Summary:

- The revenues of tech companies are on the rise due to the boost provided by AI, offering stocks substantial competitive advantages and the potential for significant upside appreciation.

- Since mid-July, many tech stocks have pulled back, presenting an opportunity to pick up quant Strong Buy AI stocks that have dipped amid poor market sentiment.

- We measured metrics on 147 AI stocks and have identified the 10 most valuable players (MVPs) for the fourth quarter, quant-rated Strong Buys.

- If you’re looking to kick off the rest of 2023 with companies primed for revenue and earnings growth, strong profitability, and upward analyst revisions, consider 10 top AI stocks powering the future with competitive advantages.

- As a bonus, I’m including three top non-tech companies leveraging artificial intelligence that also are quant-rated Strong Buys.

mesh cube/iStock via Getty Images

AI Stocks Lead Market Rallies

The golden age of artificial intelligence is here – one of the biggest bulls in market rallies. AI added nearly $500 billion to the U.S. market cap in 2023, and NVIDIA (NVDA), the “Godfather of AI,” captures the enthusiasm surrounding artificial intelligence.

After delivering outstanding first quarter and second quarter results that increased Nvidia’s market value from $760 billion to $1.17 trillion, the AI frenzy is creating “drop the mic” historical moments in tech. Apple (AAPL) stock crossed over $3 trillion, and the Nasdaq Composite rallied to its best-ever first half of the year, now 40%-plus year-to-date. With a craze in full swing, consider capitalizing on the massive return potential of the future – AI.

Will artificial intelligence (AI) lead the tech rally into 2024?

Rallying with the Nasdaq, the tech sector (XLK) is up 40% YTD, and the growth prospects of artificial intelligence – the new technological disruptor – are driven by a wave of demand for software and semiconductor chips. AI – the latest tech bull – is leading the 2023 stock market rally and has been a critical driver of global economic growth. An unprecedented wave of IT spending for artificial intelligence amid rising demand for chips, cloud computing, and a massive shift across enterprises and the consumer landscape seeking the best and most innovative tech for the future is underway, a shift that will likely reach well beyond 2024.

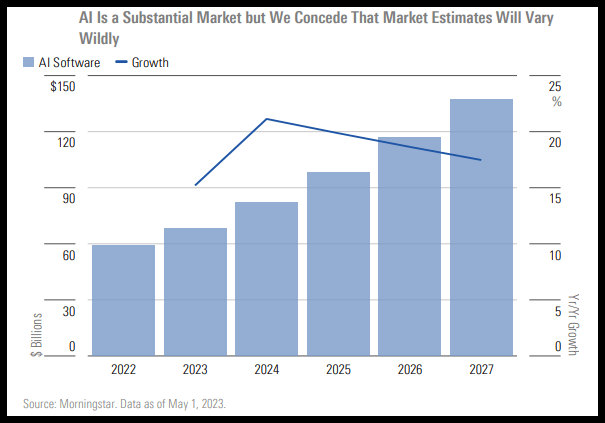

AI Market Estimates Vary (Morningstar)

As showcased in the chart above, a blend of industry estimates compiled by Morningstar highlights that the scope of artificial intelligence will likely reach well beyond software. Morningstar reports:

“Consumers and businesses alike are interested in artificial intelligence, although there’s no clean and clear way to size this market. We anticipate that AI development will be enormous, but monetization may be scattered. Some firms may weave AI into existing products, while some may earn direct fees from AI models.”

Global AI spending has surpassed International Data Corporation’s (IDC) forecasts, well over its $300B projections. From 2022 to 2026, IDC reported that AI-centric systems expect a growth rate of 27%, with AI spending accounting for 25% in 2023 alone. As more businesses invest in AI’s benefits, many buy opportunities are outside the trillion-dollar behemoths like Apple (AAPL), Microsoft (MSFT), and Nvidia, which are dominating as the most valuable players.

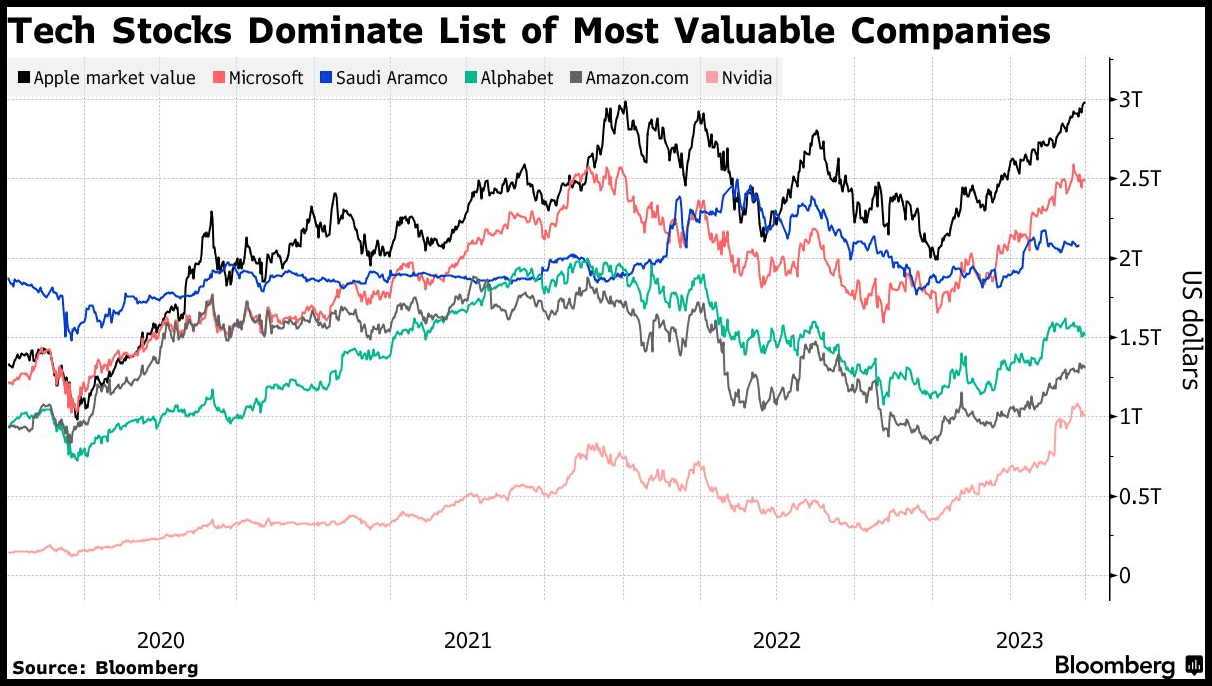

Big Tech Stocks Dominating as MVPs (Bloomberg)

