Summary:

- The Tech sector is leading the markets in 2023.

- My Top 10 Tech Stocks for 2023 stunningly performed, collectively +40% this year, inspiring me to create a list of 10 Tech Stocks for the second half of 2023.

- Core drivers of the rally can be attributed to investors seeking a safe haven in mega Tech due to inflation and interest rate uncertainty, cost-cutting measures, and the AI revolution.

- Despite mega Tech stocks dominating the sector, many smaller Tech stocks offer strong forward growth rates, excellent profitability, and trade at substantial discounts to the sector.

- Each stock is strong buy-rated and offers excellent fundamentals, bullish momentum, and tailwinds to complement boosted investor sentiment amid improving economic conditions.

asbe/iStock via Getty Images

Big Tech Dominates the Markets

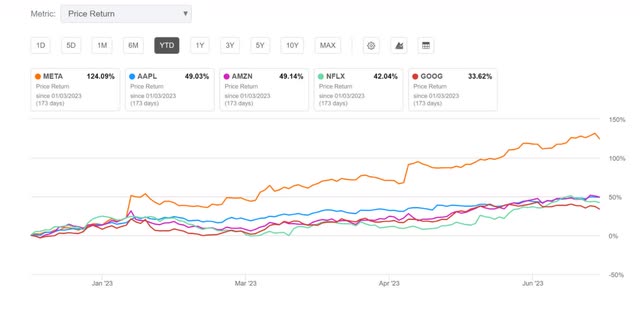

Tech stocks are rallying high and forging a positive path in 2023 after a rough 2022. Following six consecutive quarters of declines, FAANG stocks continue to be favorites despite market conditions, which are now topping expectations with Apple (AAPL) of investors’ eyes up nearly 50% YTD, and Amazon (AMZN) and Netflix (NFLX) close behind.

Tech Stocks are Back in Action with FAANGs Leading the Way

Tech stocks are back in action with FAANGs leading the way (SA Premium)

“We’re seeing people come back following the bear market, and Apple is just one of the stocks where investors are comfortable owning it whether it goes up or down because they’re confident they’ll make money over the long run,” said Chief Market Analyst Wayne Kaufman, in a Bloomberg interview.

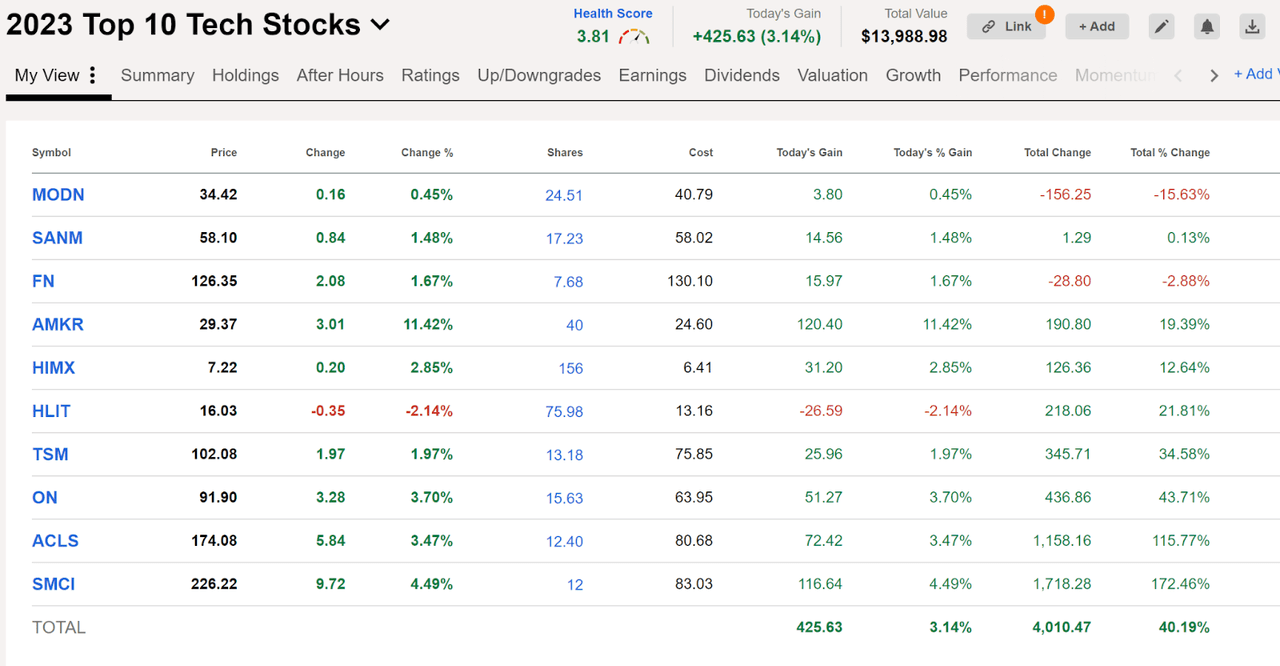

To kick off 2023, I wrote Top 10 Tech Stocks. The core drivers of the rally can be attributed to retracing a condition back to its long run, investors seeking a safe haven in mega Tech due to inflation and interest rate uncertainty, cost-cutting measures, and the AI revolution. Since then, these same picks featured below have collectively returned 40% YTD. And while my picks may be riding the momentum of the mega Techs, most are the sleeper Tech stocks you didn’t know you wanted in your portfolio – undervalued and selected based on strong collective metrics.

YTD Performance and Ranking of Top 10 Stocks to Begin 2023

YTD Performance and Ranking of Top 10 Stocks to Begin 2023 (SA Premium)

The AI boom, semiconductors, a softening labor market, and a downturn have created opportunities to buy smaller Tech stocks at discounted valuations in hopes of price appreciation. I have ten new Tech stocks to buy for the second half of 2023.

