Summary:

- Thermo Fisher’s challenging period is likely behind them, with growth expected to resume in the second half of the year.

- The company’s Q1 earnings showed a decrease in sales, but the impact of the pandemic on the sector is still evident.

- Thermo Fisher’s strong control over spending and maintained debt ratios position them well for future growth opportunities.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Thermo Fisher (NYSE:TMO) has faced a challenging period over the last eighteen months, something I delved into in depth in my first article about the company (link here). However, following the latest earnings presentation, I believe we can confirm that the worst is behind us, and it is very likely that growth will resume in the second half of the year, restoring the company’s usual efficiency. We will discuss this more thoroughly throughout the article, but as a summary, I think the current macroeconomic situation for Thermo Fisher will allow it to return to the sales growth rates it was achieving before the pandemic.

The latest earnings presentation was a pleasant surprise for me, as, although I anticipated that the end of headwinds was near, it confirmed that they are indeed coming to an end. In this article, I want to delve into three aspects: First, to summarize the recent results presented by the company and put them in context with its closest competitors. Second, to explain why I believe 2025 will again be a year of record revenue for the company and how this will boost operational leverage. Lastly, to update my valuations of the company to see if we might be facing a good investment opportunity.

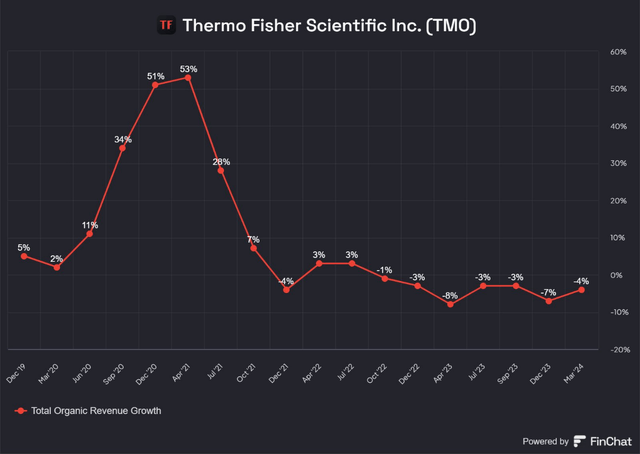

Good earnings despite the situation

This first quarter of 2024, sales have decreased by 3% organically, still reflecting the weakness of the sector following COVID. Although it might seem that COVID is far behind us, I don’t think it’s just an excuse from the management but rather the reality. Investment in health laboratories worldwide skyrocketed for obvious reasons during this period, and although direct COVID sales (testing, vaccine development and production, etc.) are practically no longer having a direct impact on sales (1% this quarter), the pandemic continues to have an indirect impact. Besides the direct spending we just discussed, investment in updating laboratory tools soared thanks to the huge amounts of money that flowed into the sector from governments and pharmaceutical companies. The following chart, I believe, clearly shows the effect that both direct and indirect pandemic investment had on Thermo Fisher’s sales.

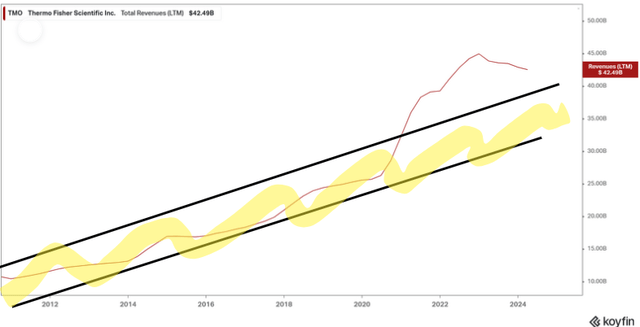

A company that was accustomed to growing its top-line at rates of 7-10% suddenly found itself with growth of 50%. From my point of view, all we are seeing is a reversion to the long-term mean. The following chart also shows how sales after the pandemic soared well above the long-term trend that had been ongoing for a decade.

