong growth in the electron microscopy business. In the Specialty Diagnostics segment, both reported revenue and organic revenue grew by 4% Y/Y attributed to increased revenues in the transplant diagnostics and immunodiagnostics businesses, as well as the healthcare market channel. Finally, in the Laboratory Products and Biopharma Services segment, both reported and organic revenue were flat Y/Y as growth in the research and safety market channel and the clinical research business was offset by lower revenues from COVID-19 vaccines and therapies.

TMO’s Historical Revenue Growth (Company Data)

Moving forward, I am optimistic about the company’s growth prospects. After three years of declining organic sales, comparisons are easier and most of the COVID-19-related sales run down has already happened. So, we are close to the bottom in terms of organic sales.

The company’s organic growth decline went from -4% Y/Y in Q1 2024 to -1% Y/Y in Q2 2024 to flattish in Q3 2024. If we look at last year’s organic sales declines, it went from -3% Y/Y in Q3 2023 to -7% Y/Y in Q4 2023. So, the company will see ~400 bps easier comparisons in Q4 and should return to organic growth based on this easier comparison alone.

Another interesting thing to consider is that the decrease in COVID-19 vaccines and therapies was around 300 bps of headwind last quarter. Excluding it, the underlying sales growth was positive. Moving forward, the COVID-19 vaccine and Therapies related headwinds are decreasing and, according to management, FY25 should be the last year with these headwinds and the impact in FY25 being lesser than that seen in FY24. So, the lesser impact from this headwind should also help sales growth.

Some of the company’s key end markets that faced challenges in recent years are also expected to improve moving forward. China has been challenging and while the Chinese government announced a stimulus package, it didn’t help the company’s sales as there was a lack of clarity around rules and the customers delayed orders as they waited for more clarity around rules and deployment of funds. However, this should change moving forward and as these funds get deployed, we should see the Chinese market becoming a tailwind in FY25 compared to a headwind in FY24.

Another end market that was challenging in the last couple of years was biotech, but the funding environment there is also improving. With interest rate cycle reversal and broader sentiments in equities turning to risk-on mode, I expect continued improvement in this market. There is usually some lag between funding and deployment. So, while this improvement is not yet getting reflected in the recently reported sales, it should become apparent over the next few quarters.

Below is the relevant excerpt from last quarter’s earnings call, where management talked about improving the biotech market,

“The 2 things we did talk about, about what could change the range for this year was how would biotech perform in terms of funding and what would happen in China, right? And biotech is progressing in the right direction. Funding is improving, confidence is improving. As you know, there’s a lag between funding and ultimately how that flows into our industry. So that’s encouraging relative to what we saw certainly in the previous couple of years in that dimension. So that kind of helps you think a little bit about market conditions going forward.”

Marc Casper, Chairman and Chief Executive Officer, Thermo Fisher

In general, a lower interest rate environment reduces loan cost for funding equipment purchases, and this should be a positive for demand.

The company is also executing well in terms of innovation. Recently, the company’s Orbitrap Astral Mass Spectrometer won gold in the R&D 100 Awards (which recognizes the most revolutionary product in Science and Technology) under the market disruptors special recognition category where it was recognized as one of the most significant advancements in mass spectroscopy in the previous year. Management noted that adoption of Orbitrap Astral continues to be strong, and I believe the company’s innovation is helping it gain share and charge better prices despite challenging market conditions.

Overall, I am optimistic about the company’s organic growth prospects helped by easing comparisons, run off of COVID-19-related headwinds, benefit from China stimulus, improvement in biotech demand, and good execution.

In addition, the company has a solid track record of value creation through M&As. Last quarter, the company deployed $3.1bn in the Olink acquisition. The company’s net leverage (net debt to EBITDA) was at a comfortable 2.7x as of the last quarter end, and I expect continued M&As to complement organic growth moving forward as well.

