Summary:

- Comcast’s Q4 revenue increased by 2.3% compared to the previous year, with significant growth in net income and earnings per share.

- The company has a strong commitment to returning value to shareholders through dividends and share buybacks.

- Comcast is trading at a discount compared to its sector and historical valuation, making it an appealing investment opportunity.

Sundry Photography

Comcast (NASDAQ:CMCSA), a leading telecommunications conglomerate, offers a range of services including cable television, internet, and phone services. With its headquarters in Philadelphia, Pennsylvania, Comcast serves millions of customers across the United States. The company is also a major player in the entertainment industry, owning NBCUniversal, which includes popular networks like NBC, CNBC, and Universal Pictures. Known for its reliable services and innovative technology, Comcast continues to expand its offerings to meet the evolving needs of consumers in the digital age.

In June 2022, we initiated coverage of the company with a buy rating, which we reaffirmed in October 2022. However, we have not offered any further updates on the company’s performance since then, nor have we shared our outlook on its future financial performance. Therefore, the purpose of our current analysis is to provide this updated perspective and assess whether our previous recommendation to buy the stock still holds true.

We’ll start our discussion by examining the financial performance of the previous quarter, focusing particularly on growth and profitability. Next, we’ll evaluate the company’s dedication to returning value to shareholders, which was a significant consideration in our previous analysis supporting our optimistic rating. Finally, we’ll delve into the company’s valuation, utilizing a range of conventional price multiples to gauge its current standing in the market.

Highlights – Q4 earnings

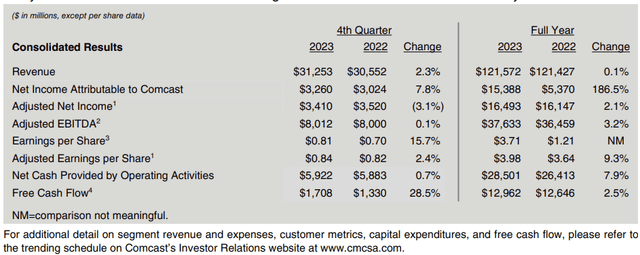

The following table presents key financial data for Comcast for the fourth quarter and full year of 2023 compared to the same periods in 2022.

Revenue: Comcast’s revenue increased by 2.3% in the fourth quarter of 2023 compared to the same period in 2022. However, for the full year, revenue saw a marginal increase of 0.1%.

Net Income Attributable to Comcast: Net income attributable to Comcast grew significantly by 7.8% in the fourth quarter and 186.5% for the full year of 2023 compared to the respective periods in 2022.

Adjusted Net Income and Adjusted EBITDA: Adjusted net income slightly decreased by 3.1% in the fourth quarter but increased by 2.1% for the full year. Adjusted EBITDA remained relatively stable in the fourth quarter but increased by 3.2% for the full year.

Earnings per Share (EPS): Earnings per share increased notably by 15.7% in the fourth quarter and significantly in the full year of 2023. Adjusted earnings per share also saw an increase, up by 2.4% in the fourth quarter and 9.3% for the full year.

Net Cash Provided by Operating Activities and Free Cash Flow: Net cash provided by operating activities increased slightly by 0.7% in the fourth quarter and significantly by 7.9% for the full year. Free cash flow increased notably by 28.5% in the fourth quarter and 2.5% for the full year.

Let us take a more granular look at the results to see which segments have been the primary drivers of these results. Now, let us start examining the connectivity and platforms segment, and the content and experiences segment separately.

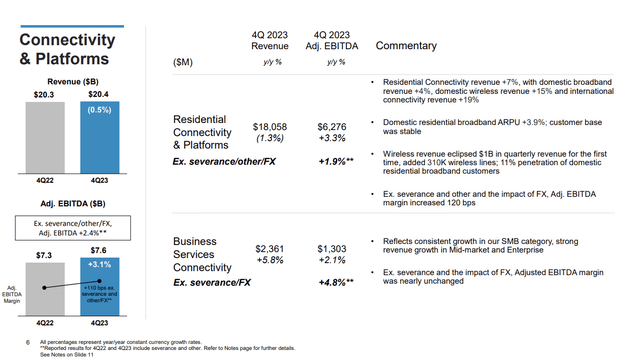

Connectivity & Platforms

The following slide summarizes the results of the connectivity and platforms segment. Here, we would like to highlight that CMCSA’s largest segment the residential connectivity and platforms has maintained a relatively stable revenue year-over-year, but more importantly the wireless business revenue has reached a record of over $1billion, while adding 310K wireless lines. The profitability of this segment has also increased as shown by the EBITDA margin improvement of 120 bps.

