Summary:

- As I’ve noticed increased voices recommending selling Walmart, I’ve decided to take another look at my investment in the company.

- The company’s robust free cash flow supports substantial shareholder rewards, including dividends and stock repurchases, enhancing long-term portfolio performance.

- Walmart’s current valuation appears stretched, suggesting potential stock price volatility, but long-term investors who secured an attractive yield on cost benefit from its consistent shareholder rewards.

- While not a buy due to valuation concerns, Walmart’s leadership position, adaptability, and strong negotiating power justify holding the stock.

Alexander Farnsworth

Walmart (NYSE:WMT) has been one of the most favoured businesses among retail investors, especially those oriented toward dividend income. I’ve recently noticed a relatively increased number of voices recommending selling Walmart. As I’ve been WMT’s shareholder for years, I’ve decided to provide my perspective on reasons I believe Walmart is worth holding, despite concerns expressed by other investors.

Walmart: From Family Business To The Largest Retailer

Walmart’s history dates back to 1962 when Sam Walton opened the first store. Just five years later, the Walton family already owned 24 stores and exceeded $12.7m in sales.

Two years ago, Walmart celebrated its 60th anniversary. As of June 31, 2024, Walmart operated over 10,600 retail units, reporting across three business segments:

- Walmart US

- Walmart International

- Sam’s Club

If I were to summarize Walmart with one word, I’d certainly use STABILITY.

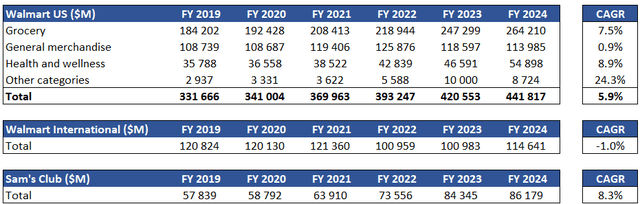

Despite the relatively high degree of uncertainty in the US and worldwide, including geopolitical tensions, supply chain disruptions, inflationary pressure, high interest rates, COVID-19, etc. Walmart provided steady revenue growth and stable margins. Walmart US is by far the most critical segment of WMT’s business in terms of its scale and still achieves mid-single-digit growth, securing almost 6% CAGR during FY 2020 – 2024.

Its International segment experienced some headwinds and kept a stagnant scale, but its least prominent segment (Sam’s Club) delivered the highest compound annual growth rate of 8.3%. Please review the tables below for details:

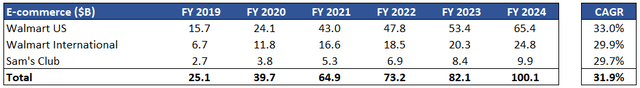

It’s worth recognising that Walmart adjusts to the ever-changing world by digitizing its connection to customers and providing them with e-commerce-oriented solutions. It records double-digit growth rates within each segment. Please note that the numbers provided in the table below have been included in the table above, so e-commerce adoption can undoubtedly be considered a driving force of Walmart’s revenue growth.

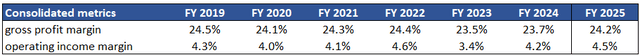

Profitability-wise, Walmart proves to be as stable as in terms of revenue:

It’s also worth recognising the solid ROI the Company keeps recording yearly, which amounted to 15.1% in the trailing twelve months ending in July 2024.

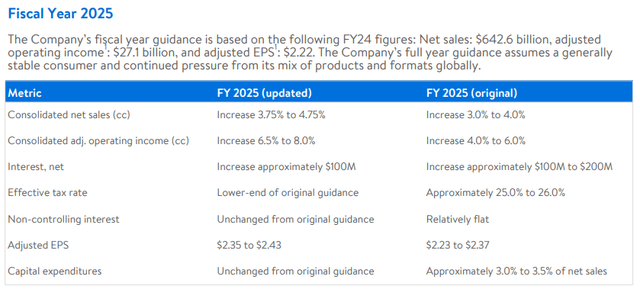

FY 2025 – so far, so good and upgraded guidance

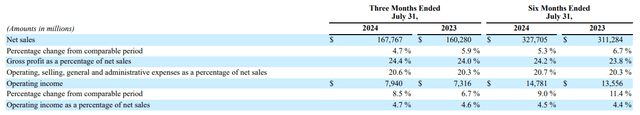

As indicated in WMT’s latest 10-Q, the Company continues to record mid-single-digit growth rates and stable profitability levels (both in terms of gross profit and operating income).

