Summary:

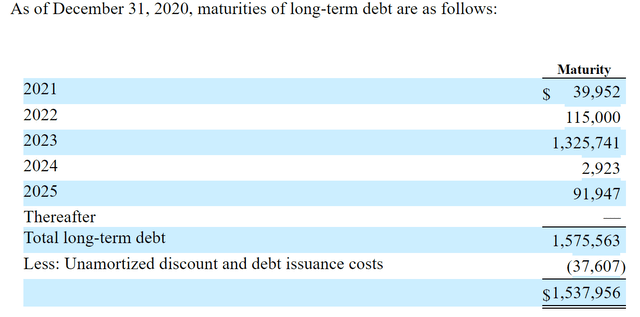

- XELA is heavily indebted, with $1.5 billion maturing in the next 24 months.

- Most revenues come from low-margin, labor-intensive services that don’t generate enough cash to pay operating expenses, not to mention creating shareholder value.

- Management is banking on its Business Automation portfolio, which according to company officials, is not very meaningful right now.

- The company is issuing an eyewatering number of new shares, diluting shareholder equity.

- Institutional debt holders are the only winners from this meme-trade bonanza.

Investment Thesis

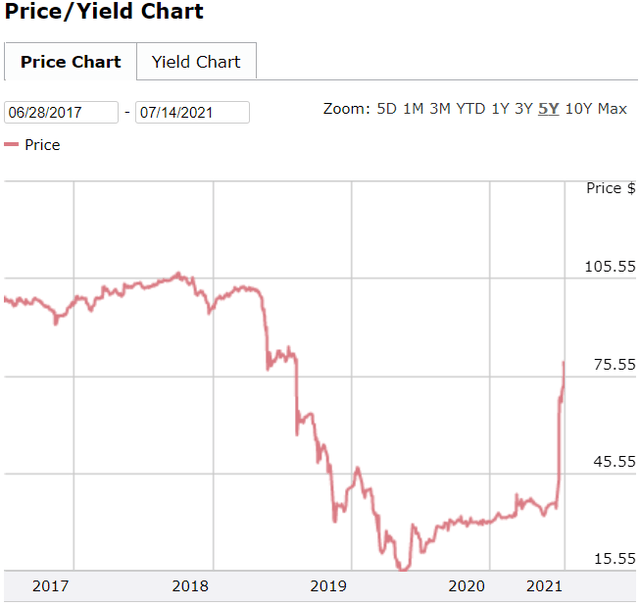

Exela (NASDAQ:XELA) is issuing an eyewatering number of new shares, taking advantage of a high share price. Management announced it is primarily using the new equity proceeds to pay down debt, effectively transferring the capital meme traders are throwing at the stock to debtholders. Last week, its 2023 notes were trading 37 cents to the dollar. Today, these same bonds are trading 80 cents to the dollar. Despite its size, the new equity proceeds are not enough for the company to meet its debt obligations maturing in the next two years, which sums to ~$1.5 billion. XELA will have to refinance, issue more shares, or sell assets to stay afloat.

Source: Morningstar

Even if the company succeeds in refinancing, it will likely be on unfavorable terms. Its financial position has deteriorated since it signed the first loan, which already carried strict covenants and a 10% interest. FY 2018 is the first year incorporating the full benefits of its Novitex SPAC transaction. Since then, revenue, net income, operating cash flow, and adjusted EBITDA decreased 19%, 5%, 200%, and 37%, respectively.

|

FY 2018 |

FY 2020 |

% Change |

|

|

Revenue |

$1,586,222 |

$1,292,562 |

-22.7% |

|

Net Loss |

$(169,806) |

$(178,530) |

-5% |

|

Operating Cash Flow |

$23,600 |

$(29,781) |

-200% |

|

Adjusted EBITDA |

$276,200 |

$173,400 |

-37% |

Source: Table created by the author. Data sourced from company website.

Issuing more shares will leave meme-traders holding the bag, especially those buying the top. We’ve seen this before too many times, and it is always sad receiving messages from traders asking about the prospects of the highly overvalued companies they jumped into too late. While no one can time the market, good companies’ shares increase over time, providing a safety net if your calculations or timing were wrong. The meme trades are harder to predict.

XELA plans to issue $150 million in new shares, above the $100 million earlier in May, bringing the total to $250 million, which is more than its $236 million market cap! (This is on top of the $25 million in Q1).

