Summary:

- iPhone saved the day for Apple Inc. fiscal Q2 earnings, likely due to a pull forward of demand from the holiday quarter production shutdowns that caused an 8% YOY decline in iPhone revenues.

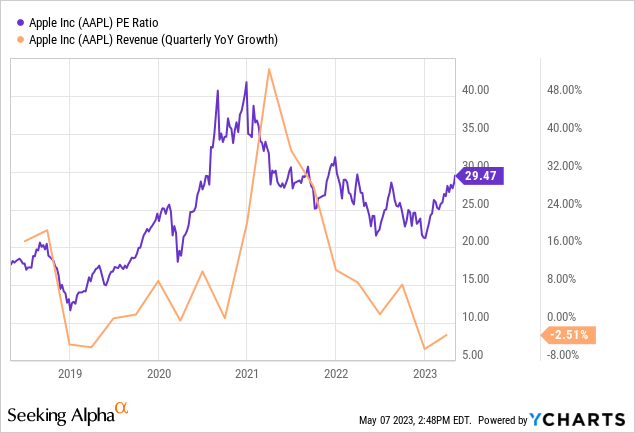

- Apple has a P/E of nearly 30, a 60% premium to the S&P 500, despite shrinking revenue and profits.

- This is the fourth time Apple has traded above $170 since January 2022 with each time leading to a correction.

Scott Olson

Introduction

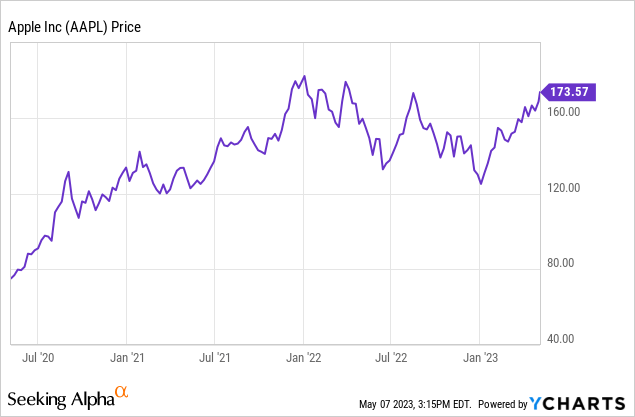

Apple Inc. (NASDAQ:AAPL) is one of the greatest businesses the world has ever seen and one of the best investments of the last two decades. However, it’s easy to forget that not everyone had the opportunity to buy Apple before it was a multi-trillion dollar company. At a valuation of $2.8 trillion, or $173.57 per share, Apple is knocking on the door of its all-time high of just over $180, where it became the first company worth $3 trillion. If Apple grew at the historical 10% average of the S&P 500 (SP500), it would be worth nearly $6 trillion by 2030, which would be a grand task even for a great company.

Historically speaking, the 170s have already been a rough level for Apple. This is the fourth time that Apple has traded above 170 in the last two years and each time there was a correction. Perhaps this is the maximum value for Apple stock, because even after two years, it achieved this point with a relatively rich valuation; unlike the last three times, Apple’s sales and earnings are currently in decline.

December Production Constraints Likely Saved the Day

For the March quarter, iPhone revenue beat expectations, but there’s one thing that bothers me: the fourth quarter iPhone production shutdowns in China. This negatively affected iPhone availability for the most important quarter of the year, and by late November, any orders for an iPhone were already being pushed beyond Christmas. As a result, Apple’s iPhone revenues for the holiday quarter were down more than 8% from the previous year, contributing to the biggest quarterly revenue decline for the company since 2016.

Last quarter, CEO Tim Cook assured investors that demand remained strong and that they were production-constrained for the March quarter. This time, iPhone saved the day, but just barely with a 1.5% gain. How much of it was from a pull-forward from the holiday quarter? When asked, Tim Cook only briefly commented on it on the fiscal Q2 conference call:

It’s hard to quantify this, but we do believe we did recapture some amount of sales in the March quarter as we did see the iPhone performance accelerate relative to the December quarter. The production levels for the whole quarter were where we wanted them to be. So supply was not an issue during Q2.

When asked about demand, unlike last quarter Tim Cook did not want to comment on demand for the current quarter, aside from what was already provided by Luca Maestri:

We expect our June quarter year-over-year revenue performance to be similar to the March quarter (a 3% decline) assuming that the macroeconomic outlook does not worsen from what we are projecting today for the current quarter.

Hardware outside of iPhone was far below expectation. Mac revenue tumbled more than 30%, iPad sales declined 13%, and even wearables saw a 1% decline, despite new products such as the Apple Watch ultra and HomePod. Considering the sharp underperformance of other categories being attributed to macros, I would have expected iPhone sales to decrease as well. Most likely, they were offset by the 8% decline in the previous (most voluminous) quarter. On the bright side, Services remained a silver-lining as it grew 5.5%. Although slightly below analyst consensus, a new record (and growing) install base in all geographies is a nice backbone for Services growth and stability.

Not much was said about AI

I was expecting Apple to fail the AI test, which has been the use of the buzzword over conference calls from food companies, transportation, or Big Tech. However, you can’t fail a test you don’t take. Analysts were eager to ask where Apple is on the matter, but they had nothing much to say other than that they remain excited but cautious:

I do think it’s very important to be deliberate and thoughtful in how you approach these things. And there’s a number of issues that need to be sorted, as is being talked about in a number of different places. But the potential is certainly very interesting.

