Summary:

- Stable and reliable dividend stocks with strong yields and significant dividend growth can help insulate from inflationary pressures, portfolio losses, and market volatility.

- Dividend investors know chasing yield is risky. Opportunity can be found by identifying durable dividend growth stocks that pull back with market dips.

- YTD, many dividend stocks are beaten down. I have 14 stock picks with an average yield (TTM) of 3.74% vs. the VIG yield at 1.99% and SPY yield at 1.53%.

- The stocks possess three-year dividend growth rates ranging from 3.74% to 29%, all rated strong buys. Each stock was picked using our screener, which can quickly validate stocks with strong dividend growth while flagging stocks with at-risk dividends.

- Where many stocks have cut dividends this year amid rising interest rates and debt, each of my 14 stocks offers significant dividend growth rates and is collectively strong on value, growth, profitability, earnings revisions, and momentum attributes.

DavidLeshem

Why Dividend Investing Matters: Growth

Dividend stocks can be a great option for investors looking for steady income streams or a hedge against inflation, but only some stocks pay dividends. In a high-interest rate environment, some companies are impacted by slowing economic growth, higher costs, and rising debt levels. For businesses that face pressure in this environment, this may lead them to slash dividends to protect profits. Investors that chase high dividend yields could be at increased risk as the higher yield is often a sign the stock price has suffered due to poor investment fundamentals. Investors seeking dividends should consider stocks with above-market (S&P 500) dividend yields and strong dividend growth rates – the sweet spot that leads to capital appreciation and income generation. Seeking Alpha’s ‘Strong Buy’ Dividend quant ratings result from powerful computer processing and our special ‘Quantamental’ analysis. Since December 2009, based on our dividend growth model backtest, the return on our Strong Buy Dividend growth stocks is 520% vs. 334% for the Vanguard Dividend Appreciation Index Fund ETF Shares (VIG).

-

From nearly all U.S. securities with dividends, our quant algorithm picks stocks with the strongest dividend growth metrics vs. the peer sector.

-

These attributes are assigned grades and then weighted to maximize the predictive value. The best dividend growth stocks are awarded an ‘A+’ grade.

-

Over the last 12 years, the back-tested strategy has delivered very impressive returns, beating the Vanguard Dividend Appreciation ETF.

-

What’s more, if we look at the performance since inception (December 2009 onwards), our ‘A+’ Dividend Growth stock picks have delivered a positive return.

Simply put, dividend growth stocks are based on the idea that a more profitable company is committed to delivering back to shareholders by consistently increasing their dividends – a byproduct of profit. If the market were to trade sideways or down, strong dividend growth rates help to insulate from price movement and bolster returns. Dividend growth matters because focusing on higher-quality companies and those with good track records tend to deliver consistent dividend increases, equating to stronger earnings and earnings potential, which is why screening for top dividend stocks is crucial.

Dividend Stocks: Chasing Growth Instead of High Yield

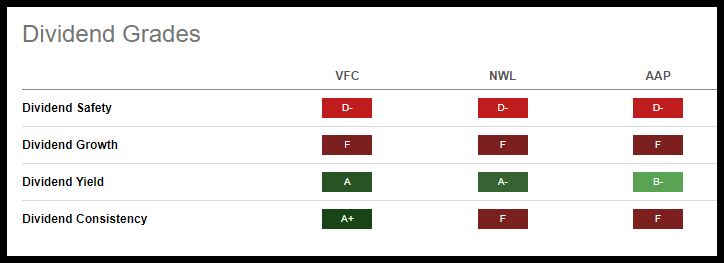

Whether in an up or down economy, the right dividend stocks can help bite back against the inflation eating at portfolios. Since mid-July, some of our favorite dividend yield stocks are even more attractive as most stocks have retreated with poor investor sentiment and a market pullback. Lower stock prices mean higher yields, but fundamentals remain very strong for the dividend stocks with quant Strong Buy ratings. As the current economic environment exhibits, inflation is sticky in many areas and will likely be around for a while. The Fed continues to signal that rates will stay ‘higher for longer;’ I want to reiterate a company may have a substantially high dividend yield because its stock price was crushed, spelling potential financial trouble for future dividend payments. Case-in-point is diversified REIT W. P. Carey’s (WPC) announcement to slash its dividend, ending a 24-year growth streak. Additional examples of stocks that suspended or cut their dividends this year are V.F. Corporation (VFC), Newell Brands Inc. (NWL), and Advanced Auto Parts, Inc. (AAP). As evidenced by these three stocks and their attractive dividend yields (TTM), chasing yield in isolation can lead to disappointment.

Dividend Grades (SA Premium)

As showcased by their dividend grades, it should be no surprise that with lackluster dividend safety and poor dividend growth, VFC, NWL, and AAP slashed their dividends this year. Given the uncertain economic environment, consider a combination of key criteria like yield, dividend safety, and strong dividend growth when looking for top dividend stocks:

-

Dividend Growth Rates Above 3%

-

Strong Dividend Safety

-

Capital Appreciation Potential

-

Collectively strong on value, growth, profitability, earnings revisions, and momentum

Morningstar Indexes strategist Dan Lefkovitz explained:

“It’s really critical to be selective when it comes to buying dividend-paying stocks and chasing yield. Looking for the most yield-rich areas of the market can often lead you into troubled areas and dividend traps – companies that have a nice-looking yield that is ultimately unsustainable. You have to screen for dividend durability and reliability going forward.”

Although some investors believe that the Fed may be more dovish going forward, investors may best be served by considering higher-quality companies that offer strong dividend growth rates as a hedge in this macro environment. Even if the market starts to rebound soon, the timing of these top 14 dividend stocks may be opportune, as the dividend yields could be at optimal levels given stock price weakness. We’ve designed a Top Quant Dividend Stocks screen to highlight stocks with tremendous dividend safety and dividend growth. This article aims to reach outside the parameters of high-yielding stocks and focuses on stocks that offer a combination of capital appreciation potential, dividend growth, and solid overall fundamentals. Dividend investing matters because

-

Income-oriented investors may want investments other than high-growth securities.

-

Power of Compounding – Reinvesting dividends can increase the value of one’s portfolio significantly, boosting growth and returns over time.

