Summary:

- We are maintaining our Buy rating on MO, with the stock consistently supported at the $40s and NJOY’s shelf reset likely to bear excellent results by H2’24.

- Its cigarette volume decline may be painfully accelerated compared to its peers, warranting the management’s aggressive smoke-free approaches thus far.

- MO may have bottomed here, with an excellent potential for capital appreciation and dividends, assuming a future rerating nearer to the sector median and 3Y pre-pandemic means.

- Assuming similarly depressed stock prices, we may also see the tobacco company retiring a good amount of shares ahead, with the $1B already triggering a reduced annual dividend obligation of up to $88.3M.

- However, MO investors may need to temper their intermediate term expectations, with marketing expenses likely to balloon and profit margins impacted during the transition.

Jeffrey Coolidge/Stone via Getty Images

We previously covered Altria (NYSE:MO) in October 2023, discussing its oversold status then, with the market over reacting to the minimally lowered FY2023 guidance and consistently declining sales volume for conventional tobacco products.

However, we had placed our confidence on its latest acquisition, NJOY, with it demonstrating the management’s determination to diversify its tobacco offerings while tapping on its existing manufacturing and distribution expertise.

In this article, we shall discuss why we are maintaining our Buy rating on MO, with the stock consistently supported at the $40s. At the same time, investors only need to be patient as the NJOY acquisition is likely to bear results by H2’24.

Combined with the robust profitability and the management’s sustained share repurchases, we believe that the tobacco company’s dividends remain safe throughout the slow but sure transition.

The MO Investment Thesis May Have Bottomed Here

For now, MO reported a top-line miss in its FQ4’23 earnings call on February 1st, with revenues of $5.02B (-4.7% QoQ/ -1.2% YoY) and adj EPS of $1.18 (-7.8% QoQ/ inline YoY). We may expect further underperformance as well, based on the management’s FY2024 adj EPS midpoint guidance of $5.075 (+2.5% YoY).

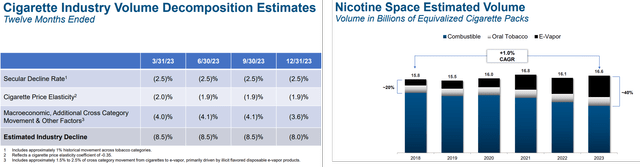

Cigarette Secular Decline

It is apparent that the cigarette industry’s secular decline has yet to bottom, with it already hitting another -8% in decomposition rate in 2023, with approximately 2% attributed to the transition from cigarettes to illicit e-vapors.

It is unsurprising then that MO’s sustained price hikes for Marlboro has had the unintended effect of accelerated volume decline by -10% YoY by FY2023, compared to the industry’s averages, as consumers switch to lower priced alternatives.

MO’s drastic volume decline is notable indeed, compared to its direct peers, such as Philip Morris (PM) whom guided a mere “1% to 2% cigarette volume decline” in FY2023, and British American Tobacco p.l.c. (BTI) whom reported an absolute -5.2% decline in H1’23 with flat global volume share in combustibles in 2023.

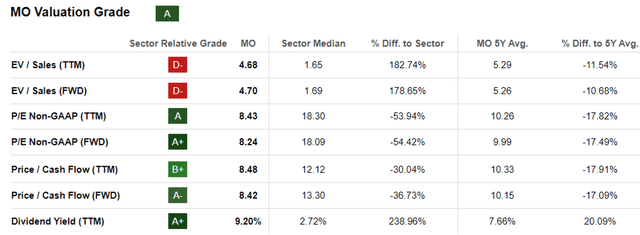

MO Valuations

Based on its impacted near-term prospects, it is unsurprising that MO trades at lower FWD Price/ Cash Flow valuations of 8.42x, compared to its 1Y mean of 9.31x, 3Y pre-pandemic mean of 21x, and sector median of 13.30x.

Aside from BTI whom recently suffered from a dramatic correction post write-downs with lower FWD Price/ Cash Flow valuation of 5.03x, it is apparent that MO’s prospects have been discounted compared to its direct peers, such as PM at 14.37x and Japan Tobacco (OTCPK:JAPAF) at 13.57x.

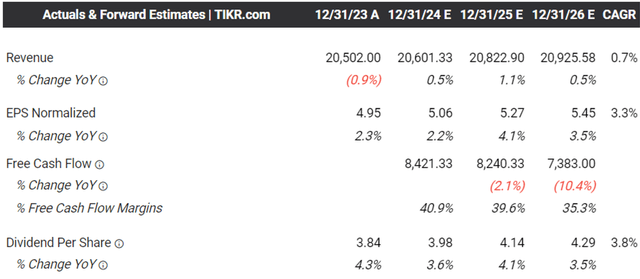

The Consensus Forward Estimates

With declining combustible volumes, impacted top/ bottom line performances, and yet-to-be-successful smoke-free product portfolio, we can understand why the consensus estimates through FY2026 appears to be stagnant, with MO expected to generate a minimal top/ bottom line growth at a CAGR of +0.7% and +3.3%, respectively.