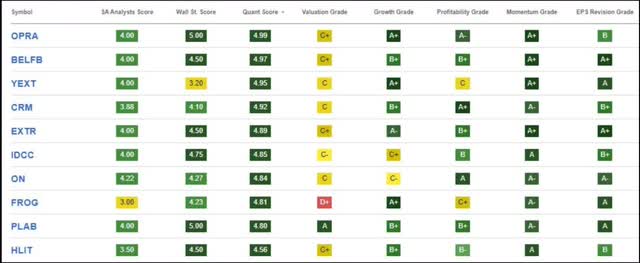

Top 10 Stocks for the Second Half of 2023

Top 10 Stocks for the Second Half of 2023 (SA Premium)

Each of my picks has been rated a strong buy for months and possesses six-month, nine-month, and one-year double- and triple-digit price performance. Although the Fed paused the latest rate hike, inflation and interest rates remain concerns and near-term headwinds for the industry. As market optimism gives rise to the sector, stock selection is crucial, so we’re highlighting 10 of Seeking Alpha’s top quant-ranked stocks to buy for the second half of 2023.

10 Tech Stocks to Buy

The artificial intelligence surge aims to augment and replace humans, so many industries are advancing products and services for future profit. My ten Tech picks with market caps over $700M offer diversification and differ from the typical FAANGs. They possess excellent fundamentals and are supported by strong growth drivers and excellent valuation frameworks. The perennial Tech sector is primed for upside potential, so I’ve selected ten discounted Tech stocks ready to heat up this summer.

1. Opera Limited (NASDAQ:OPRA)

-

Market Capitalization: $1.55B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 1 out of 584

-

Quant Industry Ranking (as of 6/26/23): 1 out of 205

Let the games begin with Opera Limited, the application software company at the forefront of expanding browser technology, offering the highest security, privacy, and flexibility for gaming, news, and more.