-

Inflation Hedge – Dividend-paying stocks can offer a combination of regular income and a cushion when the markets are volatile.

-

Less Volatile – Dividend-paying companies with strong dividend growth rates tend to be more profitable, hence their ability to pay dividends, possessing enough excess free cash flow to overcome challenging times.

-

Tax Advantages – Some qualified dividend-paying stocks are taxed lower than ordinary income.

Because inflation has resulted in investors budgeting for every dollar, building a portfolio that generates income offers an opportunity to hedge against potential downturns. Because not all dividend stocks are created equal, I have selected 14 stocks in varied sectors whose overall Quant Ratings and Factor Grades complement their high dividend growth rates.

- Innovative Industrial Properties, Inc. (IIPR)

-

Forward Dividend Yield: 9.82%

-

3-Yr Growth Rate: 24.62%

-

Market Capitalization: $2.06B

-

Dividend Growth Grade: A

-

Dividend Safety Grade: A-

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

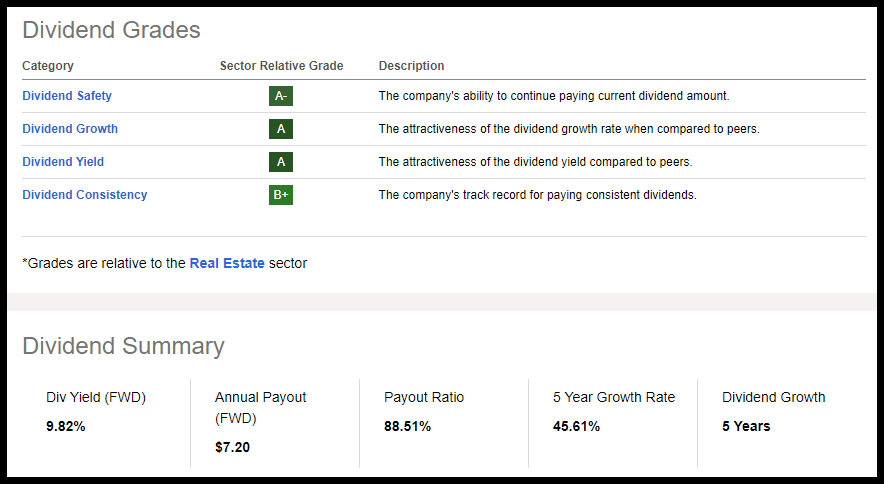

An industrial REIT focused on state-licensed operators of regulated cannabis facilities, Innovative Industrial Properties Inc. may prove to be a buy-the-dip opportunity. Offering a consistent dividend despite a stock price falling from its high, tremendous fundamentals, discounted valuation, and upward earnings revisions support this strong buy-rated stock.

Changes in monetary policy have delivered blows to many sectors and industries, including real estate. Suffering from rising interest rates, analyst downgrades, and macro challenges, Innovative Industrial Properties maintains its position as a quant-rated strong buy. Although the stock fell 23% YTD, its bustling dividend growth, complemented by a 9.82% forward dividend yield, makes it extremely attractive as REITs bounce back. Seeking Alpha contributor Nikolaos Sismanis writes that the 9% yield doesn’t signal a cut. Sismanis explains that “despite concerns about the sustainability of its payouts, the dividend remains covered, and the company continues to grow its top line and AFFO/share.” IIPR’s A- Dividend Safety grade also indicates the dividend should be safe.

IIPR Stock Dividend Scorecard

Innovative Industrial Properties Dividend Scorecard (SA Premium)

With strong cash flow margins, significant overall growth, and profitability to support its dividend scorecard, IIPR showcases substantial revenue and forward AFFO Growth, a 141.12% difference to the sector. Significant cash allows IIPR to maintain its dividend and 3-Year Dividend Growth CAGR of nearly 30%. Trading below its 52-week range, Innovative Industrials comes at a compelling forward P/AFFO of 9.14x, a -31% difference from its peers, and a -73.23% difference to the sector in Total Debt/Capital (TTM). With little debt and a portfolio concentrated in industrial properties with little overhead to help keep costs low, as analyst Julian Lin writes:

“IIPR deserves to trade at a premium or at least in line with NNN REIT peers, which trade at around 12x to 14x FFO and at 5% to 6% dividend yields. That implies around 25% potential upside just to trade in-line with traditional net lease peers, but the stronger long-term growth rate arguably demands a sizable premium.”

Despite marijuana remaining illegal at the federal level, more than 40 states allow its use and sale in some form. Given IIPR’s already strong fundamentals and incredible 88.51% dividend payout ratio, should this strong buy pick benefit from the easing of government restrictions, how high will it go?!

- Essential Properties Realty Trust, Inc. (EPRT)

-

Forward Dividend Yield: 5.15%

-

3-Yr Growth Rate: 6.46%

-

Market Capitalization: $3.63B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: A-

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

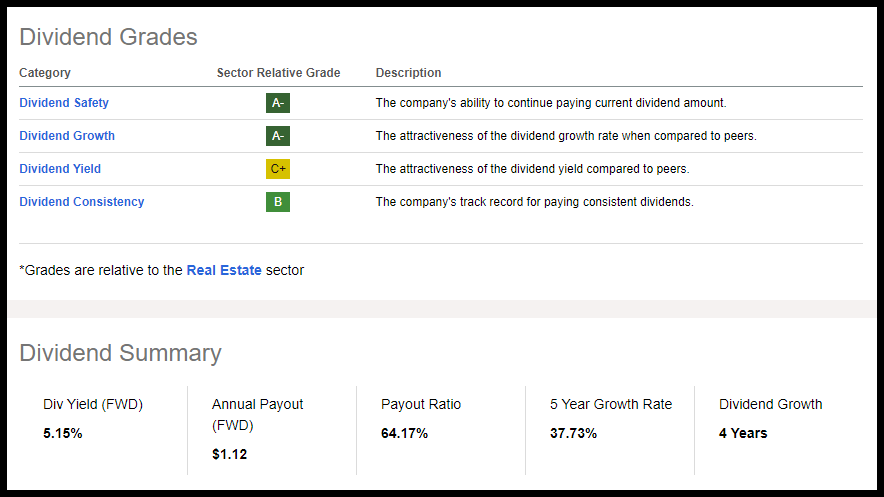

Diversified REITs with strong fundamentals can offer favorable tax structures and higher dividend income than common equities. Essential Properties Realty Trust offers a unique portfolio of tenants, including McDonald’s, Marriott, and Circle K, with exposure to varied sectors and industries.

