Summary:

- Thermo Fisher has a very attractive product mix and market distribution.

- Strong performance across pharma, biotech, industrial, and diagnostics segments will continue well into the future.

- Decreasing revenue from COVID-related products will be more than compensated by other segments of the company in the future.

Maskot/DigitalVision via Getty Images

Investment Thesis

Thermo Fisher Scientific (NYSE:TMO) is the world leader in manufacturing scientific devices, instruments, diagnostic products, and related services. The company offers a great combination of stability and growth, and has a highly complementary product mix and favorable revenue profiles in multiple markets that will ensure future growth. Thermo Fisher has been an outstanding investment option for a long time, and I believe this will continue to be the case for a while. The following are the main reasons:

- All segments of Thermo Fisher are growing at a steady pace, and overall growth will remain strong despite decreasing revenue from COVID-related products.

- Thermo Fisher’s ability to generate cash is impressive, and looks solid heading into the future.

- High profit margins illustrate a strong economic moat, operational efficiency, and quality of growth.

Strong Performance Across The Segments

Since my previous article, Thermo Fisher reported 2Q 2022 results, and once again posted great earnings. Overall revenue grew 18% YoY, with strong performance across all of their segments. Pharma and biotech delivered mid-teen growth, academic and government grew in the mid single-digits, and industrial and applied grew in the low double digits. These are outstanding given the challenges from COVID lockdowns, supply chain issues, and cost control.

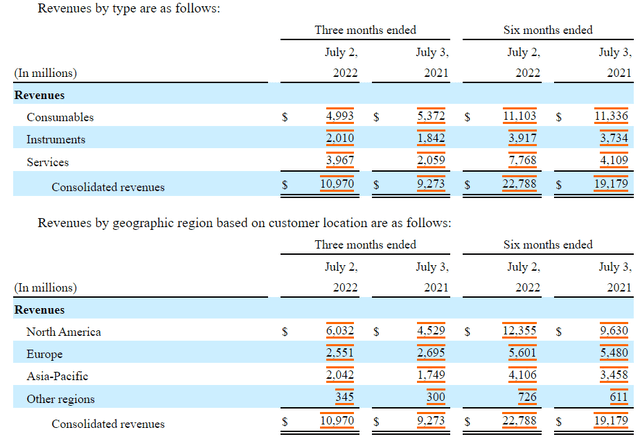

Several new products were launched earlier this year, and they are already boosting Thermo Fisher’s growth. An automated sample prep platform (AccelerOme), Thermo Scientific Direct Mass Technology mode for its mass spectrometers, and cloud-based software platform (Thermo Scientific RDO) are assisting customers in reaching greater efficiency in their research and operating environment. The most exciting part of the results was the large increase in the services segment. Three month service revenue nearly doubled from $2.0 B to $4.0 B. As the services segment is a higher margin business, this will improve Thermo Fisher’s profit margin even further in the future.

Disaggregated Revenue (SEC Filings)

Strong Operating Cash Flow

Thermo Fisher has always been great at generating operating cash flow, but they have been taking that to the next level in the past couple of years. Operating cash flow was $2.0 B in 2012, and the figure increased to $8.8 B in the past twelve months. With steady organic growth mentioned above and inorganic growth (e.g., recent PPD acquisition), Thermo Fisher will continue to grow, and operating cash flow will increase even further.

I particularly expect strong synergies from the PPD acquisition. PPD is the global industry leader in providing services to pharmaceuticals and healthcare companies. They accelerate the development process of medicines and medical devices by providing customers with custom-tailored strategies for clinical development and analytical services. For example, Thermo Fisher supported Moderna’s development of the Spikevax COVID vaccine, and the two companies decided in February to extend this collaboration to Moderna’s entire pipeline. Combining this formidable service expertise with impressive lines of life science products, I believe Thermo Fisher can now offer the whole package to their customers and partners.