The promise of enhanced productivity, long-term cost savings, and efficiency have prompted the biggest names in tech to capitalize on the AI boom. But as you know, our quant ratings also capture lesser-known names with strong fundamentals. So, in the spirit of the most valuable players (MVPs) and the start of America’s football season, let us kick off the fourth quarter with 10 quant-rated top picks out of a field of 147 AI Stocks.

MVPs: Best AI Stocks to Buy

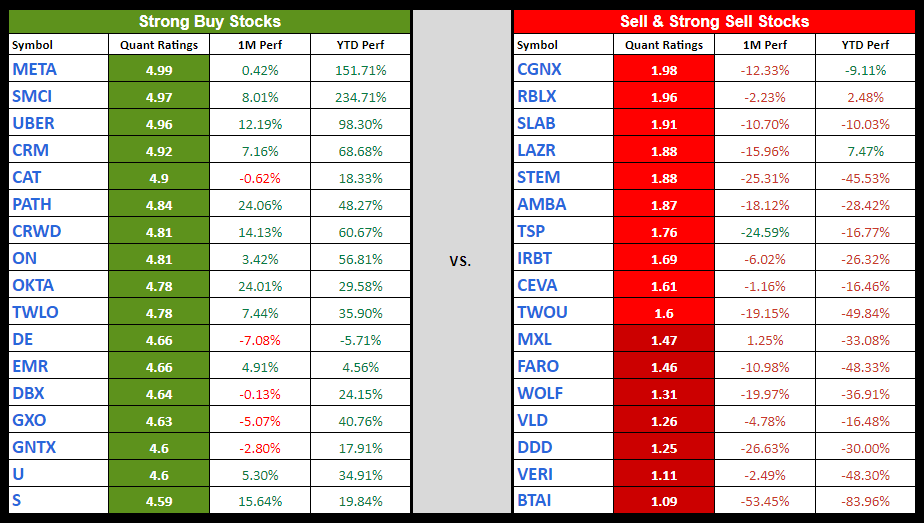

Companies want to leverage AI technology for its competitive advantages, like increased efficiency, cost savings, scalability, and the potential to improve customer experiences. Some of the top 10 are well-known Mega-Tech stocks, but others are not well-known and are not Mega-Tech. The top 10 AI stocks below are selected by blending four of the largest AI ETFs and narrowing from 147 stocks created in an AI Quant portfolio. As shown in the table below, leveraging Seeking Alpha’s portfolio tool allows investors to compare stocks from Strong Buy to Strong Sell. The average monthly performance of our 17 Strong Buys is 6.53%, which significantly outperforms 17 Sell/Strong Sells, whose monthly performance is -14.86%.

Strong Buy AI Stocks vs Sell/Strong Sells (S&P Global/Seeking Alpha 9/12/23)

Meta, Super Micro Computer and Salesforce have been on my Strong Buy list in the past. As we move through the fourth quarter, finding top stocks with solid underlying fundamentals ripe for growth leveraging AI can be an excellent opportunity to capitalize on a booming industry.

1. Meta Platforms (NASDAQ:META)

-

Market Capitalization: $791.40B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 1 out of 249

-

Quant Industry Ranking (as of 9/12/23): 1 out of 62

Consecutively beating earnings expectations, Meta Platforms showcased a Q2 EPS of $2.98, beating by $0.09, and revenue increased by more than 11% year-over-year for the same period. Up more than 140% YTD, the social media, virtual reality, and AI-driven company continues to develop products for the world to connect and share. Meta’s latest Instagram Reels feature allows users to create 15-second video clips that can include music sharing to stories, feeds, and more, which Morgan Stanley believes will aid the company’s “core” ads business and generate as much as $20 per share in earnings by 2024.

Like most Mega-Techs, Meta comes at a premium valuation, showcasing a forward P/E of 22.36x vs. the sector’s 17.54x. However, its forward PEG ratio of 1.04x is nearly a 28% discount to the sector. Complemented by strong fundamentals, growth, and tremendous profitability, Meta’s +$55B in Cash from Operations (TTM) will aid Meta’s AI implementation and monetization of enhanced applications and breakthroughs expected to contribute significantly to Meta’s run rate – Reels is anticipating a $5B run rate by the end of 2023. With bullish momentum, significant gross profit and EBIT margins, and 44 FY1 Upward analyst revisions, this tech heavyweight and our next pick, Alphabet, are quantitative Strong Buys launching offenses in AI.

2. UiPath Inc. (NYSE:PATH)

-

Market Capitalization: $10.87B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 18 out of 582

-

Quant Industry Ranking (as of 9/12/23): 1 out of 46

After consecutive earnings beats since 2021, the systems software company UiPath surged more than 10% after posting Q2 results. A leader in automation, UiPath boasts of being the AI-powered platform everywhere in business, used by everyone for everything. With better-than-expected earnings and guidance, Truist analyst Terry Tillman writes,

“We believe PATH is an automation leader and should benefit from the groundswell in (generative AI) interest owing to its differentiated approach of combining GenAI with Specialized AI driving better accuracy and quicker time to value.”

