Summary:

- Thermo Fisher Scientific Inc. is being downgraded to a potential Sell opportunity near its 52-week-high.

- The company has experienced growth through M&A activity, focusing on laboratory products and biopharma services.

- The challenges Thermo Fisher faces are headwinds in the healthcare industry and flat company performance.

JHVEPhoto

We are downgrading our Buy assessment we issued to retail value investors for Thermo Fisher Scientific Inc. (NYSE:TMO) in January 2023. We assess it as a potential Sell opportunity near its 52-week high.

Profile

Thermo carved an impressive niche in the Health Care Sector of the Life Sciences Tools and Services Industry. The company was created from the merger of Thermo Electron and Fisher Scientific in 2006. The current market cap is $215.76B.

Growth has been spurred by M&A activity. The latest takeover is of Olink Holding AB (OLK), a biotech products and services business. Olink missed revenue and EPS estimates in its last announcement. Shares sold for $14.90 before Thermo’s $26 a-share cash offer.

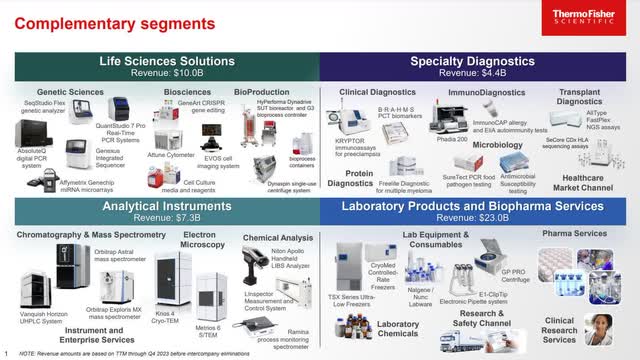

Thermo Fisher spent an estimated $100B accumulating over 70 companies in 16 countries. 53% of end market revenue is generated from North American sales, 25% from Europe, 22% from Asia and elsewhere. 38% of the 13 businesses bought in the last 5 years are in life sciences. 18% produce and sell testing and measuring equipment. The remainder are in software, hardware, and systems technology. Thermo is exploring ways to enhance products and services through AI. One focus of attention is how AI can impact laboratory automation.

Company Segments (Thermo Fisher Scientific)

Thermo’s 350K prime customers are labs and testing service centers in hospitals, pharmaceutical biotech, clinical diagnostic companies, universities, and government agencies.

Headwinds

Healthcare products and services are the S&P’s third largest industry. On April 2, 2024, U.S. Bank’s Wealth Management division released a review of the sector describing its underperformance in 2023; they forewarned healthcare products and services stocks are likely to lag the S&P in 2024.

Three leading ETFs we looked at reflect the industry’s struggles that Thermo Fisher faces as well. Vanguard Health Care Index Fund ETF Shares (VHT) are up over the last year by a mere +3.65% and +1.62% YTD. Seeking Alpha assigns its Quant Rating of Sell. The Health Care Select Sector SPDR Fund ETF (XLV) reports a similar upside in low growth numbers and has a Quant Rating of Sell. The SPDR S&P Health Care Equipment ETF (XHE) price is worse off; its shares are -12% over the last 12 months and -0.44% YTD. It, too, has a Sell Quant Rating. Revenue and earnings guidance for Thermo Fisher are dicey.

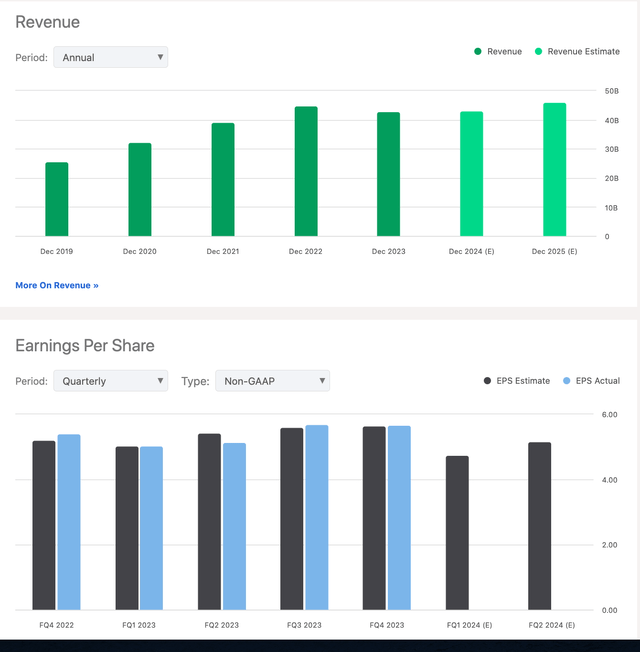

Revenue & Earnings TMO (Seeking Alpha)

We expect a lower quarterly EPS Y/Y when the company announces next earnings on April 24, 2024. Following better-than-expected EPS reports for the last two quarters, investors ran up the stock in the next 3 months, from $434 to $597 in March ’24. October ’23 estimate was forecast at $5.61, but was $5.69 per share. January ’24, the forecast was $5.64 but came in at $5.67.

