Summary:

- I, like many of my readers, have a personal attachment to McDonald’s Corporation, and I will forever be a fan of the Big Mac.

- My sentiment toward McDonald’s stock, or investing in the company, is in complete contrast with the attachment I feel for McDonald’s.

- McDonald’s has struggled to revive U.S. foot traffic since 2010, relying instead on menu inflation to drive growth —a strategy, I believe, is unsustainable.

- Unlike previous generations, Gen Z and Gen Alpha seem less attached to McDonald’s for a surprising reason.

- McDonald’s is entering unchartered territory, with the company having to compete with different types of fast-food chains.

M. Suhail

McDonald’s Corporation (NYSE:MCD) is a household name. For this reason, almost every investor has an opinion on the outlook for MCD stock, including yours truly. Although this is my first Seeking Alpha analysis on McDonald’s stock, I have been following the company and its stock for as long as I can remember. I have enjoyed the Big Mac for even longer, but my health-conscious self does not allow me to indulge in the softness of the hamburger as regularly as I used to as a teenager.

Before I reveal the reasons why I am bearish on the prospects for McDonald’s, let me reiterate that I am strongly attached to the golden arches. I grew up in Colombo, Sri Lanka, and my family hosted most of my birthday parties at a local McDonald’s.

Today, as a Dubai resident, I visit a McDonald’s located just a couple of minutes away from my home whenever I am in need of a quick bite. This is especially true when I feel adventurous enough to deviate from my healthy eating habits once in a while.

Despite identifying myself as a true fan of McDonald’s, I cannot get myself around to invest in the company for three main reasons.

- McDonald’s will find it difficult, if not impossible, to grow foot traffic in the U.S. back to the 2010 peak in the foreseeable future.

- McDonald’s does not have the same brand recognition among Gen Z as it does with previous generations, and it would be near-impossible to replicate its past success when Gen Zers become the biggest target market.

- McDonald’s is entering unchartered territory where the business has to compete with fast-food chains of different natures.

In this analysis, I will dive deep into each of these reasons.

The Company’s Struggles In The Domestic Market

McDonald’s has a strong domestic business with the company generating more than 40% of its second-quarter revenue from its U.S. operations. The company, since its founding more than 80 years ago, has maintained a strong brand perception among American consumers as their go-to fast-food joint.

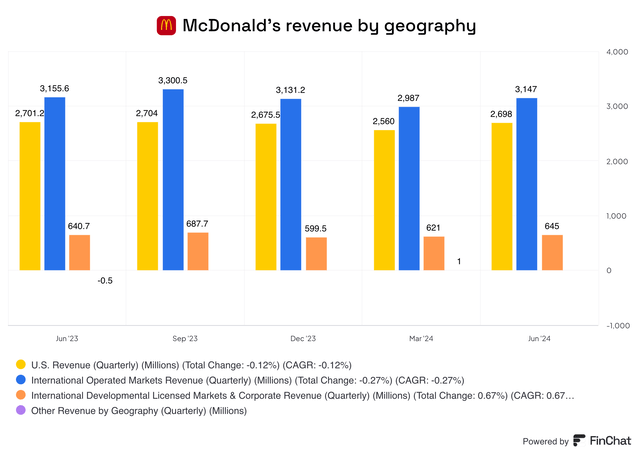

Exhibit 3: McDonald’s revenue by geography

Although revenue generated in the U.S. has grown steadily in the last decade, foot traffic has declined sharply, which has been compensated by an increase in average order value as McDonald’s delivered several price hikes in the recent past. According to Evercore ISI analyst David Palmer, there have been two interesting phases for the fast-food giant since 2012.

| Period | U.S. foot traffic decline | Increase in check size |

| 2012-2019 | 12% | 22% |

| 2019-2024 | 10% | 50% |

Source: Yahoo Finance.

As evident from the above data, McDonald’s has relied on menu inflation to drive domestic revenue growth in the past 12 years. Although the success of this strategy highlights its strong brand value, as a long-term-oriented investor, I find it concerning that McDonald’s has failed to revive foot traffic for well over a decade. In the next decade, the chances of a major rebound in foot traffic are dismal, in my view. There are a few main reasons behind my thinking.

