Summary:

- Thermo Fisher Scientific is a leading healthcare supplier with strong customer relationships and a track record of impressive revenue and net income growth.

- TMO’s superior business model, focused on innovation and serving scientific customers, positions it for long-term growth and outperformance in the healthcare sector.

- Despite a challenging first quarter, TMO maintains a confident outlook, and its valuation, although not cheap, is justified by expectations of double-digit annual earnings growth.

marchmeena29

Introduction

I own two healthcare stocks. AbbVie (ABBV), which is a high-yield drug manufacturer, and Danaher (DHR), a diversified producer of healthcare equipment. Danaher is also the largest competitor of Thermo Fisher Scientific (NYSE:TMO), which is the star of this article.

In the past few days, I made the decision to make healthcare a major part of my portfolio. I want to add at least two more stocks in the industry, as I am a big believer in the value high-quality healthcare stocks can bring to the table.

Not only because of secular tailwinds but also because some come with tremendous pricing power, financial stability, and ways to let shareholders benefit from their success.

In this article, we’ll discuss Thermo Fisher. Although the stock has an ultra-low yield of 0.3%, I still believe it’s a great dividend growth stock. The company is a fantastic wealth compounder thanks to innovation, anti-cyclical customers, and its ability to generate value.

Hence, I will explain why I put TMO on my watchlist, despite the fact that I already own DHR. I’m likely to buy the stock for a number of portfolios that I manage as well.

So, let’s dive into the details!

A Quick Look Back

In my prior article, I already briefly discussed the company’s business model – especially in light of its 1Q23 earnings and funding risks related to elevated rates.

Moreover, Danaher noted some funding struggles among its biotech clients. After all, biotechnology is highly capital-intensive. Thermo Fisher didn’t say that it saw these issues. However, it mentioned that the funding environment is a factor worth monitoring.

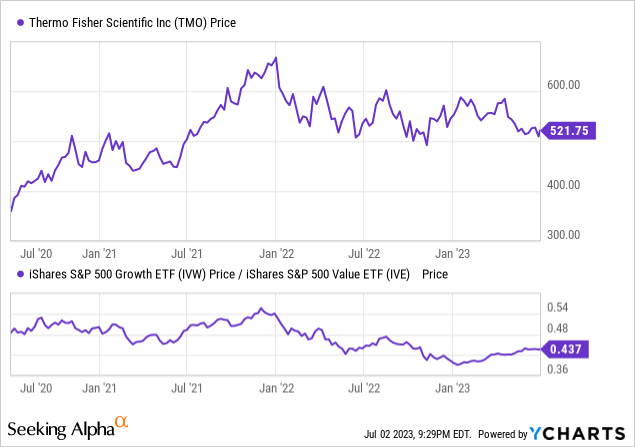

Since then, the stock has fallen by another 6% – despite the rotation from value to growth stocks that started in January.

While I will cover the business model again in this article – it’s too important to the company’s success – I will shed some additional light on its measures to grow, as this continues to be key in a challenging business environment. Not only because the company sticks to very ambitious growth targets, as reiterated at recent investment conferences, but also because of its more attractive valuation and my decision to include the stock in various portfolios that I manage.

Thermo Fisher’s Superior Business Model

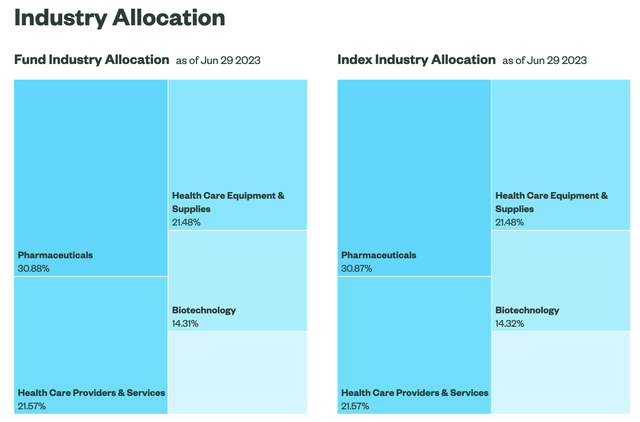

Healthcare is a highly complex sector. Looking at the holdings of the major healthcare ETF (XLV), we see that it consists of pharmaceuticals, healthcare equipment suppliers, biotechnology, healthcare providers, and life sciences.

While every single one of these industries has fantastic companies, I like to buy suppliers. In general, I believe in the power of suppliers. It may have something to do with my background in purchasing & supply management, but I believe that buying suppliers lowers competition risk, because suppliers sell to a wide range of buyers that compete with each other.