Thermo Fisher Scientific’s Margin Analysis And Outlook

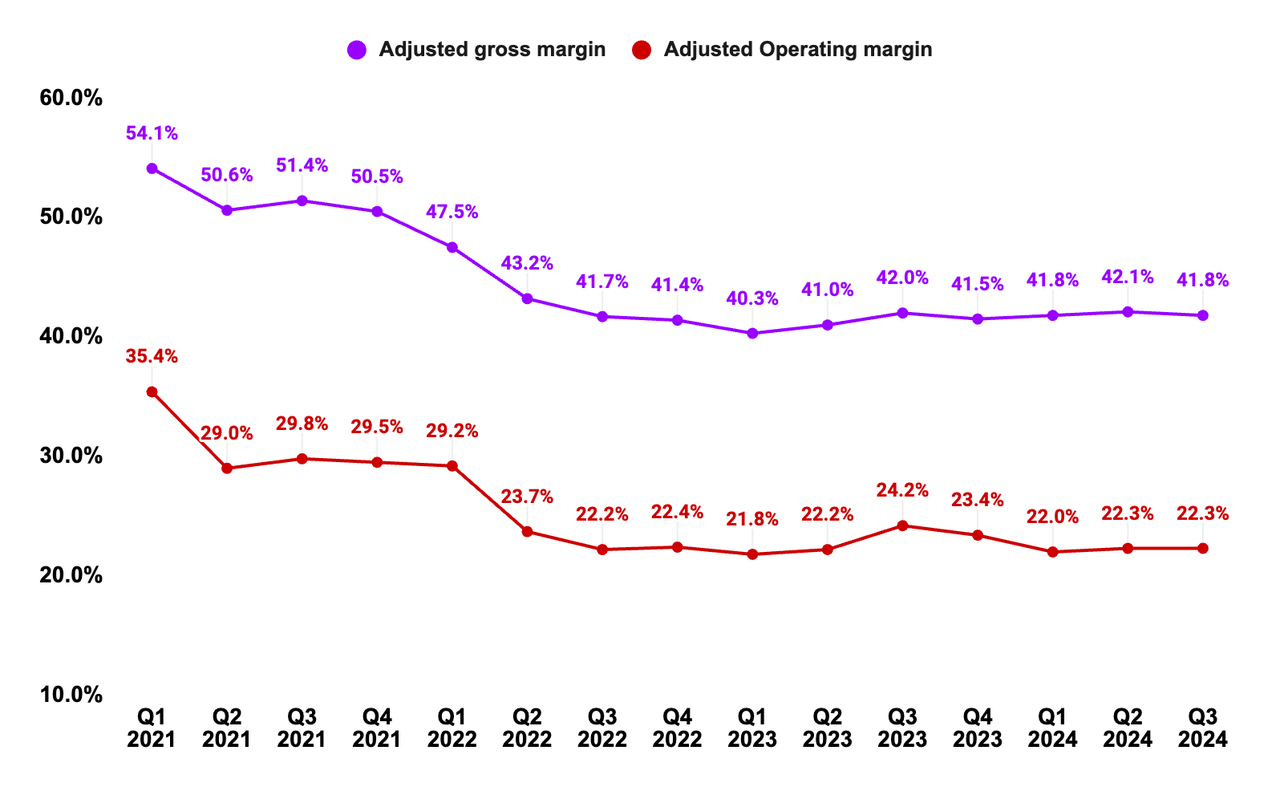

In Q3 2024, the company’s margins were affected by an unfavorable volume mix, retention costs related to the Olink acquisition, and elevated growth investments which more than offset the benefits from productivity improvement. As a result, the company’s adjusted gross margin contracted by 20 bps Y/Y to 41.8% and the adjusted operating margin declined by 190 bps Y/Y to 22.3%.

