Summary:

- Netflix’s stock has nearly doubled since August, but it’s currently overbought with negative divergences, suggesting a potential period of selling or consolidation.

- Despite strong growth and margin expansion, Netflix’s current valuation appears stretched, making it a risky buy at these levels.

- Earnings growth is projected to slow, and much of the future growth seems already priced in, reducing the risk/reward appeal.

- I recommend holding off on buying Netflix now and waiting for a pullback to achieve a better risk/reward entry point.

ATHVisions/E+ via Getty Images

Streaming OG Netflix (NASDAQ:NFLX) has been on fire lately, to put it lightly. The stock has nearly doubled from its August low, reaching a market cap of $400 billion in recent days. The company’s pivot a couple of years ago to an ad tier has worked out beautifully, and it continues to see higher numbers of customers, and engagement from those customers. However, there are signs this rally has gone too far, and despite the fact that Netflix has proven an outstanding business, I do not believe now is the time to chase it.

Overbought and negative divergences

Those four words are how I’d describe Netflix right now. And while that doesn’t guarantee anything, it does make it much more likely that we’ll see a period of selling and/or consolidation. Let’s take a look at the daily chart.

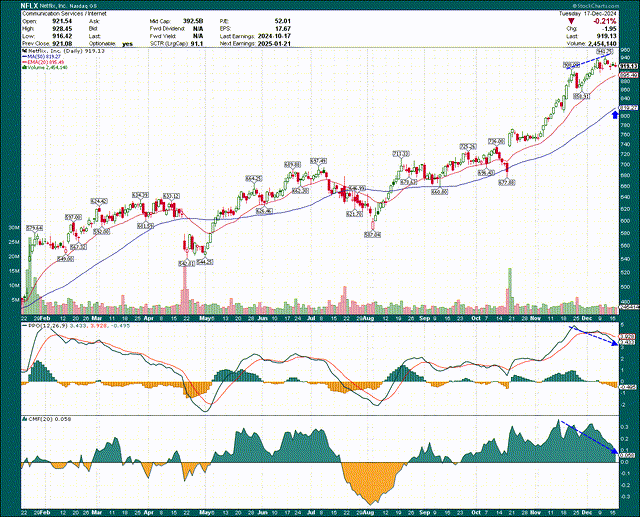

StockCharts

A negative divergence has formed on the daily chart as price made a new high in December, unaccompanied by a new high in momentum. The PPO and Chaikin Money Flow index both put in meaningfully lower highs on the December high. While this doesn’t guarantee anything, it does show that the bulls may be starting to struggle. That, in turn, makes it harder for buyers to continue to power the stock higher.

Generally, when we get a setup like this – extremely overbought, negative divergences forming – we’ll see a 50-day simple moving average test. That line is currently ~$820 but rapidly ascending, and while that may seem far-fetched, that’s where I’d look for an entry into Netflix.

The 50-day SMA will continue to rise for the foreseeable future, so any potential test will be at a higher level than $820. Point being, if you’re looking to get long Netflix, the risk/reward won’t be sufficient in my eyes until we’re within a couple of percent of that line. If it never reaches there, so be it; I see the stock as far too risky to buy today on this recent rally.

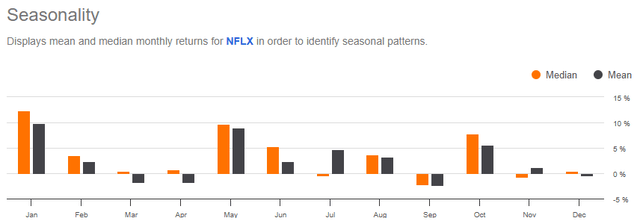

One thing aiding the bulls short-term is that January is the best month of the year for Netflix.

Seeking Alpha

It’s very difficult to stand in the way of this kind of seasonality, but I’ll offer up that November and December are generally pretty weak, but have produced an enormous rally this year. In other words, seasonality didn’t hold for November and December; should it be expected to in January? Seasonality is always a secondary indicator, so I wouldn’t ignore the evidence in the price chart and just blindly buy it ahead of January. But it’s possible we get one more attempt at a high in January before any real selling takes hold.

Lots of growth, but is it enough?

Obviously, Netflix is growing quickly. You don’t get a price chart like the one above for a company that’s struggling. And I’m not here to tell you that Netflix isn’t a terrific business, because it is. What I’m saying is that this rally has come too far, and that chasing today doesn’t make any sense from a risk/reward perspective.

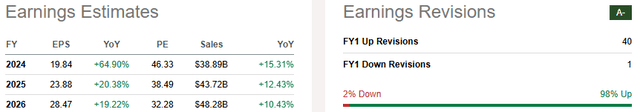

Seeking Alpha

Earnings are exploding for 2024, but growth rates into the coming years are much more pedestrian. We have 20% for 2025 and 19% for 2026, on sales growth rates that are set to steadily decline. While this is still good growth, does it warrant the current run in the share price? That’s difficult for me to reconcile as it appears to me that we’re pricing in much or all of 2025’s growth already.

To be fair, 40 of the past 41 revisions have been up, so it’s possible we see the EPS values in this table drift higher and work off some of the valuation increase. But it’s also possible we don’t.