Upon publication of its FY Q2 2025 results, Walmart substantially upgraded its FY 2025 outlook:

- higher expected net sales growth of 3.75%-4.75%, which looks attainable given the Q1-Q2 2025 developments and the fact that historically, Walmart has realised the highest sales volume in the last fiscal quarter of each year

- higher expected adj. operating income margin (6.5%-8%)

- lower end of previous guidance regarding interest exposure (net) and effective tax rate

- increased adjusted EPS guidance

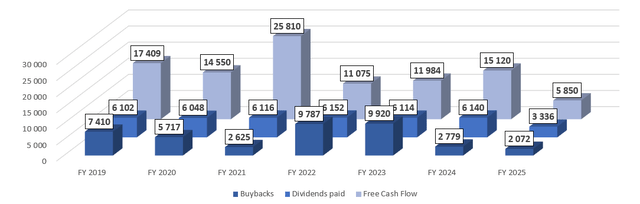

Walmart Is A Free Cash Flow Machine Providing Substantial Shareholder Rewards Over The Years

Stable profitability and a strong negotiating position over suppliers and customers translate into robust operating cash flow generation, supporting WMT’s rewards for shareholders. During the 2019–YTD period, the Company generated an unimaginable $101.8B of free cash flow and rewarded its shareholders with:

- $40.0B of dividend payments

- $40.3B of stock repurchases

Please review the chart below for details.

Although Walmart’s current dividend yield is far from attractive, its long-time holders should not be disappointed, as Walmart has provided both capital appreciation and steadily growing safe distributions, significantly improving the portfolio performance of its holders, especially those who secured attractive entry levels.

The ‘Buy’ Window May Have Closed, For Now

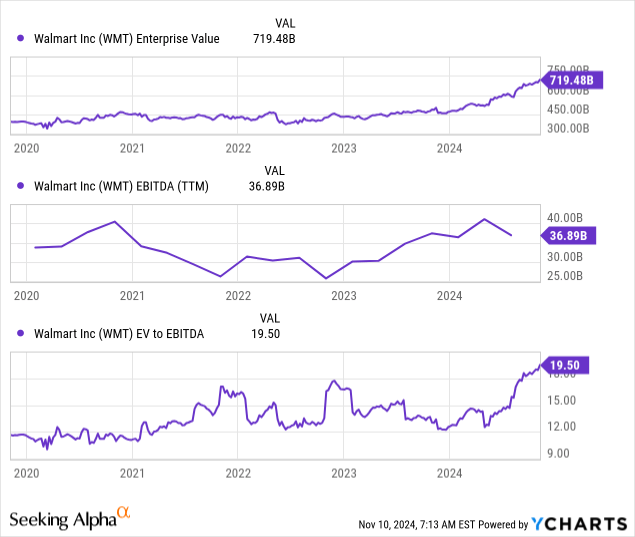

As an M&A (fancy name for buying and selling businesses) advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. It allows for accessible and market-driven benchmarking.

This method comes to the rescue of investors relying too much on the stock price alone. Let me remind you that relying solely on the development of the stock price will likely mislead you, as:

- it doesn’t reflect the changes in the number of shares outstanding

- it doesn’t factor in the changes in the scale and profitability of the business

With that said, please review the development of Walmart’s EV/EBITDA multiple (a rule of thumb for most sectors in the transactional market) in the chart below.

As we can see, its EV/EBITDA (valuation) has detached from its historical levels, growing as high as 19.5x. That’s because WMT’s enterprise value growth significantly outpaced the development of its EBITDA. As a result, EV/EBITDA increased, suggesting that Walmart has become overvalued.

Therefore, one may conclude that Walmart still needs to grow to reach its current valuation. As a result, we may experience some stock price volatility along the way.

Conclusion: Walmart Is Far From A ‘Sell’

Walmart holds numerous qualities, setting it apart not only from its peers but also within the broad economy:

- leadership position with the most prominent retail chain

- the strongest negotiating position with suppliers

- top-tier supply chain

- steady growth accompanied by stable margins and ROI

- long history of substantial shareholder rewards in terms of dividends and share repurchases

- ability to adapt to changing market environment and withstand a high degree of uncertainty (stable results even during recent turbulent times and e-commerce development)

Therefore, I will remain a happy Walmart shareholder and always think twice when anybody recommends selling my stake in WMT. The current dividend yield is not tempting, but long-term investors who were capable of securing substantially higher yield on cost can benefit further. Walmart is a solid ‘hold’ for me.

On the flip side of the coin, Walmart is not a ‘buy’ for me right now. I prefer to allocate my resources to opportunities offering higher upside potential. Due to its quite stretched valuation (as presented through its historical valuation multiple), I expect some stock price volatility to move on. However, it still wouldn’t encourage me to sell, as Walmart’s shareholder reward should more than compensate (depending on your yield-on-cost).

Apart from the valuation aspect, investors should be aware of other market and company-specific risk factors, including:

- headwinds in the development of its international business

- still existing exposure to the Amazon effect

- uncertainty regarding the state of the economy and interest rates, influencing consumer decision-making

- supply chain disruptions

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.