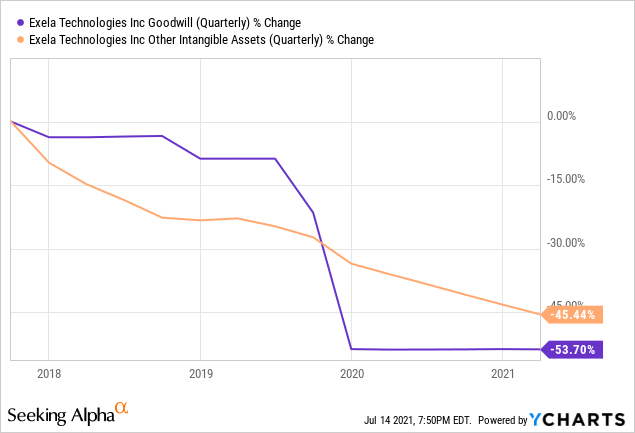

Selling assets will hurt revenue. Moreover, I don’t believe the company’s assets are worth enough. Most of the debt is related to Goodwill, and Other Intangibles teemed on the balance sheet during its private equity bankers’ M&A slicing and dicing before its SPAC deal brought it to the public market. The company has already written off about half of these accounts’ balances. Currently, the company records $360 million and $281 million in Goodwill and Other Intangibles, respectively. In total, the two accounts constitute about 58% of the company’s total assets.

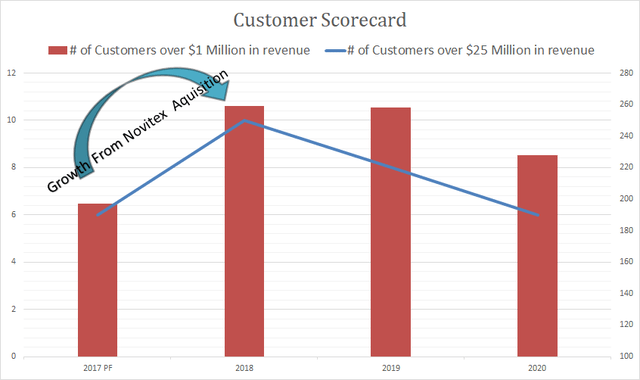

Doing nothing is also not an option. Revenue has been declining since 2018, demonstrating operational challenges. Promises of cross-selling and expanding share of customer wallets never materialized. The number of clients paying +$1 and +25 million, an internal management performance metric, is declining, according to the latest investor fact sheet presentation dated May 4, 2021.

Source: Data from company fact sheet (excel download). Graph created by the author

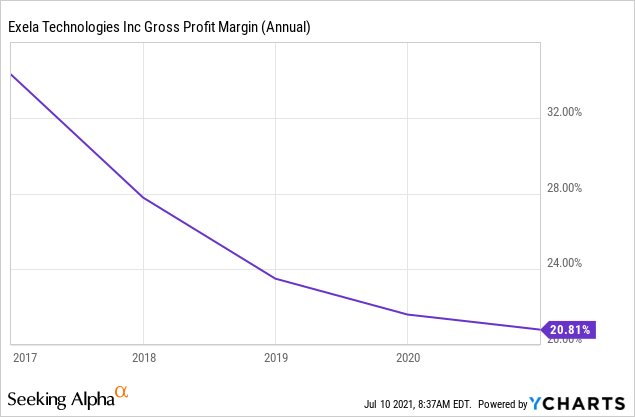

The vast majority of XELA’s revenue comes from thin-margined, labor-intensive business outsourcing services “BPO” that don’t cover operating expenses. In the past two years, cash flow from operations has been negative despite aggressive cost-cutting initiatives. Annual interest, which stood at $175 million in FY 2020, is more than two-thirds of its current market cap ($236 million at the time of this writing.)

The company’s digital transformation portfolio is currently not meaningful, according to company officials. High debt, interest expense, and cash burn impede management’s plans to transform into a business automation company “BPA.” Adjusted EBITDA, another management metric, has been on a downtrend since 2018, decreasing 37%, reaffirming the troubles beyond interest payments.

The company has an active Investor Relations division, pursuing bloggers and content writers, so there is a lot behind the curtains for readers to see this piece. I believe that the company’s press releases overstate its technology, emphasizing the use of buzz words to describe its business. In a recent article,(paywall) Bloomberg described XELA as a software company, so I don’t blame retail traders for falling for the same mistake.