That’s where Thermo Fisher comes in. With a market cap of $201 billion, this Waltham-MA-based healthcare giant is one of the biggest healthcare suppliers in the world.

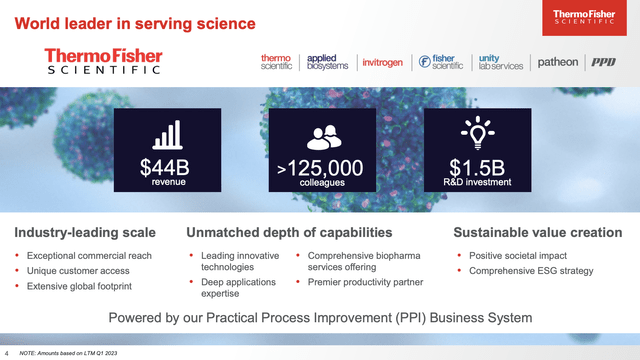

The company is a world leader in serving scientific customers, with strong brands, $44 billion in revenue, and 125,000 employees. The company invests heavily in research and development and capital expenditures to ensure that it stays on top of the game.

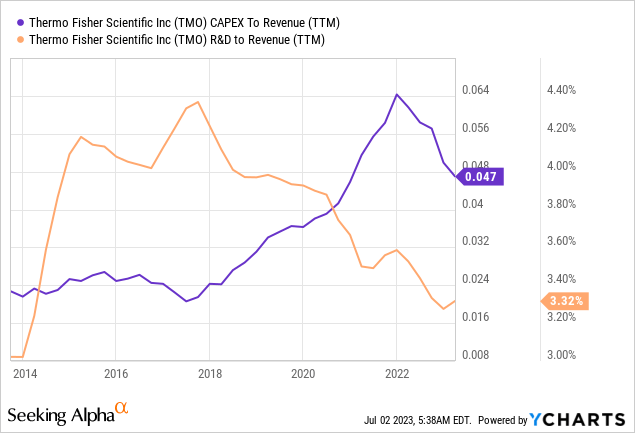

The company currently spends close to 5% of its revenues on CapEx and 3.3% of its revenues on R&D.

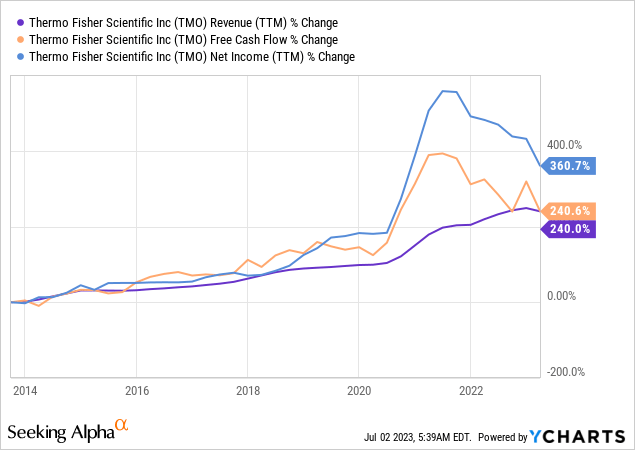

While R&D spending as a percentage of revenue is down, it needs to be said that revenue growth has been wild. Over the past ten years, revenues have grown by 240%. Net income has soared by 360%, thanks to higher margins. These numbers are wild and a sign of significant tailwinds in its industry.

Thermo Fisher believes that its mission is to enable customers to make the world healthier, cleaner, and safer by supporting important work in fields such as cancer research, diagnostics, and materials science.

The company’s products are aimed at making that possible, with a significant portion of its portfolio serving pharmaceutical, biotech, academic, and government customers.

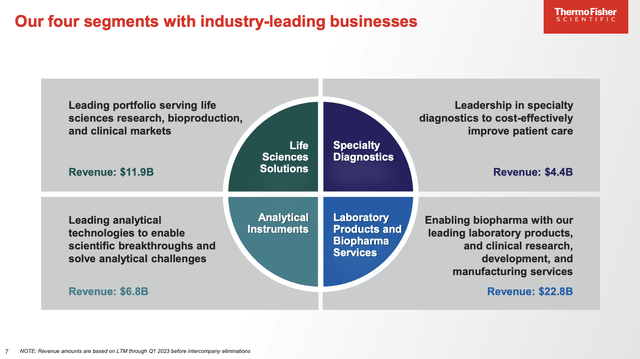

This is done through four segments:

- Life Science Solutions

- Specialty Diagnostics

- Laboratory Products and Biopharma Services

- Analytical Instruments

When it comes to the aforementioned surge in revenue and margins, the company is essentially making the case that this is caused by its ability to innovate and strong customer relationships. While that may seem obvious, it’s not at all obvious. Having strong relationships with buyers is what being a good supplier is all about. While TMO will never share with us how it achieves strong customer relationships, it needs to be said that researchers have spent decades figuring out what drives strong relationships.