The end-to-end automation platform with robotic processing delivers strong growth and innovation. Consensus estimates expect sales between $313M and $318M, above its estimate of $315.16M. The second quarter delivered an ARR of nearly $1.31B, an increase of 25% Y/Y.

With an EPS of $0.09, beating by $0.06, and revenue of $287.31M, up 18.61% Y/Y, Path’s go-to-market strategy, strategic initiatives, expansion deals, and value selling are driving the platform’s adoption. In addition to increasing margins and $47M in free cash flow for Q2, PATH trades at a discount. Possessing a B+ forward PEG ratio of 1.13x, a -35.72% difference to the sector, this leader for robotic process automation reigns supreme for the fifth year. Consider this strong buy-rated stock for a portfolio, along with my next pick, which has been my No. 1 stock pick since the start of the year.

3. Super Micro Computer, Inc. (NASDAQ:SMCI)

-

Market Capitalization: $14.67B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 5 out of 582

-

Quant Industry Ranking (as of 9/12/23): 1 out of 29

Super Micro Computer, my No. 1 pick for 2023 and top-performing Alpha Picks, is +227% YTD and +222% since its selection on Nov. 15, 2022, into the Alpha Picks portfolio – nothing short of super! A top stock focused on high-performance server and storage solutions, SMCI was added to the S&P midcap 400 earlier this year.

Offering record-high backorders, FY23 non-GAAP EPS of 109% year-over-year, and FY 2024 sales between $9.5B and $10.5B, expected well above the consensus estimate of $6.92B, SMCI has showcased company strength and bullish momentum. Boasting the only U.S.-based scale AI platform designer, its tremendous partnerships that include the AI Godfather Nvidia have led to seven Wall Street analysts revising FY1 estimates up over the last 90 days and a one-year price-performance of +311%.

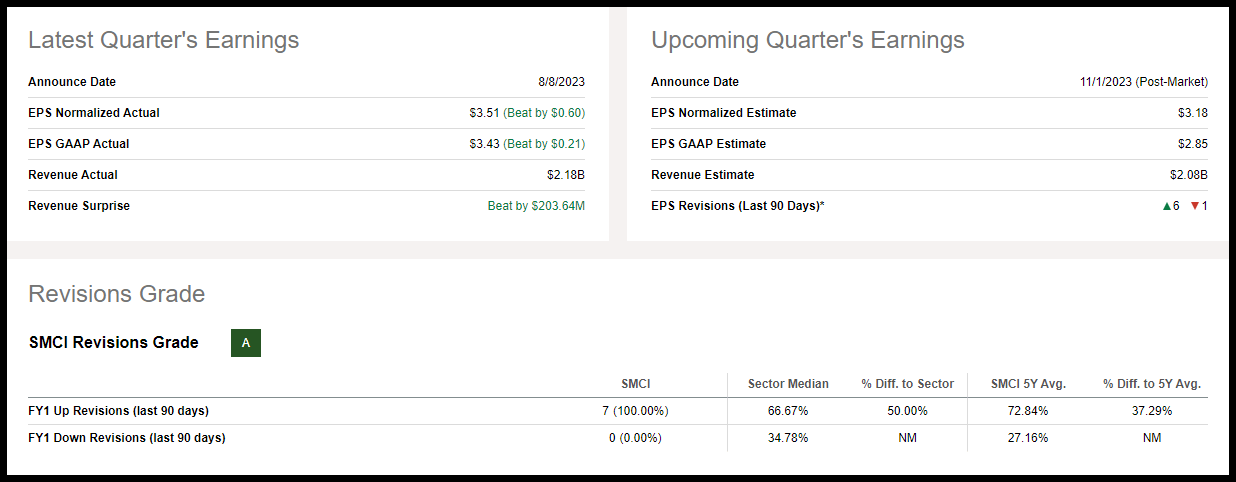

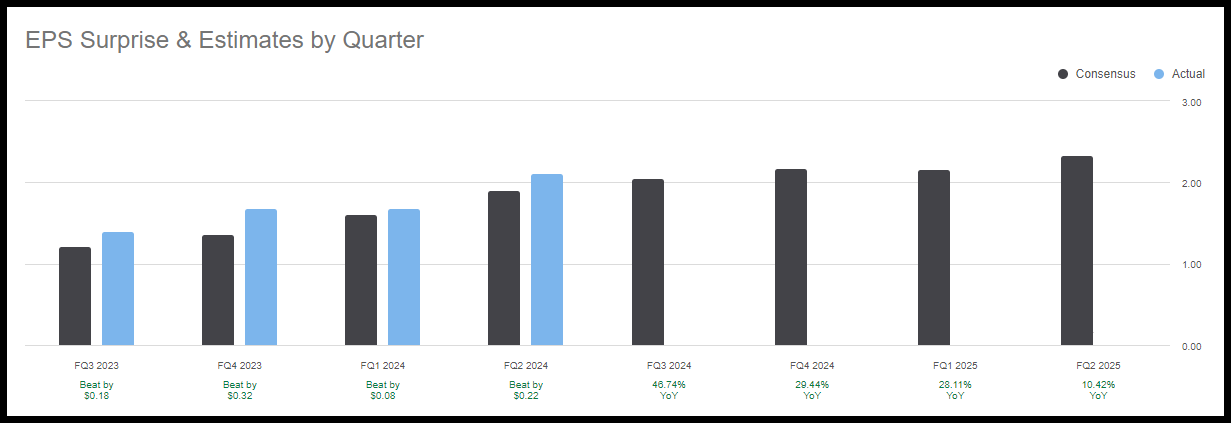

SMCI Stock Earnings and Revisions (SA Premium)

Despite its run-up, SMCI stock continues to trade at a discount. SMCI’s forward P/E ratio is 18.14x, more than a 30% difference to the sector, and forward PEG is more than a 50% discount. Fourth quarter earnings surged past expectations, with an EPS of $3.51, beating by $0.60, and revenue of $2.18B, beating by nearly 34%. A Seeking Alpha news report highlights that the rise in generative AI doesn’t appear to fade soon. Wedbush Securities upgraded SMCI, given the “limited” near-term downside. Analyst Matt Bryson increased the stock’s rating given its “outlook as very much fitting with its conversations suggesting GPU tightness as generally governing near-term AI server shipments.” Consider SMCI for a portfolio.