Offering income and growth, EPRT has delivered consecutive earnings beats. With a Q1 2023 AFFO of $0.40 in line with expectations and revenue of $83.69M, beating by $4.63M for 19.4% year-over-year growth, and Q2 net income per share of $0.35 and AFFO per share of $0.41, guidance was increased, substantiating the company’s reputation for strong cash yields and solid dividend grades.

EPRT Stock Dividend Scorecard

Essential Properties Realty Trust Dividend Scorecard (SA Premium)

Strong dividend grades are supported by 9.10% forward FFO growth compared to the sector median of 4.34% and 5.15% dividend yield (FWD). Although past performance does not guarantee future results, EPRT’s dividend growth has experienced gradual increases over the last four years.

Trading at a discount, EPRT possesses a ‘B-‘ valuation grade, highlighted by a P/AFFO (FWD) in line with the sector and Total Debt/Capital (TTM) at more than a 32% discount. Despite macroeconomic headwinds, EPRT remains profitable, with strong growth prospects and liquidity, and in a recent announcement, priced a stock offering to raise $240M of 8.7M shares. Consider EPRT, a top higher-yielding diversified REIT for a portfolio, especially as the secondary offering has caused a pullback, making shares more attractive.

- VICI Properties Inc. (VICI)

-

Forward Dividend Yield: 5.63%

-

3-Yr Growth Rate: 9.04%

-

Market Capitalization: $29.87B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: B-

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

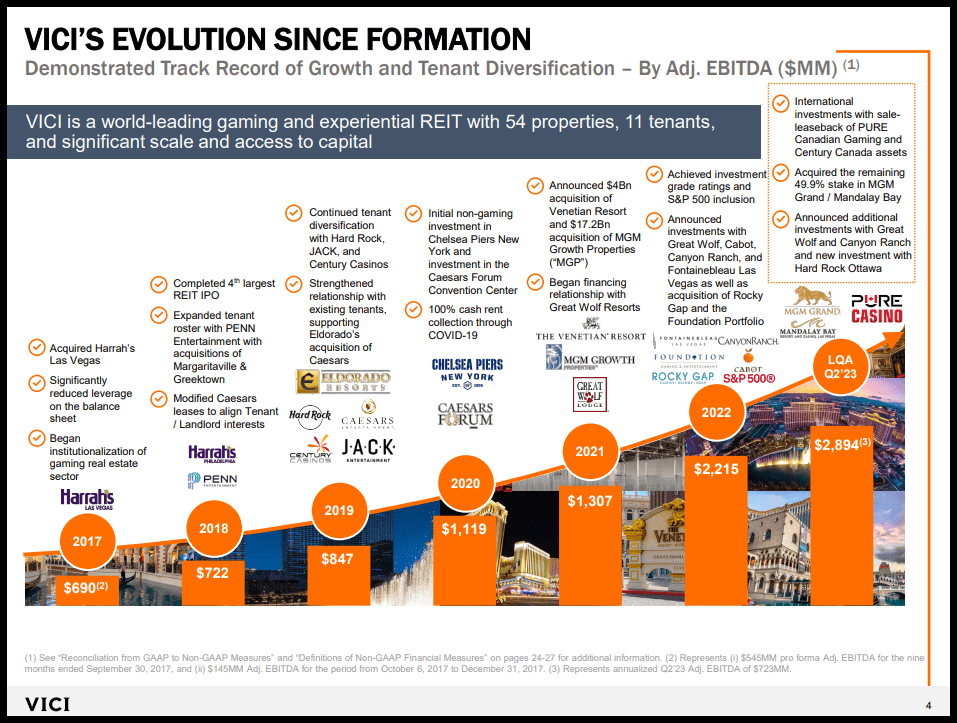

It may not be beginner’s luck if you bet on VICI Properties, a specialized REIT with one of the largest portfolios within the gaming, hospitality, and entertainment destinations. Offering more than 54 gaming facilities across the U.S. and Canada, including Caesars Palace, MGM Grand, and the Venetian, VICI’s unique portfolio of companies is primed for growth. Like my first two stock picks, VICI is down year-to-date but comes extremely discounted.

VICI Properties Investor Presentation

Source Link: VICI Investor Presentation

Showcasing consistently strong earnings that include an A+ Growth Grade and an ‘A’ for Profitability, VICI’s organic growth, acquisitions that included MGM/Mandalay over the last few years, and a recent sales-leaseback transaction in Canada highlight why this company has consistently raised its dividend. Focused on casino and golf transactions, VICI’s Q2 results featured year-over-year AFFO per share growth of nearly 12%. While some may consider the stock’s price a bit stretched with a forward P/AFFO of 13.81x versus the sector’s 13.28x, its rent increases and lease-backs make a solid case for VICI instant rental income of more than an average $54M per asset. Offering multiple, diversified revenue streams, VICI’s growth prospects and dividend scorecard are paying dividends!

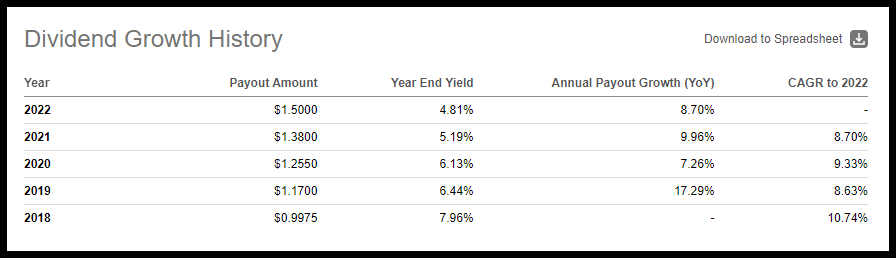

VICI Stock Dividend Growth History

VICI Properties Dividend Growth (SA Premium)

Showcasing four years of dividend growth, a 17.42% growth rate, and a 65% payout ratio, VICI offers a means to curb some of the costs eating at portfolios. In addition to its 5.58% forward dividend yield and ‘B’ dividend safety grade, it’s consistent dividend growth that has resulted in a post-Q3 results increase of 8.3% for a compound annual growth rate of 8.2% since October 2017, VICI again raised its quarterly dividend in September by 6.4%. I’m not telling you to double down on this stock, but this Strong Buy-rated dividend stock is no crapshoot based on its fundamentals, and neither is my next well-known energy pick.

