Summary:

- With Berkshire Hathaway’s decision to significantly cut AAPL position, many voices emerged stating that Apple is a ‘sell’.

- Apple ticks all the boxes regarding cash-flow-generating potential, shareholder rewards, sustainability and quality of the business model, as well as valuation.

- Investors who claim AAPL is overvalued based on its stock price increases seem to miss two crucial factors: share repurchases and the multiple-based approach to assess the valuation.

Shahid Jamil

I’ve held on to Apple (NASDAQ:AAPL) for quite some time, and the Company has served me and my portfolio well. With recent noise around Apple and Berkshire Hathaway’s (BRK.A) (BRK.B) decision to significantly cut its AAPL position, many voices emerged stating that AAPL is a sell. When writing this article, I can see four recent, consecutive analyses of Apple declaring either a ‘sell’ or a ‘strong sell’ rating, which is uncanny for me for such a quality business.

I am a long-term-oriented investor with a buy-and-hold approach who concentrates on cash-generating businesses that offer attractive shareholder rewards – preferably paying dividends. Apple fits really well into my portfolio, with a strong ‘brand’ factor accompanying its technology-driven business and cash-flow machine characteristic.

Hold on to top-tier businesses and let the noise be noise – investment thesis

Apple has a well-deserved place in my portfolio. It is a ‘hold’ for me. It also has a noticeable position in my portfolio that limits my willingness to add more, but I’ll certainly consider adding at a potential pullback. I highly admire its:

- brand value component attached to the attractive, technology-driven segment

- ability to generate cash flows and reward its shareholders

- high profitability

- product ecosystem, ensuring cross-sell and up-sell opportunities

Many things should be considered upon making investment decisions, but for me, they often tend to come down to three factors:

- Are shareholders rewarded?

- Is the business model sustainable?

- How is the business valued? Spoiler alert: Apple is not overvalued as many portray it to be – I’ll discuss it further

Answering these questions ensures a wide enough margin of safety and a good night’s sleep by concentrating on cash-generating businesses with stable business models that are not going anywhere in the upcoming years. Apple is one of these businesses.

Let me present to you Three Reasons Why You Should Hold On To Apple Despite Many ‘Sell’ Recommendations.

Enjoy the read; cheers!

Reason #1: Apple Is A Cash-Flow Beast

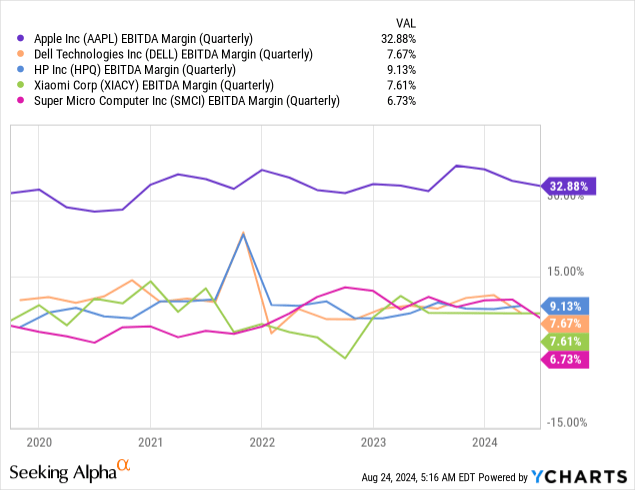

We don’t have to do much research to find one of the main reasons why Apple deserves a higher multiple than some of its peers: profitability. Naturally, profitability reflects all the other good things going on in the Enterprise, starting from supplier/customer relationships, management decisions, unique value proposition, pricing power, brand awareness, supply chain management, technological edge, etc…

Business is supposed to make money, and Apple took that to heart. Its EBITDA margin usually exceeds 30%, which is outstanding compared to some of its peers. For details regarding the last five years, please review the chart below.

Naturally, when combined with other factors (e.g., negotiating position with suppliers and customers regarding procurement), high profitability directly affects the business’ capability to generate cash flow.

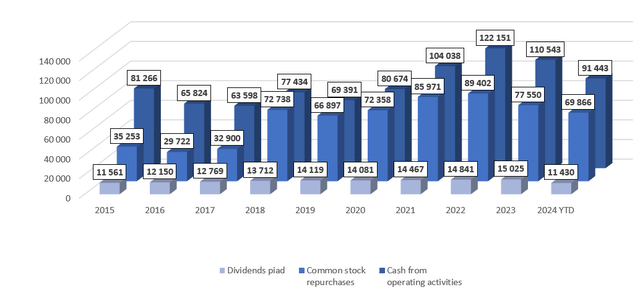

Apple is a true cash-flow beast, as the Company generated over $866B in cash from operating activities during the 2015-2024 YTD period. At the same time, AAPL provided outstanding shareholder rewards through:

- Common stock share repurchases (over $632B)

- Dividends (over $134B)

Please review the chart below for further details.