I’m perhaps most concerned about the company’s ability to drive big sales increases, as evidenced by the below.

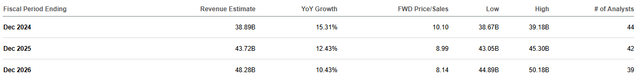

Seeking Alpha

These growth rates are okay, but 10% or 12% won’t get it done as far as I’m concerned. The company’s ad tier has been a masterstroke, and it’s important to note that the standard tier has not seen a price increase for years. The latter is a lever the company can pull and generate hundreds of millions of dollars of additional revenue – and margin dollars – quite easily if/when that price increase takes place.

Point being, subscriber numbers are critical to watch, but simply raising the price of the subscription is a big lever to pull for margins.

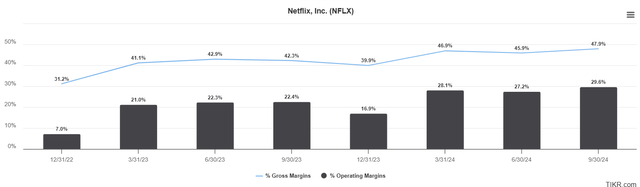

TIKR

Gross margins have ticked higher in recent quarters, closing in on 50% of revenue from near 30% a couple of years ago. Operating margins have followed suit, and as revenue increases, we should continue to see operating margins drift higher. Any price increases would go a long way towards boosting margins as that is costless revenue, meaning pretty much all of it goes to the bottom line. But until that happens, we have to stick with what we have.

I’d also argue that margin expansion is already priced in. EPS growth is set to be ~8% and ~9%, respectively, ahead of revenue growth for the next two years. That means that the margin expansion we’re looking at is accounted for already. Where’s the upside surprise going to come from?

Hold your nose and buy? I don’t think so

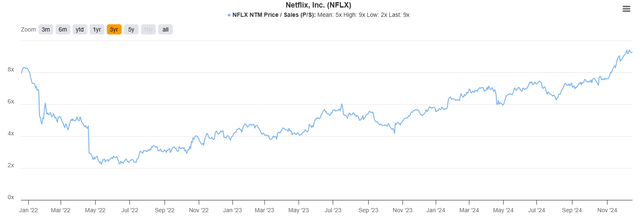

Let’s finish up with a valuation discussion, and we’ll kick that off with price-to-sales.

TIKR

The stock is now more expensive than it’s been in the past three years, sporting a P/S ratio of ~9X today. To be fair, any company that is seeing expanding margins should have a higher P/S ratio because each dollar of sales is worth more to the bottom line. I don’t mind that the P/S ratio is expanding, but it’s just expensive on this measure.

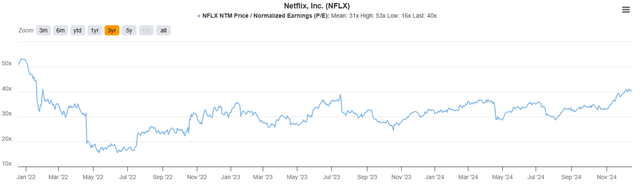

The P/E ratio follows a similar pattern, reaching multi-year highs recently.

TIKR

Today’s ratio of ~40X next-twelve-months earnings is expensive both absolutely and relatively. Keep in mind that earnings growth for the next two years is set to be ~20% annually, so we’re looking at a price-to-earnings-growth ratio of about 2. I like growth stocks to be closer to 1 as that means they’re undervalued. A PEG of 2+ generally indicates that earnings growth is largely (or fully) priced in, and that’s how I’m viewing Netflix at the moment.

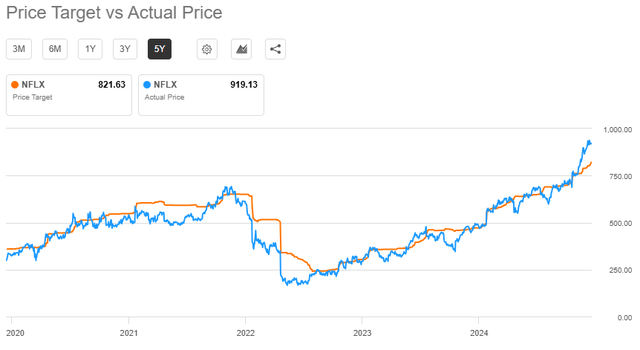

Finally, the stock is in an unusual position with respect to its price target from analysts.

Seeking Alpha

The stock is more expensive relative to Wall Street price targets than it has been for at least the past five years. The average PT implies 10% downside from today’s level. Again, this is not a reason alone to run out and sell the stock, but it’s one more feather in the cap of the bears, and I’m unwilling to ignore it.

I’ll say again that this article is not about Netflix suddenly losing its mojo. It’s a leader, and will be for a long time to come. I’m simply saying it has come too far, and buying today is a poor value proposition.

I am NOT suggesting Netflix as a short. I’m simply saying to take profits and wait for a better entry when the stock isn’t so stratospherically overbought. For that reason, I’m at a hold on Netflix, looking for that strong risk/reward on a pullback to buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.