- Marathon Petroleum Corporation (MPC)

-

Forward Dividend Yield: 1.94%

-

3-Yr Growth Rate: 9.74%

-

Market Capitalization: $61.75B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

According to our quant ratings, energy behemoth Marathon Petroleum Corporation is the #1 ranked oil and gas refining company in its industry. MPC’s share price has rallied +35% YTD and more than 52% over the last year, benefiting from fuel demand despite volatile fuel prices and geopolitical constraints. With a forward EPS Long Term Growth rate (3-5Y CAGR) OF 39% versus the sector’s 3.41%, Return on Total Assets (TTM) of 14.75%, and cash from operations of nearly $15B, this stock’s dividend scorecard captures precisely why Marathon is a high-quality company that offers investors dividend consistency.

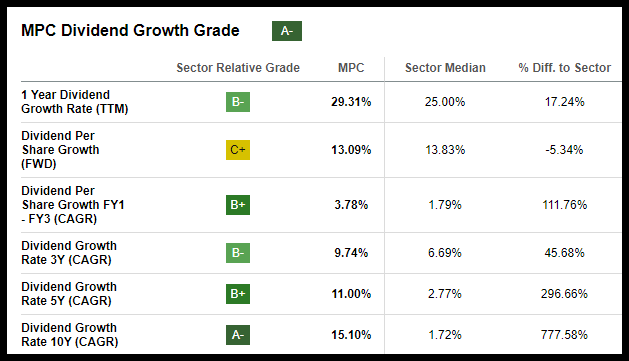

Marathon Petroleum Dividend Growth Grade (SA Premium)

Highly profitable with a tremendous financial outlook, MPC has consecutively paid 11 years of dividend payments. While MPC’s management has favored stock repurchases over dividend increases, its diverse geographic footprint that benefits from macro tailwinds and its large cash balance should bode well in enticing investors looking for a company with strong dividend growth. Compared to the sector median, MPC’s dividend growth grade on several metrics outperforms. Consider MPC, along with my next energy pick, Phillips 66.

- Phillips 66 (PSX)

-

Forward Dividend Yield: 3.40%

-

3-Yr Growth Rate: 4.60%

-

Market Capitalization: $54.94B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

One of the most diversified independent refiners in oil and gas, Phillips 66 has underlying dividend metrics to support three years of solid dividend growth and strong dividend safety. Approaching its 52-week high, +48%, while trading at a discount over the last year, PSX has a forward P/E ratio of 7.51x versus the sector median of 10.78x, which is a 30% difference to the sector. Price/Sales (FWD) and EV/Sales are more than a 75% difference, and with a focus on income, why not add one of the most geographically diverse refining portfolios to the mix?

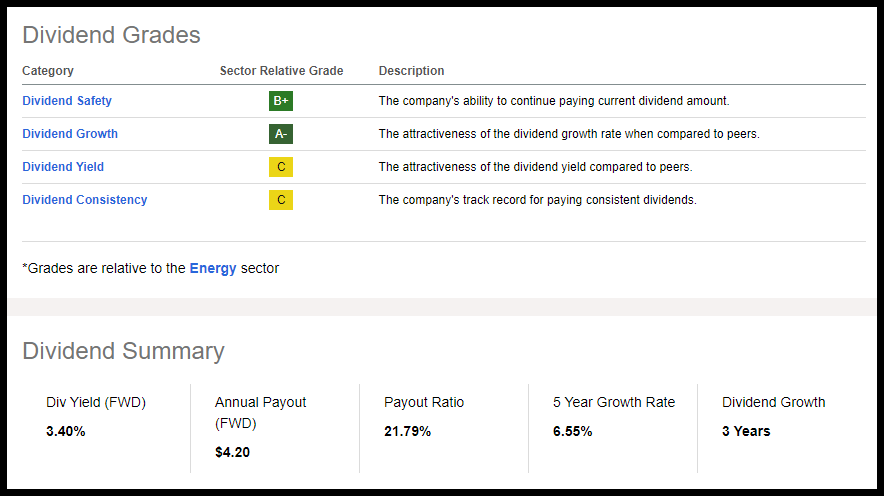

Phillips 66 Dividend Scorecard

Phillips 66 Dividend Scorecard (SA Premium)

Despite weaker market conditions, PSX stands to benefit from higher crude prices. PSX maintains its commitment to shareholders by focusing on cost-cutting and midstream expansion to grow its midcycle EBITDA from $3B to $13B through 2025. PSX returned $1.8B in Q2 through share repurchases and dividends, and its strategic priorities are to return $10B to $12B over the ten quarters between July 2022 and December 2024. Despite missing second-quarter revenue projections, Phillips 66 EPS of $3.87B beat by $0.31. Maintaining more than $10B in cash from operations, a 310% difference to the sector for forward EPS Long Term Growth (3-5Y CAGR), the company is well-positioned as a top dividend stock. Showcasing a B+ dividend safety grade and five-year growth rate of 6.55% while trading at a discount, consider this energy stock for a portfolio.

