Summary:

- I am upgrading Thermo Fisher Scientific Inc. to a “Buy” with a fair value of $610 per share due to anticipated recovery in the pharma and biotech industries.

- Thermo Fisher’s high-impact innovations and strategic M&A, including the acquisition of Olink, support a 7%-9% organic revenue growth and mid-teens EPS growth.

- Q3 results show stabilization in life sciences, with raised full-year adjusted EPS guidance, maintaining revenue guidance of $42.4 to $43.3 billion.

- Despite risks in China, I favor Thermo Fisher’s diversified portfolio and growth capabilities, projecting 9% organic revenue growth and 30bps annual margin expansion.

JHVEPhoto

For Thermo Fisher Scientific Inc. (NYSE:TMO), I highlighted the downturn in the pharma and biotech industry as well as weak growth in China in my previous article published in January 2024. I anticipate the overall pharma and biotech industry will start to recovery as the Fed has begun to cut the interest rate. After several quarters of decline in China, I anticipate the market will start to normalize for Thermo Fisher Scientific. Their Q3 result demonstrated some end-market stability, particularly in the life science market. Therefore, I am upgrading to a “Buy” with a fair value of $610 per share.

2024 Investor Day

Thermo Fisher Scientific had their 2024 investor day on September 19th. I think the major takeaway can be summarized as follows:

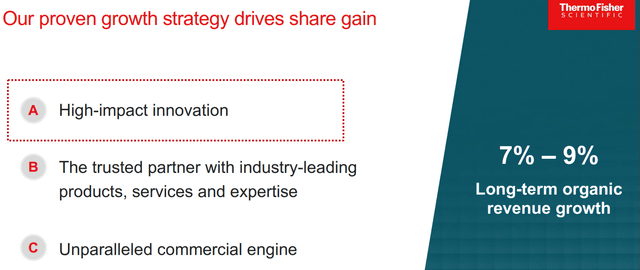

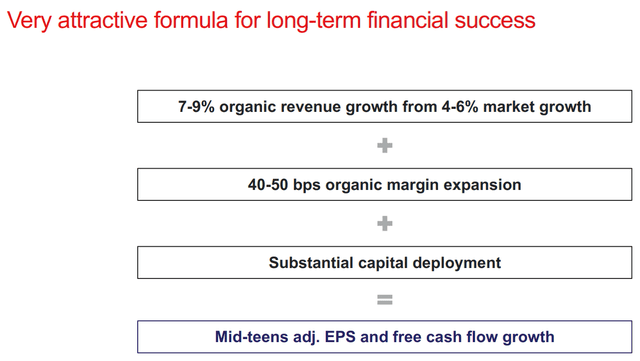

- High-impact innovations: Thermo Fisher Scientific has a broad range of portfolios across the life science, analytical instruments, specialty diagnostics and laboratory products. The company spends $1.3 billion in R&D with 7,200 R&D scientists and engineers, making solid progress in key technologies including proteomics, precision medicines, biology and advanced materials. The high-impact innovation enables the company to launch new products with higher selling price, sustaining their 7%-9% organic revenue growth with margin expansion.

Thermo Fisher Scientific 2024 CMD

- M&A: Thermo Fisher Scientific plans to allocate 60%-75% of total capitals towards M&A, focusing on high-ROI areas. In July 2024, the company completed the acquisition of Olink, a leading provider of next-generation proteomics solutions, for $3.1 billion. Olink’s technology for proteomics could strengthen Thermo Fisher Scientific’s mass spectrometry and life sciences offerings. The management anticipates Olink will grow in the mid-teens in the future, with $200 million annual revenue in FY24. I view these acquisitions as highly accretive to shareholders.

- Lastly, Thermo Fisher Scientific provides a very attractive playbook for their future growth: 7%-9% organic revenue growth rate and mid-teens EPS growth. I think the growth ambition is aligned with their historical track record.