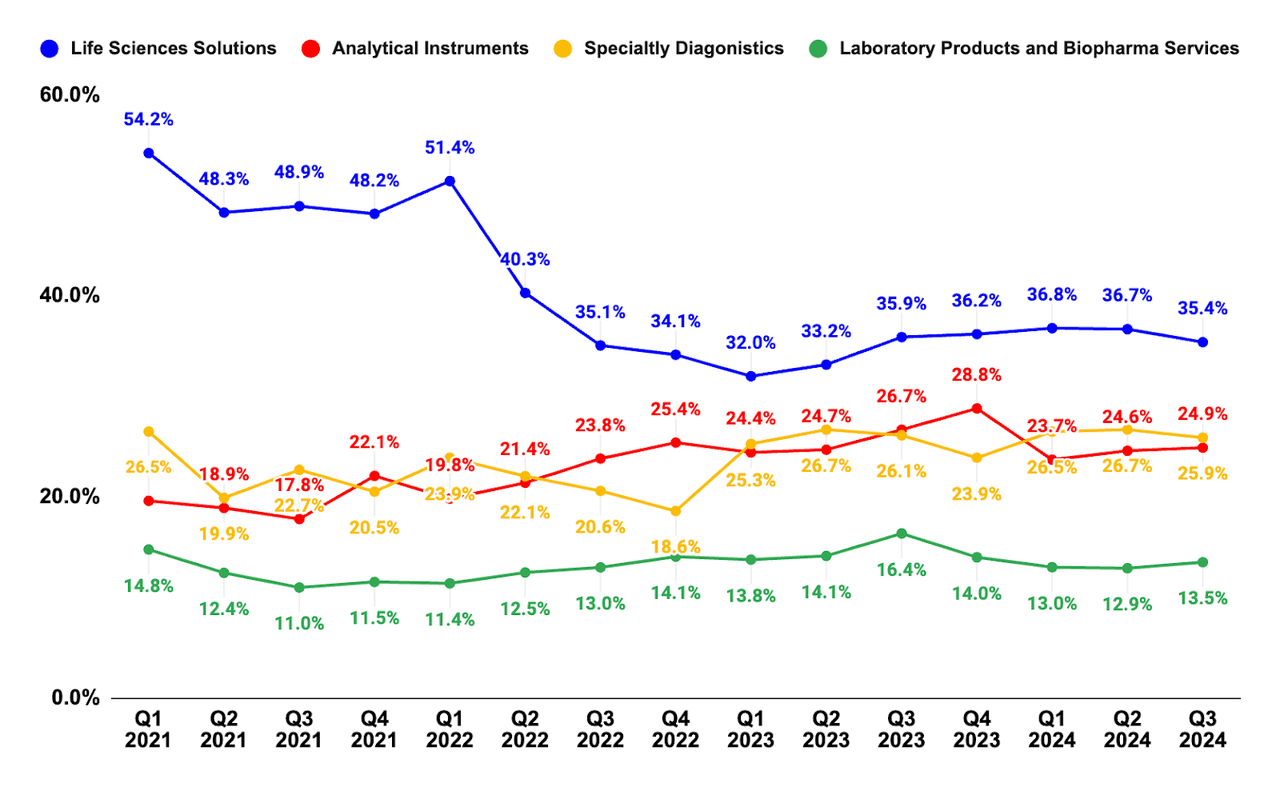

On a segment basis, the operating margin contracted by 50 bps Y/Y in the Life Sciences Solutions, 180 bps Y/Y in the Analytical Instruments, 20 bps Y/Y in the Specialty Diagnostics, and 290 bps Y/Y in the Laboratory Products and Biopharma Services segments.

TMO’s Adjusted Gross Margin and Adjusted Operating Margin (Company Data)

TMO’s Segment-Wise Operating Margin (Company Data)

Looking forward, the company’s margins should benefit from volume leverage as organic growth improves. The company is also doing a good job in terms of cost reduction through its Practical Process Improvement (PPI) business systems. Last quarter, the company further enhanced the supply chain in Asia-Pacific by optimizing inventory across its network, while in Europe, it streamlined and automated the manufacturing process for high-end analytical instruments to meet strong demand. While the benefit from these cost improvement initiatives is not that apparent currently because of challenging demand conditions, once the volumes pick up we should see good incremental margins given the reduced cost structure. In addition, integration synergies from recent M&As and pricing/mix improvement from continued innovation should also help margins. So, I am optimistic about the company’s margin prospects.

Valuation

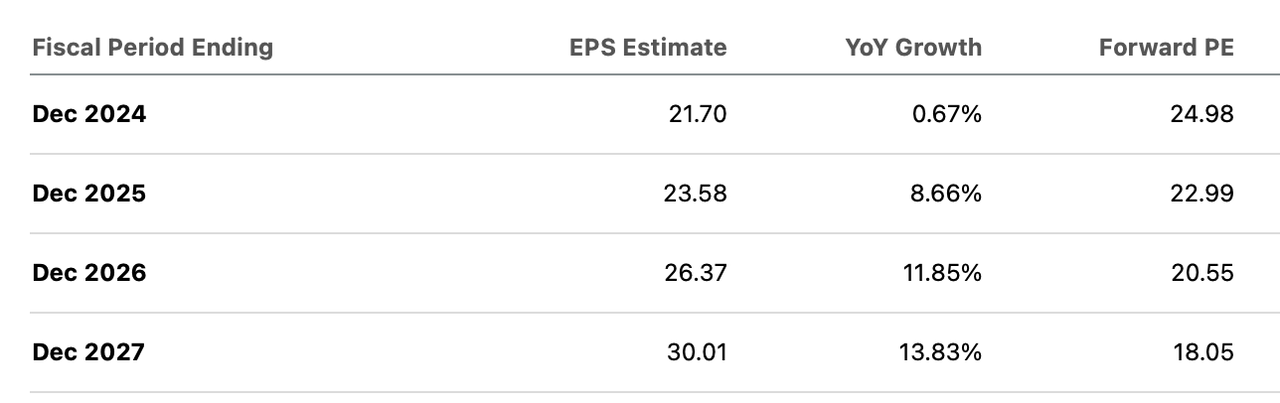

TMO is currently trading at 22.99x FY25 consensus EPS estimates of $23.58 and 20.55x FY26 consensus EPS estimates of $26.37. Over the last five years, the stock has traded at an average forward P/E of 24.78x.

