Summary:

- AbbVie Inc. reported Q1 results this week that investors found underwhelming.

- This is the first full quarter with the loss of the Humira patent protection in the U.S.

- AbbVie Inc. increased full year guidance, but still fell short of analyst expectations.

vzphotos

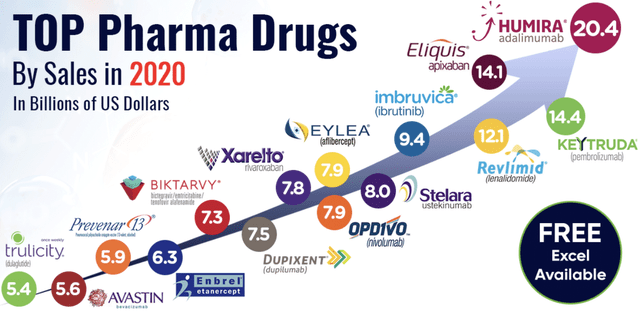

AbbVie Inc. (NYSE:ABBV) reported their first quarter results, which were notable in the fact that these results were the first full quarter without Humira having patent protection here in the U.S. Humira for years has been the best-selling drug in the world, and years back the drug’s sales accounted for roughly 70% of total company sales for AbbVie. That impressive run is over and management has spent years, leading up to this cliff, positioning itself as more of a well-diversified company.

Relying on one major product is fine when it is a blockbuster product like Humira, but all good things come to an end. Leading up to the pandemic, you can see just how dominant Humira was compared to other top selling drugs.

2023 was the year investors and management alike had their eyes on when it came to ABBV, due to the patent protection loss in the U.S. For those of you unaware, Humira is approved to treat several autoimmune conditions in adults and children, including the following:

- Rheumatoid arthritis

- Psoriatic arthritis

- Ankylosing spondylitis

- Plaque psoriasis.

The two drugs that have come through the pipeline that are expected to carry the torch for ABBV moving forward are Skyrizi and Rinvoq. Let’s take a closer look at the Q1 financials to see how those two drugs did and how the company did overall.

Q1 Results Fall Flat For Investors

Here is a summary of the company’s Q1 2023 results:

- Revenue: $12.23 billion compared to expectation of $12.2 billion

- Adj EPS: $2.46/share compared to expectation of $2.49/share.

Here is a closer look at the revenue breakdown by key areas of the business for the quarter:

- Immunology had revenues of $5.6 billion, a decrease of 9%

- Oncology had revenues of $1.4 billion, a decrease of 14%

- Neuroscience had revenues of $1.7 billion, an increase of 14%

- Aesthetics had revenues of $1.3 billion, a decrease of 14%.

Immunology is a main focus for the company, as this is where Humira, Skyrizi, and Rinvoq all are held. Humira sales came in at $3.5 billion, which was a decrease of 25% globally. Skyrizi and Rinvoq generated revenues of $1.4 billion and $0.7 billion, respectively. Skyrizi and Rinvoq sales grew 45% and 48%, respectively, compared to prior year.

The Humira sales decline was expected, as we have already seen Amgen Inc. (AMGN) start selling a biosimilar to Humira and another half dozen are expected to hit the market in the back half of the year, putting further pressure on Humira sales. Humira was the first drug in its class to ever achieve $20 billion in revenues, but management believes Rinvoq has more breadth than Humira did. The company continues to go through this period of transition.

Skyrizi and Rinvoq fell short of analysts’ expectations during Q1, but management maintained their expectation that the drugs will combine for sales of $11 billion in 2023. This means that growth is expected to really pick up and continue at a high rate moving forward, as right now they combined for $2.1 billion in Q1.

Looking further out, management has high hopes for these two drugs as they expect $17.5 billion combined in 2025 and more than $21 billion in 2027. Skyrizi is approved for forms of arthritis, psoriasis and Crohn’s disease in the U.S., while Rinvoq treats arthritis, eczema and ulcerative colitis.

Botox was a bright spot during Q1, as this segment generated $1.4 billion between both Botox therapy and cosmetic. Botox was part of the Allergan acquisition the company closed in 2020 in order to help diversify the company’s product offerings.

During the Q1 earnings release, management also raised their 2023 EPS guidance from a range of $10.62-$11.02 to a new range of $10.72-$11.12. Analysts have an average 2023 EPS expectation of $11.14, so even with the raise, it still fell flat of expectations.

Investor Takeaway

AbbVie has long been a very shareholder-friendly company since becoming its own separate public company following its spinoff of from Abbott Laboratories (ABT) roughly a decade ago. AbbVie has a nice yield approaching 4% with a 50% payout ratio, leaving the dividend plenty safe at the moment.

In terms of valuation, following the earnings release, AbbVie Inc. shares fell ~8%. This has ABBV shares trading at a 2023 earnings multiple of 13.6x when using the midpoint of management’s estimate. Given the lack of growth expected in 2023 and 2024, this current price is higher than I am willing to pay right now even with the selloff in AbbVie Inc. stock. Shares back under $125 would be a level I would consider adding to my position, but I already have a sizable position with AbbVie Inc.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.