4. Salesforce (NYSE:CRM)

-

Market Capitalization: $219.23B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 9 out of 582

-

Quant Industry Ranking (as of 9/12/23): 4 out of 202

In the face of Customer Relationship Management, Salesforce, the pioneering technology bridging companies and their customers, uses cloud computing and AI to drive customer success. The world’s first generative AI for CRM, Salesforce created Einstein GPT, which partners with OpenAI’s advanced models, using natural-language prompts for better customer experiences.

Salesforce was one of the biggest stock gainers last month, along with our next pick, Okta. Salesforce’s consistent growth and profitability have resulted in ceaseless top and bottom line earnings beats. Over the last 90 days, 43 analysts have revised fiscal year estimates up after Q2 2023 EPS of $2.12 beat by $0.22 and revenue of $8.60B beat by $75.18M.

Salesforce stock has consistently crushed earnings.

Salesforce Stock (CRM) has consistently crushed earnings (SA Premium)

CRM’s second quarter unveiled an impressive $808M operating cash flow, +142% Y/Y, and continued margin improvements. Like other Big-Tech stocks, Salesforce comes at a relative premium valuation. Although Salesforce’s forward P/E ratio comes at a bit of a premium to the sector, its forward PEG ratio of 1.12x is a -36% difference. With room for upside, given its substantial quarterly price performance compared to sector median peers and bullish momentum, consider Salesforce, an AI force for a portfolio.

5. Okta, Inc. (NASDAQ:OKTA)

-

Market Capitalization: $14.78B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 25 out of 582

-

Quant Industry Ranking (as of 9/12/23): 6 out of 27

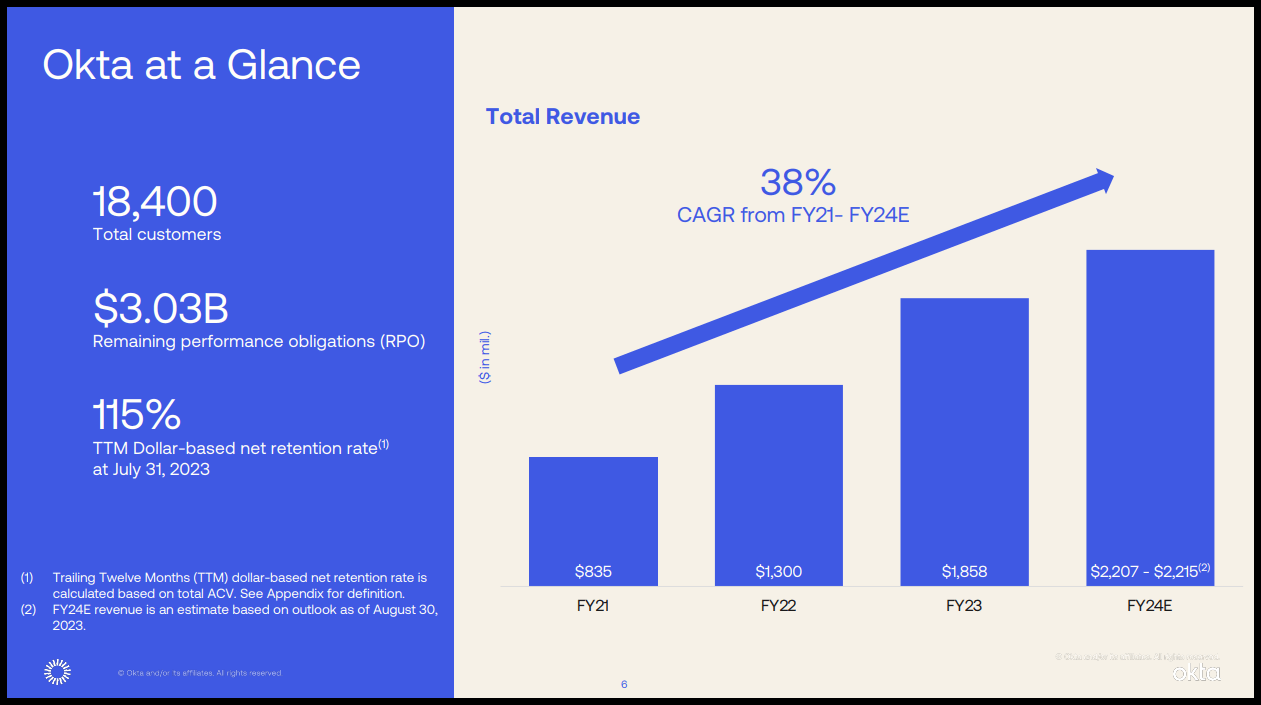

Offering a unique suite of products and services to secure identities, Okta is the solution for small and medium-sized businesses and organizations around the world. Through machine learning and artificial intelligence, Okta’s Intelo.AI streamlines access to the IT company’s platform. Planning to invest nearly $40M in annual research and development for AI projects, Okta CEO Todd McKinnon says AI is “worthy of the hype.” Strong sales and profitability include a record number of signups and +$5 million total contract value deals, and OKTA is seeing improvements in operating profits and cash flow. Shares of OKTA surged 15% following its Q2 top and bottom line earnings results. EPS of $0.31 beat by $0.10, and revenue of $556M beat by +23%, prompting Okta to raise its FY2024 revenue guidance to a range of $2.207B to $2.215B, from $2.175B to $2.185B, and compared to the consensus revenue estimate of $2.18B.