- Northern Oil and Gas, Inc. (NOG)

-

Forward Dividend Yield: 3.73%

-

3-Yr Growth Rate: 0%

-

Market Capitalization: $3.78B

-

Dividend Growth Grade: A+

-

Dividend Safety Grade: B-

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

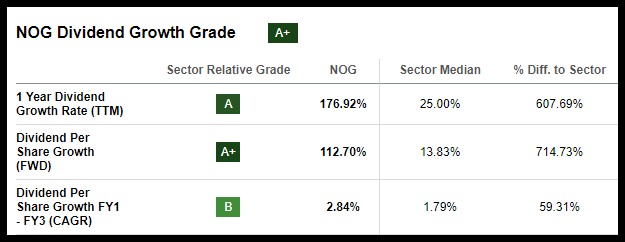

Northern Oil Gas Inc. is an exploration and production company with bullish momentum. Up 38% YTD and +45% over the last year, NOG is an energy company with strong margins, cash from operations, and excellent growth. With back-to-back earnings beats, NOG presented second-quarter earnings with an EPS of $1.49 that beat by $0.15 and revenue of $416.49M that beat by $4.37M. Launching a 6.65M-share public offering to buy a 30% stake in a Delaware Basin partnership for a $162M deal, NOG hopes to expand its footprint and increase production. Second-quarter EBITDA was up 16%, and while the financial benefits of several acquisitions remain to be seen, as Northern Oil and Gas CEO Nicholas O’Grady highlights, “We are actively investing, hedging and looking to drive consistent long-term growth to profits and cash returns. This has driven and will drive future dividend growth and share performance.”

Northern Oil and Gas Dividend Growth Grade (SA Premium)

With bullish momentum and a price performance that has gradually increased quarterly, NOG’s B- dividend safety grade and overall A+ dividend growth metrics make the stock highly attractive for investors seeking income. Showcasing a 3.73% dividend yield to complement its dividend growth metrics, consider NOG for a portfolio.

- Caterpillar Inc. (CAT)

-

Forward Dividend Yield: 1.88%

-

3-Yr Growth Rate: 5.95%

-

Market Capitalization: $140.92B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

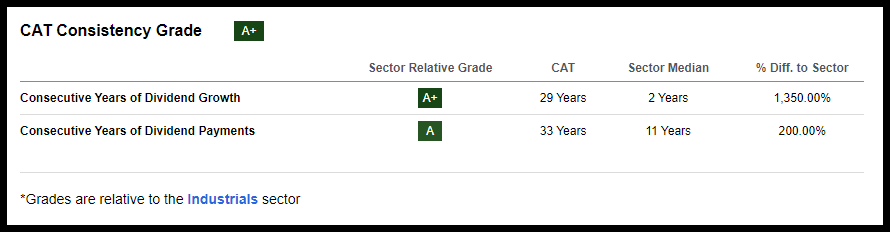

Caterpillar Inc. is a global construction and machinery company changing the way industries operate, integrate logistics, and distribute services. Not only has it capitalized on artificial intelligence through autonomous machinery, but CAT offers years of dividend growth, compared to the average two years for the sector, a difference of 1,350%.

Caterpillar Consistency Grade (SA Premium)

Caterpillar is relatively discounted, possessing some attractive underlying valuation metrics, including a forward P/E of 14.66x versus the sector’s 19.53x and a forward PEG of 1.06x versus the sector’s 1.66x. Supported by increased demand for construction inventory, the first half of 2023 gave way to companies restocking construction products, a benefit for CAT. As the global heavy machinery market leader, Caterpillar’s sales growth will likely benefit as economies recover and U.S. infrastructure spending experiences increase.

Consecutive top-and-bottom-line earnings beats have led to 24 FY1 Upward analyst revisions over the last 90 days. Second-quarter EPS of $5.55 beat by $0.97, and revenue of $17.32B saw a near 22% year-over-year increase. The strength of CAT’s dividend growth grade and strong free cash flow were highlighted by Caterpillar’s CEO, James Umpleby, during the Q2 earnings call.

“We generated strong ME&T free cash flow of $2.6 billion in the second quarter. We returned $2 billion to shareholders, which included about $1.4 billion in repurchase stock and $600 million in dividends. In June, we announced an 8% dividend increase. Since May 2019, when we introduced our current capital allocation strategy, we have increased the quarterly dividend per share by 51%. We remain proud of our dividend aristocrat status and continue to expect to return to substantially all ME&T free cash flow to shareholders over time through dividends and share repurchases.”

Showcasing a strong dividend scorecard that includes a 26.82% dividend payout ratio, B+ dividend safety, and a five-year growth rate of 8.9%, consider this top dividend stock for a portfolio.

- Terex Corporation (TEX)

-

Forward Dividend Yield: 1.17%

-

3-Yr Growth Rate: 20.84%

-

Market Capitalization: $3.91B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: A

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

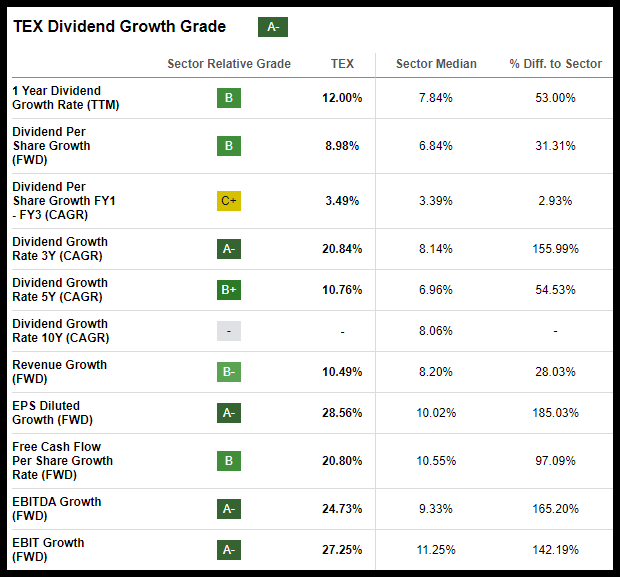

Selected as one of my Alpha Picks to kick off this year, Terex Corporation is up 19.89% since being selected into the AP portfolio compared to the 7.96% delivered by the S&P 500. Terex Corporation manufactures and sells aerial work platforms and materials processing machinery worldwide and has consistently delivered top-and-bottom-line results, smashing FQ2 2023 out of the park.