The company’s revenues and EPS are expected to be flattish this year but resume growth from next year onwards. I believe as the company’s growth improves, its stock should see a re-rating in the coming years, and it should return close to its historical mid-20s P/E (forward) range.

TMO Consensus EPS Estimates (Seeking Alpha)

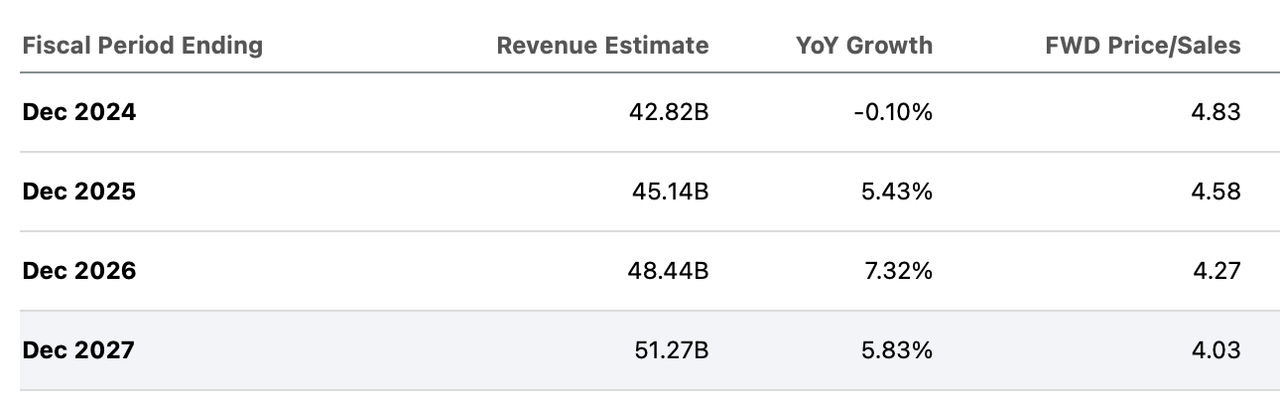

TMO Consensus Revenue Estimates (Seeking Alpha)

The company’s valuation multiple is also at a discount versus its peer Danaher which is another high-quality company exposed to similar end markets and is trading at a mid to high 20s P/E valuation range based on FY26 and FY25 EPS. So, there is some potential to close this gap.

A potential P/E multiple re-rating coupled with good growth prospects makes TMO stock a good Buy.

Risks

-

The incoming Trump Administration is known for strict tariff policies. TMO due to its global sales and supply chain exposure, is not immune to tariffs. Last time, the company was able to navigate it well through price increases and changes in the supply chain. I expect a similar response to any tariffs this time as well. Nevertheless, it may cause temporary short-term disruptions until the company adjusts to them.

-

The company’s inorganic growth strategy is relatively riskier than organic growth as there is always a risk related to overpaying for an acquisition, execution issues with integrations, etc.

Takeaway

In my view, Thermo Fisher Scientific Inc.’s growth outlook looks positive moving forward after seeing a decline over the past years. The company’s revenue growth is nearing a bottom, and I expect it to inflect positively in the coming quarters thanks to easier comparisons. Additionally, COVID-19 vaccines and Therapies-related headwinds that impacted sales over the past years are also dissipating, supporting sales ahead. Furthermore, improvement in end markets given increasing clarity from the Chinese government stimulus package and improving funding environment within the biotech end market should also support sales growth ahead. Lastly, good traction toward the company’s innovations should help increase market share. These tailwinds along with inorganic growth from M&As should help the company deliver positive sales growth ahead. This improving sales should also provide good operating leverage which, along with cost-saving initiatives, M&A cost synergies, and favorable price/mix should help in margin growth.

So, the company has good prospects ahead. The valuation also looks favorable as it is trading at a discount to historical averages as well as its peer Danaher. As the company’s sales turn positive moving forward, I believe the P/E multiple should re-rate to its mid-20s historical levels, providing a good upside. Hence, I have a buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TMO, DHR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.