Summary:

- Thermo Fisher is paying a high price for Olink, but its size relative to the overall company is not big enough to significantly affect Thermo’s valuation.

- With little upside from current prices to the deal value of $26 per share, OLK stock is now a sell.

- TMO stock has modest upside to fair value if it can get back to targeted organic sales growth of 8% after a below-plan 2023.

Love Employee

Tough Year For Thermo Fisher Scientific

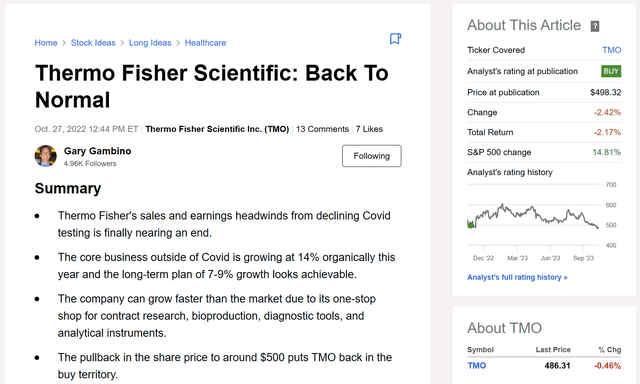

In the one year since I last covered Thermo Fisher Scientific (NYSE:TMO), the stock round-tripped from just under $500 to over $600 and back.

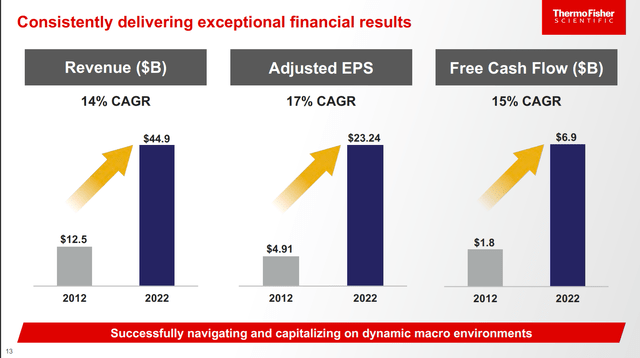

That article was the first one in eight that I wrote with a Buy rating for Thermo. I have always considered it a high-quality company, able to grow through smart acquisitions over the years. The company started from its roots in lab equipment, expanding into Life Sciences in the mid-2010’s and more recently into services such as contract research and manufacturing. This growth was supercharged during the Covid pandemic by demand for PCR testing equipment and other tools used in researching the virus and developing vaccines and treatments. As a result, Thermo could claim mid-teens annual growth rates for the decade ending in 2022, although the actual peak happened in 2021 due to the Covid business.

Headed into 2023, I expected headwinds as the Covid sales finally declined to a low steady state run rate, but be more than offset by organic growth. As you see in my article from last year, I expected EPS growth in 2023 compared to 2022. It appears the company agreed with me in January, forecasting non-GAAP 2023 EPS of $23.70 compared to the 2022 actual result of $23.24.

2023 did not proceed as planned, and when Thermo last reported in July, they lowered EPS guidance to $22.50. As stated on the earnings call,

… the macroeconomic environment became more challenging in the quarter. Economic activity in China slowed and across the economy more broadly, businesses became more cautious in their spend. This impacted our Q2 results and informed a more moderated view for the full-year. We’re taking appropriate actions to successfully navigate these conditions.

As a reminder, when we set out our guidance at the beginning of the year, we assumed core market growth would be in the normal range of 4% to 6% for 2023. Given the more challenging macroeconomic environment at this point, we think it is best to assume that these conditions will persist for the remainder of the year, and our current assumption is that core market growth will be in the 0% to 2% range this year.

Thermo Fisher is now valued at 21.5 times 2023 earnings based on the latest guidance. While this is a good value for a company with mid-teens earnings growth rates like Thermo experienced over the last decade, it is about fairly valued for a company with 7%-9% organic sales growth that Thermo expects to achieve over the long term.

This year’s results have been a setback to this long term growth plan, and some risks have increased. These include dependency on China for growth now that the geopolitical environment has become more volatile, and sustained R&D spending by pharma and biotech companies now that the US government is looking to limit prices on their products. The inorganic growth route is still available, but Thermo’s sheer size now makes it hard to find acquisitions that can move the needle. This brings us to the recently announced deal for Thermo to buy Olink Holding (NASDAQ:OLK) for $26/ADR.