With strong earnings and the need for heavy equipment components and replacement parts, its $3.7B backlog remains significantly above historic levels. Tailwinds from the Inflation Reduction Act, infrastructure investments in public and private sectors, and anticipating economic growth to meet the needs of a growing population and urbanization have allowed sales to increase. Q2 sales of $1.4B were +30% year-over-year, and EPS of $2.35 beat by $0.69. With a trailing year-over-year EBITDA growth rate of 71%, forward Long Term Growth (3-5Y CAGR) of 26%, and a Return on Total Assets (TTM) of 13% helps return cash to shareholders and grow its dividend. TEX is committed to investing in its business and returning cash to shareholders. Despite a modest 1.17% forward dividend yield, TEX has a 10.76% five-year growth rate, and an exceptional three-year growth rate of +20%. Its dividend safety grade is an ‘A’ and its dividend continues to grow.

Terex Dividend Growth Grade (SA Premium)

“In July, we announced a 13% increase in our dividend to $0.17. This follows a 15% increase we announced earlier this year. The combined increases put our dividend 31% above last year and reflect our continued confidence in the company’s strong financial position and future prospects. We repurchased $31 million of shares in the second quarter. We have fully offset dilution associated with incentive comp for the year and have $159 million remaining on our share repurchase program,” said Terex CFO Julie Beck.

If you’re an investor and appreciate industrials, TEX offers great investment characteristics on a sector-relative basis and trades at a discount. Alternatively, my next Industrial is ranked #4 in its industry.

- PACCAR Inc (PCAR)

-

Forward Dividend Yield: 1.26%

-

3-Yr Growth Rate: 6.01%

-

Market Capitalization: $44.81B

-

Dividend Growth Grade: A

-

Dividend Safety Grade B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

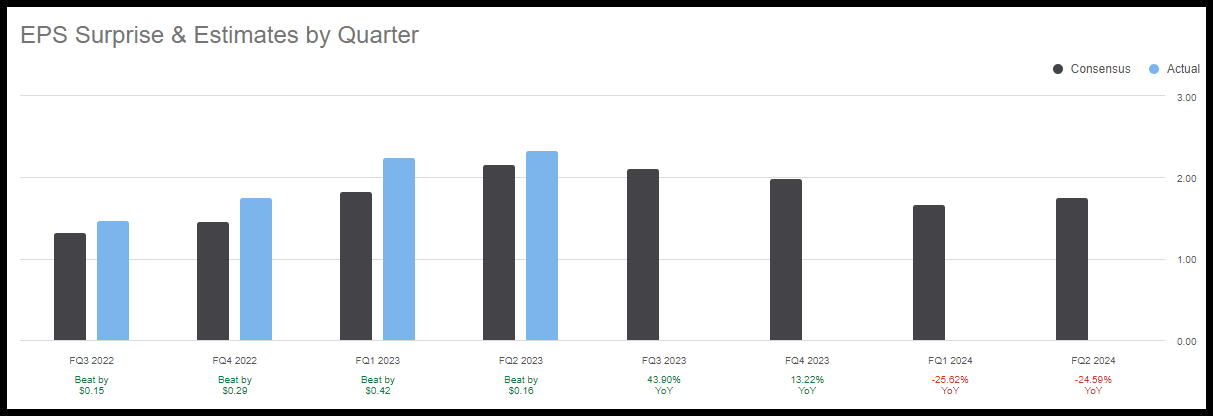

My next Industrial stock designs, manufactures, and distributes commercial trucks worldwide. Benefitting from the nearly 28% in year-over-year truck sales and 11% in parts over the same period, PACCAR Inc. has consecutively put up strong numbers, surprising estimates for multiple quarters.

PACCAR EPS Surprise and Estimates by Quarter (SA Premium)

Second-quarter EPS of $2.33 beat by $0.16, and revenue of $8.44B beat by more than 24% year-over-year, resulting in 16 upward analyst revisions in the last 90 days. Strong freight demand is prompting the need for new trucks, and with a company already up 30% YTD and +55% over the last year, it should be no surprise that PACCAR raised its dividend by 8%. I wrote about PACCAR and Caterpillar last year in an article titled Construction Is America’s Backbone: 2 Best Industrial Stocks and both stocks have done exceptionally well. PCAR trades at more than a 41% discount to its sector on P/E, and its trailing PEG ratio is a 73% difference to the sector.

- Ennis, Inc. (EBF)

-

Forward Dividend Yield: 4.66%

-

3-Yr Growth Rate: 3.57%

-

Market Capitalization: $554.81M

-

Dividend Growth Grade: A

-

Dividend Safety Grade: B-

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

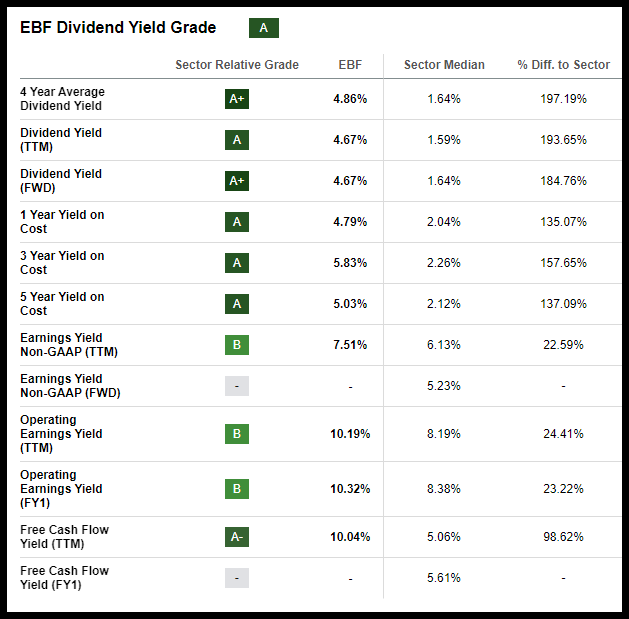

My final Industrial stock is a commercial printing company that has grown through strategic acquisitions – purchasing its smaller competitors. With a cash surplus and strong financials, Ennis Inc., headquartered in Midlothian, Texas, has an attractive forward dividend yield of 4.66% and a B- Dividend Safety grade. Despite a Q2 earnings miss, analysts continue to revise estimates up, as the company has excellent fundamentals, zero outstanding debt, and offers products in a stable industry.

Ennis Dividend Yield Grade (SA Premium)

Ennis is down more than 6% YTD while trading at a discount. Its trailing P/E ratio is 12.12x versus the sector’s 19x, and its trailing PEG is a 20% discount to the sector. Its underlying dividend yield grades are very attractive, helping to offset some of the potential losses investors have experienced over the last year.