Although shrugged off, generative AI is an important question for Apple as they were a pioneer when it came to virtual assistants thanks to Steve Jobs. However, Siri has for years underperformed the competition and with the rise of chatbots, it seems archaic. It’s not about being able to provide a correct answer, but also being able to understand a user’s request.

This doesn’t mean Apple doesn’t utilize AI. Outside of Siri, Photos, Autocorrect, Maps, or the camera app all utilize AI in a variety of ways. During the call, Tim Cook pointed to how their use of AI has helped save lives with Crash Detection and Fall Detection. However, generative AI is a new animal and Apple has plenty to benefit or lose from it.

Apple Valuation

After Friday’s post-earnings rally, Apple is valued at $2.8 trillion and sports a P/E of 29.5, surpassing both the S&P 500 (18) and NASDAQ 100 (NDX, 27). Apple’s P/E is effectively an earnings yield of 3.39%, which is historically rich given the circumstances. The last time Apple had a P/E ratio above 29, it was growing at high single digits. A P/E of 29 was still quite rich for any company sporting just single-digit growth at the time, but it was understandable given high inflation concerns and very low interest rates. Cash was trash and it felt like there was nowhere else to put your money, and Apple seemed like a great option.

In contrast, today, cash is king (just ask the banks) as T-Bills are paying over 5% and high-interest savings accounts are paying over 4%, including Apple’s own savings account. With a P/E ratio of 29.5, Apple has an earnings yield of 3.39%, which is substantially lower than the guaranteed returns from T-Bills and high-interest savings accounts. Remember, this low yield was higher than prior guaranteed earnings options. Furthermore, inflation concerns have calmed and have been replaced with economic uncertainty, which typically applies pressure on stocks. You can’t blame investors for valuing Apple at a premium versus other stocks, but provided that revenue and earnings are shrinking, at its current valuation Apple appears to be a medium-risk, low-reward proposition.

The chart below shows Apple’s P/E ratio rising despite shrinking growth.

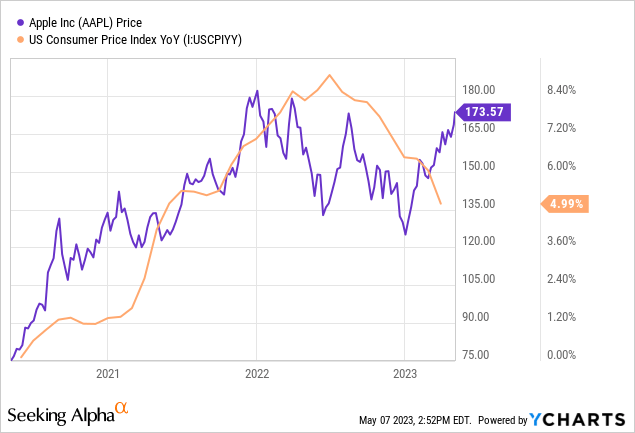

Apple’s performance relative to inflation:

The Macros are against stocks in general

I’m not here to bash Apple for its stellar business and results. There’s a variety of pressure being applied to stocks and some would argue that Apple is holding the entire market up. If Apple had missed badly, the Friday rally may have been inverted.

The Fed remains aggressive

The Fed has hawk eyes on inflation, and last week rose rates again despite being the primary reason for bank failures. You can blame banks for mismanagement, but if the Fed hiked earlier and less aggressively, it’s likely that these bank failures could have been avoided. On Friday, we got a rather hot jobs report; 253k versus 180k expected and wages increased 4.4% versus 4.2% expected. Unfortunately, this is not what the fed wants to see. While the fed seemed open to a pause when it raised rates last weeks, the chances of that just got a little bit lower. Jerome Powell remained hawkish enough to say that they will remain data dependent; of course, that means we’ll need to see inflation data for April.

The consumer is weakening

Inflation is placing a toll on the consumer, many are turning to credit cards as their savings dwindles, and the fed will put more people out of work. Credit card debt is often not talked about, but just hit an all-time high of $930 billion, surpassing the last peak in 2008. Unlike mortgages and car loans, credit card interest rates are variable and rise as the fed raises rates; they also provide no collateral for banks. Credit card interest rates are at a record high, making it even more difficult to pay off record debt levels. Credit card debt wasn’t the straw that broke the camel’s back during the Great Recession, but it was certainly a part of the problem.

Stocks in general are overvalued

As mentioned earlier, the S&P 500 and NASDAQ 100 have P/E ratios of 18 and 27, respectively, which is historically rich. That’s an earnings yield of 5.6% and 3.7%, which is simply unattractive for the risk. Sure, the S&P is yielding more than T-Bills, but taking on risk to eke out a slight gain over the virtually guaranteed returns of bonds makes little sense.

Conclusion

While Apple Inc. remains a remarkable business and an incredible investment over the last two decades, its current valuation and growth prospects raises questions about its future performance. The current macro environment is already to blame for the underperforming categories outside of iPhone, and I strongly believe that the iPhone’s beat was thanks to a pull forward of demand due to production shutdowns during the end of 2022.

Apple is now trading above $170 for the fourth time since January 2022, and each time has failed to move higher. Provided the macro environment and shrinking revenues and profits, I believe that it will be difficult for Apple to break above or hold a new all-time high for an extended period of time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.