Nonetheless, while most of the new equity proceeds will go to lowering debt, some will develop its digital transformation portfolio. The company states that it plans to invest $20 million – $25 million in capital expenditure this year. I expect R&D to remain stable between ~$1.5 million to $3 million, maybe more depending on how much it puts aside from the new cash injection.

Revenue Trends

- Current Revenue Trends:

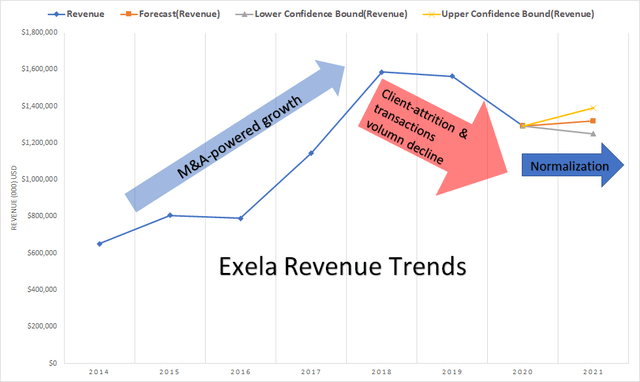

XELA revenue has been declining in the past two years despite the 2018 Asterion acquisition. Three trends are dragging sales down

- Exiting of contracts

- Lower volumes

- Sale of assets

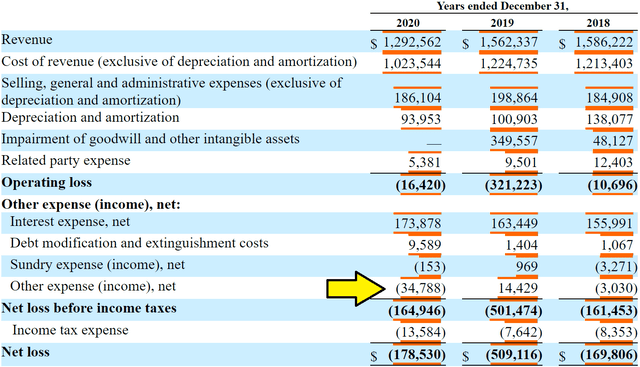

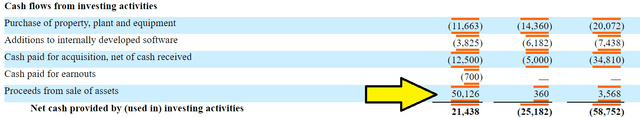

The company is exiting contracts that are hard to execute due to unpredictability and low margins. XELA is also conducting its 2019 debt-reduction plan, which saw the sale of its Logistics, Physical Record Storage, and SourceHOV Tax businesses for ~$50 million in 2020.

On Mar. 16, 2020, the Company and its indirect wholly owned subsidiaries, Merco Holdings, LLC and SourceHOV Tax, LLC entered into a Membership Interest Purchase Agreement with Gainline Source Intermediate Holdings LLC at which time Gainline Source Intermediate Holdings LLC acquired all of the outstanding membership interests of SourceHov Tax, LLC for $40.0 million subject to adjustment as set forth in the purchase agreement. The company recognized a gain of $35.5 million on the sale of SourceHOV Tax, LLC during the first quarter of 2020, which takes into account approximately $2.0 million downwards adjustments to the purchase price in accordance with the purchase agreement. The gain on sale of SourceHOV Tax, LLC is included in Other expense (income), net in the consolidated statements of operations for the year ended Dec. 31, 2020.

On Jul. 22, 2020, the company completed the sale of its physical records storage and logistics business for a purchase price of $12.3 million. The company recognized a gain of $8.7 million on the sale of physical records storage and logistics business during the third quarter of 2020. The gain on sale of physical records storage and logistics business is included in Other expense (income), net in the consolidated statements of operations for the year ended Dec. 31, 2020.

– FY 2020 Annual Report

Source: Company SEC filings. XELA recorded gains on the sale of its assets on its income statement as profit “Crediting the Other Expense account”

Source: Company SEC filings. XELA recorded $50 million in cash from the sale of assets in FY 2020, primarily from its Logistics, Physical Records Storage, and SourceHOV Tax businesses.

Nonetheless, there is some visibility in its earnings, stemming from the nature of its business and annual/long-term contracts. However, the company remains prone to economic cycles because of its transaction-based pricing model, in contrast to other B2B micro-caps such as Issuer Direct (ISDR), which maintains a subscription-based model. Other B2B subscription-based companies include Workiva (WK), BlackLine (BL), and Broadridge’s (BR) compliance segment.