Connectivity and platforms (CMCSA)

Content & Experiences

Content and experiences (CMCSA)

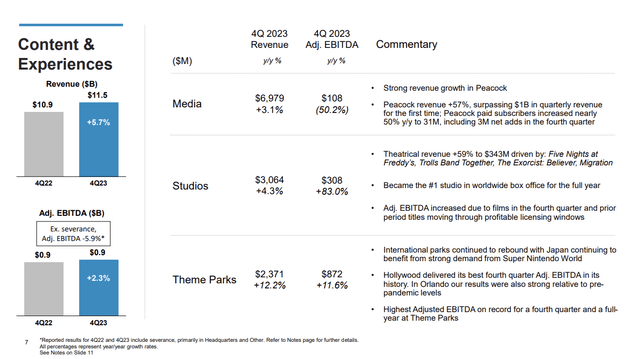

When looking at the media segment, the following points are the key takeaways from the recent earnings release:

- Revenue increase from higher domestic distribution, international networks, and other sources.

- Domestic distribution growth led by Peacock’s rise in paid subscribers.

- International networks revenue rose, particularly from sports channel distribution and favorable foreign currency effects.

- Domestic advertising revenue declined due to lack of revenue from Telemundo’s FIFA World Cup broadcast in the previous year, but excluding this, advertising revenue increased by 2.7%.

The decline in revenue due to the World Cup is a one-time effect, which will not impact the comparables in the coming quarters, and which does not serve as an indication for the general performance of the business. Therefore we put a smaller emphasis on this point.

Turning our focus more towards the entertainment side and focusing on the firm’s performance in the Studios segment, we can see that:

- Revenue rise due to increased theatrical earnings, notably from successful productions.

- Content licensing revenue remained steady, but higher film studio earnings offset reduced revenue from television studios.

- Shift influenced by content availability timing under licensing agreements and effects of work stoppages by Writers Guild and Screen Actors Guild.

Here we would like to underline the first bullet point. We believe that creating quality content that the viewers demand and like is the key to the success of this segment. The revenue rise indicates that CMCSA has done well in this regard. Looking forward, it is important that we understand that view preferences can rapidly change and content which is trendy now, may be outdated in a few months’ time. For this reason, it is important to closely monitor how this segment is doing on a continuous basis.

Last, but not least, the Theme Parks Segment:

- Revenue increase from higher earnings at international and domestic theme parks.

- Domestic theme parks saw growth, driven by Hollywood location’s success with Super Nintendo World.

- Partially offset by reduced revenue at Orlando theme park, which still outperformed pre-pandemic 2019 levels.

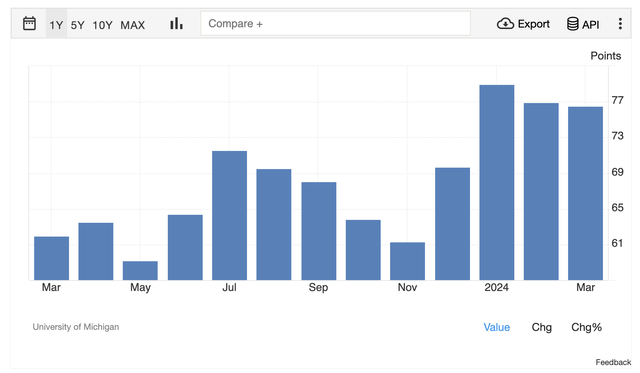

We believe that this segment is the most dependent on consumer confidence. As consumer confidence has started to rebound in the recent months, we believe that the performance of this segment is also likely to gradually improve further, however, the improvement may take several quarters, as consumer confidence is normally a leading economic indicator.

U.S. Consumer confidence (Trading Economics)

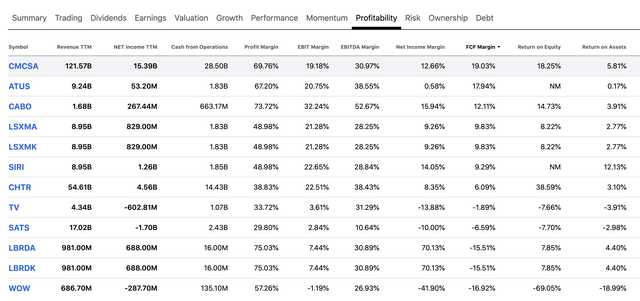

Overall, Comcast showed positive financial performance, with notable increases in net income, earnings per share, and cash flow metrics, indicating strong operational efficiency and financial health. Also, when looking at the profitability metrics of the firm in relation with its peers and competitors, we can see that CMCSA is one of the most attractive players in the cable and satellite industry, from a profitability perspective.

For these reasons, our bullish view remains intact based on the recent financial performance.