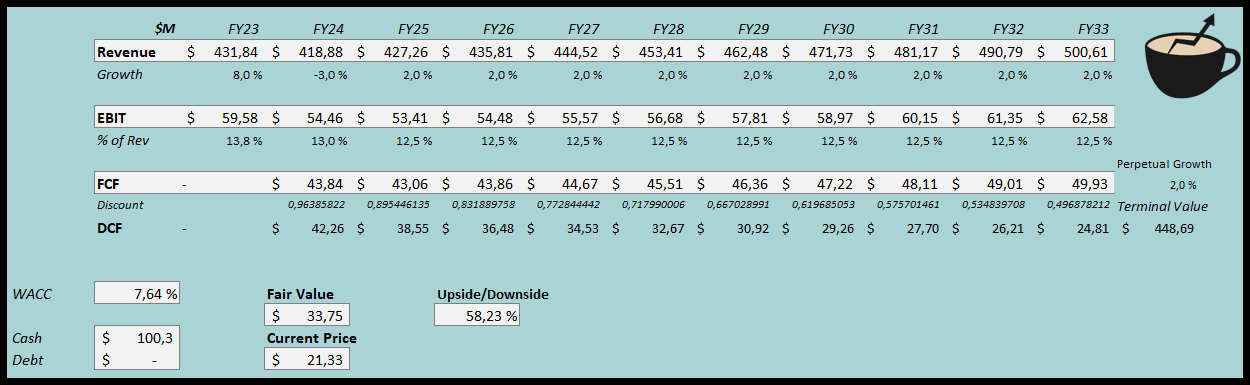

Enis Stock Discounted Cash Flow Model

Enis Stock Discounted Cash Flow Model (Caffital Research)

As highlighted by Caffital Research, a review of Ennis’ Discounted Cash Flow (DCF) “points towards a very significant upside on the stock.” Given its profitability, solid cash from operations, growth, and ability to pay a dividend, consider this stock for a portfolio.

- Cogent Communications Holdings, Inc. (CCOI)

-

Forward Dividend Yield: 5.94%

-

3-Yr Growth Rate: 11.48%

-

Market Capitalization: $3.02B

-

Dividend Growth Grade: A-

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

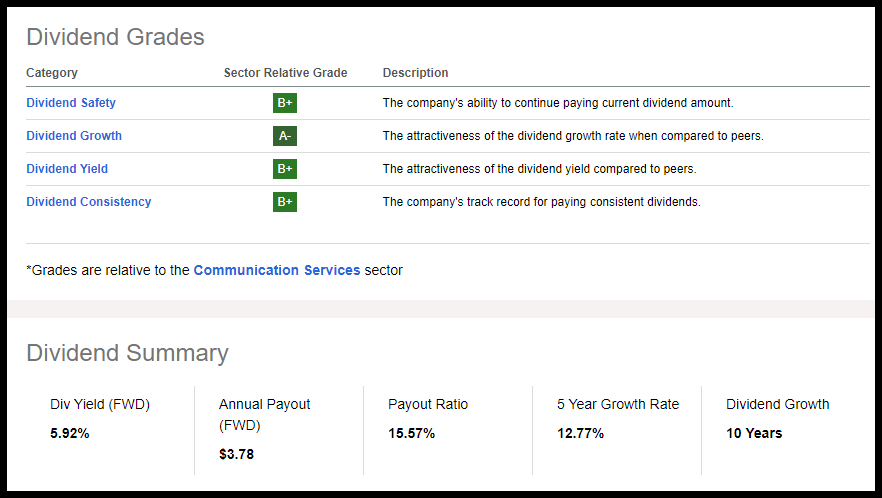

Goldman Sachs upgrades Cogent Communications, following its acquisition of T-Mobile’s Wireline business, which is expected to benefit the company’s growth and improve its financial flexibility. Showcasing ten years of steady dividend growth, an attractive 5.94% dividend yield (FWD), and an excellent dividend scorecard, Cogent Communications is demonstrating its shareholder value and presence as an alternative carrier.

Cogent Communications Dividend Scorecard (SA Premium)

Despite missing second-quarter revenues, Cogent beat EPS of $23.65 by a whopping $23.71. In addition to strategic acquisitions, Cogent’s legacy business saw year-over-year increases, including a record $61.7M EBITDA for the quarter and an EBITDA margin of +38%. Excellent growth supports its discounted valuation, highlighted by a trailing PEG that’s -99.86% difference to the sector. Although the stock is trading above the mid-52-week range when looking for a dividend stock with tremendous dividend growth, look no further than CCOI.

- Comcast Corporation (CMCSA)

-

Forward Dividend Yield: 2.59%

-

3-Yr Growth Rate: 8.37%

-

Market Capitalization: $185.05B

-

Dividend Growth Grade: B+

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

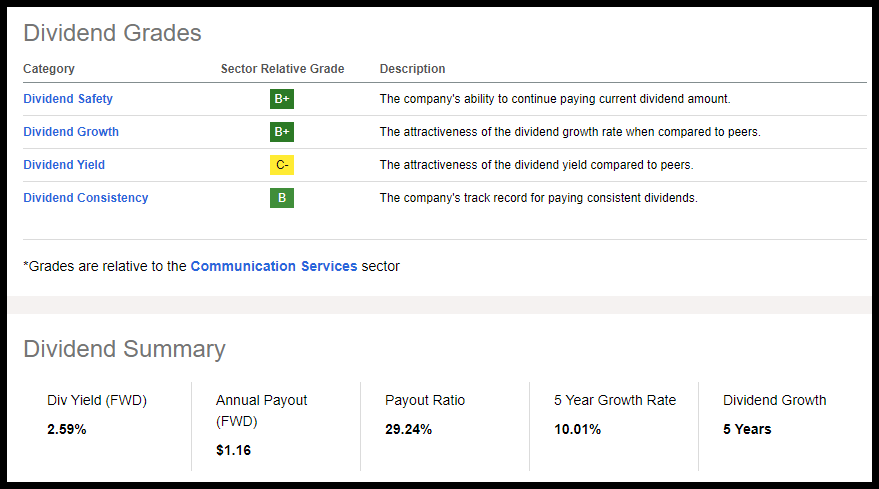

Popular cable and satellite provider Comcast Corporation has been on an uptrend in 2023 on the back of strong cash flows and solid broadband metrics that led to consecutive top-and-bottom-line earnings beats, and strategic investments in technology. Gaining broadband market share over its competitors AT&T and Verizon, Comcast has tremendous profitability for 13 consecutive years of dividend payments, five years of dividend growth, and a near 30% payout ratio.