First, the rising tendency to eat healthily, especially among the younger generation, will limit the addressable market opportunity for McDonald’s in the future. According to Dr. Dariush Mozaffarian, director of the Food is Medicine Institute at Tufts University in Boston, the number of U.S. adults who ate a poor diet (ultraprocessed food, fruit juice, beverages with high sugar, and refined grains) has declined from 49% in 1999 to 37% in 2020. This marks a notable increase in the number of Americans who are conscious about the health impact of their dietary choices. Although there is a lot of room for improvement, there’s no denying that healthy eating has gathered pace in the past two decades.

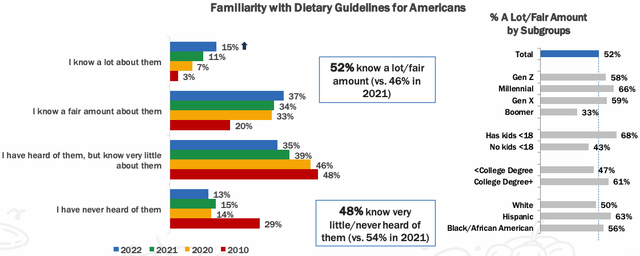

A survey conducted by the International Food Information Council in 2022 found that 52% of Americans follow a healthy diet or an eating pattern compared to just 38% in 2019. A record 52% of survey participants were familiar with dietary guidelines for Americans, up from the previous high of 46% in 2021. Younger generations, not surprisingly, proved to be the most knowledgeable of dietary guidelines.

Exhibit 4: Familiarity with dietary guidelines for Americans

International Food Information Council

I am not even remotely suggesting that healthy eating habits will kill McDonald’s. I do not see this happening, and I believe McDonald’s will remain relevant for as long as I’m alive. However, the rise of healthy eating, when combined with the other challenges that I discuss below, will make it challenging for McDonald’s to see meaningful traffic growth in the U.S., hindering domestic revenue growth.

Second, the competition is heating up in the U.S. fast-food service industry, leaving little room for McDonald’s to dominate the sector. In the value meal category, which has historically been a massive growth driver for McDonald’s, the company is now facing serious competition. The below table provides a comparison of some recent value meal options introduced in the United States.

| Restaurant/fast food chain | Value meal | Price | What’s included |

| McDonald’s | Meal Deal | $5 | A McDouble or McChicken, 4-piece Chicken McNuggets, small fries, and a small soft drink. |

| Wendy’s | Breakfast Bundles | $3 | English muffin sandwich with egg, cheese, bacon or sausage, and seasoned potatoes. |

| Taco Bell | Luxe Cravings Box | $7 | A Chalupa Supreme, Beefy 5-Layer Burrito, Double Stacked Taco, chips and nacho cheese sauce, and a medium drink. |

| Hardee’s | Original Bag Deal | $5.99 | Two entrees plus sides. |

| Hardee’s | More Bang, Less Buck | Under $4 | 10 items to choose from |

| Chili’s | 3 for Me | $10.99 | Half-pound Big Smasher burger or Crispy Chicken sandwich, bottomless chips and salsa, and bottomless non-alcoholic drink. |

| Red Robin | Monster Monday, Gourmet Cheeseburger Tuesdays, Wednesday’s Kids Meal | Starting from $10 | Varieties to choose from. |

| Olive Garden | Never Ending Pasta Bowl | $13.99 | Endless soup or salad and breadsticks. |

Source: Company press releases, USA Today.