Okta Stock Q2 Revenue (Source Link: OKTA Q2 FY24 Investor Presentation)

The Identity and Access Management (IAM) market is expected to grow rapidly, offering tailwinds for Okta. Given its international presence with U.S. headquarters, solid customer retention, growth, and a strong dollar should aid the company. Despite the stock trading near its 52-week high and up 28% YTD, Okta’s valuation metrics still come at a relative discount, evidenced by a “B-” forward PEG of 1.66x vs. the sector median of 1.77x. Additional forward price/book figures are more than a 31% difference to the sector, well worth considering for a portfolio, especially amid Okta’s margin expansion.

6. ON Semiconductor (NASDAQ:ON)

-

Market Capitalization: $42.23B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 21 out of 582

-

Quant Industry Ranking (as of 9/12/23): 1 out of 68

Semiconductors are one of my favorite industries and a game-changing component complementing artificial intelligence. ON Semiconductor has capitalized on global shortages and chip demand. Offering cutting-edge technology and advancements in the electrification of vehicles (EVs), ON is a leading provider of power management and vision-based systems. Through AI power, ON Semi VP and General Manager Gianluca Colli states,

“As we approach an era where Artificial Intelligence (AI) is becoming an integral part of vision-based systems, it becomes clear that we now share this world with a new kind of intelligence. The ARX3A0 (a breakthrough imaging sensor) has been designed for that new breed of machine, where vision is as integral to their operation as it is ours.”

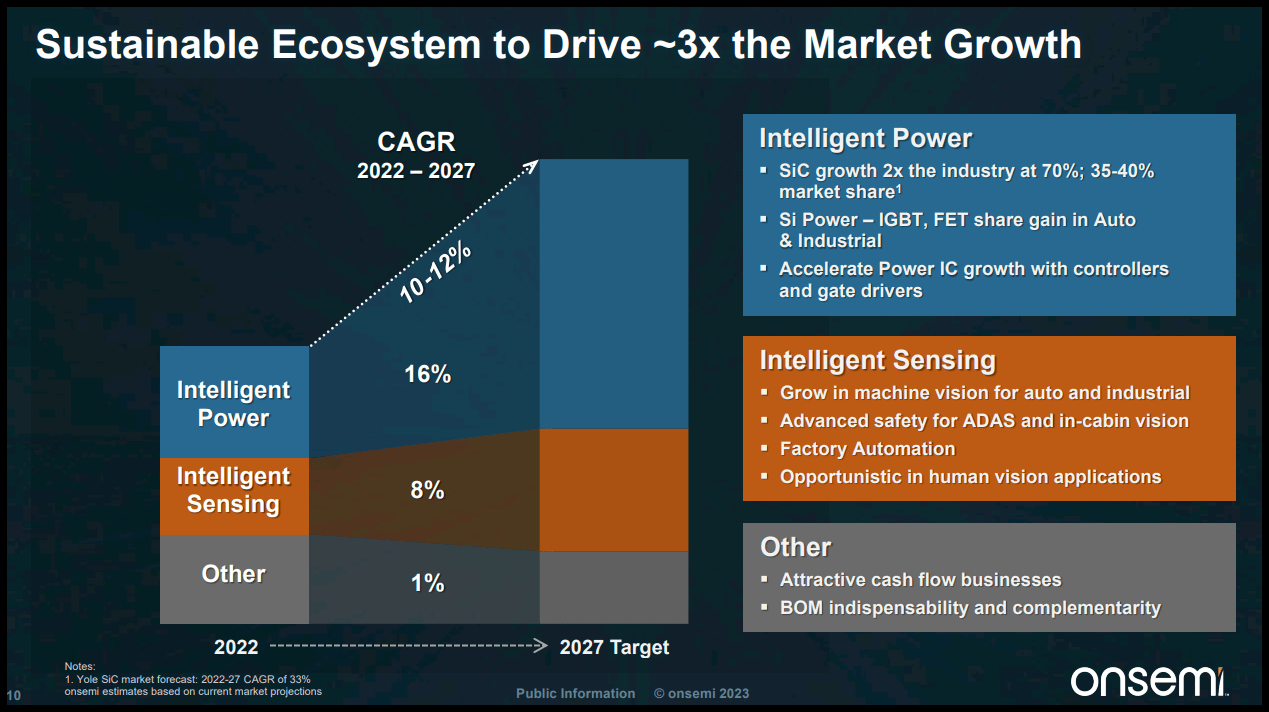

ON Semiconductor’s Growth (Source Link: On Semiconductor Q2 2023 Investor Presentation)

Fueling nearly three times the market growth, ON is executing well on expansion in the automotive and industrial markets. Through intelligent power, intelligent sensing, and other attractive cash-flowing businesses, ON Semi’s long-term supply agreements make its growth and profitability promising. Q1 sales increased 1% year-over-year and 7% sequentially, with 13 back-to-back earnings beats. The second quarter delivered an EPS of $1.33, beating by $0.12, and with its image sensors leading market share, the company continues to outgrow the broader semiconductor industry and underlying markets. Up nearly 60% YTD and +36% over the last year, ON maintains a discounted valuation and bullish momentum. With a forward P/E ratio of 19.96x trading at a 23% difference to the sector, the stock is undervalued, especially as it focuses on expansion targets of $17B in cumulative long-term agreements and $1B in sales for 2023.

7. Twilio Inc. (NYSE:TWLO)

-

Market Capitalization: $12.08B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 24 out of 582

-

Quant Industry Ranking (as of 9/12/23): 5 out of 27

The San Francisco-headquartered tech company focuses on cloud communications and offers real-time data using AI for better customer engagement and experiences. Shares of Twilio stock rose last month after unveiling its latest AI tools, which include generative AI, voice intelligence, and more actionable understanding to boost engagement.