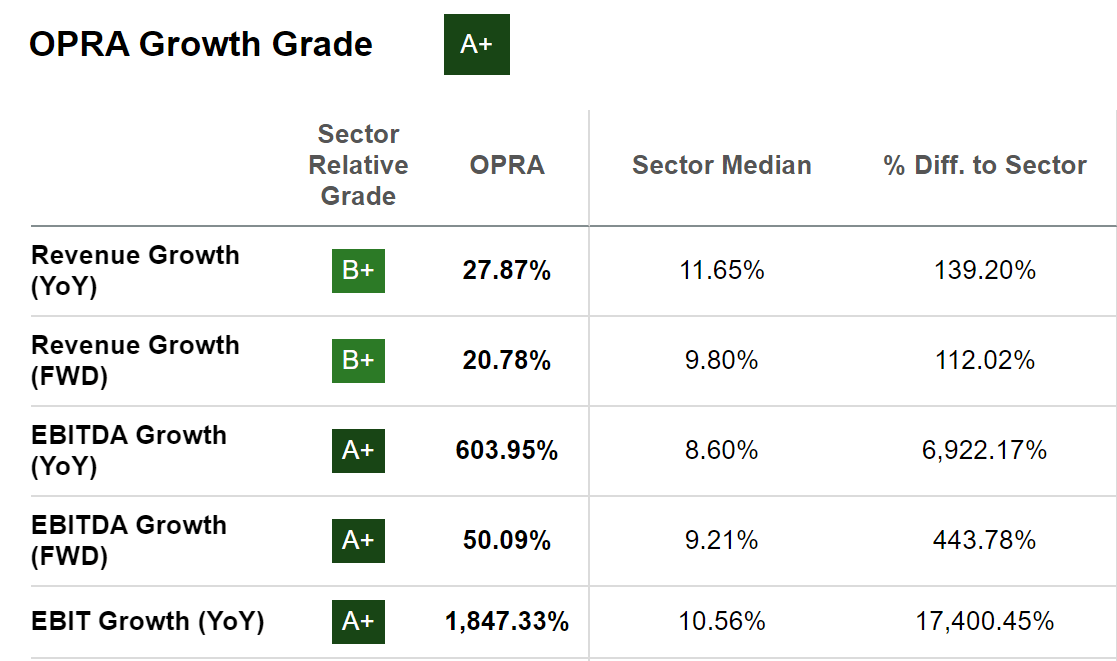

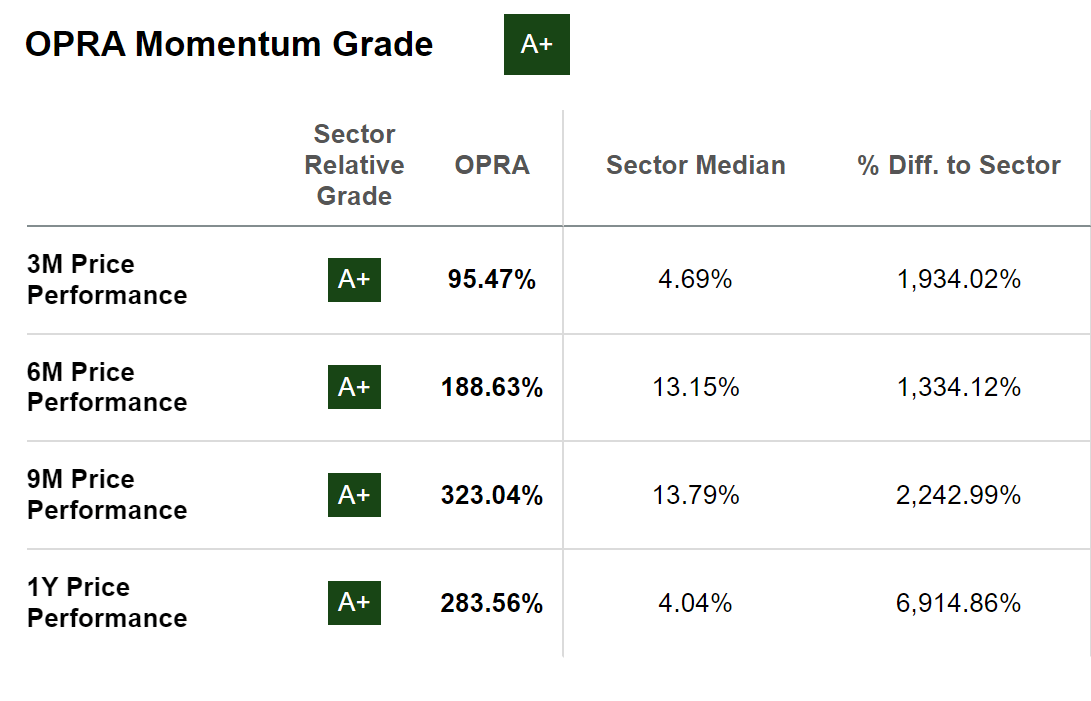

A debt-free company with rising margins and fast growth, Opera Limited beat top-and-bottom-line earnings in the first quarter of 2023. Q1 revenue reached $87.1M, up 22% year-over-year, and EPS of $0.17 beat by $0.03. With an adjusted EBITDA of $21.7M, equivalent to a 25% margin and astounding year-over-year EBIT growth, a +17,400% difference to the sector, it’s no surprise that its user base is rapidly growing. Partnering with YouTube for an influencer campaign, Opera’s launch featuring live scoring for football and credit funds surpassed 50 million users in less than six months, highlighting its distribution strength.

OPRA Stock Growth Grade (SA Premium)

Opera’s advertising revenue grew to 56% of its total revenue, benefitting from the organic and underlying growth of monthly active users and resulting in the company raising FY23 Guidance. To add to its success, as artificial intelligence is becoming big business, Opera Limited is capitalizing, as explained by OPRA Co-CEO Song Lin:

“Year-to-date, integration of the AI services has become a top priority for many popular consumer apps, and we set out to be among leaders within browsers and AI. After announcing our collaboration with Open AI, Opera became among the first browsers to have support for popular services such as the Chat GBT directly in our browser sidebar, as well as innovative AI prompts.”

OPRA Momentum Grade (SA Premium)

As if the strong balance sheet, growth, and profitability aren’t enough to convince you, OPRA has bullish momentum. Wall Street analysts are revising estimates, and the stock still trades at a discount. Opera Limited’s forward Price/Book is 2.04x versus the sector’s 4.00x, and its overall valuation grade is a C+. Well played if you add this strong buy pick to a portfolio.

2. Bel Fuse Inc. (NASDAQ:BELFB)

-

Market Capitalization: $708.37

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 5 out of 584

-

Quant Industry Ranking (as of 6/26/23): 1 out of 23

Offering more than 70 years of experience, Bel Fuse Inc. is an electrical component company designing and manufacturing diversified products that power, protect, and connect electronic circuits. With ever-evolving technologies, Bel Fuse has a proven track record of launching, marketing, and selling products used in networking, aerospace, telecommunications, computing, military, and more. A small-cap company with tremendous growth and eight consecutive top-and-bottom-line earnings beats, BELFB’s success has led to its addition to the Russell 3000.

Bel Fuse Inc. has Eight Consecutive Earnings Beats

Bel Fuse Inc. has Eight Consecutive Earnings Beats (SA Premium)

Showcasing its best-in-history earnings, Q1 EPS of $1.35 beat by $0.55, and revenues of $172.34M were up 26%, adding to the shareholders’ returns of over 155% over the last year. Despite the challenging economic backdrop, BELFB’s diversified offerings have allowed the company to continue paying a modest consecutive dividend, highlighted by an attractive dividend scorecard. On an uptrend with a YTD price performance of +61% and over the last year of +228%, BELFB is outperforming its peers.

Despite trading near its 52-week high, Bel Fuse’s valuation metrics are extremely discounted, evidenced by its forward P/E ratio of 12.06x versus the sector’s 24.83x and a trailing PEG ratio of more than an 88% discount to the sector. Consider this strong buy Tech stock for a portfolio as well as the next familiar pick – our only mega Tech stock.

3. Salesforce (NYSE:CRM)

-

Market Capitalization: $204.63B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 10 out of 584

-

Quant Industry Ranking (as of 6/26/23): 6 out of 205

The world’s #1 CRM platform and a pioneer in Software as a Service (Saas), Salesforce, Inc.’s technology has been bringing together companies for decades. Our only mega Tech stock, Salesforce, is a disruptive software innovator set to capitalize on the generative AI trend with its newest AI Cloud.

Rebounding from a December 52-week low, CRM is up 55% YTD and +20% over the past year. Where most Big Techs come with premium valuations, Salesforce is relatively undervalued, highlighted by a forward PEG ratio of a 35% difference to the sector and a forward Price/Book of 3.31x versus the sector 4.00x to offer room for upside as Tech rebounds.

With a 92% retention rate, Salesforce has an estimated revenue growth rate of 13% compared to the sector at 9% and an estimated EPS growth rate of 23.5% vs. 9.9%. After a strong Q1 earnings performance, EPS of $1.69 beat by $0.08; revenue of $8.25B beat by more than 11% Y/Y, resulting in 41 Wall Street analysts revising their estimates up within the last 90 days. With significant profit margins and tremendous Cash from Operations, Salesforce is a force to reckon with.

4. Extreme Networks, Inc. (NASDAQ:EXTR)

-

Market Capitalization: $3.01B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 13 out of 584

-

Quant Industry Ranking (as of 6/26/23): 1 out of 49

A new CFO is pushing Extreme Networks, Inc. for extreme upside – a communications equipment company with low debt, offering strong growth with consecutive earnings beats. A market leader in cloud networking, EXTR designs, develops, and manufactures wired and wireless infrastructure for better customer experiences, risk reduction, and improving operating efficiencies and top-line growth.