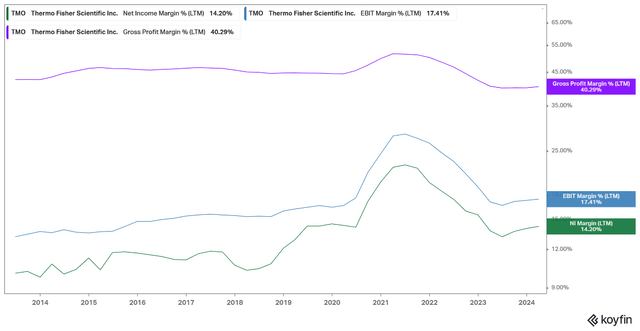

One of the most positive aspects of the report, in my opinion, is the great control they have maintained of overspending, which has helped grow the margins again. When sales decrease, it is very likely that operational deleveraging will occur, and in the case of Thermo Fisher, as we clearly see, it has happened. After the pandemic, margins skyrocketed, and now we are seeing a reversion to the mean of these margins.

However, I think it is noteworthy that although sales have not yet bottomed out, the operating margin has been growing for several quarters, resuming the pre-COVID trend, which highlights a special effort by the management to control costs. In fact, if we do not consider the pandemic years, the net and operating margin is at its peak, which is tremendously positive at this time of weakness. I see it very likely that, having done this good work during the tough times, when sales growth returns, and they can once again benefit from operational leverage, the margins will continue to grow, possibly even reaching the 20% operating margin again.

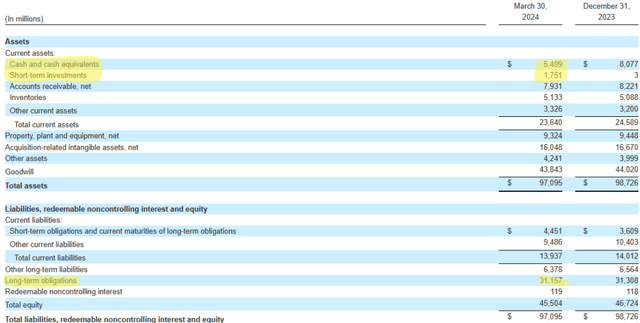

One aspect that particularly concerned me during this period of difficulty was how the balance sheet would evolve. Keep in mind that Thermo Fisher has always been a serial acquirer, partly basing its growth on the ability to acquire companies in the sector and integrate them into its holding. As I mentioned in my first article, having a healthy balance sheet is key for this, and I believe Thermo Fisher has done a good job maintaining debt ratios that, while not ideal, will allow them to continue deploying capital when opportunities arise.

Cash and short-term investments remain around $7.5bn, and long-term debt amounts to $31.1bn, staying the same as last year despite this challenging period. Generating almost $11bn of EBITDA annually and considering that most of Thermo Fisher’s revenues are recurring, we can say without going into too much detail that they have managed to maintain adequate solvency ratios to continue executing their long-term expansion. To give an example, the net debt/EBITDA ratio remains at 2.5x, below its 12-year average of 2.8x.

Thermo Fisher Q1 2024 Earnings Release

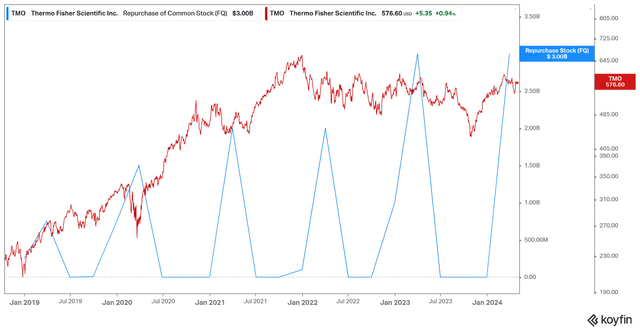

One point that I find very negative in terms of capital allocation is the policy of stock buybacks. Stock buybacks create value if they are made at an appropriate valuation. In the case of Thermo Fisher, the timing of the buybacks does not follow any valuation-based policy. Most of the capital allocated for buybacks each year is always repurchased in Q1, regardless of whether the stock is cheap or expensive. For example, at the end of last year, they had the opportunity to buy back shares at a much lower valuation than during Q1, yet not a single share was repurchased, and they waited until Q1 to make a buyback of $3.0bn. Certainly, much more value for shareholders could have been generated by executing those buybacks a few months earlier. I would like to see an improvement in this buyback policy in the future, as it does not seem correct to me, although I highly doubt it will change.