Undervalued, Twilio’s “B” valuation grade makes it an attractive portfolio consideration. Having fallen in share price in May following multiple downgrades citing “near-term” challenges, Twilio continues to thrive, receiving a recent upgrade from Argus. Argus analyst Jim Kelleher wrote, “We see AI as a key accelerant for Twilio’s business as clients seek to make their customer-communications tools more capable and more efficient.” Twilio’s forward PEG is 1.29x vs. the sector median of 1.77x, with a YTD performance of +30%. Multiple top-and-bottom-line earnings beats with accelerating revenue make this stock a great portfolio consideration.

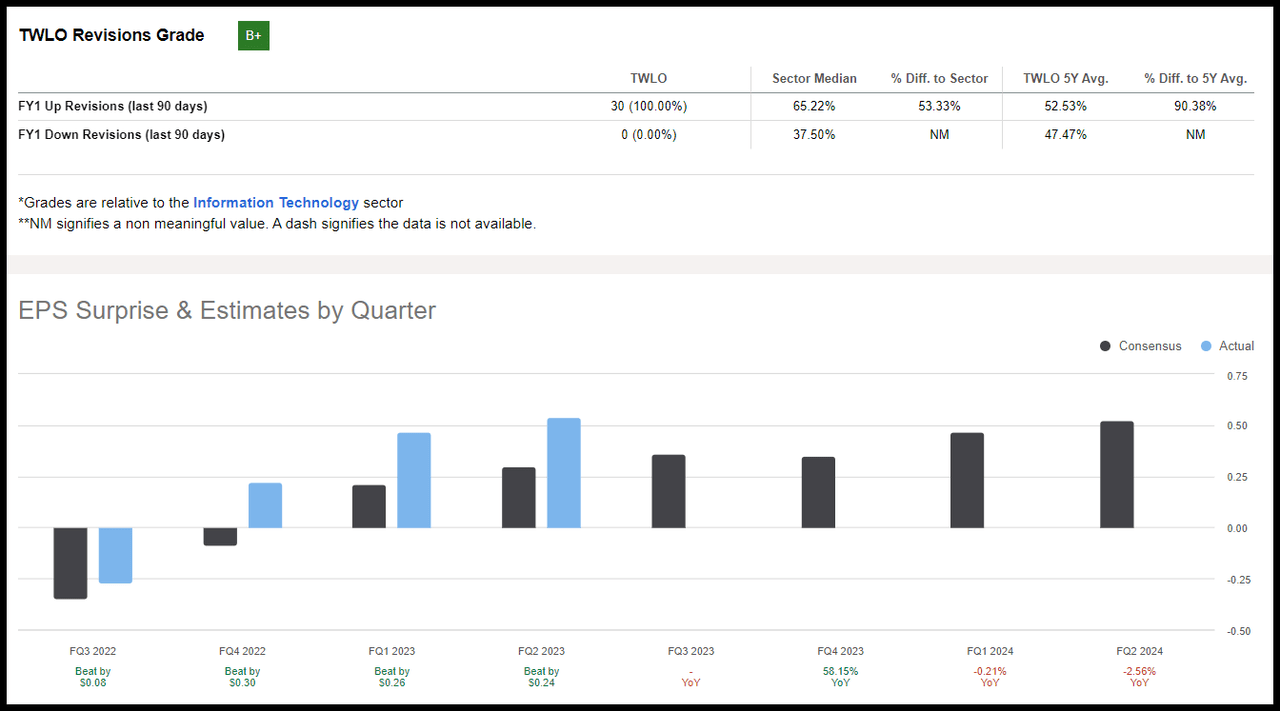

TWLO Stock Revisions (SA Premium)

Twilio’s diversified portfolio and ability to expand has experienced growth through product development and acquisitions. Strong customer retention and exceptional technology in the rapidly-growing Communications Platform as a Service (CPaaS) are driving results. TWLO’s Q2 EPS of $0.54 beat by $0.24, and revenue of $1.04B beat by more than 10% Y/Y, resulting in 30 analyst upward revisions. After generating a record $120M quarterly non-GAAP income from operations, as expressed by Twilio Co-Founder and CEO Jeff Lawson:

“We begin the second half of the year energized by the progress we’ve made to date in Communications, confident that we’ve laid the foundation to reaccelerate growth in our Data & Applications business over time, and optimistic about AI’s potential to be an accelerant for Twilio’s vision.”

With organic growth laying the foundation for growth and capitalizing on the rise of AI, Twilio is an Internet Services and Infrastructure company worth considering.

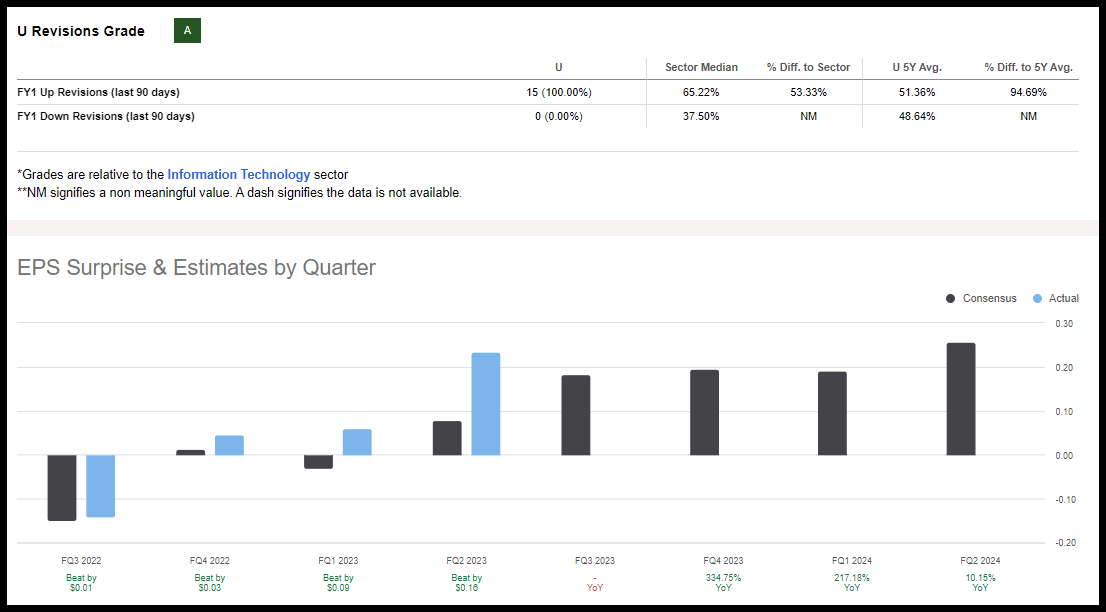

8. Unity Software Inc. (NYSE:U)

-

Market Capitalization: $14.58B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 41 out of 582