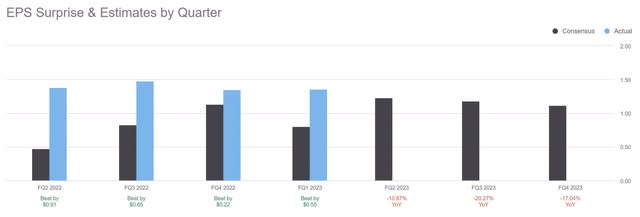

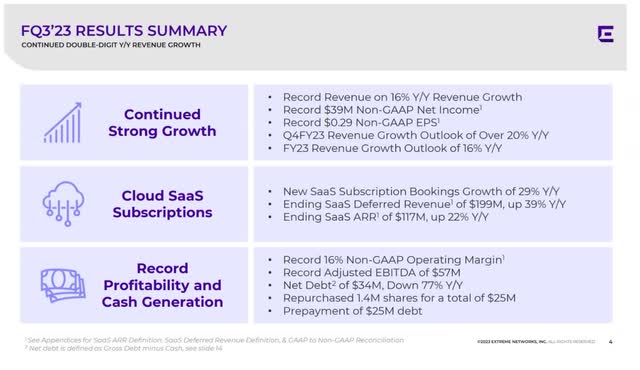

As evidenced by their top-line growth, EXTR has crushed earnings consecutively, with a Q3 EPS of $0.29 beating by $0.03 and revenue of $332.51M, up 16% Y/Y resulting in six analyst upward revisions over the last 90 days and zero down.

EXTR Stock Revisions Grade (SA Premium)

In addition to Extreme Network’s record 16% Y/Y revenue growth, FQ3’23 also gave way to a record $39M in Non-GAAP Net Income, new SaaS subscription growth bookings of nearly 30% Y/Y, and record profitability and cash generation. With a 16% Non-GAAP Operating margin, adjusted EBITDA of $57M, and Net Debt of $34M, down 77% Y/Y, EXTR repurchased 1.4M shares for $25M.

EXTR Stock FQ3’23 Results (EXTR Q3’23 Investor Presentation)

Bullish momentum has allowed the stock to trade near its 52-week high of $25.13/share. The stock is up +143% over the last year and outperforms its sector peers quarterly. In addition to tremendous growth and profitability, EXTR is also undervalued. With a forward PEG ratio that’s a -39% difference to the sector and discounted EV/Sales ratios, consider Extreme Networks an extreme discount with upside potential portfolios.

5. InterDigital, Inc. (NASDAQ:IDCC)

-

Market Capitalization: $2.44B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 17 out of 584

-

Quant Industry Ranking (as of 6/26/23): 7 out of 205

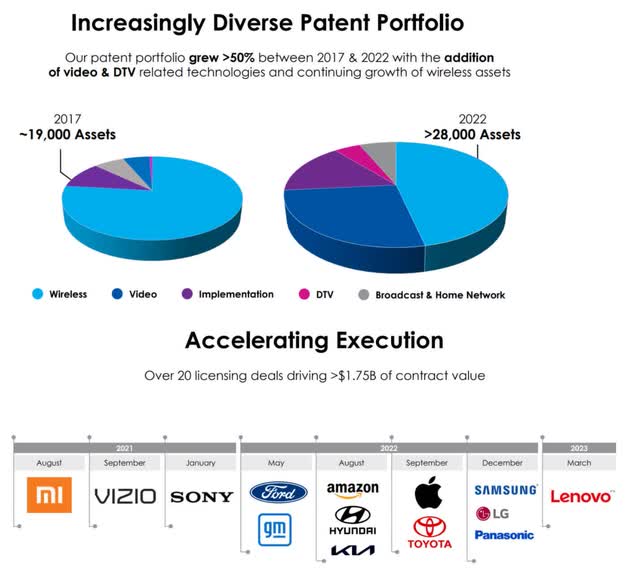

Up more than 60% YTD with stellar FQ1 earnings beats and a robust pipeline of customers, including potential licensing agreements with Lenovo, Oppo, and Vivo as growth drivers, InterDigital Inc., together with its subsidiaries, is enhancing wireless communications.

More than 50 years of research and innovation allow this application software company to continue to pioneer the industry. Following consecutive earnings beats that resulted in Bank of America upgrading the stock, InterDigital inked a patent agreement with Japanese electronic and components company Alps Alpine. In a press release, InterDigital Chief Licensing Officer Eeva Hakoranta said:

“This new agreement demonstrates once again how our innovation is applied across a range of devices…Our long history of research in the video space means that we have a very strong portfolio of assets in HEVC and other leading codecs, and we’re delighted that we have been able to close this deal and open a new customer relationship with Alps Alpine.”

IDCC Stock Diversified Portfolio (IDCC Stock 2023 IR Materials)

First quarter 2023 EPS of $3.58 beat by $2.99, and revenue of $202.37M beat nearly 100% Y/Y, resulting in four upward analyst revisions. IDCC repurchased $24.7M in shares in the month of April, and with a diverse patent portfolio of more than 28,000 patents and applications, this undervalued innovator continues to grow at an exponential rate. Trading near its 52-week high, this stock has room for potential upside given its buybacks, a trailing PEG ratio that’s nearly an 87% difference to the sector, and P/E ratios trading at more than a 40% discount. InterDigital, Inc. is reflecting on its mission of powering extraordinary experiences. Consider it for a portfolio.

6. JFrog Ltd. (NASDAQ:FROG)

-

Market Capitalization: $2.70B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 22 out of 584

-

Quant Industry Ranking (as of 6/26/23): 1 out of 47

JFrog Ltd. is the software supply chain platform that organizes, builds, and distributes companies’ ecosystems for automation, scale, and efficiency. Despite trading at a relative premium, highlighted by a D+ valuation grade, the company’s growth is A+, highlighted by the all-important forward PEG of 1.06x versus the sector’s 1.77x. Year-over-year revenue growth and forward revenue growth are more than a 170% difference to the sector.