Return to shareholders

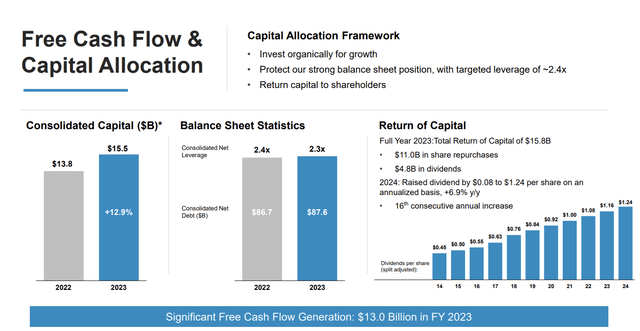

One of the primary reasons why we have been bullish on CMCSA’s stock in our previous writing was their commitment to return value to shareholders.

And our view has not changed in this regard. Comcast has kept on delivering attractive returns to its shareholders both in the form of dividend payments and through share buybacks. In the previous year alone, the firm has bought back $11 billion worth of shares and paid almost $5 billion in dividends. With the recent 6.9% dividend increase, the current annual dividend has reached $1.24 per share. This increase marks the 16th consecutive annual dividend increase.

For this reason, we believe CMCSA’s stock remains attractive to dividend and dividend growth investors.

Valuation

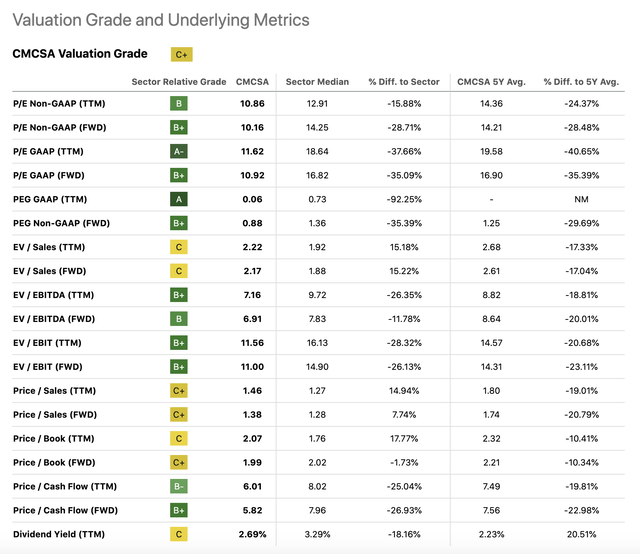

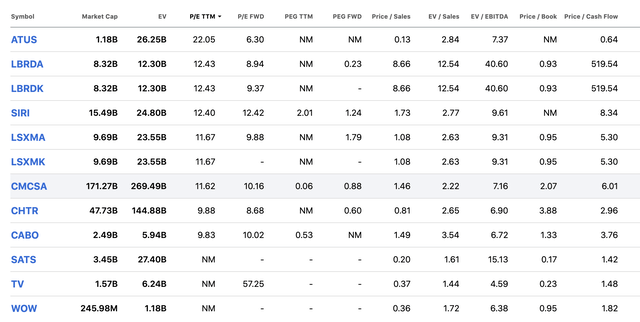

To assess the valuation of Comcast, we are going to take a look at a set of traditional price multiples. We will compare CMCSA’s figures with those of the respective sector median and also with those of the firm’s closest peers and competitors.

Based on the table above, we can see that currently Comcast is trading at a significant discount compared to the communication services sector, according to most metrics. Moreover, CMCSA also appears to be cheap in comparison to its own historic valuation multiples. Considering the financial performance of the firm in the previous quarter, and its commitment to return value to its shareholders, we believe that this discount is not justified.

If we narrow down the comparison to CMCSA’s closest peers and competitors, we can also see that the valuation is reasonable.

From a valuation standpoint, we also believe that our previously established bullish view is justified. In our opinion, based on the above-discussed price multiples and the firm’s financial performance/fundamentals, a P/E expansion is warranted. We expect a 20% to 25% upside at the current valuation, which would be in line with the firm’s historic valuation over the past 5 years.

Risks

Before concluding our writing, we briefly have to highlight some risks that we believe are important for investors to keep in mind.

Comcast faces several key business risks, including increased competition in the telecommunications and media industries, which could erode market share and pricing power. Rapid technological advancements may require significant investments to stay competitive, impacting profitability. Content acquisition costs could continue to rise, potentially squeezing margins. Shifts in consumer preferences towards streaming services could lead to cord-cutting and declining revenue from traditional cable subscriptions. Additionally, economic downturns may reduce discretionary spending on entertainment services, adversely affecting Comcast’s bottom line.

Conclusion

Comcast has sustained growth on both a quarterly and yearly basis. With a strong commitment to returning value through dividends and share buybacks, it remains an attractive option for dividend and dividend growth investors. Trading at a discount compared to its sector and its own historical valuation, Comcast presents an appealing investment opportunity. Therefore, we maintain our “buy” rating, believing the company will continue to perform well in the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.