That’s exactly what I’m looking for in a business:

- Competitive edge

- High profitability, beating its peers

- Significant shareholder rewards

Reason #2: The Business Model Is Not Going Anywhere

Apple operates globally, including in the Americas, Europe, China, Japan, and other Asia-Pacific regions. The Company distinguished two segments of its distribution structure: direct channels consisting of its retail and online stores, as well as its direct salesforce, and indirect channels, including its B2B clients that further resell its products. What’s worth mentioning is that Apple is not completely reliant on its B2B partners, as its direct distribution channels accounted for 37% of its net sales in fiscal 2023.

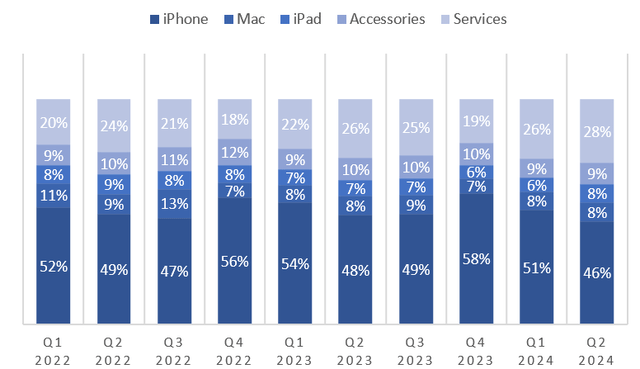

One wouldn’t have to review AAPL’s SEC filings to guess that most of the Company’s business revolves around iPhone sales, which typically generated from 45% to 60% of the sales, depending on the quarter, as seasonality applies to Apple. For reference, please review the sales structure in the chart below.

The Company is accompanied by relatively high sales seasonality leaning towards calendar Q4 (fiscal Q1) each year, which is related primarily to the new iPhone releases:

- iPhone 8 – September 2017

- iPhone X – November 2017

- iPhone XS – September 2018

- iPhone XR – October 2018

- iPhone 11 – September 2019

- iPhone SE (2nd Gen) – April 2020

- iPhone 12 – October 2020

- iPhone 13 – September 2021

- iPhone SE (3rd Gen) – March 2022

- iPhone 14 – September 2022

- iPhone 15 – September 2023

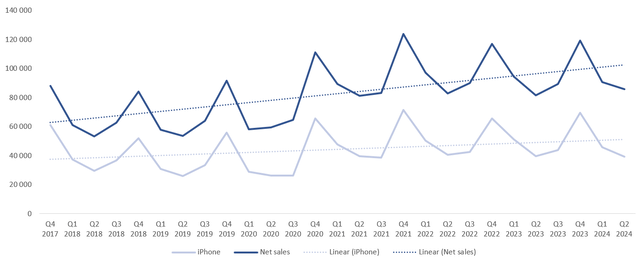

Please review the quarterly total and iPhone sales in the chart below for details (calendar periods).

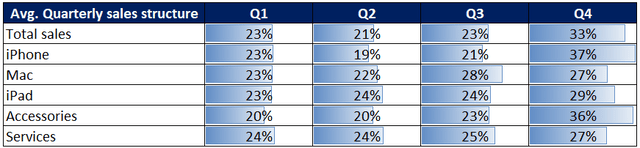

Regarding the seasonality, please review the table below depicting the average quarterly sales structure for the 2018-2023 period (please note that these are calendar periods, not fiscal ones).

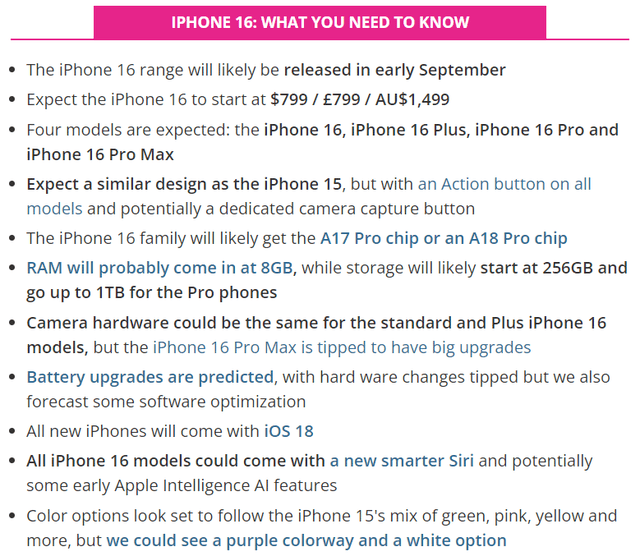

We can clearly see that most of AAPL’s segment sales are concentrated within either (calendar) Q4 or Q3 and Q4, except for Services, which are quite evenly distributed throughout the year (not surprisingly). Looking at the (calendar) YTD performance of 2024, AAPL generated $90.7B and $85.8B of revenue in Q1 2024 and Q2 2024, respectively. Considering the average quarterly sales structure and the upcoming release of iPhone 16, there’s way more to come.