FROG Stock FY23 Consensus Estimates

FROG Stock FY23 Consensus Estimates (SA Premium)

First quarter earnings resulted in a top-and-bottom-line earnings beat, including an EPS of $0.06, beating by $0.03, and revenues of $79.82M, beating by $1.43M with tailwinds from increased cloud usage, pay-as-you-go, annual SaaS customers and overall growth in customer ARR. Despite a challenging macro environment, FROG is focused on the future. With the migration from self-managed subscriptions to hybrid or multi-cloud, momentum gaining, and 12 analysts revising estimates up over the last 90 days, FROG sees FY 2023 guidance well above consensus. So consider leaping on board with JFrog in a portfolio for potential upside through 2027.

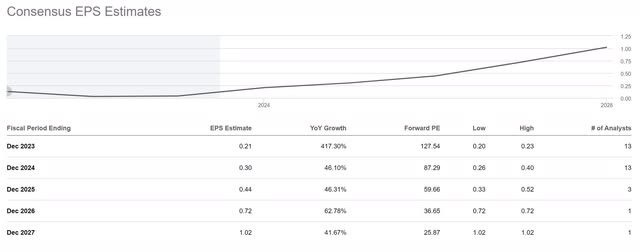

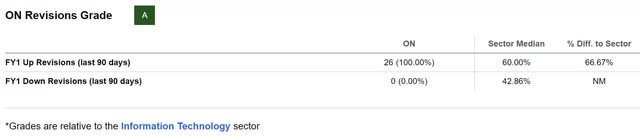

7. ON Semiconductor Corporation (NASDAQ:ON)

-

Market Capitalization: $37.80B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 18 out of 584

-

Quant Industry Ranking (as of 6/26/23): 2 out of 68

One of my favorite Tech industries, because semiconductors are in virtually every must-have product, ON Semiconductor Corporation, is one of my top Tech stocks. Raising its long-term financial targets across the board, Onsemi paves the way for premier, intelligent Tech for the automotive, industrial, and 5G cloud power industries.

Maintaining strong fundamentals, consecutive earnings growth, and EPS while trading at a discount, Onsemi’s YTD price performance is +44%, with a one-year price performance up 63%. As the company continues its uptrend, it still trades at a discount. A forward P/E ratio is a -21.56% difference to the sector, while its EV/EBIT and EV/EBITDA showcase double-digit percentage discounts.

Positive demand for the semiconductor industry has allowed ON to position itself to profit from the fast-growing secular trends. With more than $17B in cumulative long-term agreements, ON has doubled-down on differentiated chips to capitalize on the growth in data center applications and cross-selling products, including EVs.

Consecutive earnings beats resulted in 26 Wall Street analysts revising estimates up over the last 90 days and zero downward revisions after another quarter that exceeded expectations. ON is on a mission to continue capturing market share. Q1 revenue of $1.96B beat by $34.49M, EPS of $1.19 beat by $0.11, gross margins are up more than 45%, and automotive revenue increased 38% Y/Y.

ON Semiconductor Revisions (SA Premium)

On continues to exceed expectations, which is why during the Q1 2023 Earnings Call, Onsemi President & CEO Hassane El-Khoury highlighted the following:

“[Onsemi was] recently honored with the 2022 Supplier of the Year Award from Hyundai Motor Group, which recognized ON Semi as a trusted provider for key technology in its ecosystem, offering supply chain resilience and manufacturing sustainability. Customers also recognize us as a strategic partner that provides high value through the entire design cycle, which gives them a competitive edge over their peers.”

Given the advancements in technology and semiconductors, ON is one of the large-cap stocks worth considering amid a potential technological boom through 2023. Now could be right-ON time for this strong buy purchase.