-

Quant Industry Ranking (as of 9/12/23): 12 out of 202

Unity Software offers a platform that gives way to real-time 3D tools and services. Serving some of the biggest names like Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft, and Amazon (AMZN) in tech, Unity’s immersive experiences are set to capitalize on its latest partnership with Apple’s Vision Pro headset.

A first-of-its-kind creation and AI challenge, Unity’s Obstacle Tower Challenge is designed to “test the capabilities of intelligent agents and accelerate the research and development of AI. In collaboration with prize sponsor Google Cloud Platform, the Obstacle Tower Challenge will be a new benchmark aimed at testing AI systems’ vision, control, planning, and generalization abilities – capabilities that no other benchmark has tested together before.”

Unity Software Revisions Grade (SA Premium)

Having delivered consecutive earnings beats, Unity Software crushed Q2 earnings with an EPS of $0.23, beating by $0.16 and revenue of $533.48M, beating by nearly 80% year-over-year, resulting in 15 FY1 upward analyst revisions in the last 90 days, with zero downward. The stock’s momentum remains strong as it gears up as a potential AI catalyst for an investor event in November. Although Unity’s Valuation Grade is a “C-” some of the underlying valuation metrics come at a substantial premium. Some prudence is needed when considering Unity Software at its current price, but the company’s outlook is promising, given its innovation and AI on the heels of the tech rally.

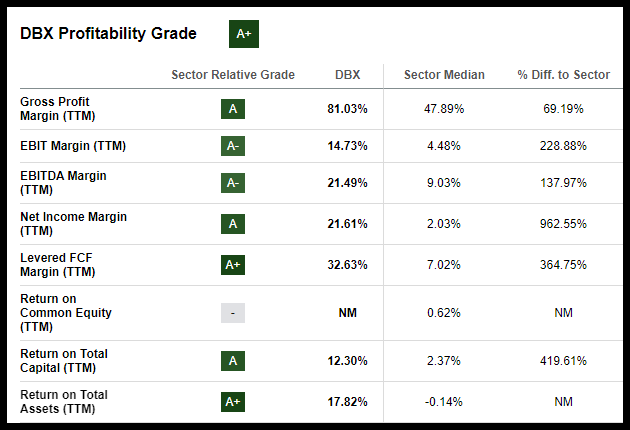

9. Dropbox, Inc. (NASDAQ:DBX)

-

Market Capitalization: $9.72B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 34 out of 582

-

Quant Industry Ranking (as of 9/12/23): 9 out of 202

Dropbox is an application software company that allows collaboration between teams looking to store and share important files. Trading at a discounted valuation, Dropbox’s B+ forward P/E ratio is a 36% difference to the sector, its forward PEG of 1.01x is more than a 40% discount, and the stock’s momentum is uptrending. Year-to-date, Dropbox is +22%, and after solid revenue and margins despite a difficult macroeconomic environment, the company raised its full-year revenue and margin outlooks.

DBX Stock Profitability Grades (SA Premium)

Dropbox’s margins continue to expand, along with its cash from operations. Second quarter EPS of $0.51 beat by $0.06, and revenue of $622.50M beat by $9.14M, and as the AI boom took hold, Dropbox Dash introduced its AI-powered universal search, Dropbox AI. Through Dropbox Dash, the AI-powered tool connects all users’ tools, including major platforms like Google Workspace, Outlook, and Salesforce. It will allow customers to pull information to answer any content-related questions using generative AI. “You won’t need to sift through all your company’s internal links and pages to find out when the next company holiday is—you’ll just be able to ask Dash and get an answer, fast.”

Given its competitive nature, Dropbox has continued to thrive and organically grow while penetrating customers using its lower-cost options compared to competitors like Microsoft, Google, and DocuSign. Consider Dropbox for your portfolio.

10. SentinelOne, Inc. (NYSE:S)

-

Market Capitalization: $5.22B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 9/12/23): 43 out of 582

-

Quant Industry Ranking (as of 9/12/23): 5 out of 46

An IT disruptor, SentinelOne is redefining cybersecurity through autonomous technology, offering real-time AI-powered enterprise threat prevention, detection, and response. SentinelOne has strong tailwinds in a rapidly-growing security market, a strong balance sheet, consecutive earnings beats, and solid fundamentals. SentinelOne is focused on platform improvements to avoid customer churn. Since its IPO in 2021, the company has expanded margins by scaling and cost-cutting measures. Sentinel has increased its free cash flow margins and streamlined costs for greater profitability. During the Q2 Earnings Call, SentinelOne CEO Tomer Weingarten shared:

“Our competitive success is a direct result of our innovation and technology leadership. We’re in the early innings of taking market share and mind share of a massive $100 billion addressable market right for disruption. Our ARR grew by 47% year-over-year to $612 million, reflecting net new ARR of $49 million in the quarter. Our gross margin reached a new record of 77%.”