The Olink Deal

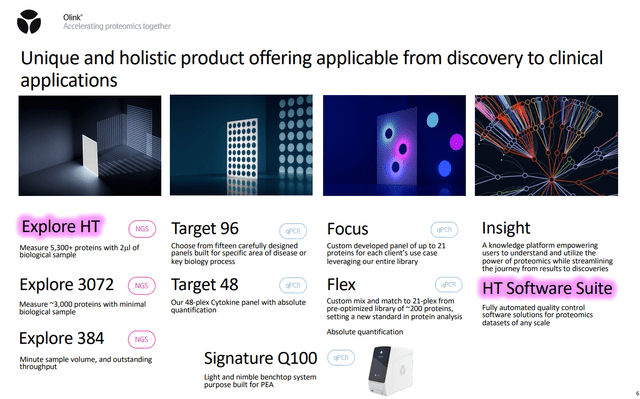

Olink is a Swedish company founded in 2016 and listed on the stock exchange since 2021. The company is focused on proteomics, which is the study of proteins, specifically the “proteome”. The proteome is basically a map of the types and structures of all the proteins produced by an organism. The name is analogous to the “genome” which is a map of all the genes in an organism. However, while genes contain the DNA “blueprint” for an organism, the actual instructions to manufacture proteins are communicated via messenger RNA, or mRNA. Despite a common DNA blueprint, the actual structure and amount of proteins produced by the organism can still vary based on different chemical and physical conditions in the cells. This knowledge is important in diagnostics and drug development because it can be used to identify protein structures on a virus and design drugs that block them from interacting with cells in the body. Olink makes the diagnostic kits, analyzers, and interpretive software for proteomics. This makes it a logical extension for the Life Sciences division of Thermo Fisher.

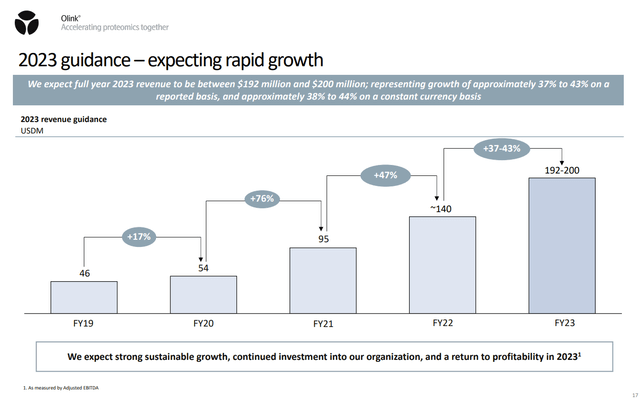

Olink has delivered impressive sales growth in recent years, although growth appears to be slowing. Thermo Fisher’s acquisition announcement states expected revenue of $200 million in 2024, but this is only slightly above Olink’s 2023 guidance.

Olink has not yet been profitable on a net income basis. Thermo states that the in the first year after the deal closes (expected mid-2024), Olink would be accretive to Thermo’s earnings by $0.10 per share not counting financing costs and share-based compensation. Including these items, the deal will be dilutive by $0.17 in the first year.

Even by year 5 after the close, Thermo only expects the deal to add $125 million per year of operating income including synergies. This works out to only $0.32 per TMO share. Also, given the deal price of $3.1 billion, Olink (with future synergies) is being valued at 24.8 times 2028 earnings, which is quite expensive.

The deal may have some strategic value for Thermo Fisher, extending the offerings in the Life Sciences segment and making Thermo more of a “one-stop shop” to its customers. Still, it is not a needle-moving acquisition for Thermo’s growth targets, amounting to only 1%-2% of EPS five years out. It does not significantly change my valuation of the company. For Olink shareholders, the current share price around $24.90 implies only a 4.4% total return based on the $26 deal price. This is not much different from T-Bill returns assuming 9.5 months until a mid-2024 close. While a higher bid is a possibility, so is a rejection by shareholders or regulators, even if unlikely. Due to that risk, I consider Olink a Sell.

Thermo Fisher Financial Model

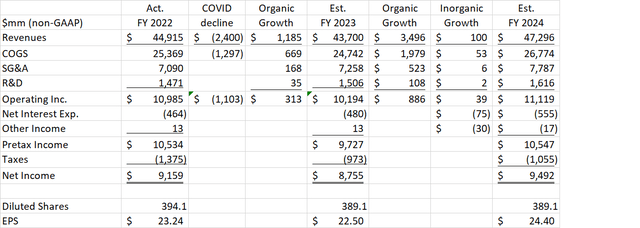

I updated my model from last year’s article with 2022 actuals and the lower guidance for 2023. I also added in the impact from a half year of Olink in 2024. I assume organic sales growth for 2024 returns to the company’s midpoint target of 8%. Interest expense has come up due to higher rates, but I now assume a lower non-GAAP effective tax rate of 10% based on company guidance for this year. The company is still buying back around 5 million shares per year despite also spending on acquisitions, so I have revised the share counts lower accordingly.

The resulting EPS estimate for 2023 agrees with the midpoint of company guidance at $22.50. For 2024, my EPS estimate is $24.40, representing 8.4% growth. This is down about 10% from the $27.14 I estimated for 2024 in last year’s article.