This is compared to the previous consensus estimates of +2.7%/ +8.6% and historical growth at +0.8%/ +7.3% between FY2016 and FY2023, respectively.

Combined with PM’s and BTI’s latest settlements, we may see the former’s IQOS 3 heat-not-burn offerings eventually imported into several US states from April 30, 2024 onwards, triggering further headwinds to MO’s NJOY penetration.

While PM has already signaled a delay in the IQOS ILUMA’s scaled-up rollout, with the US FDA PMTA likely to be approved only by H2’25, if not later, it is apparent that MO has a rather narrow window of opportunity to succeed.

This is especially worrying, since BTI’s Vuse continues to command the leading market share at 42% for the four weeks ending December 30, 2023 (inline MoM), compared to MO’s NJOY at 2.6% (inline MoM), based on the latest Nielsen convenience store report.

As a result, MO investors may need to temper their intermediate term expectations, with marketing expenses likely to balloon and profit margins impacted. The same has been estimated by the consensus, with the tobacco company likely to report declining FCF margins over the next few years.

So, Is MO Stock A Buy, Sell, Or Hold?

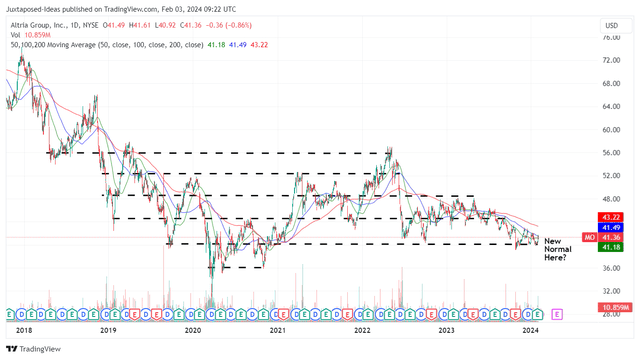

MO 6Y Stock Price

And it is for these reasons that we can understand why MO has fallen as it has, with the stock appearing to chart a new normal at these bottom levels.

Based on the stock’s underwhelming performance over the past few years, attributed to the conventional tobacco’s secular decline, it is unsurprising that its prospects are tied to the eventual success of its smoke-free approaches.

While there have been some studies surrounding the secular growth of alternative tobacco products linked to the cessation of cigarettes, MO has yet to successfully tap into the market, as observed by NJOY’s stagnant market share over the past few months.

However, readers may note that the MO management has reported excellent progress in its limited NJOY marketing trials by the end of December 2023.

For example, thanks to the strengthened supply chain across materials, logistics, and retail, the company has been able to expand the distribution of the ACE pods to over 75K stores by the end of FQ4’23, exceeding the original target of 70K.

At the same time, MO has already convinced 70% stores to upgrade NJOY’s positioning to premium locations, with resets expected to be completed by H1’24. This is on top of the limited trials on bundle sale offers from November 2023 onwards, which have directly increased NJOY’s relative retail share by +0.6 points over the past two months.

As a result of the promising early results in the limited trial locations, we share the same optimism reported by the management, with investors likely to see incremental US market share growth over the next few quarters.

These developments suggest that the MO stock may have bottomed here, thanks to the bullish support at $40s, with opportunistic investors likely to enjoy excellent capital appreciation through stock upside and dividends.

Assuming that MO is eventually rerated closer to its peers’ FWD P/E of 18x, we may see a more than decent upside potential to our long-term price target of $81.70. This is based on the consensus FY2026 adj EPS of $5.45 and its 3Y pre-pandemic P/E mean of 15x.

This is on top of MO’s richer forward dividend yields of 9.40%, compared to its 4Y average of 7.98% and sector median of 2.70%. This is thanks to the $6.8B in FY2023 payout (+3.1% YoY) and 5Y Dividend Growth Rate of +5.06% (compared to the sector median of +5.11%).

As a result of its prospective dual pronged returns, we continue to rate the MO stock as a Buy for opportunistic investors with long-term investing trajectories, since its full diversification from conventional tobacco to smoke-free approaches will not occur overnight.

Lastly, anyone expecting tech-like growth from tobacco companies may have been mistaken indeed, since the sector typically offers stable YoY sales (i.e. minimal growth at single digits) and dependable income payouts for retirees.

This is on top of the new $1B in share repurchase program, with MO already retiring 23M shares over the past year at an average price of $43.96.

Assuming similarly depressed stock prices, we may see the tobacco company retiring a good amount of shares ahead, with the $1B already triggering a reduced dividend obligation of up to $88.3M on an annual basis.

With a robust shareholder return thus far, MO simply needs to execute its smoke-free approaches competently to jump start its reversal, in our opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.