Should we assume (according to the table above) that Apple’s YTD sales revenue equal to $176.5B represents ~44% of a whole calendar year’s revenue, one could expect the next two quarters to bring around $226B revenue (to a total of $402.5B for calendar 2024), which is my base scenario. However, that’s naturally highly dependent on the upcoming iPhone 16 release, but given AAPL’s track record and the power of its brand and technological ecosystem, I am not overly concerned.

For a brief expectations summary from TechRadar, please review the screen below.

Apple continues to build upon its technological ecosystem, creating great cross-sell potential. The effectiveness of its operations, not only regarding the products and brand but also the supply chain and relationship management with its counterparties, is well-reflected within its outstanding profitability (discussed in the previous point). Businesses that are so well put, offering industry-leading products and generating top-tier results, don’t just go away or lose their competitive edge earned over time and proven through consistent and sustainable track record. To summarize this point, let me provide you with two quotes that speak volumes about AAPL’s cutting-edge enterprise from Q4 2023 and Q3 2024 Earning Calls (bold added).

Q4 2023: Apple’s unique ecosystem of hardware, software, and services delivers an unparalleled user experience.

Q3 2024: With each innovation, we’re unlocking new ways of working, new ways of learning, and new ways of tapping into the unlimited promise of human potential. We are doing that across every product and every service.

Reason #3: Overvalued? By What Standards?

I’ve noticed many voices raising the matter of Apple’s ‘overvaluation’, justified by the growth of its stock price. There’s no argument about the fact that its stock price increased, considering the recent level of ~$227 per share and the level recorded in late August 2014 of ~$25.6 per share. The stock price recorded a CAGR of 24.4% during that period. Naturally, that’s an over-exaggeration and low-base effect, but AAPL’s stock price has also performed well in recent years.

What’s the problem with the above approach? It doesn’t factor in two crucial aspects:

- The development of the business

- Substantial share repurchases mentioned earlier

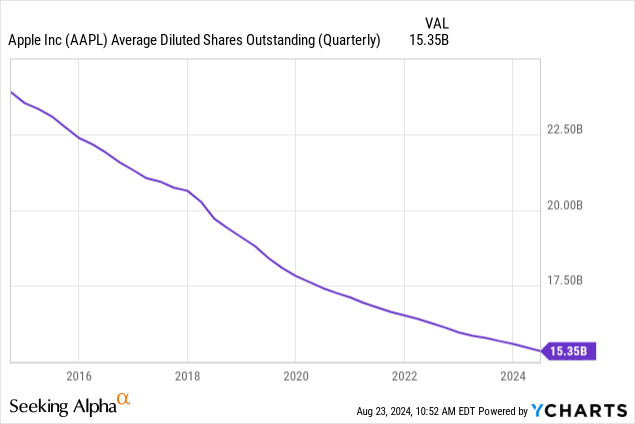

Let’s begin with the latter. Share repurchases typically lead to stock price appreciation, especially when financed through the Company’s operating activities. As mentioned earlier, the Company spent $632B on share repurchases during the 2015-2024 YTD period. Looking at the last 10 years, AAPL’s average diluted shares outstanding recorded a negative CAGR of ~4.5%.

Let’s look at the former. Analyzing the value of any business CAN NOT be detached from its financial results. That’s why multiples have become common in the transactional market. When we collect NBOs (non-binding offers, which indicate interest to acquire a given company) or bid one, the offer is generally structured as ‘X’ times a given financial metric, leading to Enterprise Value, which is later subject to certain adjustments.

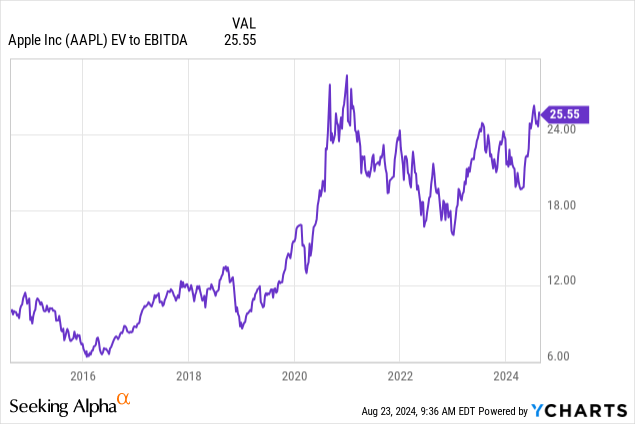

Therefore, as an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors.