Although SentinelOne is a small player compared to its biggest competitor, CrowdStrike (CRWD), Sentinel’s cloud-based one-stop-shop solution called Singularity Platform attracts and grows its customer base. Singularity Platform allows customers to scale their businesses quickly, improves labor productivity, and focuses on big-picture IT security. Reporting strong Q2 earnings that include an EPS of -$0.08, beating by $0.06, and revenue of $149.42M, beating by nearly 46% Y/Y, the world’s first AI agent with fully integrated data and security platform with self-healing capabilities raised its outlook for FY24 revenue and margins following strong results. S trades at a steep discount compared to market-leading competitors like CrowdStrike and Palo Alto Networks (PANW). Exceeding expectations on all key metrics, including ARR of $49M and a record gross margin of 77% for Q2, consider this undervalued cybersecurity company if you’re looking for a company with competitive differentiation, a unique platform, and solid fundamentals. Where each of the top 10 AI stocks offers the promise of productivity gains, efficiency, and many other benefits, each company is in a sector or industry one would typically expect an AI stock to be. In addition to the top 10, I will highlight four companies, including a well-known megatech and three not traditionally considered AI stocks, leveraging AI in unique ways for consideration.

A Mega-Tech Hold-Rated Stock and 3 Top Non-Tech Companies Leveraging Artificial Intelligence (AI)

I would be remiss not to include the trillion-dollar mega-tech Alphabet Inc., no stranger to AI-related products and services. Alphabet Inc. is taking advantage of the increasing demand for generative AI. One of the “front runners” and “clear” winners in the AI race, Google’s online dominance has led to one of the biggest antitrust showdowns against the U.S. Department of Justice. But when it comes to large language models (LLMs) that use deep learning techniques for natural language processing, Alphabet’s increasing accuracy and overall outlook make this former strong buy-rated stock (now rated a Hold), very attractive.

During the Goldman Sachs Communacopia & Technology Conference, Google Cloud CEO Thomas Kurian stated,

“We build a foundational set of AI models that are many generation(s) of foundational AI models that we have, and we expose it to clients through five product lines; infrastructure to help them modernize their core systems; develop our platforms to help them build new cloud-native applications; data analytics to help them understand data, analyze it, and manage it more efficiently; cyber security tools to keep their systems, users, and data safe; and collaboration to help them communicate and collaborate better.”

With one of the best balance sheets in the world and continuous innovation for substantial cash reserves, Alphabet’s momentum is A-rated. Up 53% YTD with back-to-back earnings beats, Alphabet’s Q2 EPS of $1.44 beat by $0.10 and revenue of $74.60B beat by $1.85B. Like Meta, Alphabet trades at a premium to the sector. Showcasing a “D” Valuation grade with a forward P/E ratio of 24.40x vs. the sector’s 15.26x requires some prudence if considering an investment at its current price point. Where slowing consumer demand and macroeconomic factors negatively affected many companies, Google has consistently remained an Only Mega-Tech Strong Buy as other techs missed earnings in previous quarters. Although Google recently dropped to Hold, a Hold rating does not mean sell. When a stock has a hold rating, it should trade in line with its sector, and the rating may simply result from one of the stock’s core factors – in this case, valuation – no longer ranking as high as when it was rated a Strong Buy.

Staying ahead of the competition today means forging a path with digital advancements, particularly AI, for simplified, quicker, and cost-effective solutions. Where the 10 top AI stocks are centered around tech industries, other industries can leverage artificial intelligence for a competitive advantage. Highlighted earlier in the table showcasing 16 Strong Buy stocks are Caterpillar (NYSE:CAT), Deere & Company (NYSE:DE), and Emerson Electric (NYSE:EMR).

While non-tech, CAT, DE, and EMR have revolutionized their industries through transformative technology, complemented by underlying solid fundamentals. Where many industries, including construction, agriculture, and machinery, have made substantial investments into the ability for autonomous equipment operation through AI, improvements in their equipment designs serve as strategic business solutions, long-term safety solutions, and cost savings. Additionally, as highlighted by On Semiconductor, AI offers advanced monitoring capabilities, control mechanisms, and vision and power-based systems. And although the list of AI benefits is lengthy, we’d be remiss by not outlining some risks.

Risks of Investing in AI Stocks

In addition to the volatile price swings within tech, the primary sector and catalyst for AI, interest rates, competition, and macro and geopolitical factors can pose headwinds. The AI surge and growth opportunities also face concerns of a potential bubble. Where the price of an investment may become disconnected from the underlying value, trends that pick up too much steam may become bursting bubbles.

In a recent announcement, the European Commission released its first list of “gatekeepers,” six tech companies subject to the Digital Markets Act. Artificial intelligence’s complexities come with the concerns of violating privacy, cybersecurity, tech issues, algorithmic manipulation, and the use of intellectual property for generative AI. As legislation and regulators begin to digest and focus on ways to implement safety boundaries, regulation may hinder some of the advancements until AI can better navigate a path forward.

Should you invest in AI stocks?

The Golden Age of AI is here, and many companies are riding the AI wave to gain an edge for employees and businesses in their respective industries. The combination of human and machine intelligence offers the potential for cost savings and improved productivity when tight labor markets pose problems for some businesses. Companies invest millions of dollars into AI to scale and outperform the competition.

When just mentioning AI has caused companies to rally, we’ve seen top names in tech and growth – like Meta, Amazon, and Alphabet – rally back from their 2022 lows. Artificial intelligence is shaping the future. Strong Buy-rated stocks possessing strong fundamentals with a focus on AI over the long term may prove to be great additions to a portfolio. AI stocks offering double-digit growth, profitability, and tremendous cash from operations can benefit from the tailwinds of this revolution. With bullish momentum and Wall Street analysts revising estimates up over the last 90 days, consider 10 top AI stocks as measured by Seeking Alpha’s Quant Ratings and Factor Grades. Alternatively, we have dozens of top-rated stocks, or if you’re seeking a limited number of monthly ideas — curated from a list of top quant stocks — consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. The author is an employee of Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.