Essentially, it can be said that buyers that have good relationships with suppliers benefit from better innovation. That is key in healthcare.

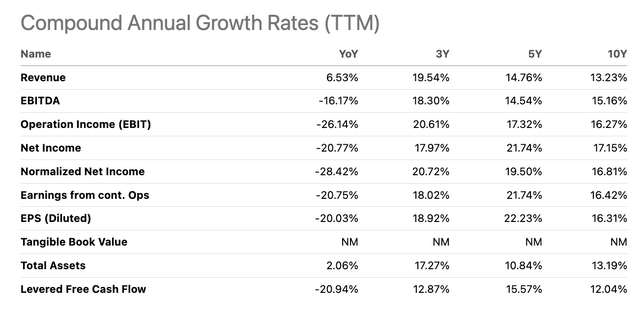

So, while the company has run into short-term headwinds (post-COVID), we see that the company has done tremendously well in the past. Using Seeking Alpha data, we see a few mind-blowing numbers over the past ten years:

- 13.2% compounded annual revenue growth.

- 15.2% compounded annual EBITDA growth.

- 17.2% compounded annual net income growth.

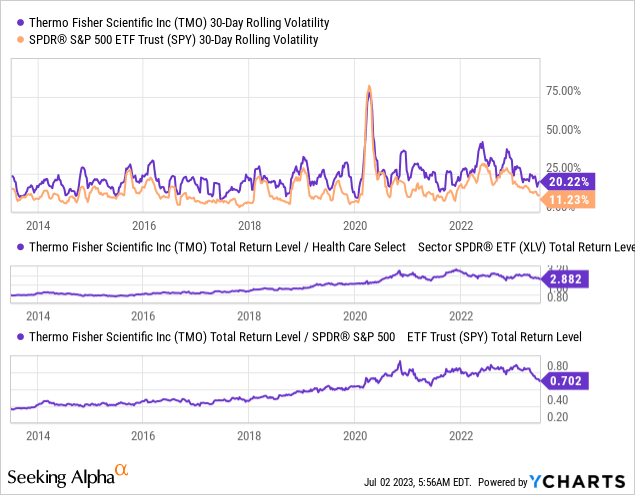

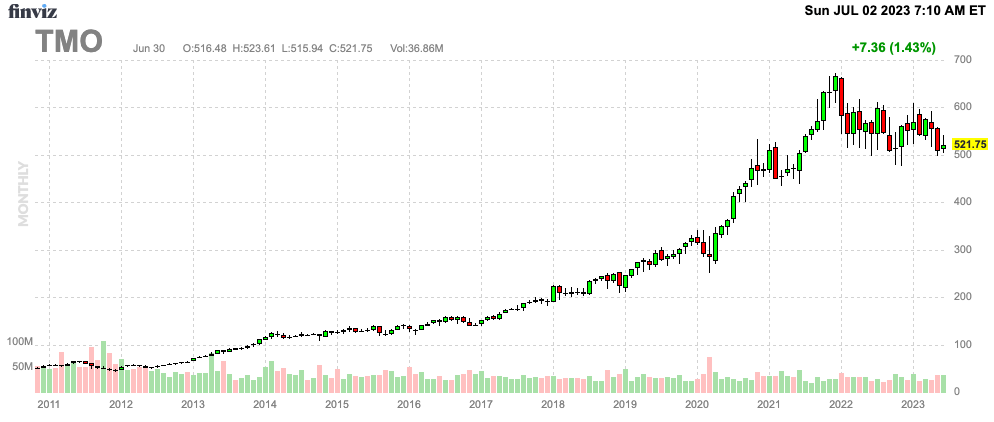

As a result of this anti-cyclical business model and stellar results, the company has outperformed the S&P 500 and the healthcare sector by a wide margin and on a very consistent basis. The chart below also shows that the company is doing this with subdued volatility, which makes it perfect for long-term portfolios.

With that in mind, what can we expect going forward?

What’s Next?

During this year’s Bernstein Strategic Decisions Conference, the company highlighted five key factors that are expected to fuel future growth.