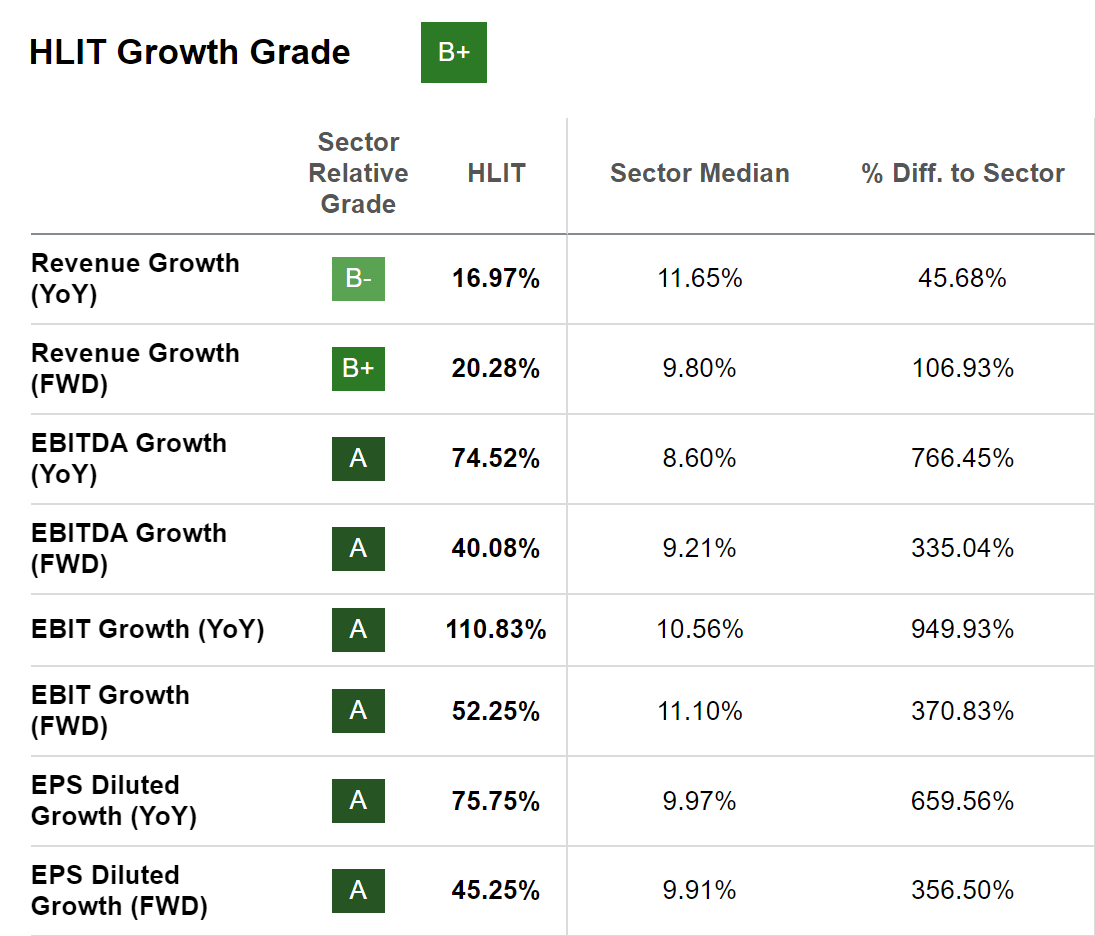

8. Harmonic Inc. (NASDAQ:HLIT)

-

Market Capitalization: $1.85B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 48 out of 584

-

Quant Industry Ranking (as of 6/26/23): 3 out of 49

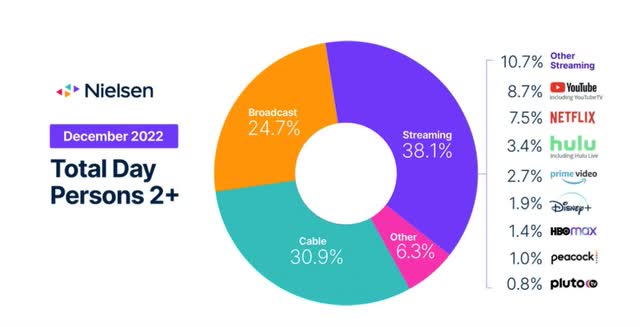

The Communications Sector (XLC) was crushed alongside the tech sector last year, but the turnaround for both has showcased their momentum in the new year. Together with its subsidiaries, Harmonic Inc. offers video delivery software, products, and services for the streaming world.

Streaming As Dominant TV Viewing (Nielsen Report)

As streaming continues to be the dominant form of U.S. TV viewing, according to a December Nielsen report, HLIT has taken advantage, gaining +88% over the last year.

A global streaming service provider with over 5,000 media companies, HLIT offers next-gen technology that has allowed it to profit and grow, as evidenced by another earnings season with excellent results.

HLIT Stock Growth Grade (SA Premium)

Despite a Q1 2023 revenue miss of $0.26M, EPS of $0.12 beat by $0.03, and adjusted EBITDA margin was 14%. HLIT’s Broadband segment year-over-year revenue grew 23%, with Video SaaS revenue +72% for the same period.

Strong demand resulted in multi-year contracts for CableOS and Video SaaS in Q1 for competitive success and showcasing to investors the potential to deliver on full-year results and growth objectives. Total gross margins are up ~54%, and with HLIT appointing a new CFO, this small-cap Tech keeps outperforming.

I last wrote about this stock in November, and the stock is +18% since. With a C+ valuation grade, some prudence is required when investing in this stock at its current price, trading near a 52-week high. While there is room for improvement in some of its valuation metrics, Harmonic’s momentum, growth trajectory, and overall factor grades are music to many investors’ ears.

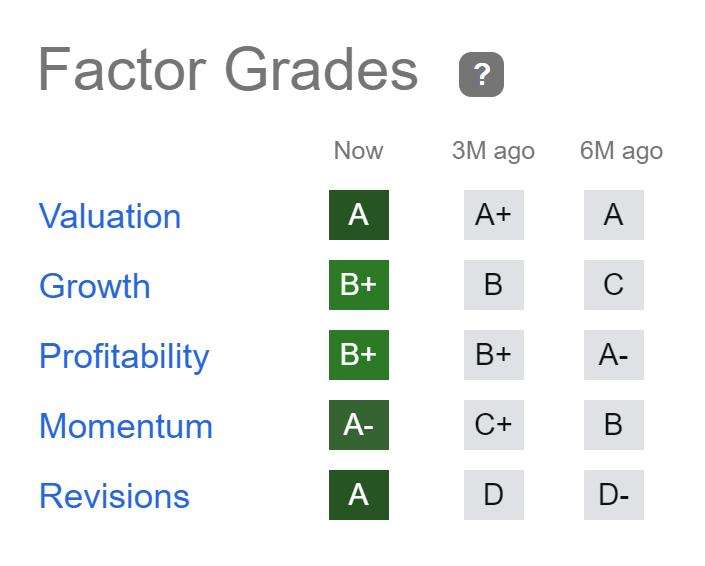

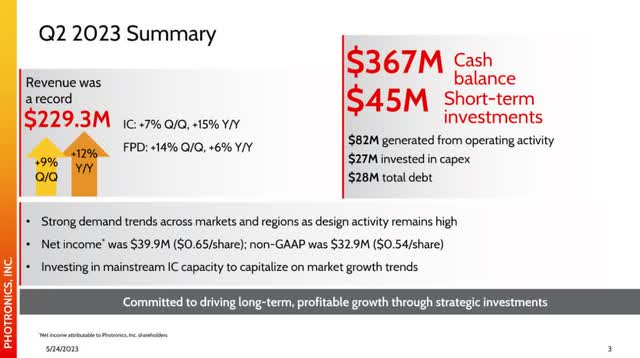

9. Photronics, Inc. (NASDAQ:PLAB)

-

Market Capitalization: $1.44B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 23 out of 584