- Past Revenue Trends:

Before listing on the public markets in mid-2017, XELA powered its revenue through M&A, accumulating a significant amount of debt in the process, which its bankers rationalized by “synergies” and “cost reduction opportunities,” which haven’t materialized, at least enough to create value to shareholders.

- What to expect this year?

Management expects transaction volumes to return to pre-COVID levels this year; however, its revenue guidance is far below 2019 levels, possibly indicating more asset sales, customer attrition, or both. Still, I believe we’ll see some normalization in revenue this year. In any case, XELA’s problem is not its revenue. The current low valuation already reflects the competing trends on its topline figure. Instead, its main issue relates to its interest expense, margins, low-tech, and unsustainable operating expenses.

Source: Data from XELA filings. Graph created by the author

Margins

XELA is an amalgamation of businesses pieced together in the offices of private equity bankers before being leveraged up and spun to the public market. The events that led to XELA’s existence resemble the private equity boom in the 1980s, a company that Michael Milken would conceive.

I believe this complexity explains why XELA can’t get it right in terms of operating costs. Despite its vast revenues, SG&A expenses eat up most of its already thin gross profits. In the past two years, cash flow from operations has been negative. Part of the issue is related to the nature of its operations. However, if you look at Conduent (CNDT), its SGA/Revenue is 11.6%, compared to 14.4% for XELA. At some point, managing a sprawled company like XELA becomes difficult, and problems start surfacing, such as its 2020 legal troubles costing $57 million (preliminary ruling), internal control issues, such as accounting errors, and restatement of financial statements. I think XELA is too big for its own good. I believe that bankers who recommended the deal just wanted to make quick money from the SPAC and private transactions before it went public.

The business outsourcing market is competitive, with low barriers to entry, pushing gross margins lower. In Q1 2021, we saw a sequential increase in margins due to exiting some low-margin contracts, but it is too early to call a reversal. More importantly, I believe these troubles touch on management talent. If the company is struggling in the BPO industry, how would one expect it to succeed in the BPA sector, which is even more competitive?

Although 41% of the company’s workforce is located in India and the Philippines, many contracts can’t be outsourced outside the US due to data laws that prevent data transfer outside US borders, especially banking contracts. This leaves XELA susceptible to wage inflation and labor shortage in the US and EMEA, which doesn’t bode well for its 2021 gross margins.

Financial Position

High-interest expense drags earnings deeper into the red. As of March 2021, the company recorded $1.5 billion in long-term debt and $2 billion in total debt. FY 2020 annual interest expense stood at $174 million.

In Q2, the company issued $100 million in new equity and planned on an additional $150 million bringing the total to $250 million, a massive sum that exceeds its $236 million market cap. This is on top of the $25 million equity raise in Q1. This enhances its balance sheet but leaves the fate of equity shareholders uncertain. What makes things worse is that despite these massive new equity offerings, the company needs much more to quickly stabilize its financial position before the more extensive chunk of its debt matures in 2023.

Source: Company filings

Management

XELA tries to present itself as a tech company, but in my opinion, it is primarily a highly leveraged call center. Beyond the buzz words of the earnings conference calls and press releases, low margins, revenue per employee, pricing model, and capital structure all are signs of the nature of its operations. According to company officials, the company’s digital transformation portfolio is “not very meaningful right now.” The austere R&D program also reflects the quality and value-added of its offerings.

XELA has an active Investor Relations operation pursuing Bloggers, and Content Writers, in what I see as an effort to control the narrative around the company. This mainly affects retail traders who don’t have access to research but is also not a productive way to spend shareholders’ money.

In the past few years, XELA’s management has aggressively pursued cost reduction, targeting employee medical insurance and personnel administrative expenses, which hit employee morale, many of which went to the public forums to complain about the company’s treatment. This hinders the company’s ability to attract talent as it pushes its BPA operations. More importantly, it doesn’t sit well for many millennial traders emphasizing ESG.

Summary

XELA’s cash burn, leverage, and operating challenges hinder its ability to transition to a business process automation company. New equity offerings dilute shareholders’ equity, and worse, it is not enough to save the company. XELA is between a rock and a hard place when it comes to its financial position, so I don’t blame management entirely, but the truth is, many meme-traders will get hurt from this trade, and the only winner is institutional debt holders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.