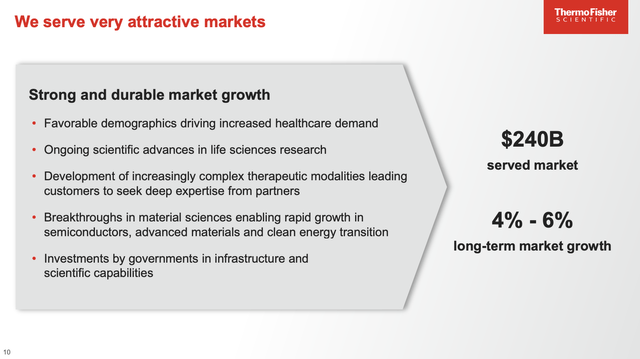

- First, the markets it serves have long-term growth potential driven by increasing healthcare demand, scientific research advancements, complex medicines, and investments in infrastructure. That’s secular growth.

- Second, Thermo Fisher’s growth strategy is based on high-impact innovation, being a trusted partner to customers, and leveraging its unparalleled commercial engine. This is based on the aforementioned strong supplier benefits.

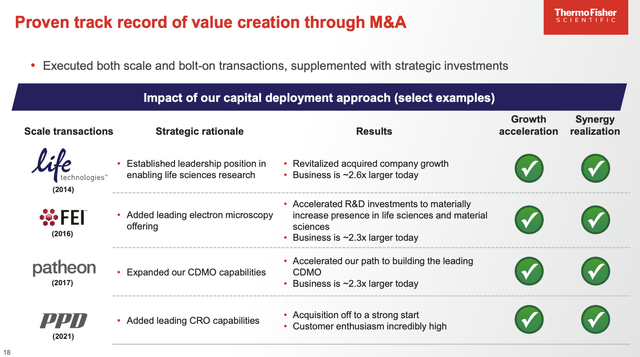

- Third, the company’s capital deployment approach, with a focus on M&A and shareholder distributions, creates shareholder value. Thermo Fisher has a disciplined approach to selecting and integrating acquisitions, with a strong track record of success.

- Fourth, the company’s PPI Business System supports continuous improvement and delivers a competitive advantage.

To enable our customers’ success in an increasingly competitive global environment, we leverage our PPI (Practical Process Improvement) Business System, a deeply ingrained philosophy of operational excellence which allows us to optimize processes, solve challenges and reduce inefficiencies. – Thermo Fisher Scientific

- Finally, Thermo Fisher’s ESG strategy ensures responsible business practices and value creation while minimizing risk. I wouldn’t call this a driver of growth, but I think maintaining strict ESG standards makes sure that the company can become a part of ESG-focused supply chains.

The company also gave us a few numbers. Thermo Fisher aims to achieve long-term growth targets of 7% to 9%

Growth strategy, right, which is based on three elements. Our long-term growth targets are 7% to 9%. We’ve grown faster than that in the last few years, but we think this is a good proxy for what our long-term growth will be.

TMO estimates that the industry it serves sees 4% to 6% annual growth, backed by the aforementioned (often secular) factors. It aims to outperform its industry using its five-pillar strategy.

Furthermore, during its Bank of America Securities Healthcare Conference in May, the company elaborated on its capital deployment and M&A strategy, which is a key factor in its success.

Essentially, the company clarified that the company’s long-term core growth target of 7% to 9% is unrelated to its capital deployment activities. The 7% to 9% growth target is about its existing portfolio.

The company highlighted its history of adjusting its outlook following M&A activities, such as the acquisition of Life Technologies. Thermo Fisher plans to continue being selective and disciplined in its M&A approach, considering opportunities that align with its strategy and generate favorable returns for shareholders.

The company anticipates deploying $40 billion to $50 billion on M&A in the upcoming years, reflecting the fragmented nature of the market.

With regard to its M&A plans, it needs to be said that rates on debt are much higher. However, because TMO has a healthy balance sheet, it is able to compete with companies with less favorable balance sheets. That opens up M&A opportunities despite interest rate headwinds.

Furthermore, with regard to organic growth, the company aims to improve its margins by 40 to 50 basis points per year, leading to mid-teens adjusted EPS growth per year, which would mean that TMO expects to continue the aggressive growth streak we’ve witnessed in the past.

It also helps that the company has a terrific balance sheet. The company ended the first quarter with $3.5 billion in cash and $35.3 billion in total debt. The leverage ratio was 3.2x gross debt and 2.9x based on net debt.

The company enjoys an A- credit rating.