The Return of Growth

As we mentioned at the beginning of the article, perhaps the most interesting aspect of the earnings presentation were the management’s comments about the future. Both Thermo Fisher and its main competitor, Danaher (DHR), raised their growth forecasts for this year and expressed greater optimism for the coming years. They reaffirmed that activity would pick up over the year and that they have seen good signs in this first quarter.

“So, wrapping up on our end-markets, underlying market conditions played out as we expected to start the year. As you recall, our assumption for 2024 is that we’ll see a modest pickup in economic activity as the year progresses. During the quarter, it was good to see a couple of positive developments in our end-markets that support this view, including continued improvements in the biotech funding environment and the stimulus program announced by China.” – Marc Casper, Thermo Fisher CEO.

Therefore, in the short term, it is likely that we will see year-over-year growth again in the second half of the year. However, I tend to prefer viewing the situation with a long-term perspective. Thermo Fisher operates in a sector with an unstoppable macro trend, such as healthcare and an aging population, and it holds a dominant position in the industry. In my first article, more than 8 months ago, I already suggested that growth would return. I was not sure whether it would be early 2024, late in the year, or in 2025, but growth was bound to return. In the short term, the growth in the coming quarters will be key; in the long term, it won’t be very relevant in which quarter growth resumes.

The strong headwinds that Thermo Fisher faced in 2022 and 2023 are clearly coming to an end, and personally, I am not too concerned about the exact timing of their conclusion but believe that good work is being done to capitalize on the growth when it returns.

Valuation and conclusions

The only reason I currently cannot recommend buying Thermo Fisher is its valuation. I believe the company is operationally doing many things right, and as we have been discussing, the headwinds seem to be coming to an end. I think Thermo Fisher’s current valuation has already efficiently absorbed all this information.

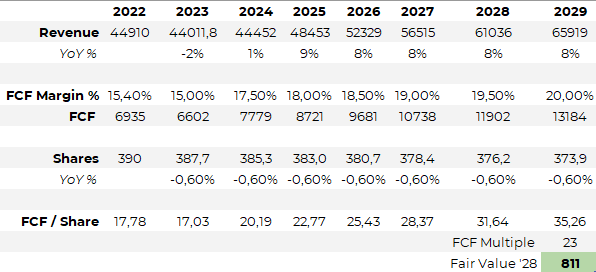

In my previous article, I presented a very simple valuation model based on the FCF per share that Thermo Fisher could be generating. I have updated it by slightly increasing my margin forecast for the coming years and by assuming an 8% growth in top-line revenue. Considering the inefficient buybacks and a final multiple of 23x (which is quite demanding but may make sense for a company of this quality with such predictable cash flows), I arrive at a target price of $811 for 2029. This translates into a modest 7.3% annual compounded return.

Author’s calculations

From my point of view, Thermo Fisher’s current valuation does not offer a sufficient margin of safety to recommend purchasing its stock. While I believe they are capable of growing the top-line above the levels I have indicated, I prefer to be conservative with such matters to add more security to my investments. That is why I am currently assigning a “Hold” rating to Thermo Fisher’s stock.

In summary, I repeat that I believe the worst has passed for Thermo Fisher and that in the coming quarters we should see growth gradually recovering. However, I believe that in the long term, the company’s potential remains intact since they have not lost any dominance in the sector during this slowdown. I am currently an investor in both Thermo Fisher and its main competitor Danaher, and for now, I remain very calm and confident with these long-term investments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.