Summary:

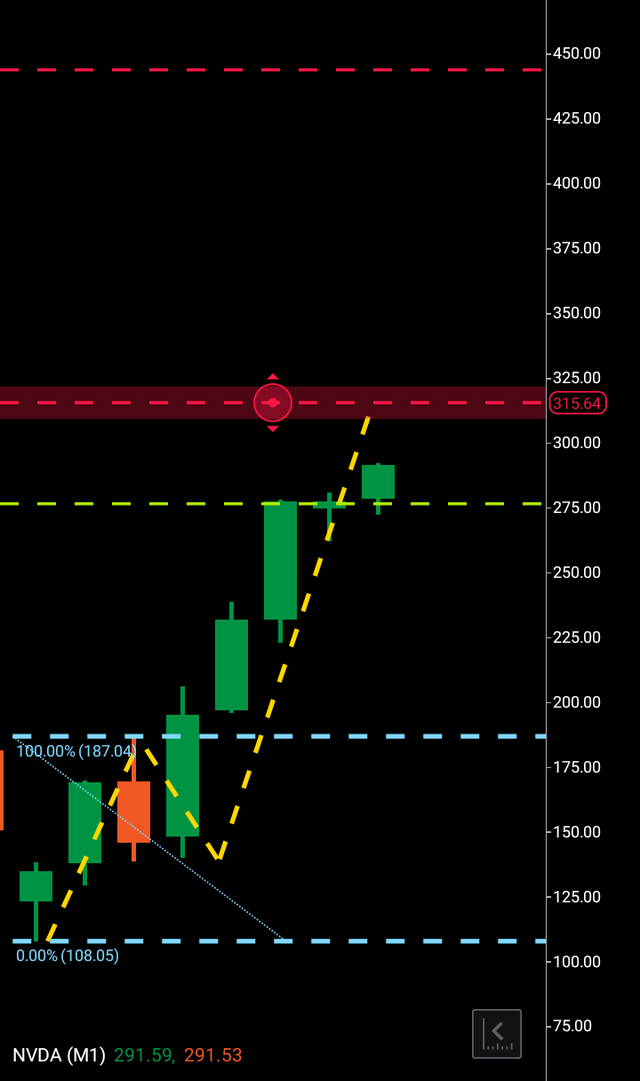

- An initial wave pattern of $187-$276 for Nvidia Corporation I outlined with Seeking Alpha has now completed.

- All eyes now switch to where the next bearish rejection will come with AI regulation or competition seemingly the only possible threat to this bullish melt-up.

- Looking to the charts, we will see if can we predict the confines of the “second” third wave and in the words of a famous wave theory practitioner, I know what this market is trying to do, just exactly how it will do it I’m not sure.

imaginima

And so it is, the man that pre-warned us about the impending pros and cons of AI on the now infamous Joe Rogan podcast, Tesla, Inc. CEO Elon Musk, says that normally regulation comes after something catastrophic happens, and in this case it may be too late by the time that scenario rolls around.

As we await the day we potentially open the curtains to find an army of red-eyed robots staring at us, in the meantime there’s money to be made. And, as this sector blooms towards its unknown destination, possibly plenty of it for investors in the companies that are developing this technology even further.

If you have read my last Nvidia Corporation (NASDAQ:NVDA) article, I explained that this equity was potentially in a bullish three wave pattern and if $187 was bypassed it would be $276 the next stop. This has now been achieved and it is the next target we will look to seek out.

In this article we will be discussing the latest news for Nvidia and what may lie ahead for this stock price wise as no slowdown in buying is apparent.

In 2022 Nvidia released its RTX 40 graphics card product range, offering substantial performance over the previous RTX 30 and priced reasonably amongst the line up in this sector, the product has been a great success so far in the gaming arena.

“Cryptotank” was also connected to Nvidia’s fortunes in 2022, as their chips are used for Crypto currency mining and the tank in the crypto market didn’t help demand for chips but a recent bounce in crypto currency will have added to stabilization in demand in that sector.

Market research firm Research Dive forecasts that demand for AI accelerators such as central processing units (CPUs), GPUs, data processing units, and other chips could grow at an annual pace of 39% through 2031, generating a whopping $332 billion in annual revenue at the end of that forecast period. Nvidia is in a solid position to take advantage of this huge opportunity.

New Street Research estimates that Nvidia controls a whopping 95% of GPUs used for machine learning. The research firm points out that its A100 GPU, which is priced at $10,000, has become the go-to chip for powering AI workloads in data centers and supercomputers. Not surprisingly, OpenAI used thousands of A100 GPUs to train ChatGPT, and it is not the only one using Nvidia’s chips to power its AI applications.

Now we will move to the charts to examine the current state of play and where this equity may be looking to stop next. In Three Wave Theory format, the $187-$276 has technically completed the first wave by the initial $187 rejection, paving the way for the third wave breakout. Looking at the chart now, the issue appears to be where the next rejection will come.

Nvidia monthly chart (Nvidia )

There are three possible price point scenarios, $315, $330 and possible but less likely one would imagine, $444.

The next bearish rejection will be important as, if that is also printed and then broken above by bulls, it will be $187 to the top of wherever the rejection comes that will technically print out the map of the following third wave.

If it were to come at $315 and be broken above, this would then tie in my with my additional $444 target for this equity, but it is merely a guessing game looking for a potential rejection area.

To finalize, I am first looking for the $315-$330 as immediate targets for Nvidia Corporation, with $444 an overall target. I will be issuing follow up articles tracking the wave patterns of this stock if it moves higher. I would expect Nvidia Corporation to achieve $444 within the next 180 days.

About the Three Wave Theory

The three wave theory was designed to be able to identify exact probable price action of a financial instrument. A financial market cannot navigate it’s way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes its future directional decision. It may continue past its third wave target but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave. The link to the Ward Three Wave Theory can be found in my bio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.