Strong Profit Margins

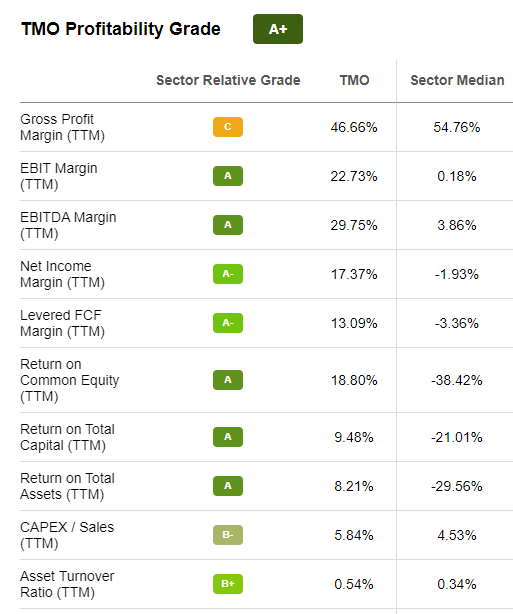

Thermo Fisher has a very robust economic moat gained through technological superiority, switching cost, and brand recognition. Also, their management is doing a great job at running the manufacturing site and managing the supply chain efficiently. A strong economic moat and high quality management decisions are demonstrated by high profitability metrics.

The high profit margins (EBIT, EBITDA, and Net income margins) represent a strong economic moat. Thermo Fisher is able to charge a premium on their products because they offer better products with advanced technology and strong brand recognition. Meanwhile, the high returns on equity and capital demonstrate manufacturing efficiency and effective supply chain management. I expect them to maintain these quality metrics in the future as well.

Profitability Metric (Seeking Alpha)

Intrinsic Value Estimation

I used the DCF model to estimate the intrinsic value. For the estimation, I utilized EBITDA ($12.7 B) as a cash flow proxy and the current WACC of 8.0% as the discount rate. For the base case, I assumed EBITDA growth of 17% (5 year average revenue growth) for the next 5 years and zero growth afterward (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 19% and 21%, respectively for the next 5 years and zero growth afterward.

The estimation revealed that the current stock price represents 20-25% upside. Their organic growth coming from strong R&D efforts and inorganic growth coming from acquisitions will keep Thermo Fisher growing, and I expect them to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$672.88 | 12% |

|

Bullish Case |

$724.63 | 20% |

|

Very Bullish Case |

$779.78 | 30% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- EBITDA Growth Rate: 17% (Base Case), 19% (Bullish Case), 21% (Very Bullish Case)

- Current EBITDA: $12,7 B

- Current Stock Price: $596.83 (08/15/2022)

- Tax rate: 20%

Cappuccino Stock Rating

| Weighting | TMO | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 4 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 4 |

| Overall | 4.3 |

Economic Moat

Thermo Fisher has a very strong moat to protect their market share. They are technologically advanced and have strong brand recognition. Also, customers could incur substantial switching costs if they were to change to another equipment line, and this helps to keep existing customers coming back. A strong R&D effort and key acquisitions will keep this moat nice and wide.

Financial Strength

Thermo Fisher took on a great deal of long term debt recently to acquire PPD. However, they have superb operating cash generating ability, and their profit margins are very high. Also, their current ratio and quick ratio are well within the range of peers.

Growth Rate

Thermo Fisher’s core business will continue its strong growth well into the future. I believe the PPD acquisition is a great move, and will bring synergies in the future. Some of their revenue growth will be offset by decreasing COVID-related revenue though.

Margin of Safety

Thermo Fisher’s stock price is undervalued by 20-25%, so it provides a nice cushion for investors. However, due to the recent market volatility, some tech and growth stocks are still 40-50% below their intrinsic value, making it hard to justify the highest rating for Thermo Fisher at this point.

Sector Outlook

R&D efforts among pharmaceutical companies, research institutions, government, and academia are only growing, so demand for Thermo Fisher’s products and services will grow accordingly. Thermo Fisher’s growth will go hand-in-hand with developing health care needs.

Risk

Even though it’s not at a worrisome level, the large long term debt incurred over the past couple of years is something the investor should monitor. The total debt level of $30 B is certainly on the high side compared to peers and the company’s historic level. Also, total debt to equity ratio (71%) is on the higher end compared to peers. Therefore, the investor should closely monitor Thermo Fisher’s debt management going forward.

The consumable segment of Thermo Fisher will experience a decline as sales from COVID-related products subside. Due to the unpredictable nature of the pandemic and emerging variants, it’s hard to gauge how quickly this revenue might decline. Therefore, this introduces a fair amount of uncertainty in the COVID-related product revenue, and will make the stock more volatile until we have a better idea of the upcoming revenue profile.

Conclusion

Thermo Fisher has been an outstanding investment option for the investor for a couple of decades now, and I don’t see any signs that this will change in the foreseeable future. The company has superb product lines built on advanced technology, and a strong R&D team to drive organic growth. Also, TMO clearly isn’t shy about acquiring key businesses. The company’s large debt and fluctuations related to unpredictable COVID revenue do introduce some uncertainty, but overall, I expect 20-25% upside going forward.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.