-

Quant Industry Ranking (as of 6/26/23): 3 out of 29

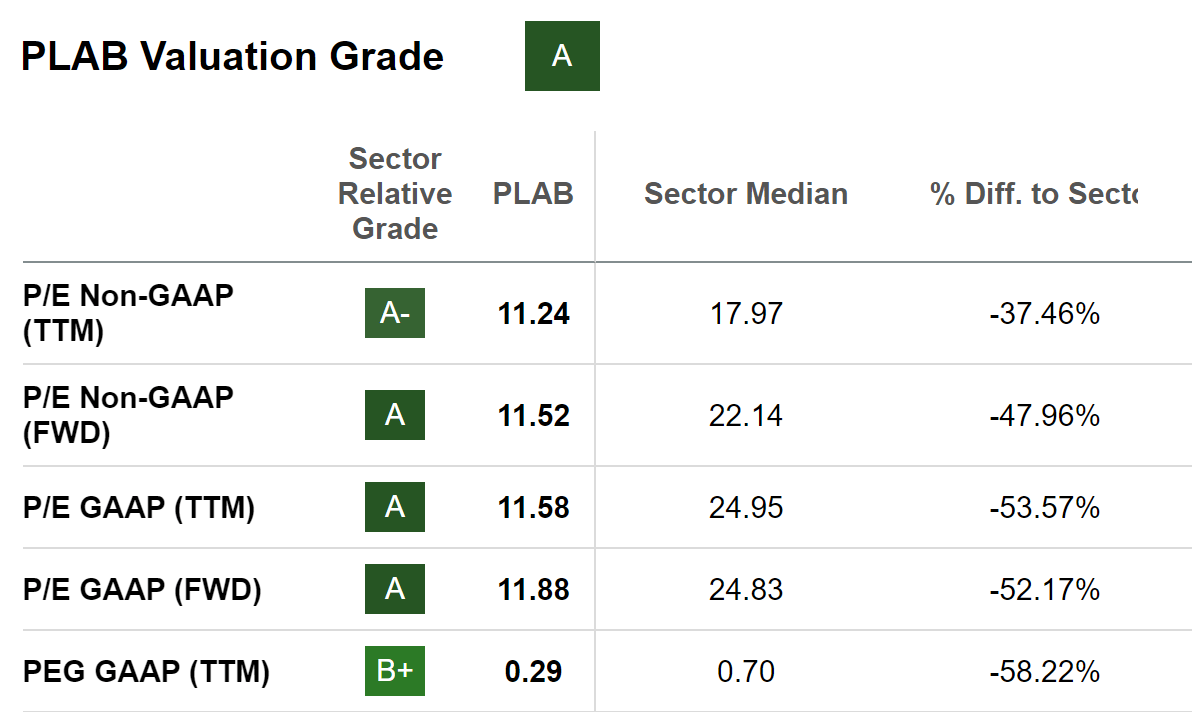

Another semiconductor company delivering record revenues, I highlighted Photronics, Inc. this time last year in an article titled 3 Best Tech Stocks for Upside, and it’s up nearly 20% since publication, a testament to its strong fundamentals and the Quant Ratings that includes one of the best Factor Grades scorecards of my ten picks.

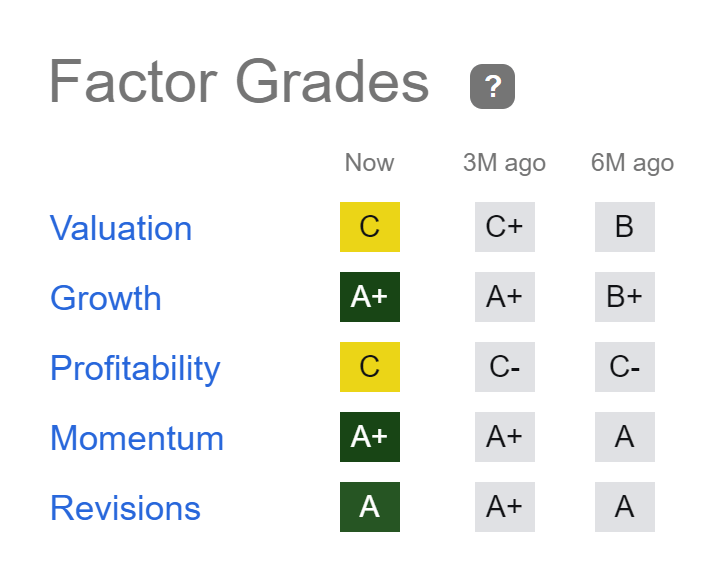

PLAB Stock Factor Grades

PLAB Stock Factor Grades (SA Premium)

Factor Grades rate investment characteristics on a sector-relative basis. Highlighted above are PLAB’s tremendous strong Growth, Profitability, Momentum, and Revisions Grades, which indicate that PLAB is one of the most profitable companies in its sector and fundamentally sound. PLAB’s photomasks use leading-edge technologies to create integrated circuits or “chips” in the semiconductor industry. Not only have semiconductor companies continued to be in high demand and resilient when the Tech sector has experienced crushing blows as geopolitical constraints, inflation, and interest rates have affected companies, but with its subsidiaries, Photronics is a global leader in photomasks. Benefitting from a $24M FX tailwind quarter-over-quarter, tremendous balance sheet, and strong demand, PLAB’s Q2 EPS of $0.54 beat by $0.10, and revenue of $229.31M beat by more than 12% Y/Y. PLAB stock offers excellent margins and steady growth despite the challenging environment, capitalizing on market growth trends.

PLAB Stock Q2 2023 Results (PLAB Q2 2023 Investor Presentation)

Where semiconductors over the last few years have offered better upside than many speculative Tech stocks, Phototronics continues to trade at an extreme discount while maintaining bullish momentum.