Comcast Stock Dividend Scorecard

Comcast Dividend Scorecard (SA Premium)

Comcast trades at a relative discount, possessing a C- valuation grade showcasing a forward Non-GAAP P/E ratio of 11.85x versus the sector’s 14.60x and a forward PEG ratio that’s 32% discounted. With 22 Wall Street Analysts revising their estimates up over the last 90 days and one of the most robust balance sheets among its core competitors to support its strong dividend safety grade, consider Comcast an easy, simple, option.

- Unum Group (UNM)

-

Forward Dividend Yield: 2.93%

-

3-Yr Growth Rate: 5.93%

-

Market Capitalization: $9.76B

-

Dividend Growth Grade: B

-

Dividend Safety Grade: B

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

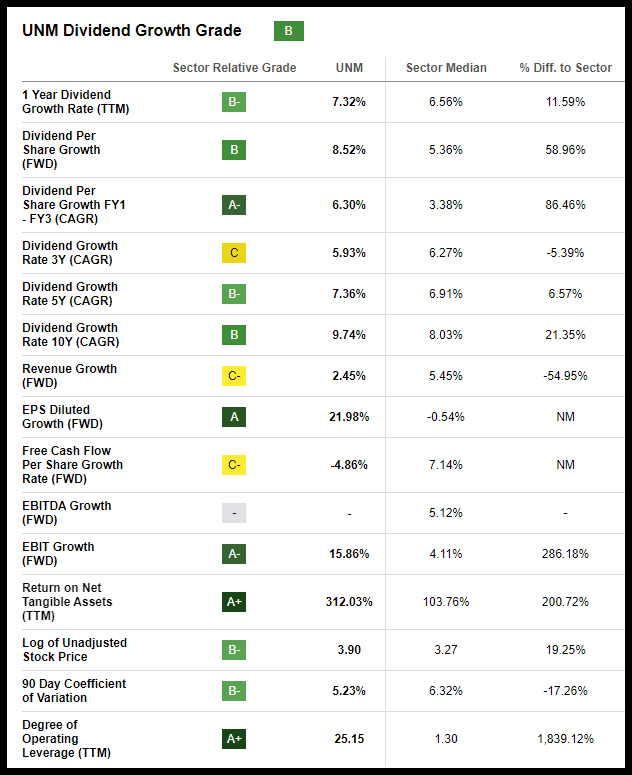

Offering comprehensive life and health insurance coverages, Unum Group is a financial company delivering strong quarterly results in a recession-resilient industry. With life and health insurance offerings, Unum Group is on an uptrend, +23% YTD, while trading at a discount. Showcasing a forward P/E ratio of 6.62x versus the sector median of 9.32x and a forward PEG that’s more than a 25% discount, although the stock is trading near its 52-week high, favorable industry trends, including disability products, increased premiums, and costs for insurance have aided Unum.

Unum Group Dividend Growth Grade (SA Premium)

Unum has 14 years of dividend growth, as highlighted in the figures above. With a 19.21% payout ratio and solid dividend safety rating. Consider Unum Group along with my next financial stock for a portfolio.

- First American Financial Corporation (FAF)

-

Forward Dividend Yield: 3.72%

-

3-Yr Growth Rate: 6.30%

-

Market Capitalization: $5.87B

-

Dividend Growth Grade: B-

-

Dividend Safety Grade: B+

-

Quant Rating: Strong Buy

*the above rating and figures are as of 9/29/23

Recently announcing a ~2% increase to its dividend, First American Financial Corporation continues its gradual uptick on the back of excellent Q2 results. With a second-quarter EPS of $1.35, beating by $0.34, and revenue of $1.65B that beat by $142.73M, analysts are revising up. Although high mortgage rates and low inventory have presented some headwinds for the company, commercial revenues were up 20% sequentially from 2022. FAF has delivered $811M to shareholders through repurchases and dividends. Like each of my top 14 picks, the benefits of dividend stocks in a high inflationary environment offer the potential for regular income and capital appreciation. Dividend stocks are also great diversifiers.

Conclusion

Changing economic conditions and monetary policy have resulted in volatility. Markets have pulled back, and some of our favorite dividend stocks have also pulled back, offering even more attractive yields. I have 14 stock picks with an average yield of 3.74% vs. the VIG yield of 2.03% and the SPY yield of 1.52%.

Although inflation and increased costs continue to pose headwinds for companies, those with solid fundamentals and balance sheets and strong dividend growth rates offer an opportunity for investors looking for consistent income to offset portfolio losses. Being preemptive and considering 14 top dividend stocks, collectively strong on fundamentals like valuation, growth, profitability, and revisions, offer benefits during periods of high inflation. Conversely, chasing abnormally high-yielding stocks can pose risks associated with stocks that may have experienced significant price declines due to poor investment fundamentals. Investors focused on dividend growth stocks will likely find more profitable companies committed to delivering back to shareholders through consistently increasing dividends – a byproduct of profit. Dividend growth matters because focusing on higher-quality companies equals stronger earnings and future earnings potential.

Dividend stocks with strong dividend growth also offer a great way to diversify a portfolio. With five-year dividend growth rates ranging from 3.4% to over 29%, investors should thrive in a rising or falling environment without sacrificing quality or growth during market swings. Not only do my picks offer solid value, but their strong profitability and significant cash help ensure shareholders that these stocks’ dividend payout should remain consistent. Consider using Seeking Alpha’s’ Ratings Screener‘ tool if you prefer alternate dividend stocks with higher Dividend Safety or strong Dividend Growth grades. Alternatively, if you’re seeking a limited number of monthly ideas – curated from a list of top quant stocks – consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. The author is an employee of Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.