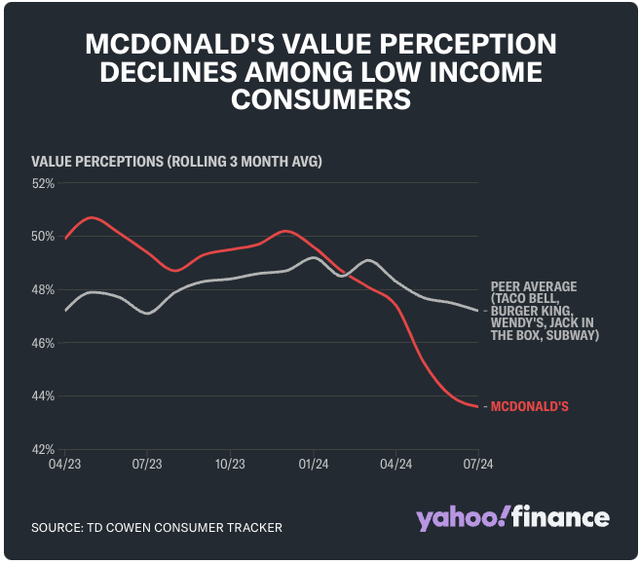

Again, I do not claim that the heating competition will drive McDonald’s out of business. But as a growth investor, I find it difficult to see the company winning market share in the U.S. despite gearing up to spend money on innovation and marketing. As illustrated below, McDonald’s value perception among low-income consumers has trended lower in the past three months to settle well below the peer average despite launching the $5 Value Meal.

Exhibit 5: Value perception of McDonald’s among low-income consumers

To bring U.S. foot traffic back to highs registered in 2010, McDonald’s has introduced several strategic initiatives.

- Introducing value meals to lure low-income customers, a cohort that McDonald’s lost in the last few years according to CFO Ian Borden.

- Promotional campaigns to drive brand visibility.

- Aggressive investments in digital marketing to become relevant among younger consumers.

- Expanding the restaurant footprint.

Some of these initiatives have delivered promising early results. For instance, the $5 Meal Deal introduced by McDonald’s led to a 3.1% YoY increase in foot traffic in the first full week after its launch. However, the factors that I discussed earlier will limit foot traffic growth in the foreseeable future, potentially impacting revenue growth.

A Unique Take On Brand Recognition Among Younger Generations

For the majority of Seeking Alpha readers and analysts, McDonald’s is a place that brings happy memories from their childhood. To put it more simply, there is some nostalgia associated with McDonald’s which makes us head over there for quick bites. This is not true for younger generations, especially for Gen Z, or Zoomers, and Gen Alpha (children born after 2010). Unlike previous generations, these younger generations tend to focus more on where they eat and prioritize factors such as sustainability, environmental impact, and other social values. Although this may seem like a negligible piece of information at first, recent survey findings highlight the important role played by these social considerations in shaping the food preferences of young generations.

According to the findings of several surveys, including a Kearney survey in 2020, an IBM survey in 2020, and a McKinsey survey in 2021, the majority of Gen Z consumers are willing to pay a premium for sustainable products and locally sourced products. This makes Gen Z the generation most focused on social values. The boycott movement McDonald’s had to face earlier this year due to tensions in the Middle East is a classic example of the relationship younger generations have formed with the brands they use products from, including food.

The convenience offered by McDonald’s will arguably remain unbeatable in the foreseeable future. However, the company’s inability to align its brand with more social values (this is an inherent problem in the fast-food service industry) may prevent it from ever enjoying the brand recognition it does among older generations.

The Competitive Landscape Is Changing

McDonald’s has been at the top of the fast-food service industry for decades, and the company has successfully defended this position through product innovation and strategically sound marketing campaigns. Today, I believe the company has found itself in unchartered territory where the competitive landscape has evolved dramatically with the introduction of innovative fast-food choices.

The rise of plant-based fast-food alternatives, the introduction of gourmet fast food, and the rapid rise of fast-food chains that cater to health-conscious consumers have changed the fundamentals of the fast-food service industry permanently.

McDonald’s still, and always will, have a place among the most elite names in this sector, but I believe growth will be difficult to come by in the next decade.

Takeaway

I will forever be a McDonald’s fan. Unfortunately, though, I cannot bring myself to invest in McDonald’s Corporation as a growth investor given the lackluster growth that I foresee for the company. International markets, for now, will contribute to the bulk of growth, but I do not see McDonald’s enjoying a meaningful expansion in valuation multiples or stellar earnings growth in the foreseeable future.

Dividend investors may still want to invest in MCD for the stable, predictable cash flows the business has generated for decades, but that’s not for me. MCD stock has more than tripled in the last decade, so investing in the company has certainly rewarded growth investors in the past, but I believe expecting similar returns in the next decade is a tad too optimistic.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.