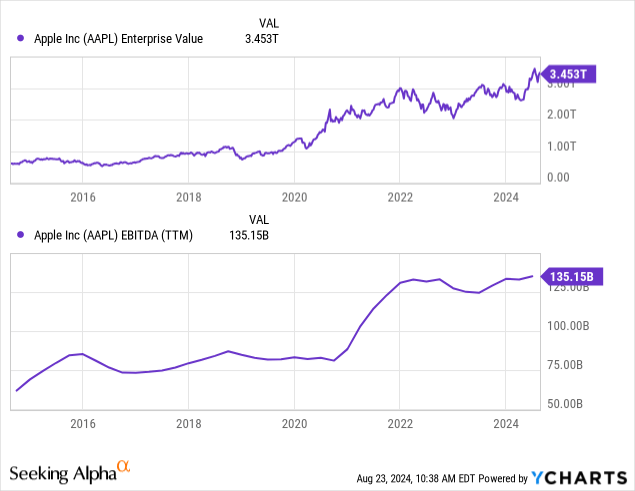

Please review Apple’s Enterprise Value (EV) and EBITDA developments during the last 10 years. We can see the correlation, as both metrics increased steadily until 2020 and then experienced dynamic upscaling.

The above metrics allow us to observe the EV/EBITDA multiple assigned to Apple, and that’s how one should approach its valuation—not simply by observing its stock price, as you can’t see the whole picture this way.

Numerous factors may impact the EV/EBITDA level assigned to a given Company, inter alia:

- Industry

- Leadership position

- Profitability

- Scale

- Diversification aspects (product, clients, geography, etc.)

- Competitive edge

- Cross-sell, up-sell, and expansion potential

- Growth prospects

- Etc.

Given the quality of Apple, reflected in its:

- Leadership position

- High profitability

- One of the strongest brands globally

- Cash-flow machine characteristic

- Continuing shareholder rewards

- Sustainable business model within an attractive, technology-driven segment

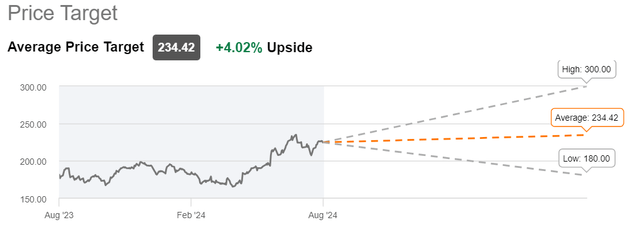

I consider AAPL fairly valued, and should it witness a pullback – I will be happy to add. For reference, Wall St. analysts expect the stock price to hover around $234, but the spread between ‘low’ and ‘high’ price targets is quite wide. For transparency, should Apple reach the ‘low’ price target, constituting an EV/EBITDA multiple of 20x or lower (should the EBITDA increase), that would be a ‘strong buy’ for me.

Risk Factors and The Bottom Line

Some market-specific and company-specific risk factors accompany each investment in the stock market. For instance:

- The potential inability for a ‘soft landing’ could result in a recession, weighing on the consumers’ strength

- Unsatisfactory results of iPhone 16 release would significantly impact AAPL’s financial results

- With global operations, AAPL is subject to numerous geopolitical risks across different regions

- With such a substantial brand factor to its business, any potential misdeliveries could significantly impact the consumers’ approach to Apple’s products going forward

- Apple operates within an ever-changing, technology-driven sector, which involves a constant race for innovation and getting ahead of the competition

Also, I am aware that Berkshire’s decision to substantially trim its AAPL position is not reassuring. I will leave that to your personal interpretation; however, I would be far from claiming that AAPL is in trouble based on these transactions.

Buffett at Berkshire’s annual meeting in May had expressed confidence that Apple would most likely remain the conglomerate’s largest stake at the end of the year.

Regarding my thesis, I will hold on to my stake in AAPL and gladly add during any potential pullbacks. The Company showcases:

- High profitability: significantly outperforming some of its competitors, usually exceeding 30% EBITDA margin

- Cash-flow machine effect: proving the effectiveness of AAPL’s business model and resulting in substantial shareholder rewards

- Strong brand factor: resulting in a high degree of consumer loyalty and uncanny brand awareness

- Unique technological ecosystem: creating cross-sell opportunities

- Fair valuation: considering AAPL’s leadership position and many other factors mentioned earlier

I believe that its shareholders will do relatively well in the future. Apple is a ‘hold’ for me. Thank you!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.