We agree with the analysts’ consensus that the next quarterly earnings will be about $4.71 per share, which is down from last year’s same quarter of $5.03. S A estimates the FY ’24 EPS will hit $21.58. Thermo has the potential for an EPS in FY ’24 between $21.70 and $21.75 if cost-cutting measures take and interest rates hold. The company reported higher EPS than estimates in seven of the last eight quarters.

The watchword of corporate America in 2024 is “cutbacks.” Staff cuts and pursuing efficiencies in operations are omnipresent. Thermo is no exception. Management is beginning with 74 job cuts in a California facility. Rumor is this facility, Thermo tells Fierce Pharma, can potentially close. Thermo began eyeing a $450M cost-cutting program last July “due to slowing demand,” Susan Kelly reported on MedTech Dive.

We believe the current share price of around $565 is a fair value price. We multiply the 26.19 PE (FWD) times the anticipated high-end estimate for FY ’24 EPS of $21.70. The shares will tumble to the $500 range if the company stumbles on revenue and earnings.

Insiders sold few shares last quarter but their selling outstripped purchases over the past year, especially when the stock topped $550 per share. Hedge funds bought shares in late 2023 when the price dropped well-below $500 each.

Another headwind to our enthusiasm for Thermo Fisher is its levered/unlevered Beta of 1.24 over the last 12 months. That is a red flag for retail value investors. While the dividend was raised around 11.4% last February, its yield remains a paltry 0.28% offering no incentive for retail value investors to weather any future headwinds.

Valuation

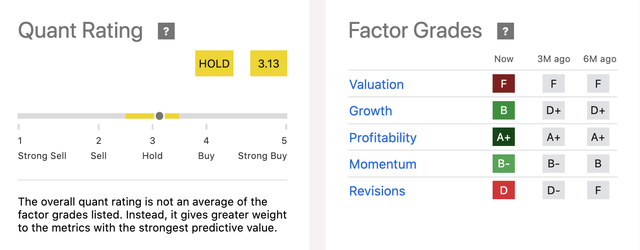

Quant Rating & Factor Grades (Seeking Alpha)

The current valuation metrics get poor-to-fair ratings. We do not expect improvements in the next few quarters because cutbacks and efficiencies take time to hit the bottom line of big corporations. For instance, Price-to-Non-GAAP, P/GAAP (FWD), P/Cash Flow, and P/Sales are graded C- compared to the healthcare sector medians. Short interest on the stock climbed steadily from November ’23 of $1.24B to a high on March 15, ’24 hitting $2B.

In addition to the double-digit dividend raise, management announced a $4B common stock buyback at the end of last year; these announcements the stock gave a lift to the stock, despite FY’23 revenue reported -5%, organic growth flat (+1%), and FY ’24 guidance of annual revenue from $42.1B to $43.3B which is close to the revenue for FY ’23.

Thermo’s long-term debt ending December 31, ’23 was over 8% higher ($31.3B) than at the end of FY ’22 ($28B). In the last report, the company had $8B in cash and equivalents and $9.6B in receivables. Its total current assets are +$24.5B. Total liabilities are $14B. Debt poses no short-term problem and interest payments are covered. We are disappointed the company seems to prefer job cuts, buybacks and acquisitions to significant debt paydown

Takeaway

Thermo Fisher Scientific’s stock tends to be volatile and its organic revenue growth is stagnant. Management is pushing to maximize AI’s value in its relevant segments. Most of its growth has come from M&A activity. S A assigns poor grades to revenue growth, EBITDA growth (FWD), EBIT growth (FWD), and EPS GAAP growth (FWD). The D+ for Free Cash Flow Per Share growth (FWD) needs to be watched.

We do not foresee a catalyst for the share price to move much higher than its current ~$565; perhaps another 5% on the strength of the overall stock market is possible with the stock’s Momentum (B+). The price has the potential to fall harder on any reports of slowing sales and lower EPS in 2024. Then, it can be a potential opportunity like last December when a record 112 funds owned the stock at an average price of about $485 per share. But for now, retail value investors ought to consider the value in a Sell opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.