TMO Stock Valuation

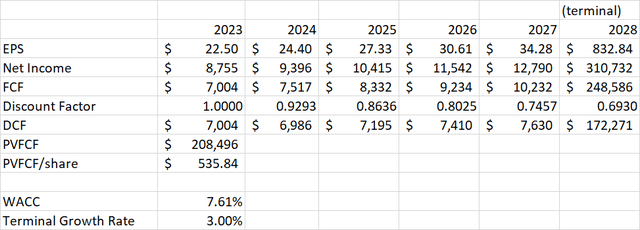

I updated last year’s DCF analysis with only a couple new assumptions. I get my weighted average cost of capital from GuruFocus which updates the WACC daily based on the risk-free rate and the stock’s Beta. Currently, the stated WACC is 7.61%. I still assume 12% EPS growth through 2028. This requires further cost reduction and share buybacks given the stated sales growth plans of 7%-9%. I have updated the terminal growth rate assumption from 2.5% per year to 3%. This is probably still conservative, but with less “margin of safety” in the valuation than I had last year. I continue to use recent history on free cash flow conversion of 80% to translate EPS projections into future free cash flows.

The resulting valuation is $535.84 per share. This is little changed from last year’s value despite the lower earnings in 2023 and 2024. Terminal growth rate is a major driver of the DCF result. If I lower it back to 2.5%, the value drops to $492.52.

Capital Management

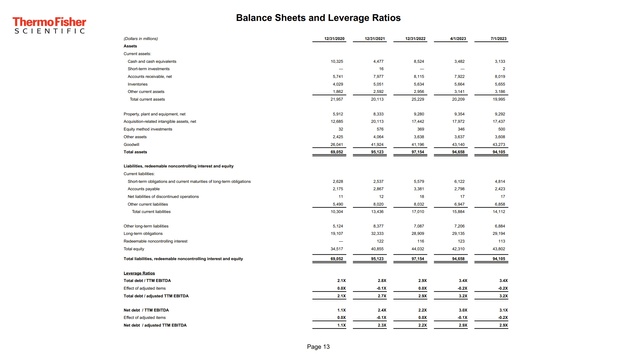

Thermo Fisher has managed debt well in the past. The company has kept its net debt/EBITDA levels low, using some of its free cash flow to pay down debt after big acquisitions, as EBITDA increases. The situation has declined a bit from last year however, when net debt/EBITDA stood at 2.1 times. EBITDA has decreased in line with earnings. While long term debt has not changed much this year, cash has decreased in order to complete the 5 million share buyback in Q1. This has caused net debt/EBITDA to increase to 2.9 times.

Thermo still continues to benefit from issuing euro-denominated debt in prior years, which had very low rates and has also benefitted from the declining EUR/USD exchange rate. Still, as of the end of last quarter, the company had $4.8 billion of debt due this year and another $4 billion due in 2024. This will likely have to be refinanced at higher rates. The $3.1 billion of cash needed for the Olink acquisition will also be a draw, however Thermo should be able to cover it with free cash flow generated between now and the close.

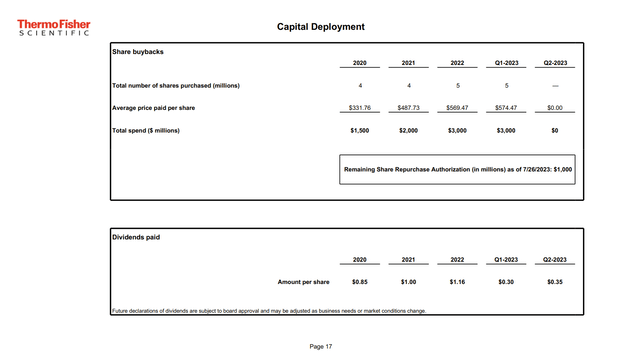

The low dividend is a turn-off for income investors, however it does preserve flexibility to do M&A like the Olink deal. Thermo has continued buybacks at a steady pace of $2-$3 billion per year despite buying PPD in 2021 and the upcoming acquisition.

Conclusion

Thermo Fisher has historically been a great acquirer, integrating big deals in the Life Sciences and lab services fields. The company is now a behemoth in its industry and it will be difficult for further acquisitions to make a big impact. This is the case with the Olink deal recently announced. Thermo is paying a huge premium for Olink relative to where it was trading before the announcement. Olink has had strong sales growth the past few years but is only just about to turn profitable. The $3.1 billion valuation is 24.8 times expected operating earnings, including synergies, in 2028. This is a great deal for Olink investors, who should consider selling, since the share price is now within 5% of the deal price.

Thermo Fisher is now valued at about 21.5 times 2023 earnings and 19.9 times 2024 earnings. This is an increase of about 1 P/E point since my October 2022 article. The Olink deal does not significantly move the needle on my valuation, since it only adds 1%-2% to Thermo’s earnings once fully integrated.

The updated DCF analysis shows little change in the valuation since last year, as the lower current earnings are offset by a higher assumption for the terminal growth rate. With the share price also little changed since last year, I am leaving the rating at Buy, although I see just about 10.5% upside to fair value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.