PLAB Stock Valuation Grade (SA Premium)

Looking at the above valuation grades, PLAB’s forward P/E of 11.88x comes at a 52% discount to the sector, and its PEG (TTM) of 0.29x is a -58.22% difference to the sector. Strong free cash flow and improving pricing power allow the company to invest in growth. Consider an investment in this stock for potential portfolio growth.

10. Yext, Inc. (NYSE:YEXT)

-

Market Capitalization: $1.41B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/26/23): 7 out of 584

-

Quant Industry Ranking (as of 6/26/23): 3 out of 205

Yext, Inc. is a cloud-based application software company offering customers the digital experience to iterate the world’s leading brands amid changing business needs. Using Ai-led platforms and “best-in-breed tools,” brands like Samsung, Subway, and Verizon are building on Yext. Over the last two years, Yext has beaten EPS estimates 100% of the time and reported another record first quarter Non-GAAP EPS of $0.08, beating by $0.03 and revenue beat, resulting in four analyst upward revisions.

YEXT Stock Revisions Grade (SA Premium)

Following the latest Q1 results, Yext CEO and Chair of the Board Michael Walrath said, “Our results demonstrate our continued commitment to driving efficiency and executing on our operational and financial goals. Yext is ideally positioned to help enterprises use generative AI, search, content management, and related technologies to deliver world-class digital experiences.” With a growing customer count and 474% forward EBITDA Growth, a more than 5,000% difference to the sector indicates that this small cap’s metrics highlight strong buy qualities. In addition, Seeking Alpha’s Factor Grades showcase why Yext is a great consideration for a portfolio.

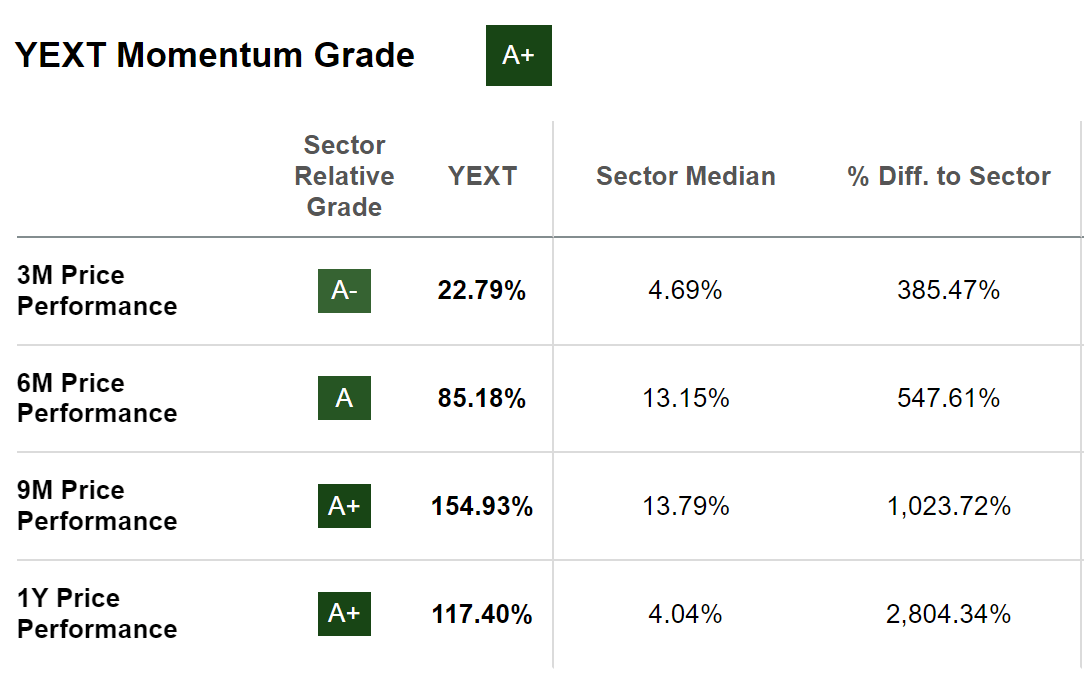

Yext Stock Factor Grades

Yext Stock Factor Grades (SA Premium)

Factor Grades rate investment characteristics on a sector-relative basis. Excellent growth, solid profitability, and bullish momentum grades complement this stock trading at a relative discount. Up 77% YTD and more than 114% over the last year. Despite the stock trading near its 52-week high, underlying valuation metrics offer room for upside following Q1 results, which led to post-market trading of +12%.

Yext Stock Momentum Grade (SA Premium)

Where Yext organizes content knowledge, and leverages complementary products, services, and technology, its bullish momentum crushes its peers, as highlighted by the momentum grade above. Each of the ten stocks outlined has strong collective metrics. While having faced headwinds amid the difficult economic times, each of my picks has been resilient when the Tech industry was crushed in 2022; they have rallied in 2023. With strong momentum and growth within their industries, my picks maintain a strong buy rating with upside potential through the second half of 2023.

Conclusion

After a brutal 2022, Tech is coming back in 2023, with some of the largest companies capturing market share in the indexes. We see buying opportunities for the long term, especially in industries like semiconductors, differentiated software, and electrical components that are increasingly important for the sector. The Top 10 Stocks that kicked off the year are collectively up 40% YTD. We want our readers to build from this momentum, offering our list of Top 10 Tech Stocks for the second half of 2023.

The ten picks outlined in this article have strong collective metrics and bullish momentum and are still trading at relative discounts. Each was selected using Seeking Alpha’s Quant Ratings and investment research tools, which help ensure you have the best resources to make informed investment decisions. If you are curious about other stocks, we have many to choose from, including other Top Technology stocks with larger market caps, or you can create your own Stock Screens to suit your specific investment objectives. Happy investing for the remainder of the year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.