TMO has a 0.3% dividend yield, which is backed by 15.2% annual compounding dividend growth over the past five years. However, due to this very low yield, I decided not to focus on the dividend in this article.

Valuation

1Q23 was a tough quarter for TMO – but not unexpected. After all, the tailwinds related to the pandemic are now quickly unwinding.

In 1Q23, total revenue declined by 9%. Organic revenue growth was negative 8% (adjusted for acquisitions of 1% and 2% currency headwinds).

COVID-19 testing revenue was down 14%. Core organic revenue growth, adjusted for COVID, was up 6%, which is a good sign.

Hence, despite a slightly more challenging macro environment, Thermo Fisher maintained its ambitious full-year outlook. The company expects revenues of $45.3 billion and adjusted EPS of $23.70 for 2023. The company also remains confident in its proven growth strategy and the power of its PPI Business System to navigate the dynamic environment and deliver differentiated performance.

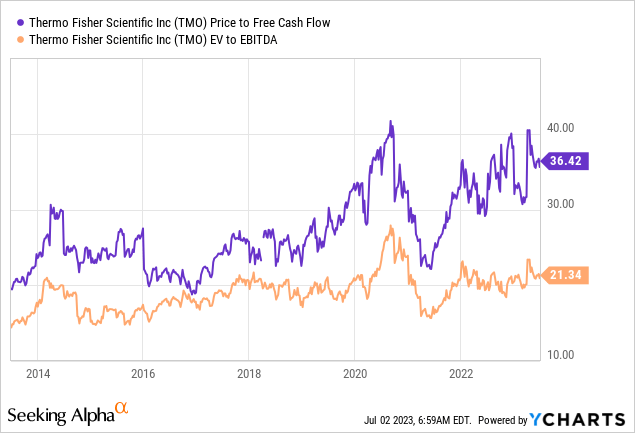

With that said, TMO is trading at 17.3x 2024E EBITDA. While I am using next year’s EBITDA estimate, the mix of a 25% stock price decline from its all-time high and higher growth expectations after 2023 gives the stock a much better valuation. While 17.3x EBITDA isn’t cheap, expectations of long-term double-digit annual earnings growth justify this valuation.

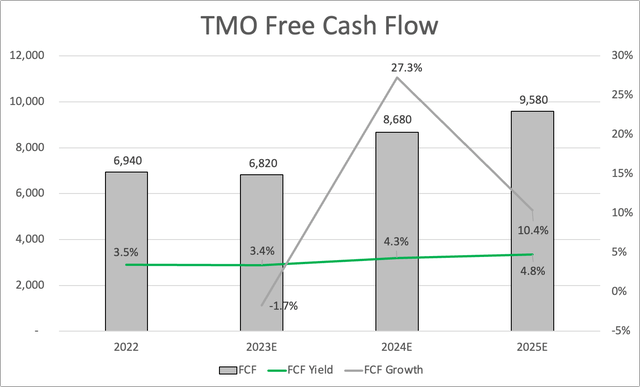

The same goes for free cash flow. Looking at the chart below, we see that post-pandemic headwinds will likely keep a lid on growth in 2023, followed by a (likely) sustainable surge in free cash flow starting in 2024.

The company is trading at 23.2x 2024E free cash flow, which isn’t cheap in the traditional sense, but a multi-year low.

Based on this context, the consensus stock price target is $626, which is 20% above the current price.

FINVIZ

TMO isn’t cheap, but I do believe that prices below $500 are buyable. I’m looking to add TMO to a few portfolios that I manage if it dips below $500.

I’m not buying it for myself, as I own Danaher. The two are highly correlated.

However, if TMO were to suddenly and unexpectedly drop for whatever reason, I might buy it anyway.

With all of this in mind, I believe that TMO will remain a strong long-term compounder with a high likelihood of significant outperformance.

Takeaway

Thermo Fisher Scientific is a remarkable wealth-compounding opportunity with its exceptional business model.

With a market cap of $200 billion, the company’s commitment to innovation, strong customer relationships, and value generation make it a standout in the industry.

Despite its low dividend yield of 0.3%, TMO’s historical revenue growth of 240% and net income growth of 360% over the past decade showcase its potential for long-term wealth compounding.

TMO’s focus on secular growth factors, high-impact innovation, capital deployment, operational excellence, and ESG standards further reinforce its position as a leader in the healthcare sector.

While TMO’s valuation may not be cheap, its expected double-digit annual earnings growth justifies the price.

As an investor, I believe TMO has the potential for significant outperformance and would consider adding it to my portfolios if the price dips below $500.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.