Summary:

- I’m upgrading Snap stock from sell to buy after a 6% price drop since my sell call and on potential gains from TikTok’s U.S. ban, expected January 19th.

- TikTok’s likely U.S. ban could benefit Snapchat significantly, as 70% of Snapchat users also use TikTok, and this could present higher user engagement on the platform.

- Snapchat is well aware and rolling out an expanded creator monetization program only days after the TikTok (possible) ban. I think this good news has yet to be priced in.

- I share my positive sentiment on Snapchat here and why I see more upside into 2025.

FOTOKITA/iStock via Getty Images

Investment thesis

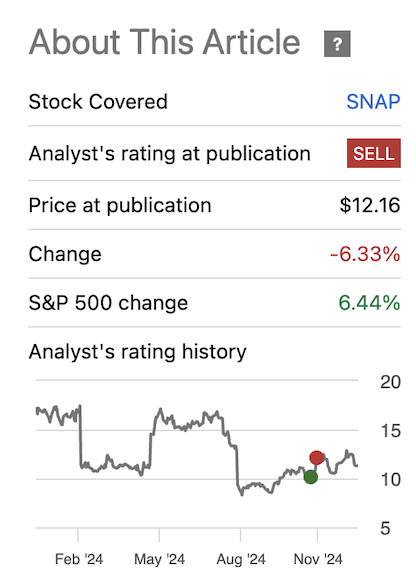

I’m upgrading Snap Inc. (NYSE:SNAP) to a buy after my sell rating in late October, delivering on my promise to find an entry point at a cheaper price. This is it. The stock has been down over 6% since my downgrade to sell call, as seen below, against the S&P 500, up 6.4% during the same period. If you look at the chart, I pinpointed the bottom for a buy at $10.2 per share and the top for a sell at $12.16. I stick to the buy low, sell high mantra, and it works well. I think there are limited downsides to Snapchat and, simultaneously, more potential good news for the New Year. Hence, I’m upgrading Snapchat to a buy based on my belief that TikTok’s loss will be Snapchat’s gain, and I’ll tell you why in a second.

Seeking Alpha

More on TikTok and why I care

Snapchat’s new catalyst is staring me in the face: the TikTok ban in the U.S., which is set to go into effect on January 19th. A quick recap of the U.S. government’s face off with TikTok: Back in April, President Joe Biden signed a bill that required TikTok to be sold to a non-Chinese company or banned from the U.S. Unsurprisingly, TikTok appealed this law. Long story short, the DC Circuit Court of Appeals rejected TikTok’s appeal for a temporary pause and called it “unwarranted” and decided to uphold the law.

On Monday, TikTok asked the Supreme Court to block a law that could ban it in the U.S., where over 170 million Americans are users. The law is called the “Protecting Americans from Foreign Adversary Controlled Applications Act,” and TikTok has challenged it, saying it violates free speech rights under the First Amendment. TikTok asked the Supreme Court to act by January 6. TikTok’s lawyers wrote in the court filing:

The Act will shutter one of America’s most popular speech platforms the day before a presidential inauguration… This, in turn, will silence the speech of Applicants and the many Americans who use the platform to communicate about politics, commerce, arts, and other matters of public concern.

This second appeal is unlikely to go through, in my opinion, and the market’s. And I think what will harm TikTok could substantially benefit Snapchat, given that 70% of Snapchat users also have TikTok, according to a report from Apptopia. The average Snapchat user spends around 33 minutes on Snapchat per day, which is lower than that of Snapchat users who also have TikTok and spend 38 minutes per day on the app.

What about the stock price movement?

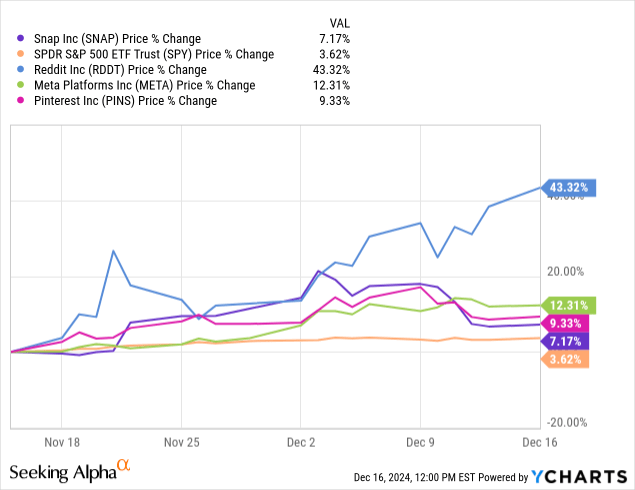

Well, consistent with my sell call, Snapchat stock has been underperforming its biggest competition. Snapchat is up 7.2% on the one-month chart, as seen below, outperforming the S&P500, up 3.6%. The stock, on the other hand, is underperforming the whole peer group; Meta Platforms (META) is up 12.3%, Reddit (RDDT) is up 43.3%, and Pinterest (PINS) is up 9.3%.

YCharts

Valuation

Snapchat has a market cap of $19.02 billion, down from $20.6 billion since my last article. The market sentiment is currently cautiously optimistic on Snapchat, with 4.5% of Street Analysts giving the stock a strong buy, 18.2% a buy, 70.5% a hold, and the rest a sell. According to data from Refinitiv, the PT mean and median also show an upward trend (more or less). The PT median was at $12.12 in mid-September, $12 in October, and up to $13 in November until now. As for the PT mean, it was at $12.66 in mid-September, $12.52 in October, up to $13.01 in November, and is currently $12.97.

As for the valuation metrics, the company has a forward PE ratio of 31.15, higher than its biggest competitor, Meta, at 25.5, and EV/Sales at 3.89, significantly lower than Meta’s at 9.95. I’m not too worried about the stock’s higher forward PE in relation to Meta, and I see a window for outperformance, considering the market hasn’t priced in the TikTok win yet, which, if it happens, I think would be pivotal for the company. Management has been adamant about innovating despite very aggressive competition, and I think AR technology has got to give.

What’s next

In more recent news, Snapchat is rolling out an expanded creator monetization program only days after the TikTok (possible) ban. The program will launch on February 1st and aims to expand the monetization opportunities to Spotlight videos meant to be shared with followers and friends alike. According to the company, the total time spent viewing the app is up 25% year-over-year, and Spotlight now has over 500 million MAUs.

I think the new program should further help push users to post more on the platform, leading to more engagement, which is what we all want. All eyes are now on January 19th, when the U.S. Supreme Court could delay the ban or uphold the law. Regardless, I think Snapchat is in a good position to exit 2024 better than it entered it, and that was proved right after last quarter’s results showed continued momentum in the business.

With all said and done regarding TikTok and the positive there, my long-term optimism on the stock remains in place. I continue to expect the company’s investments in its augmented reality platform or AR, its strides in AI since launching My AI last year, and the recent partnership with Google’s Gemini on Vertex AI to heighten engagement.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.