Thermo Fisher Scientific 2024 CMD

Q3 Result & Outlook

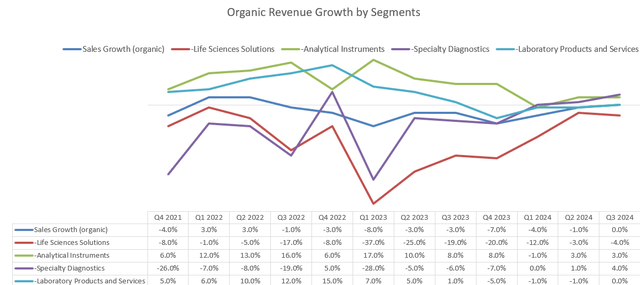

Thermo Fisher Scientific released its Q3 result on October 23rd before the market opened, delivering 0% organic revenue growth, as shown in the chart below. My key takeaway from the quarter is their core life sciences business has started to stabilize in recent quarters. The company raised its full-year adjusted EPS guidance to $21.35 — $22.07, up from its previous guidance of $21.29 — $22.07 while maintaining its revenue guidance of $42.4 to $43.3 billion.

Thermo Fisher Scientific Quarterly Results

During the quarter, the company launched their transmission electron microscope, a fully integrated multimodal analytical solution for chemical research. It is a perfect example of how Thermo Fisher Scientific executes their high-impact innovations, as discussed previously.

As the company has already delivered their results for three quarters, I don’t expect FY24’s actual result to deviate significantly from their guidance. For growth from FY25 onwards, I am thinking about the following factors:

- Life Sciences Solutions: The business segment has been significantly impacted by the weak market in pharma and biotech industries, declining by 12% in FY22 and another 26% in FY23. As the Fed began to cut interest rates, I anticipate the capital funding environment in pharma and biotech industries will gradually recover in the near future. I anticipate the segment will grow by 9%, aligned with the trend in a normalized economic environment.

- Analytical Instruments: Thermo Fisher Scientific is focusing on the broad array of analytical technologies for biology market. In addition, the company is investing in advanced materials and chemical analysis. I anticipate the segment will grow by 10% annually.

- Specialty Diagnostics: Their Specialty Diagnostics business covers clinical diagnostics, immunodiagnostics, microbiology and transplant diagnostics, with the majority of revenue generated from consumables. I project the segment will grow by 8% annually, primarily driven by the demands for service and consumables.

- Laboratory Products and Services: I project the segment will grow by 9%, in line with historical trends.

As such, I calculate Thermo Fisher Scientific’s revenue will grow by 9% organically. In addition, I anticipate the company will allocate 8.5% of total revenue towards M&A, contributing 2.4% growth to the topline.

I model 30bps annual margin expansion, driven by 10bps from new product launches, 10bps from SG&A reductions and 10bps from ongoing restructuring efforts. The WACC is calculated to be 9% assuming: risk-free rate 3.7%, beta 0.82; cost of debt 5%; equity risk premium 7%; equity balance $229 billion; debt $35 billion; tax rate 10%.

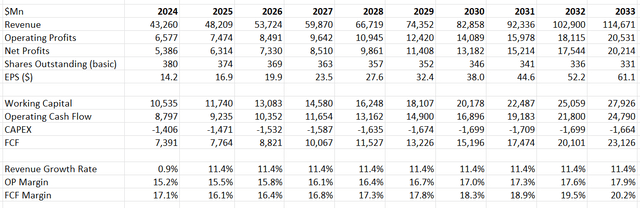

With these parameters, the DCF can be summarized as follows:

After discounting all the future FCF, the fair value is calculated to be $610 per share, as per my estimates.

Key Risks

China represents around 8% of total revenue, and the revenue has been declining since Q4 FY22 due to the sluggish economy and weak marketing conditions in the pharma and biotech industries. Although the Chinese government has tried to stimulate the local economy, it is still in the early stages, and I am not sure if their biotech and pharma market will recover in the near future.

Verdict

Similar to Danaher (DHR), Thermo Fisher Scientific is a well diversified healthcare company, providing essential products and services to the overall pharma and biotech industries. I favor their capabilities in product innovation, M&A and organic growth. I am upgrading to a “Buy” with a fair value of $610 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.